Mexico: Moving Towards Deficit as Expected

Mexico's fiscal situation is becoming challenging, with a primary deficit emerging due to increased support for PEMEX and overestimated growth projections. The Debt/GDP ratio is expected to rise to around 50.8% by 2024, possibly stabilizing around 49-54% depending on fiscal consolidation efforts. While markets remain calm, future fiscal discipline and political factors, such as judicial reforms and U.S. relations, will be crucial, especially under President Claudia Sheinbaum's leadership.

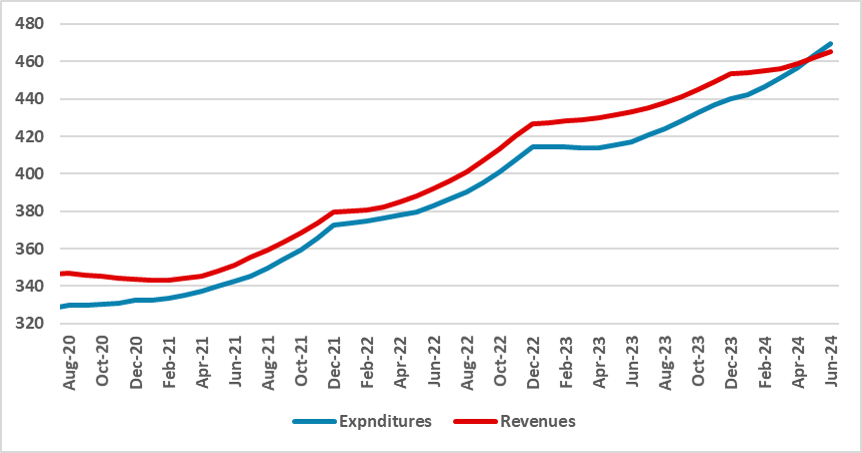

Figure 1: Mexico’s Primary Revenues and Expenditures (12 Months Sum, Billions of MXN)

Source: SHCP

Mexico’s government is beginning to register a primary deficit, meaning that revenues are not sufficient to fully cover expenditures. This development for 2024 was widely anticipated, as the government announced an increase in current transfers to PEMEX. The government projects that this increase in deficit will be reversed in 2025, a year in which the government expects to return to fiscal surpluses.

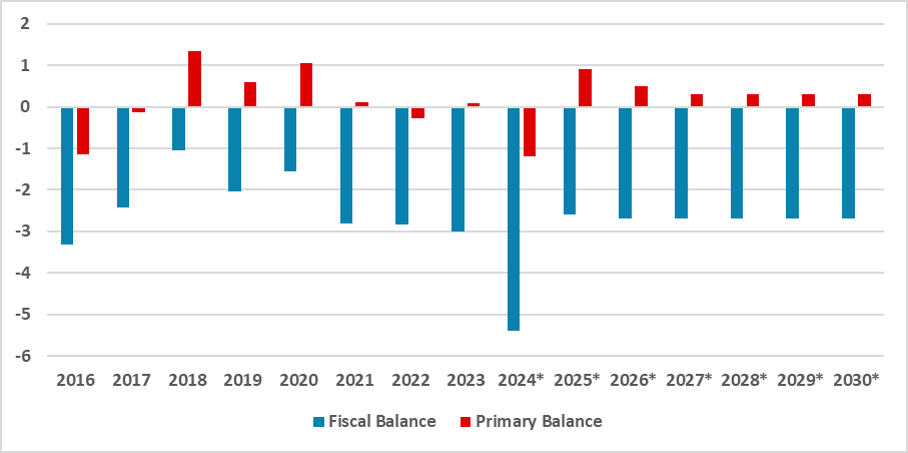

Figure 2: Mexico’s Primary and Fiscal Balance (% of GDP, Government Estimates)

Source: SHCP

Source: SHCP

However, PEMEX and CFE, the state energy agencies, are not in good shape and will likely require additional government support as structural reforms to make them sustainable are ongoing. Additionally, the government’s growth estimates (between 2.5% - 3.0%) are overly optimistic, and if actual growth is lower, it could substantially affect revenue growth, making it difficult for the Mexican government to revert to a primary surplus.

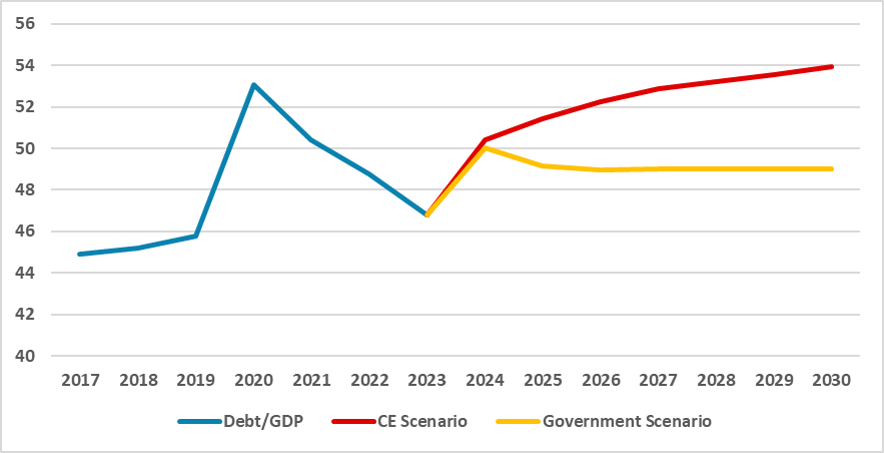

We have updated our forecast for the Debt/GDP levels, now projecting this ratio to rise to around 50.8% as a result of exchange rate depreciation and the higher deficit. From 2026 onward, we analyze two scenarios. We have maintained the fiscal targets proposed by the government in their fiscal plan but have adjusted their growth forecasts from the projected 2.5% to our estimate of 1.9%. In this scenario, we see the Debt/GDP ratio stabilizing around 49%. In a more realistic scenario, assuming a more gradual fiscal consolidation and continued fiscal deficits in 2025 due to additional support for the state energy companies, we foresee the Debt/GDP ratio stabilizing around 54%, the same level Mexico registered during the pandemic.

Figure 3: Debt/GDP (% of the GDP)

Source: SHCP and Continuum Economics

Mexico's fiscal situation is still comfortable; the 54% ratio is unlikely to cause difficulties in debt rollover. However, it will be crucial for the next President, Claudia Sheinbaum, to demonstrate a commitment to fiscal discipline. So far, markets are not overly concerned about Mexico's fiscal situation but are more focused on the potential judicial reforms, which could undermine Mexican institutions, and the future relationship between Mexico and the U.S., especially if Donald Trump wins the U.S. presidency.