Banco de Mexico

View:

August 08, 2025

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

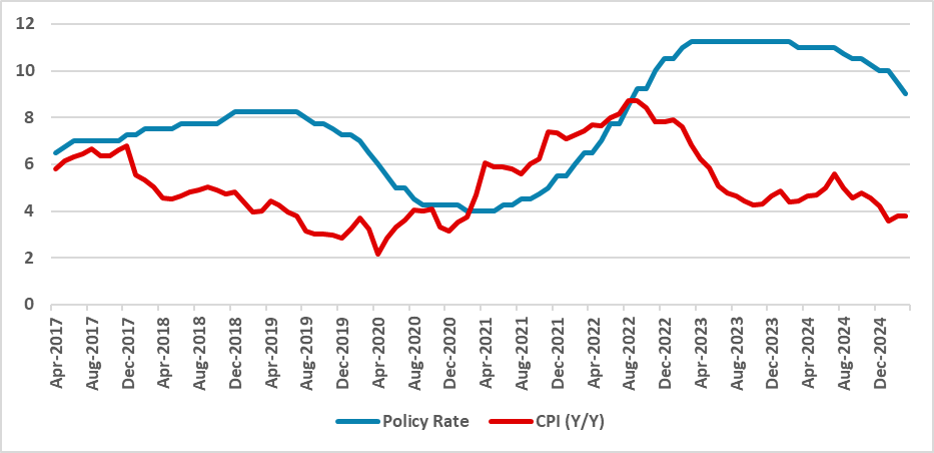

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

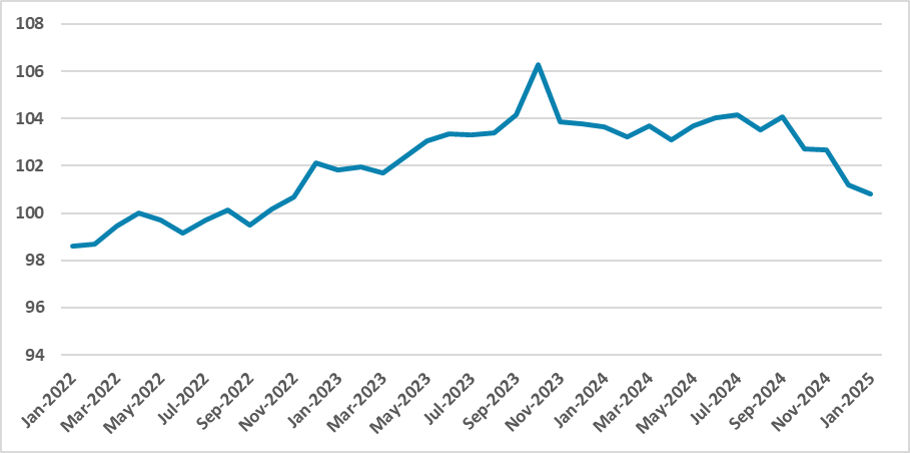

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

June 27, 2025

Mexico: Back Toward Neutral Policy Rates

June 27, 2025 6:56 AM UTC

Banxico has cut by 50bps to 8.00%, while also signalling in its statement that further easing will now be data dependent. Our forecast is for easing to move to a 25bps pace and to come once a quarter – most likely in September and December. Some improvement in the monthly inflation trajectory woul

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

April 30, 2025

Mexico’s GDP Review: Saved from the Technical Recession, but Growth Slows

April 30, 2025 2:52 PM UTC

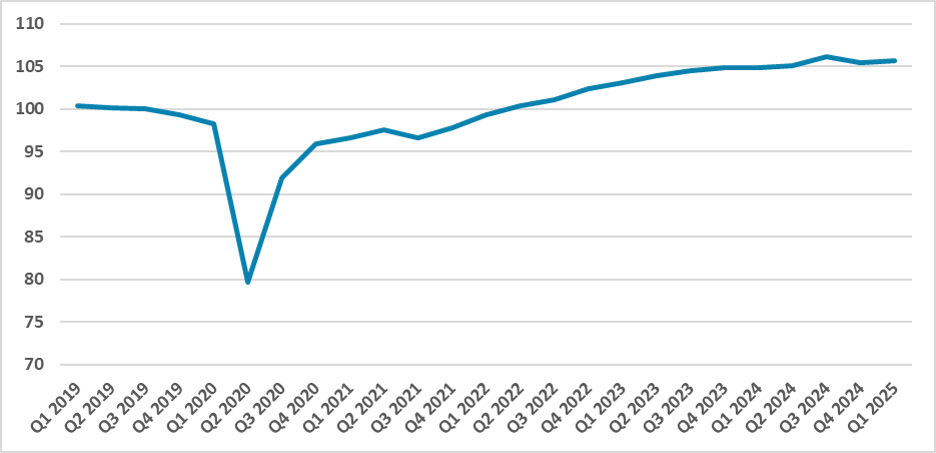

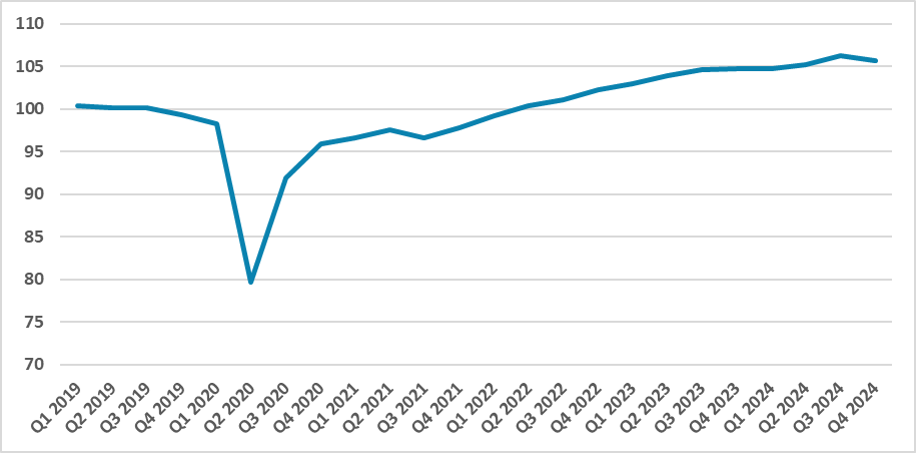

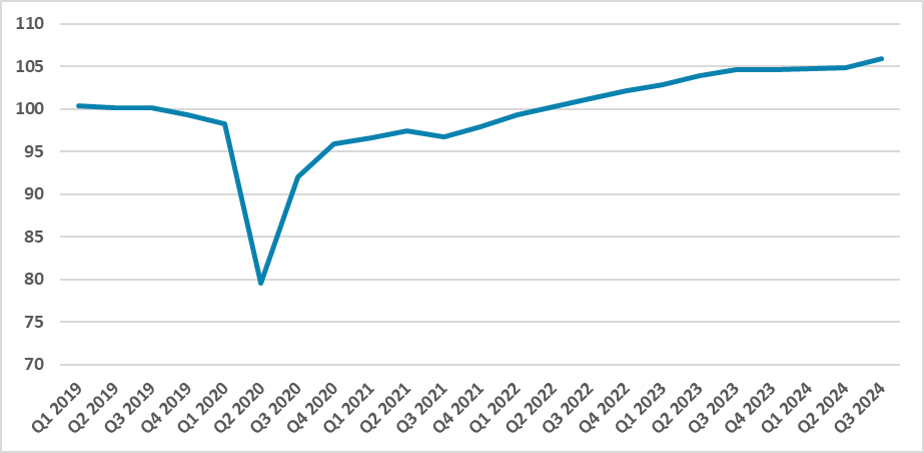

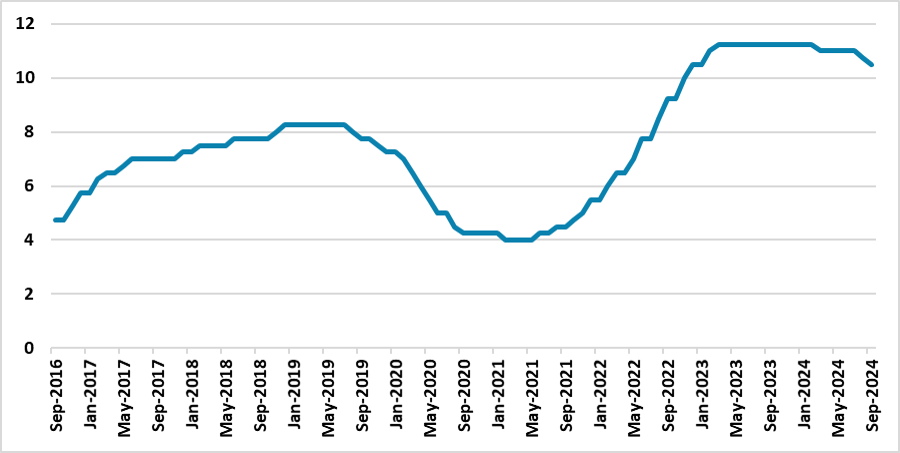

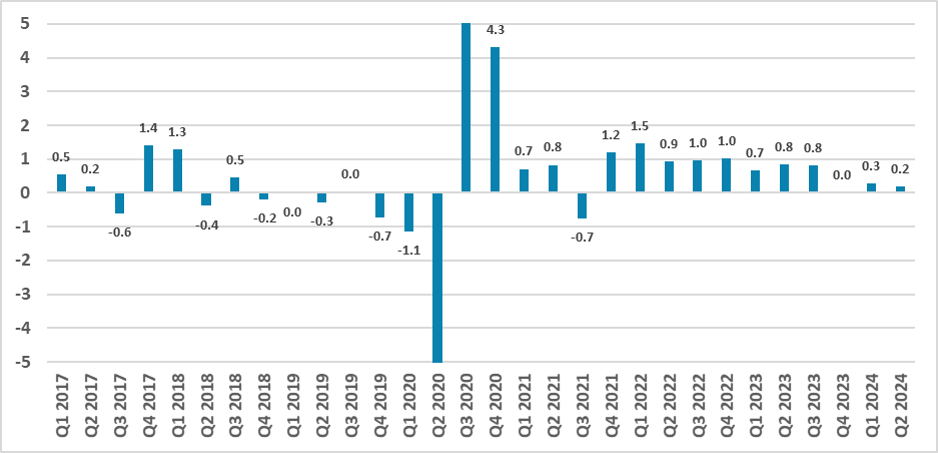

Mexico narrowly avoided a technical recession in Q1 2025 with 0.2% GDP growth, driven by a volatile rebound in agriculture. However, industrial output contracted and services stagnated, highlighting a broader economic slowdown. Uncertainty over potential U.S. tariffs and tight monetary and fiscal po

April 17, 2025

Banxico Minutes: Comfortable about the Cuts Amid the Volatility

April 17, 2025 2:26 PM UTC

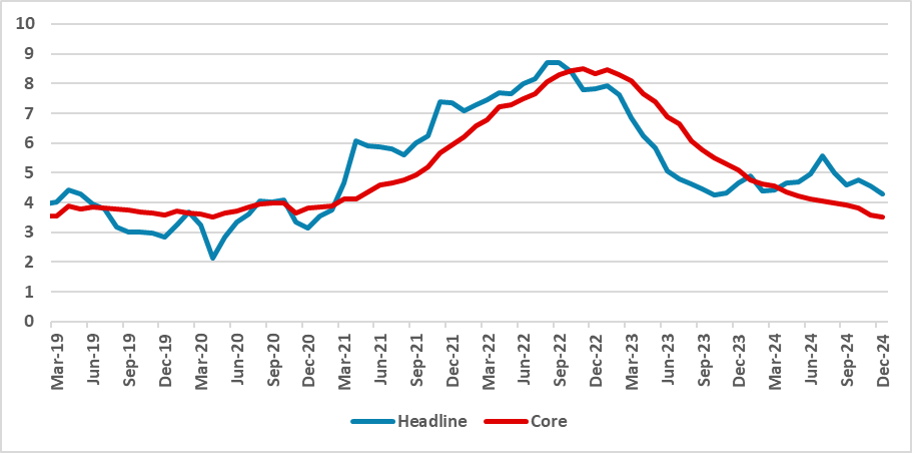

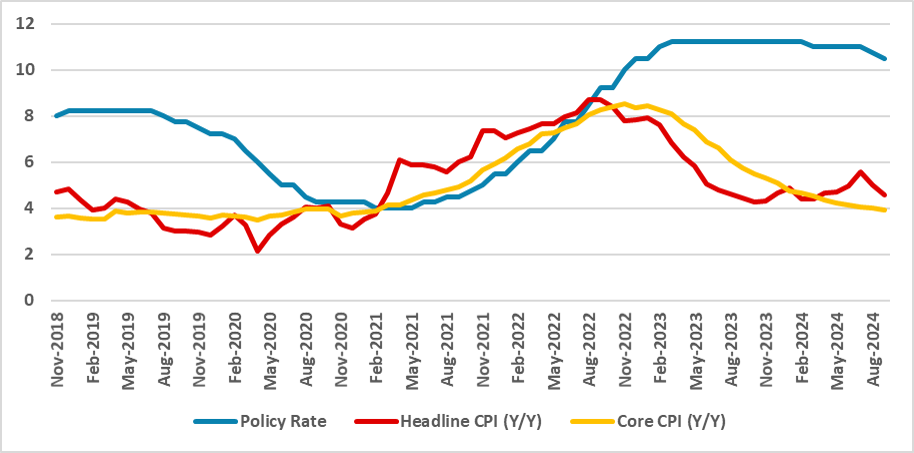

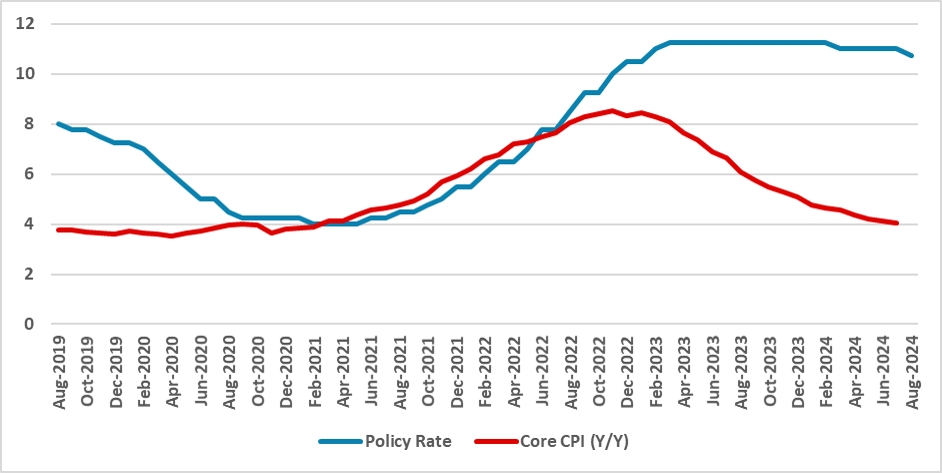

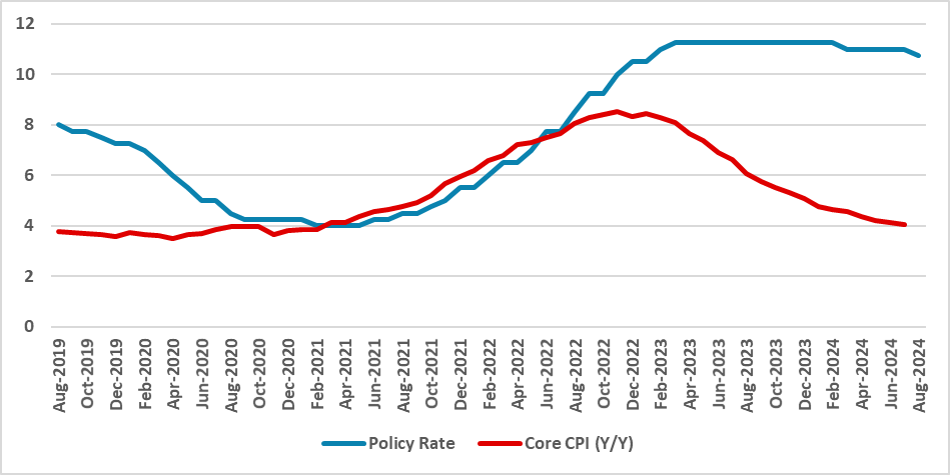

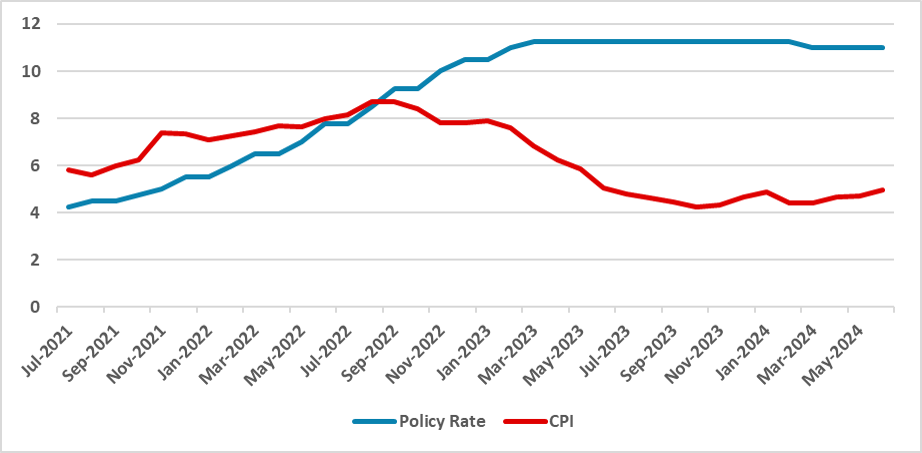

Banxico’s latest minutes confirm a cautious but steady path toward policy normalization, with the policy rate expected to reach neutral levels (7.00–8.00%) in 2025. While the economy shows signs of deceleration and a negative output gap, inflation continues to ease, nearing historical averages.

April 10, 2025

Mexico CPI Review: Moving as Expected

April 10, 2025 2:20 PM UTC

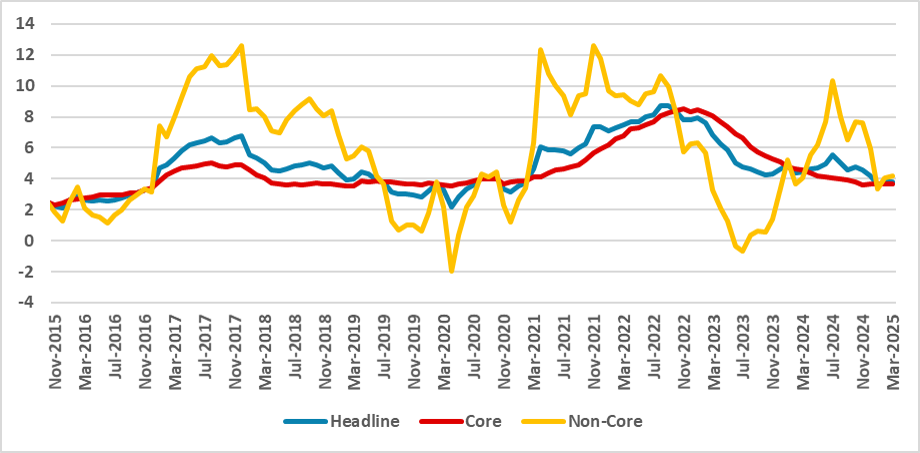

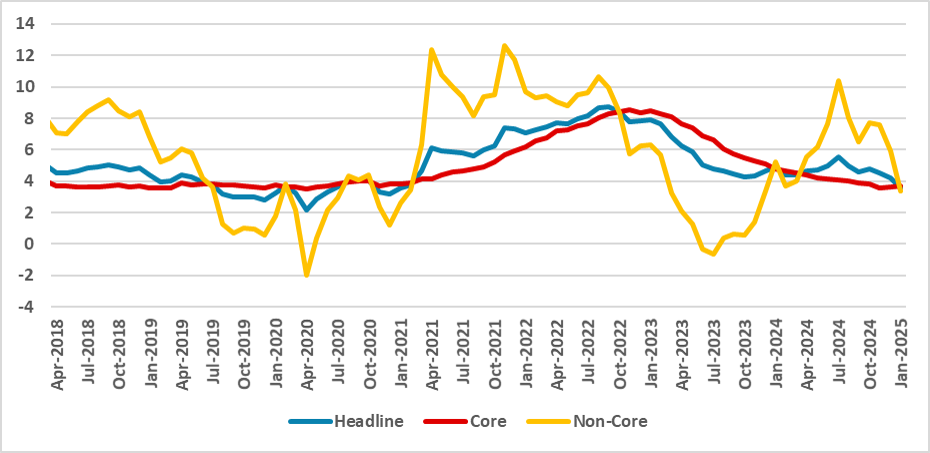

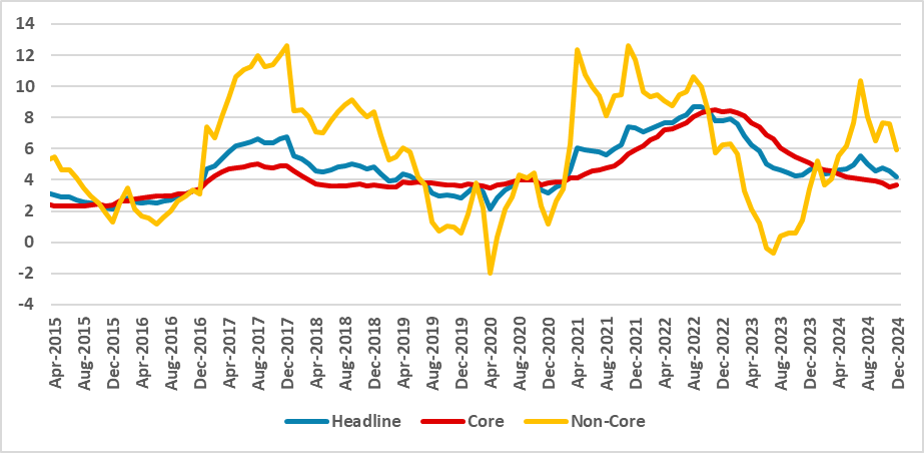

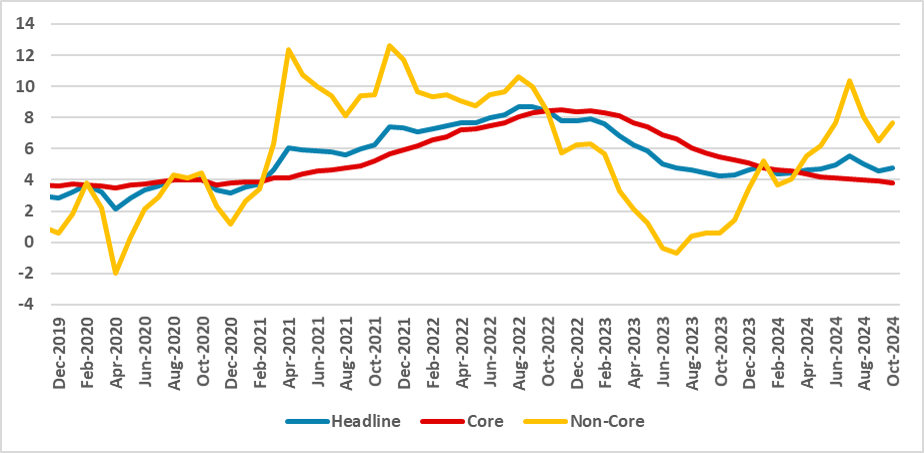

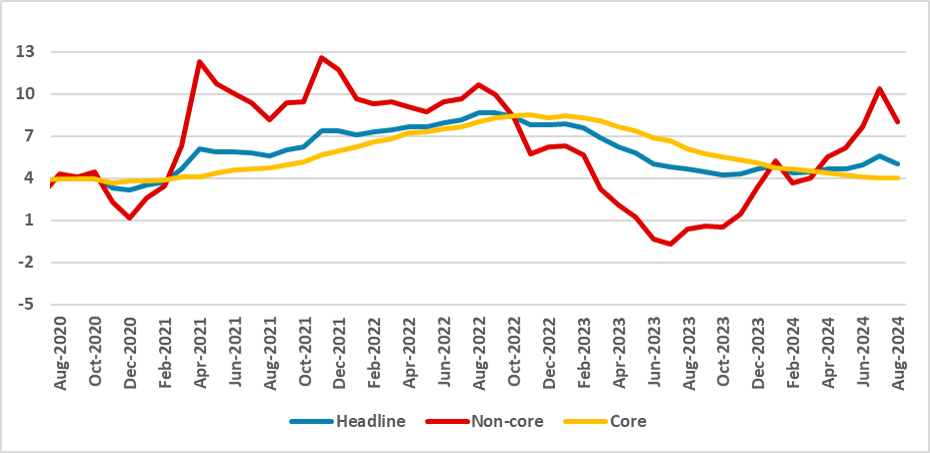

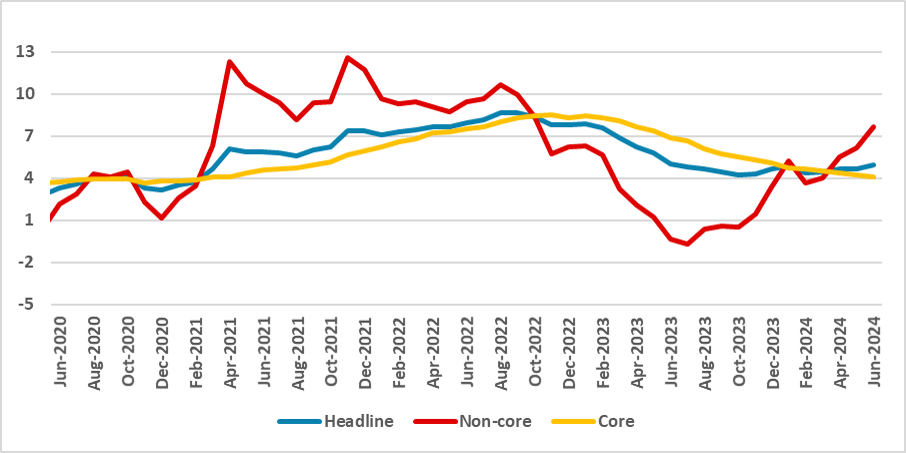

Mexico’s March CPI rose 0.31%, matching expectations but below the historical average. Annual inflation edged up to 3.80%, driven by core components like food and services. Non-core inflation fell due to lower energy prices. Food saw strong gains, while transport costs declined. The narrowing gap

April 03, 2025

Mexico: Saved from Tariffs?

April 3, 2025 7:56 PM UTC

Mexico has avoided reciprocal tariffs but still faces steel, aluminum, and auto tariffs. Authorities are negotiating to exempt goods, though retaliatory tariffs on U.S. imports seem unlikely. Mexico's economy is slowing, with growing recession fears and diminishing nearshoring prospects. The industr

March 29, 2025

Banxico Review: Lowering Rates Amid Tariffs

March 29, 2025 9:29 PM UTC

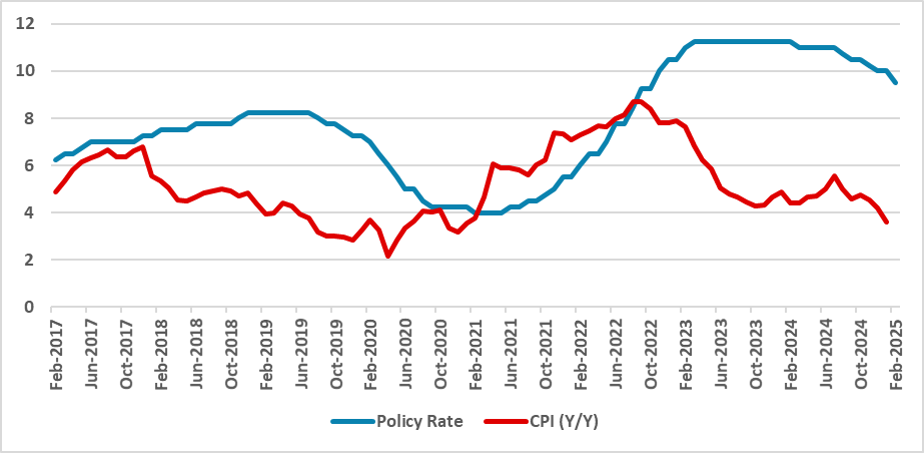

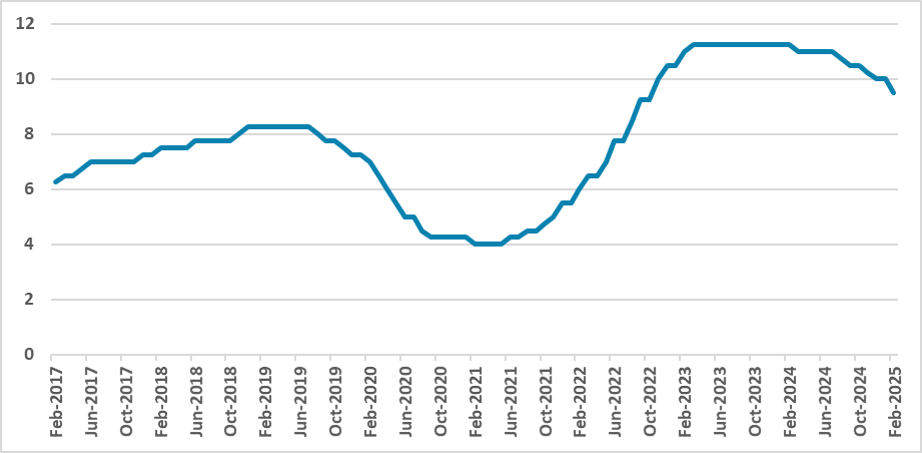

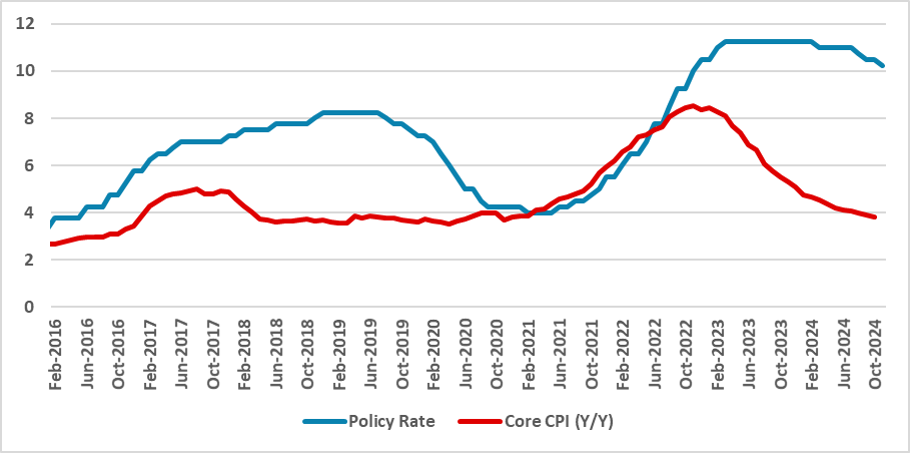

Mexico’s Central Bank (Banxico) has cut the policy rate by 50 bps to 9%, in line with market expectations. The tone of the communiqué suggests a more dovish stance, with the board moving towards a neutral rate. Inflation has reached its lowest level since 2021, while economic growth has slowed. B

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

March 05, 2025

Mexico: Uncertainty Mounts as Tariffs Are Imposed

March 5, 2025 2:43 PM UTC

Trump's administration has moved forward with 25% tariffs on Mexican imports, citing drug trafficking and migration issues. Mexico’s President Sheinbaum has stated retaliatory measures will be announced on March 9. The tariffs could push Mexico into recession in 2025, although we forecast growth a

February 28, 2025

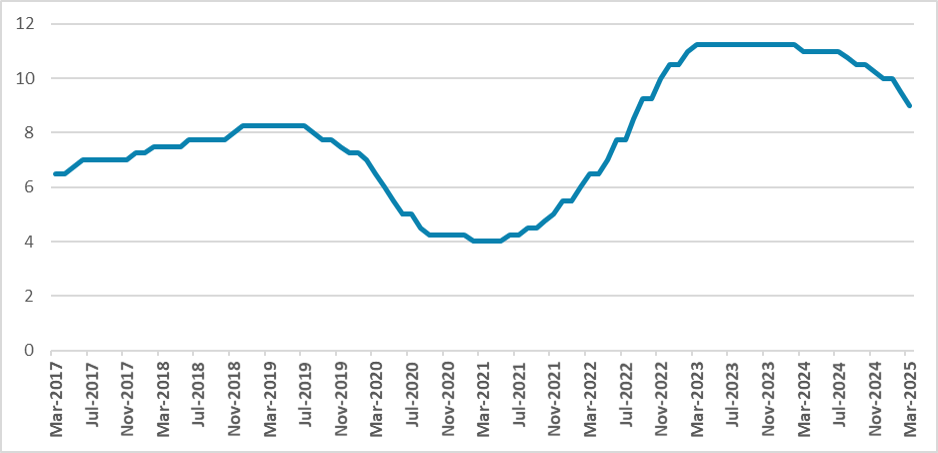

Mexico: Labour Market Decelerating as Expected

February 28, 2025 5:53 PM UTC

Mexico's labor market remains strong with an unemployment rate of 2.7%, but signs of deceleration are emerging. Worker affiliation to the pension system and wage growth are slowing, and some job creation stagnation is expected, potentially pushing the unemployment rate above 3%. A technical recessio

February 21, 2025

Banxico Minutes: More Cuts on the Way

February 21, 2025 9:57 PM UTC

Banxico cut the policy rate by 50 bps to 9.5%, signaling a more dovish stance as inflation trends downward. The board cited weak domestic demand and improved inflation prospects but highlighted risks from U.S. policy uncertainty, tariffs, and immigration effects. While most members supported a 50 bp

February 19, 2025

Mexico: Tariffs and Growth Issues Could Impose Fiscal Difficulties

February 19, 2025 10:20 PM UTC

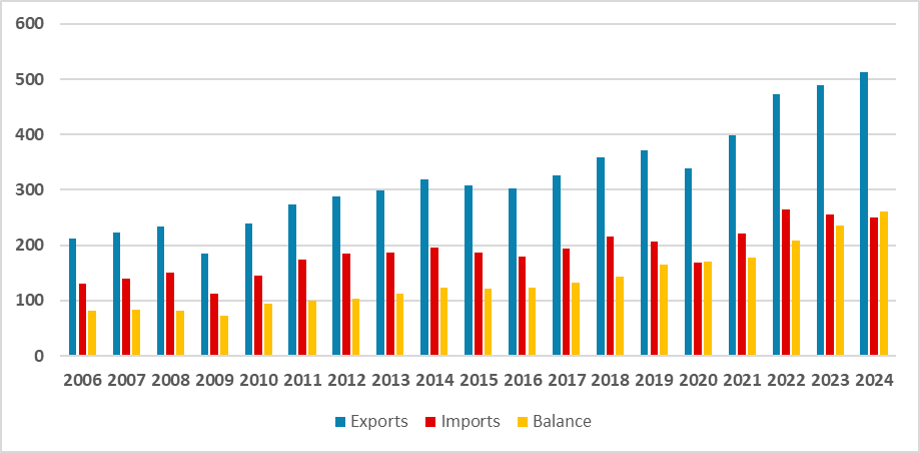

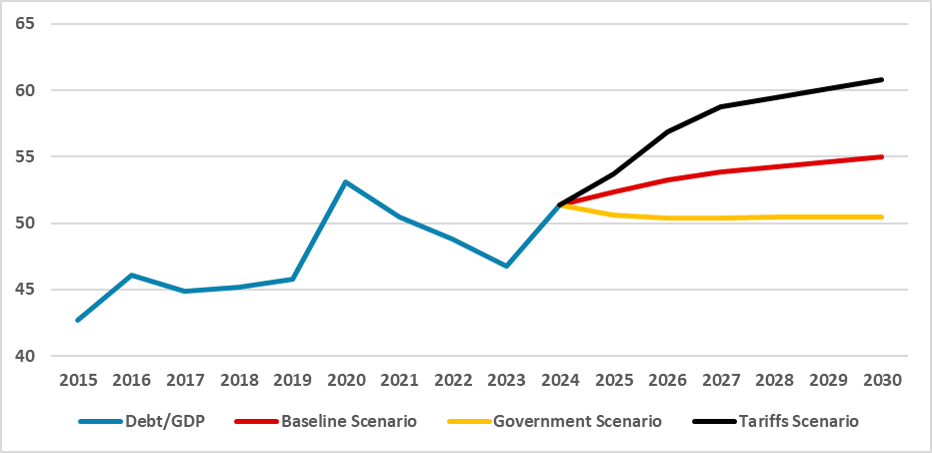

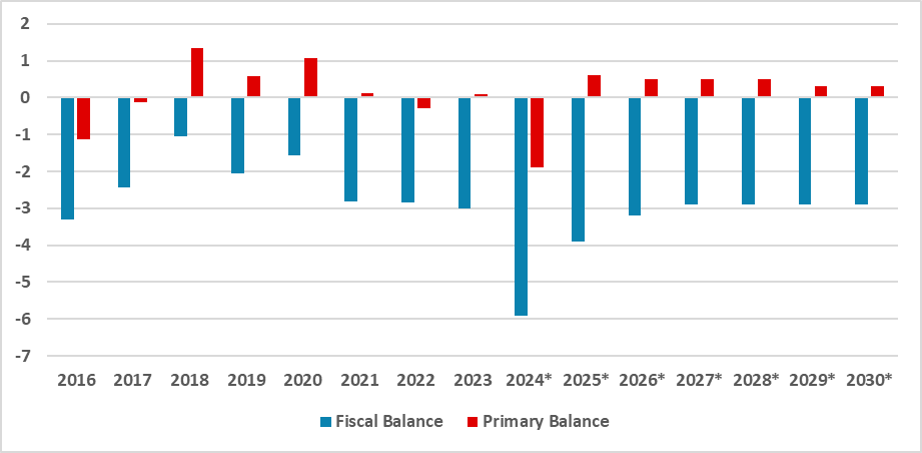

Mexico aims for fiscal consolidation in 2025, relying on revenue growth while freezing most expenditures. However, weak growth could undermine this strategy. Authorities expect 2–3% GDP growth, but our forecast is 1.6%, with a recession risk. A less integrated U.S.-Mexico trade relationship, parti

February 10, 2025

Mexico CPI Review: Inflation Falls as Demand Eases

February 10, 2025 7:14 PM UTC

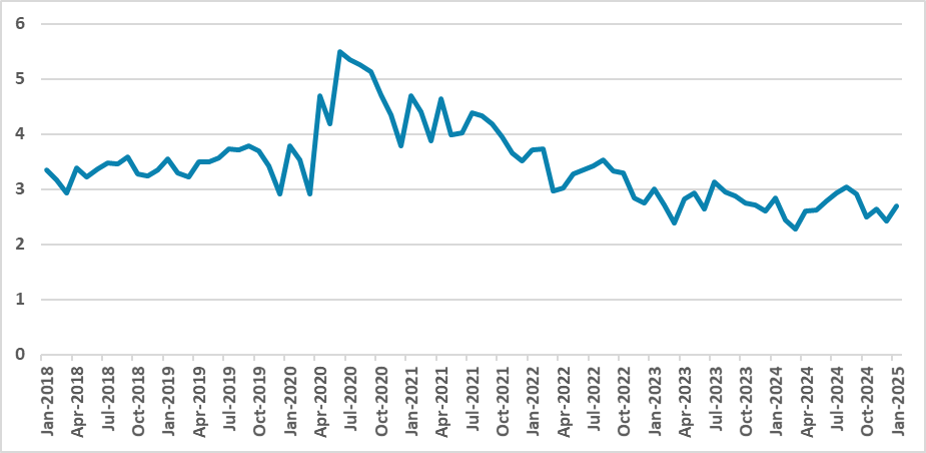

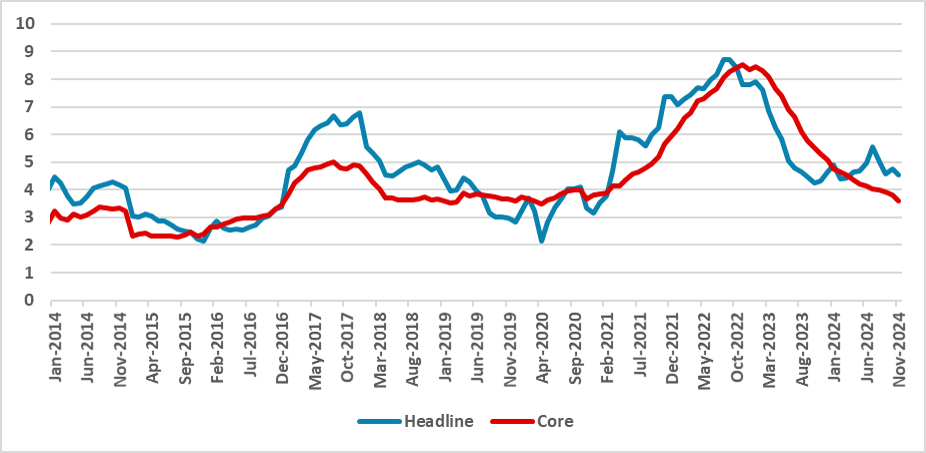

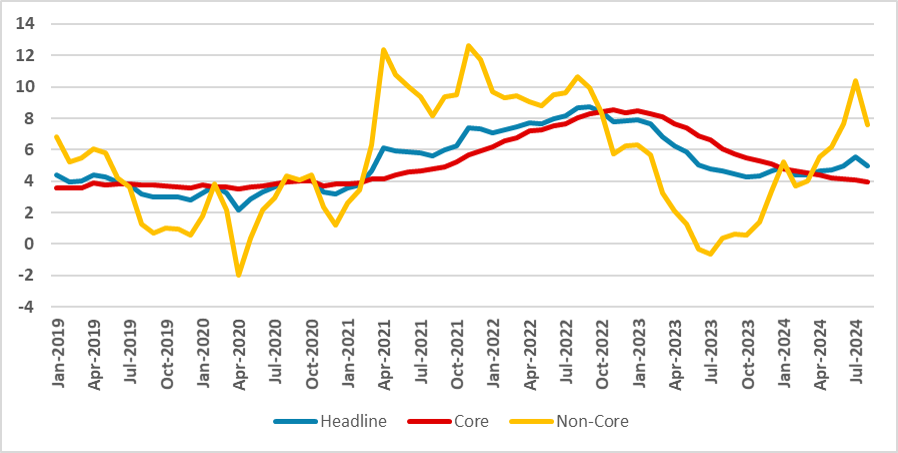

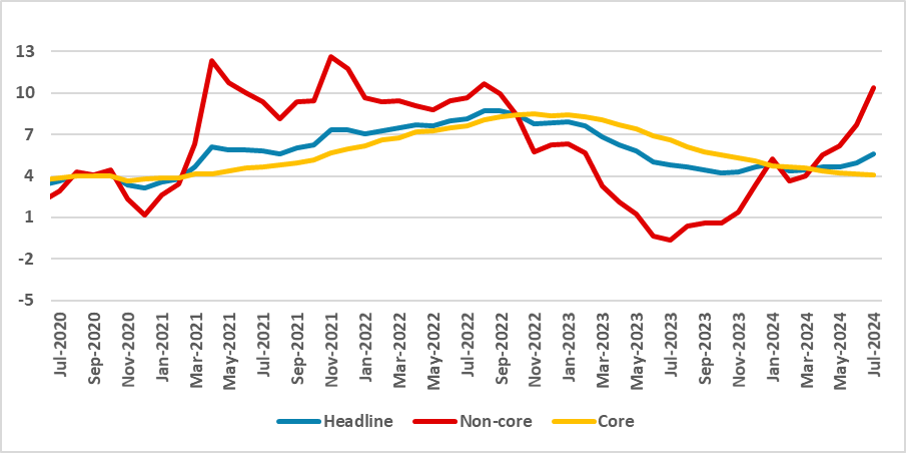

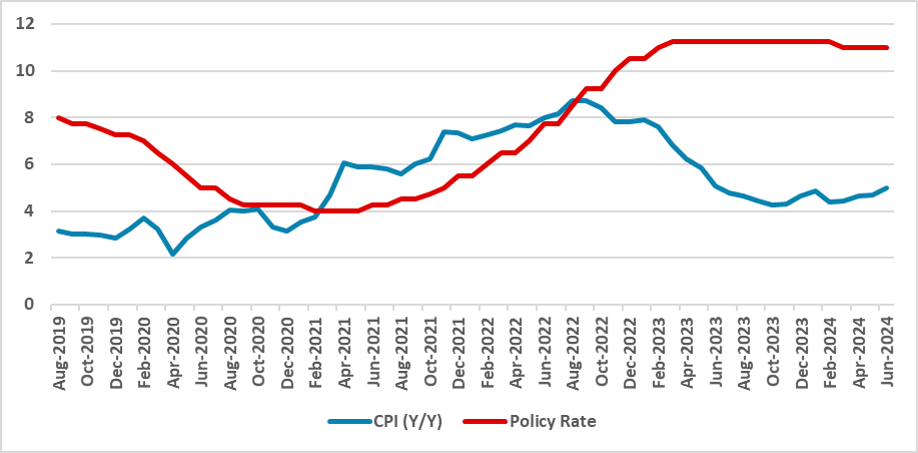

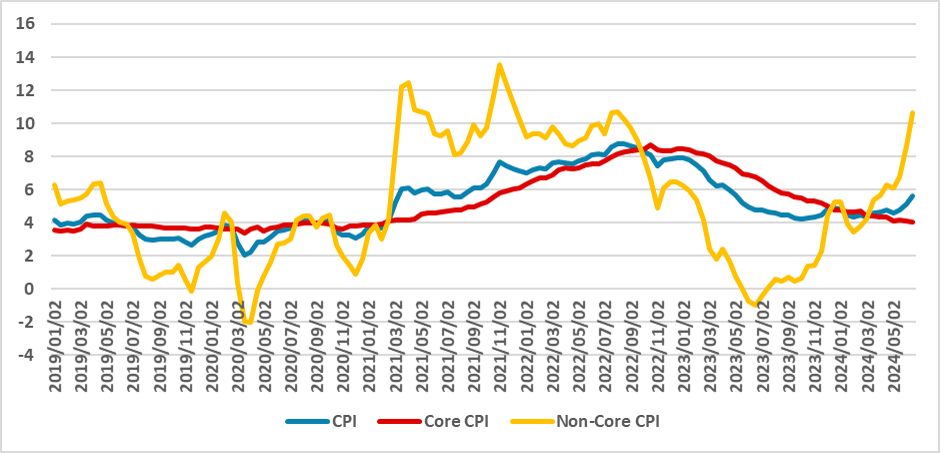

Mexico’s CPI rose 0.3% in January, below its 0.6% historical average but in line with expectations. Y/Y inflation fell to 3.6%, the lowest since Jan/2021. Core CPI rose 0.4%, with core goods up 0.7% and services up 0.2%. Non-core CPI fell 0.13%, led by a 1.5% drop in agricultural goods. The econom

February 08, 2025

Banxico Review: 50 bps Cut as Expected

February 8, 2025 9:39 PM UTC

Banxico cut the policy rate by 50bps to 10.5%, with a cautious stance and a split vote. Inflation has fallen but remains above target, expected to converge to 3.0% by Q3 2026. Global risks, including Trump’s tariff threats, add uncertainty. Despite economic weakness, some monetary tightening may s

January 31, 2025

Mexico GDP Review: 0.6% Contraction in Q4 and Recession Risks

January 31, 2025 6:34 PM UTC

Mexico’s GDP shrank by 0.6% in Q4 2024, bringing annual growth to 1.5%, well below previous years. The industrial sector led the decline, driven by uncertainty over Trump’s election and weaker investment, while agriculture also contracted sharply. Monetary tightening, lower U.S. demand, and poli

January 15, 2025

Mexico’s Plan: An Eye on Nearshoring and Displacing China in U.S.

January 15, 2025 1:17 PM UTC

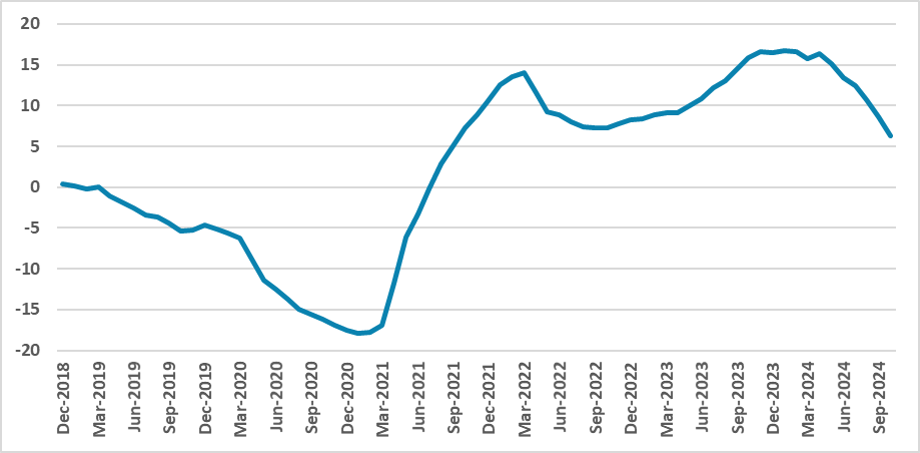

President Claudia Sheinbaum’s “Mexico Plan” targets USD 270 billion in investments, aiming to reduce poverty, boost sustainability, and expand Mexico’s economy. Key goals include nearshoring, increasing domestic production, and fostering U.S. trade relations. However, private investment stag

January 10, 2025

Mexico CPI Review: Downtrend Continues

January 10, 2025 2:11 PM UTC

December’s CPI grew 0.4%, with Y/Y inflation dropping to 4.2%, above Banxico’s 2%-4% target. Core CPI rose 0.5%, driven by services, while non-core inflation was stable. MXN depreciation’s pass-through impact remains limited. Tight monetary policy supports convergence, but Banxico faces a deci

January 06, 2025

Mexico CPI Preview: Christmas Acceleration

January 6, 2025 2:19 PM UTC

Mexico's December CPI is forecasted to grow by 0.5% in December, bringing 2024 inflation to 4.3%, above Banxico's target. Core CPI aligns better at 3.5%. Weak demand aids inflation convergence, expected by Q3 2026. Risks include a 22% MXN depreciation and U.S. tariffs. Banxico is likely to continue

January 02, 2025

EM Government Debt: BRICS Divergence

January 2, 2025 8:05 AM UTC

Brazil and South Africa suffer from debt servicing costs outstripping nominal GDP, which will remain a concern unless a consistent primary budget surplus is seen – though S Africa enjoys a much longer than average term to maturity than Brazil. India and Indonesia, in contrast, enjoy nominal

December 20, 2024

EMFX Outlook: Hit From Tariffs, Before Divergence

December 20, 2024 10:00 AM UTC

· EM currencies on a spot basis will remain on the defensive in H1 2025, as we see the U.S. threatening and then introducing tariffs on China imports – 30% against the current average of 20%. China’s response will likely include a Yuan (CNY) depreciation to the 7.65 area on USD/CN

December 18, 2024

LatAm Outlook: Economic Shifts

December 18, 2024 5:21 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico legal reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump elections, although we see tariffs in 2025 as unlikely

December 10, 2024

Mexico CPI Review: Signs of Disinflation

December 10, 2024 11:04 AM UTC

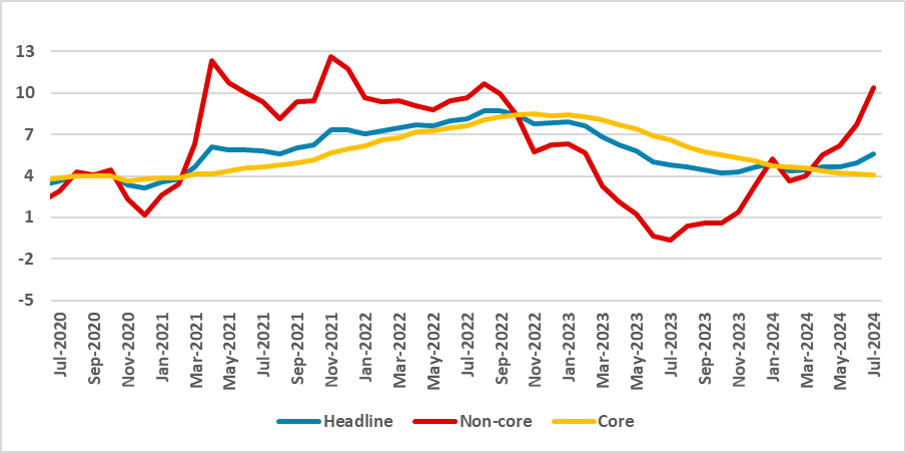

Mexico’s November CPI rose 0.4%, lowering the Y/Y rate to 4.6% from 4.8% in October. Non-core inflation increased 1.7%, driven by energy costs and seasonal electricity tariff adjustments, while core inflation remained flat, with core goods contracting 0.3%. Key declines occurred in Domestic Goods

November 29, 2024

Banxico Minutes: Evaluating Further Cuts

November 29, 2024 7:31 PM UTC

Banxico’s latest minutes reveal a 25 bps rate cut to 10.25%, with most board members supporting continued easing. They view recent non-core inflation spikes as transitory, expecting headline CPI to decline as shocks dissipate. Core CPI has dropped to 3.8%, reinforcing the case for further cuts, wh

November 22, 2024

Mexico: Budget Aims at Resuming Fiscal Discipline

November 22, 2024 11:21 PM UTC

Claudia Sheinbaum’s administration has introduced the 2025 budget, reaffirming Mexico's commitment to fiscal discipline with a projected fiscal consolidation of 2.0% of GDP, reducing the fiscal deficit from 5.9% in 2024 to 3.9% in 2025. Although there is likely an overestimation on GDP growth we b

November 08, 2024

Mexico CPI Review: Agricultural Goods Drive Inflation Up

November 8, 2024 2:58 PM UTC

Mexico's CPI rose 0.54% month-over-month in October, with a year-over-year increase to 4.8%, slightly above expectations. Agricultural goods and energy prices were key contributors. Core CPI, showing positive recent trends, rose 0.3% month-over-month and dropped to 3.8% year-over-year. Banxico is ex

November 05, 2024

Banxico Preview: Continuing to Cut at 25bps Pace

November 5, 2024 7:45 PM UTC

Mexico's Central Bank (Banxico) is expected to proceed with a 25 basis-point rate cut on Oct. 10, bringing the policy rate to 10.0%. Banxico remains focused on core CPI, which is gradually decreasing toward its 3.0% target. While some previously anticipated a 50 basis-point cut, consensus now favors

October 30, 2024

Mexico GDP: Demand Sustains Q3 Rebound, but Growth Expected to Slow

October 30, 2024 6:01 PM UTC

Mexico's Q3 GDP grew by 1.0% quarter-over-quarter, beating market expectations, though annual growth slowed to 1.5%. High employment and stronger-than-expected U.S. demand sustained growth, but the outlook remains cautious. Slower growth is expected ahead, with limited structural shifts such as near

September 27, 2024

Banxico Review: 25bps Cut as Expected, But Not Unanimous

September 27, 2024 12:58 PM UTC

Banxico cut the policy rate by 25 bps to 10.5%, but the decision was not unanimous, with one dissenter favoring a higher rate. Weak domestic growth and softening core CPI suggest further cuts are likely, though caution is needed due to market volatility. Banxico’s minutes will provide more clarity

September 26, 2024

EM FX Outlook: Fed Easing Helps but Divergent Trends

September 26, 2024 8:00 AM UTC

USD strength is ebbing across the board, which provides a positive force for most EM currencies on a spot basis. However, where inflation differentials are large, the downward pressure will remain in 2025 e.g. Turkish Lira (TRY). Where inflation differentials are modest against the U.S., but

September 24, 2024

LatAm Outlook: Diverging Patterns

September 24, 2024 12:54 PM UTC

· Brazil and Mexico started to diverge in terms of growth. While we see Brazil GDP growing above 3.0% in 2024 (pushed by the internal demand), we see Mexico’s growth decelerating to 1.3%, due to weaker demand from U.S. and contractionary monetary policy. In 2025, we see Brazil growing

September 10, 2024

Mexico CPI Review: 0% Inflation in August as Expected

September 10, 2024 1:53 PM UTC

Mexico's CPI remained flat in August, causing year-over-year CPI to drop from 5.6% to 5.0%. This stability was driven by a 0.7% decline in non-core CPI, while core CPI rose 0.2%. The Food and Beverages CPI fell 0.6%, reflecting easing pressure on agricultural goods. With the economy cooling, inflati

September 05, 2024

Mexico CPI Preview: Stabilization on August

September 5, 2024 4:39 PM UTC

Mexico’s August CPI is expected to remain flat at 0%, with year-on-year inflation dropping to 5.0% from 5.5% in July, driven by a contraction in non-core CPI. Core CPI is projected to rise by 0.2%, bringing its year-on-year figure to 3.9%. This trend may give Banxico more confidence to resume inte

August 29, 2024

Mexico: Inflation Report Shows Confidence in Cuts

August 29, 2024 2:08 PM UTC

Banxico's latest report reveals a weaker growth outlook, with a 2024 forecast cut to 1.4% and further weakening expected in 2025. Despite rising non-core CPI, inflation remains controlled. Banxico is likely to continue rate cuts, aiming for a year-end policy rate of 10.25%, amid moderate inflation c

August 23, 2024

Banxico Minutes: Cuts on the Table, Divided Board

August 23, 2024 1:02 PM UTC

Banxico has resumed its rate-cutting cycle, reducing the policy rate from 11% to 10.75%, with a split board decision. Most members noted weakening domestic activity and external volatility impacting the exchange rate. While some view the rise in non-core inflation as transitory, others see it, along

August 21, 2024

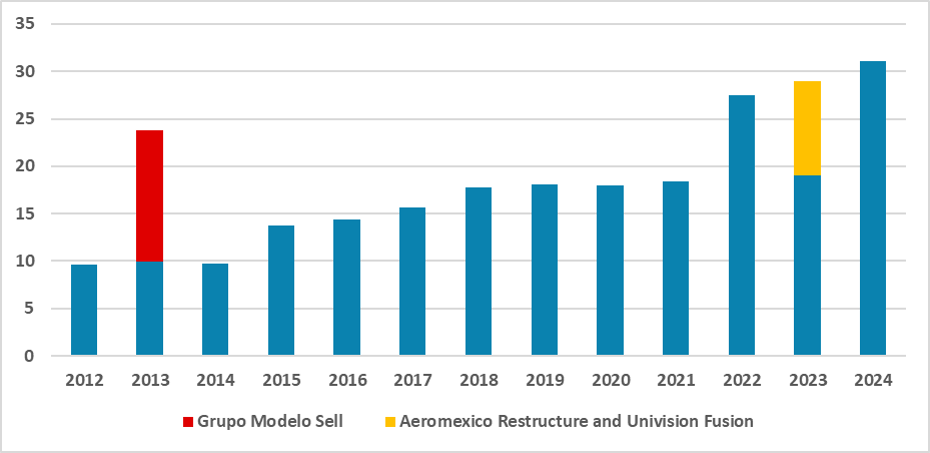

Mexico: FDI Increases but No Sign of Nearshoring

August 21, 2024 2:50 PM UTC

Mexico's FDI reached USD 31 billion in the first half of 2024, a 7% increase from 2023. However, this figure may be inflated by not accounting for USD inflation, potentially reducing real growth. While nearshoring discussions continue, current FDI largely reflects reinvestment by existing foreign fi

August 16, 2024

Mexico: Moving Towards Deficit as Expected

August 16, 2024 8:10 PM UTC

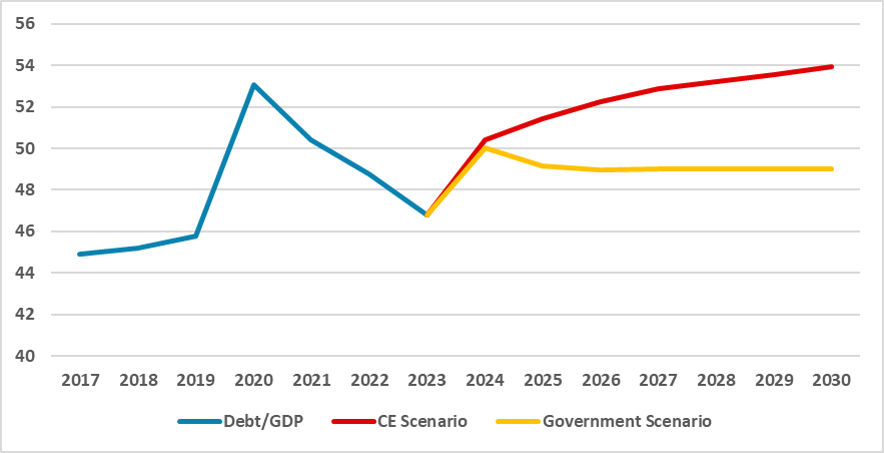

Mexico's fiscal situation is becoming challenging, with a primary deficit emerging due to increased support for PEMEX and overestimated growth projections. The Debt/GDP ratio is expected to rise to around 50.8% by 2024, possibly stabilizing around 49-54% depending on fiscal consolidation efforts. Wh

August 14, 2024

EM Markets Divergence with China Harder Landing Concerns

August 14, 2024 3:35 PM UTC

Global market turbulence has had a spillover impact into EM, but also some EM assets have benefitted from rotation away from the U.S. What are the prospects in the coming months?

We see scope for a 2nd wave of U.S. equity and Japanese Yen (JPY) correction, which are a mixed influence for EM assets

August 09, 2024

Banxico Review: 25bps Cut Amid the Risk

August 9, 2024 1:08 PM UTC

Banxico narrowly voted (3-2) to cut the policy rate by 25bps, despite rising headline inflation and peso depreciation. Core inflation is declining, standing at 4% year-over-year, with expectations of further decreases. Inflation is projected to hit the 3% target by Q4 2025. Future rate decisions wil

August 08, 2024

Mexico CPI Review: Food Prices Lead the 1% Rise

August 8, 2024 1:56 PM UTC

Mexico's CPI rose by 1.0% in July, pushing the year-over-year rate to 5.6%, the highest since November 2021. The increase was driven by a 1.9% rise in food and beverages due to drought and exchange rate impacts. Non-core inflation surged by 3.3%, widening the gap with core inflation. Given these ris

August 02, 2024

Banxico Preview: Inclined to Cut but There Are Risks

August 2, 2024 1:00 PM UTC

The Mexican Central Bank will meet on Aug. 8 to consider a 25 bps rate cut, though risks remain. At 11%, the rate is highly contractionary, impacting job creation and growth. The MXN’s volatility and 10% depreciation since June pose short-term inflation risks, complicating rate cuts. Adverse clima

July 30, 2024

Mexico GDP Review: Slow Growth in Continues

July 30, 2024 4:22 PM UTC

Mexico's GDP grew by just 0.2% in Q2 2024, with Industry and Services up 0.3% but Agriculture down 1.7%. The economy shows signs of deceleration, especially in agriculture due to extreme climate conditions, despite rising wages. The detailed data is pending, but a slowdown in investment and consumpt

July 25, 2024

Mexico: Mixed Signs for Banxico

July 25, 2024 1:52 PM UTC

The Mexican economy shows mixed signals for Banxico. Economic activity indicates a slowdown, with weaker industrial activity and decelerating formal employment. However, inflation is rising, particularly in non-core components like energy and agricultural goods, influenced by climate conditions. The

July 12, 2024

Banxico Minutes: More Slack Could Give Room for Rate Cuts

July 12, 2024 2:43 PM UTC

Banxico kept the policy rate unchanged at 11.0% but showed a slightly dovish tone, hinting at possible cuts in August. June's CPI figures revealed a widening gap between core and non-core inflation. Despite recent economic slowdowns and the MXN Peso's depreciation, Banxico expects economic slack to

July 09, 2024

Mexico CPI Review: 0.38% Inflation in June

July 9, 2024 7:46 PM UTC

INEGI reports Mexico's CPI rose 0.38% in June, above expectations. Year-over-year CPI increased to 5.0%, with core CPI at 4.1% and non-core CPI at 7.7%. Non-agricultural goods drove the rise, raising concerns about inflation due to climate-related agricultural shocks. Food and beverages saw the high

July 01, 2024

EM After the Elections: Fiscal Focus and Inflation Questions

July 1, 2024 8:05 AM UTC

Enhancing fiscal credibility is key post-election in India and S Africa, but also for Brazil. India, will do this in the 3 week of July, but S Africa needs to move from ANC/DA led coalition optimism to reality quickly. Brazil needs to stop the vicious circle of sentiment building up on fiscal slip