View:

March 06, 2026

Preview: Due March 13 - U.S. Preliminary (Second) Estimate Q4 GDP - Marginally stronger on housing

March 6, 2026 4:45 PM UTC

We expect a marginal upward revision to Q4 GDP to 1.5% in the preliminary (second) estimate from 1.4% in the advance (first) release, led by an upward revision to housing investment to a 1.7% rise from a 1.5% decline.

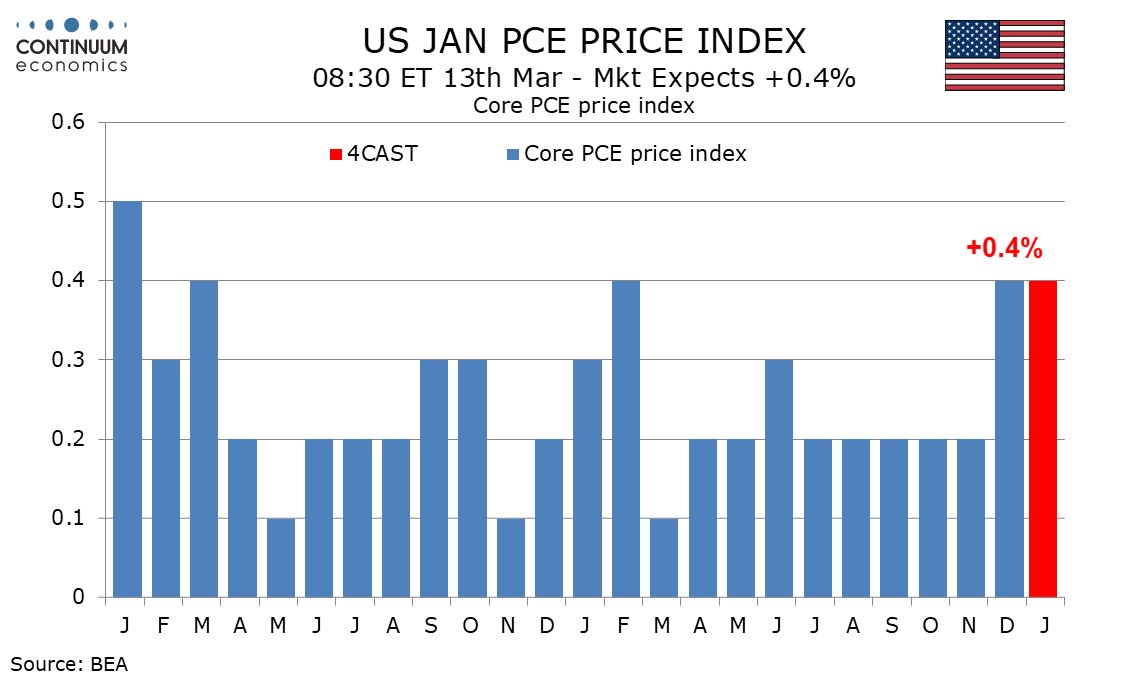

Preview: Due March 13 - U.S. January Personal Income and Spending - Core PCE Prices to outperform CPI

March 6, 2026 3:24 PM UTC

We expect January to see a strong core PCE price index increase of 0.4%, matching the rise seen in December. We expect personal income to increase by 0.6%, unusually outpacing personal spending, which we expect to rise by 0.4% for a third straight month.