View:

March 13, 2026

March 12, 2026

BoE Preview (Mar 19): MPC Agree to Disagree?

March 12, 2026 2:35 PM UTC

The rate cut that seemed partly flagged by the narrow vote against easing in early February now looks highly unlikely this month. Indeed, it is also likely that the four who dissented in favor of cutting last time around will vote with the majority in favour of no change. But while the MPC as a wh

March 11, 2026

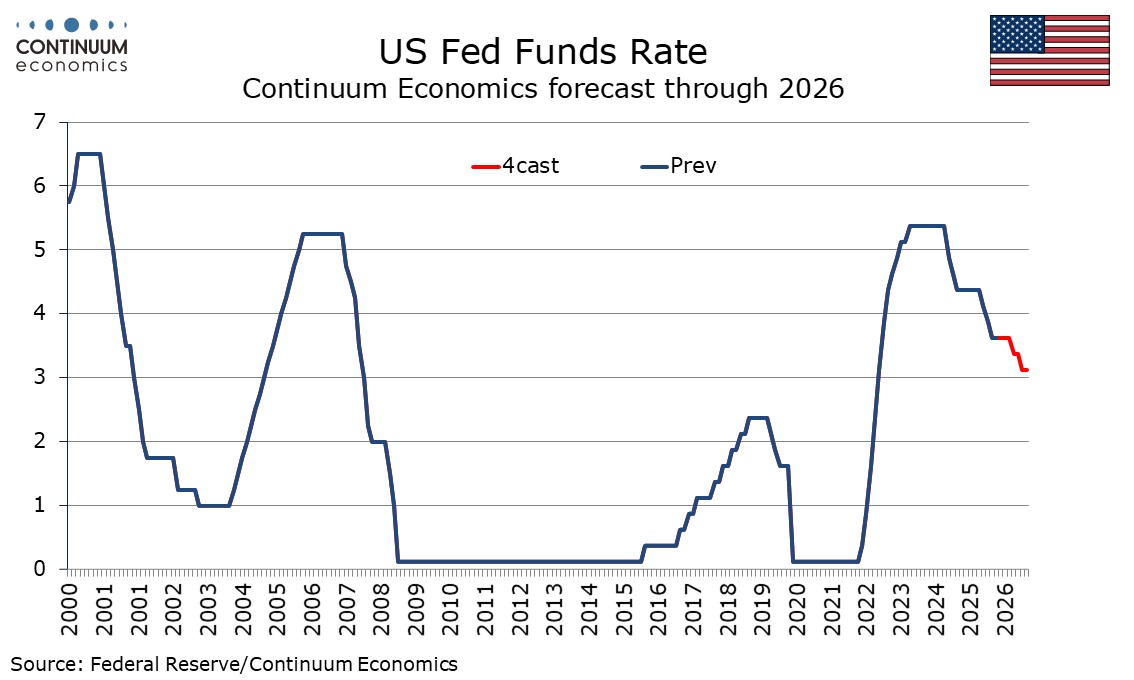

FOMC Preview for March 18: Little change seen in either statement or dots

March 11, 2026 3:37 PM UTC

The FOMC meets on March 18 with rates likely to be left unchanged at 3.5-3.75%. The dots will be updated but we expect them to remain where they were in December, looking for one 25bps easing in 2026 and one more in 2027. The economic forecasts are likely to see only modest changes from September, w

March 10, 2026

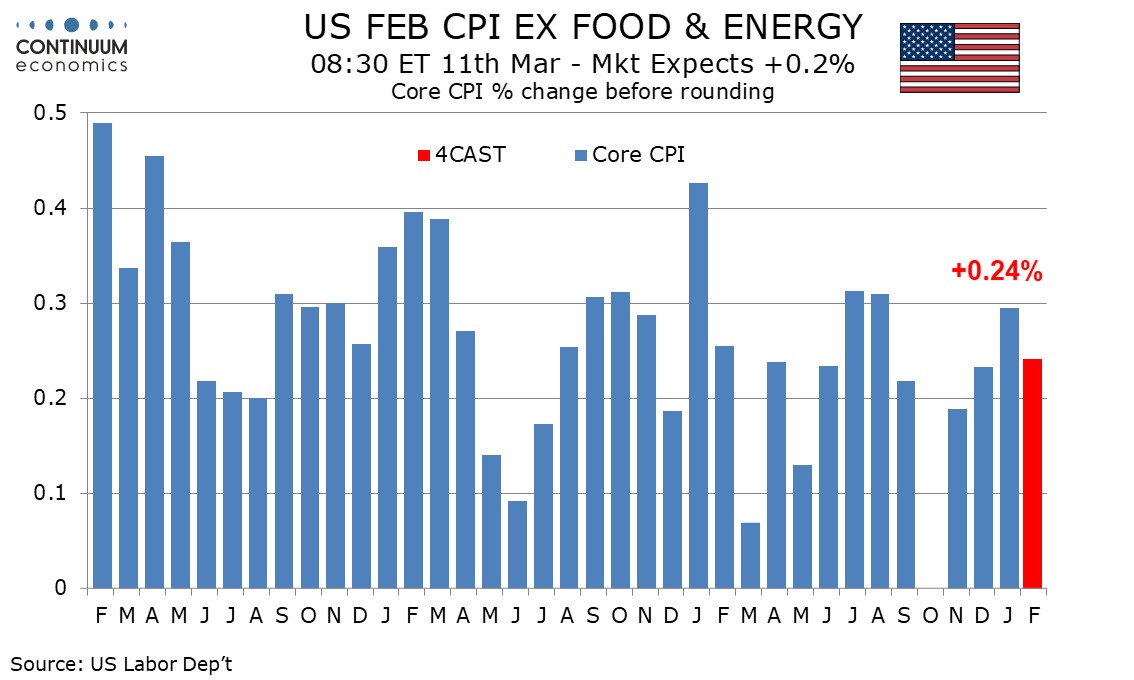

Preview: Due March 11 - U.S. February CPI - A moderate gain, but inflation not yet defeated

March 10, 2026 12:15 PM UTC

We expect February’s CPI to increase by 0.3%, with a 0.2% increase ex food and energy. Before rounding we expect the gains will be similar, with the overall CPI rounded up from 0.26% and the core rounded down from 0.24%. CPI has slowed, but it is too soon for the Fed to declare victory.

March 09, 2026

March 06, 2026

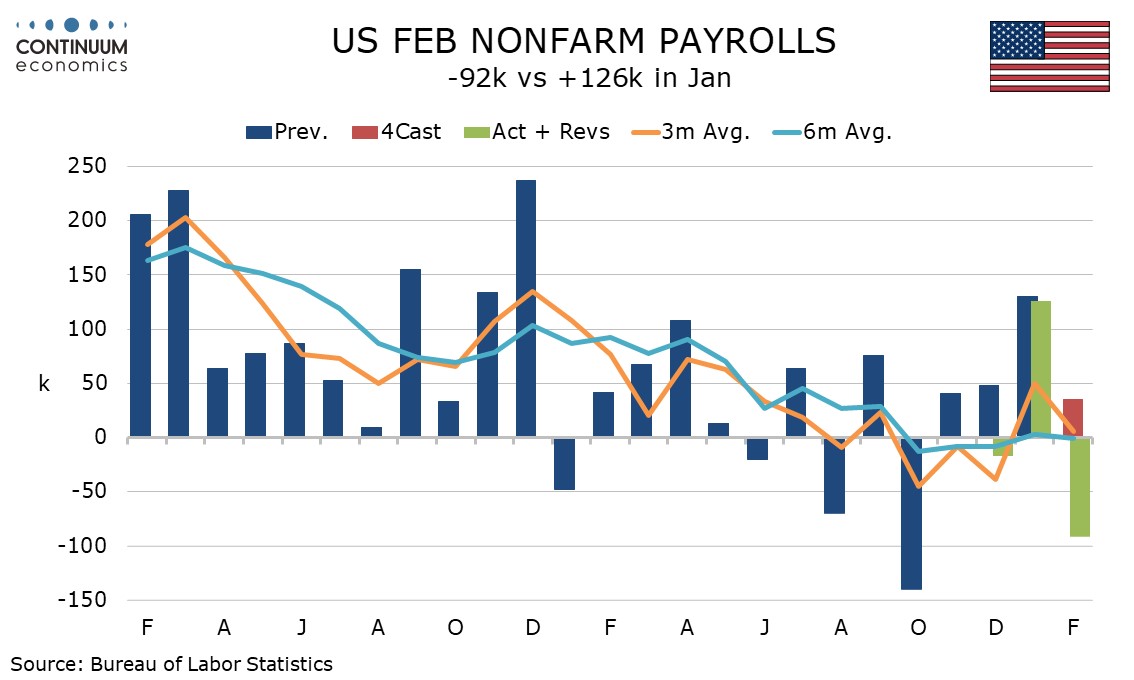

U.S. February Employment - Decline follows an above trend January, trend near flat

March 6, 2026 2:24 PM UTC

February’s non-non-farm payroll with a 92k decline is well below expectations but needs to be seen alongside a 126k increase in January, and in the context of bad weather between the two surveys. Unemployment edged up to 4.4% from 4.3% though more positive are a 0.4% rise in average hourly earning