View:

March 10, 2026

March 09, 2026

March 06, 2026

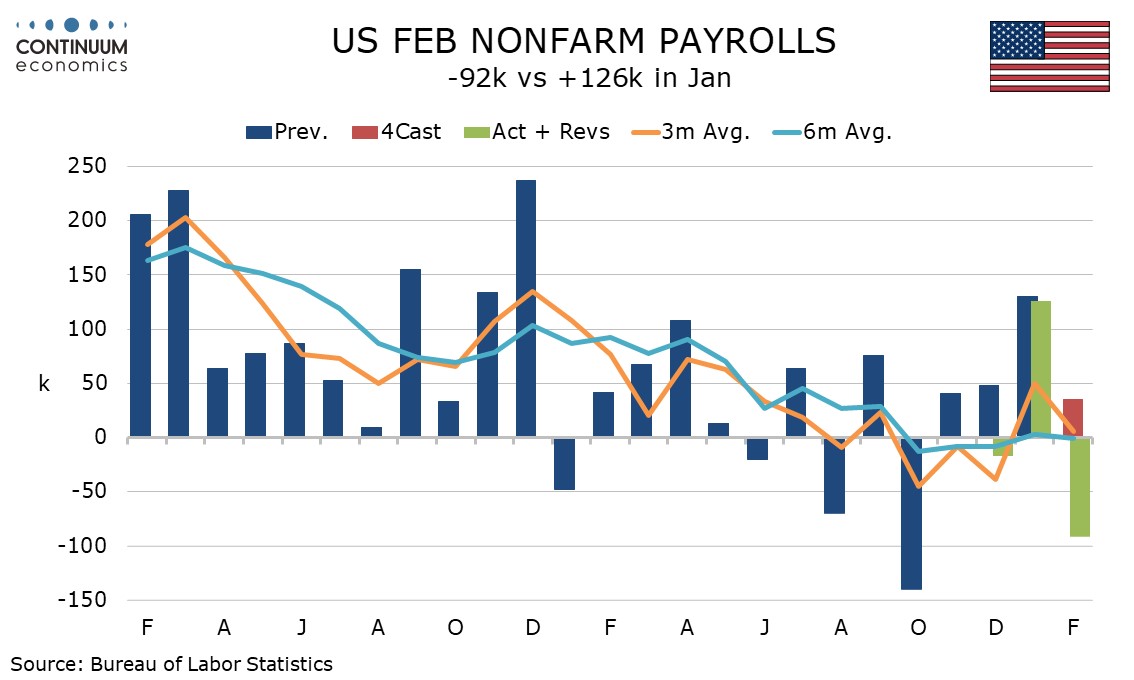

U.S. February Employment - Decline follows an above trend January, trend near flat

March 6, 2026 2:24 PM UTC

February’s non-non-farm payroll with a 92k decline is well below expectations but needs to be seen alongside a 126k increase in January, and in the context of bad weather between the two surveys. Unemployment edged up to 4.4% from 4.3% though more positive are a 0.4% rise in average hourly earning

March 05, 2026

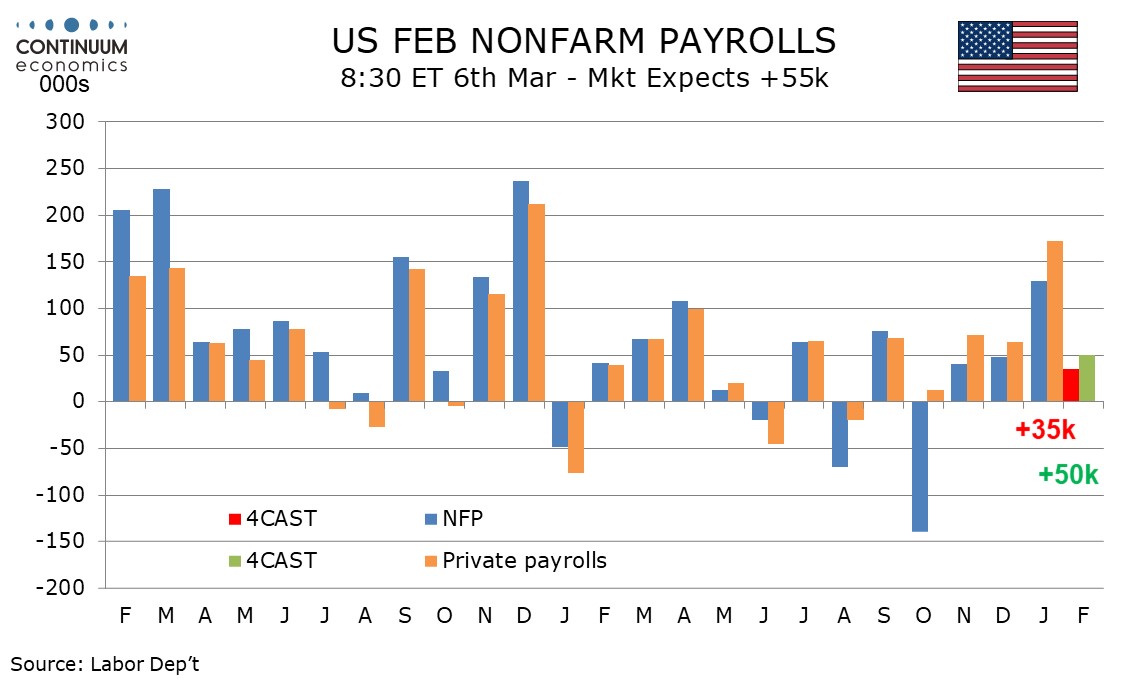

Preview: Due March 6 - U.S. February Employment (Non-Farm Payrolls) - Not as strong as January, but still marginally positive

March 5, 2026 2:26 PM UTC

We expect February’s non-farm payroll to rise by 35k overall and by 50k in the private sector, both four month lows and significantly slower than January’s above trend respective gains of 130k and 172k. We expect unemployment to edge up to 4.4% from 4.3%, reversing a January dip, and average hou

March 04, 2026

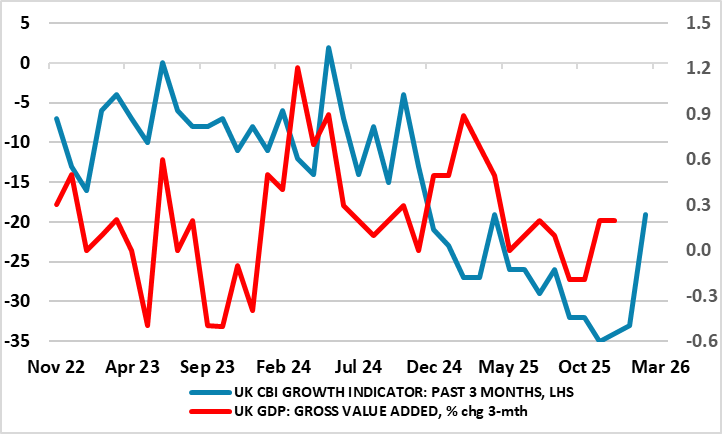

UK GDP Preview (Mar 13): Were Things Getting Better?

March 4, 2026 11:11 AM UTC

Belatedly, some good news; the UK economy grew for a second successive month in December, something not seen for almost a year. Even more encouragingly, it may very well enjoy a further rise in the looming January data, thereby providing the best three-month showing in two years. But as is famil

March 03, 2026

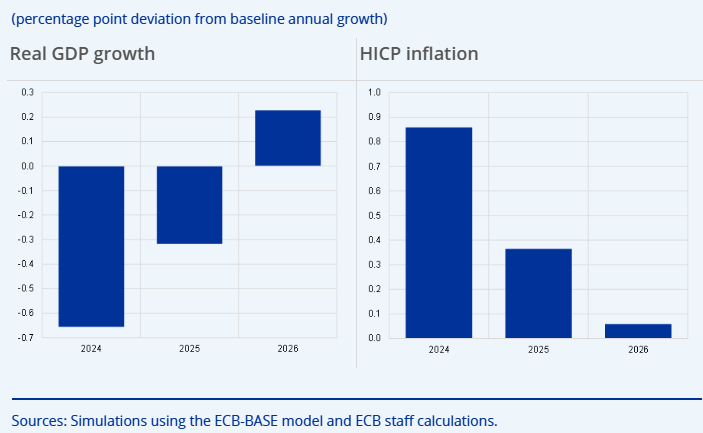

EZ HICP Review: Core Rate Spikes as Upside Inflation Risks Return

March 3, 2026 10:35 AM UTC

Having dropped to 1.7% in the January data, thereby matching expectations and the short-lived Sep 24 outcome, it is likely especially in view of the Middle East conflict that the headline HICP rate may not be any lower through this year and into next. Indeed, we headline rate rose 0.2 ppt to 1.9%