View:

March 05, 2026

Preview: Due March 12 - U.S. January Trade Balance - May be stabilizing close to pre-tariff levels

March 5, 2026 3:25 PM UTC

We expect a January trade deficit of $69.0bn, which would be only a marginal correction from December’s $70.3bn which was the widest since July, though still well below the record $136.0bn deficit seen in March of 2025 shortly before the tariff announcement.

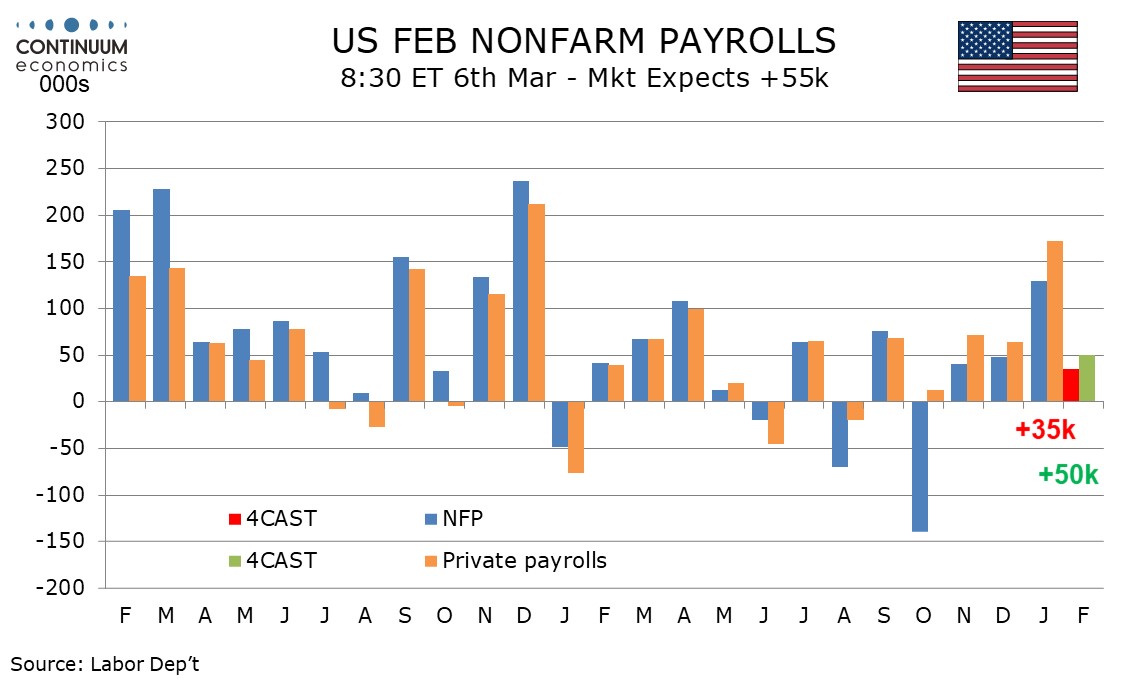

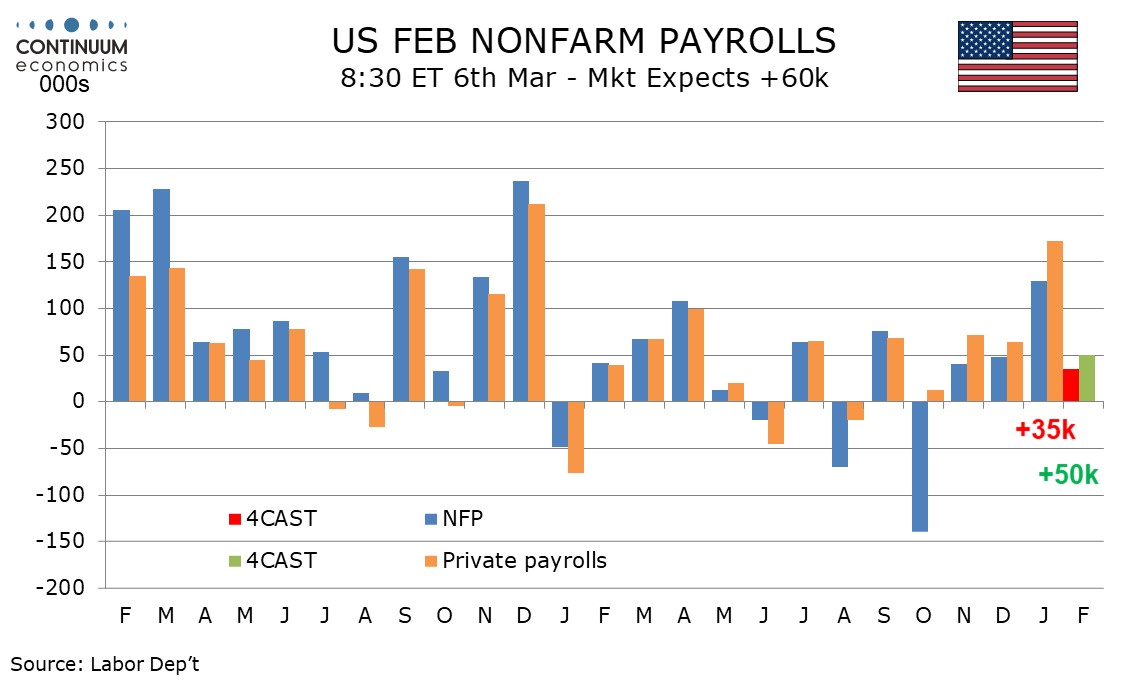

Preview: Due March 6 - U.S. February Employment (Non-Farm Payrolls) - Not as strong as January, but still marginally positive

March 5, 2026 2:26 PM UTC

We expect February’s non-farm payroll to rise by 35k overall and by 50k in the private sector, both four month lows and significantly slower than January’s above trend respective gains of 130k and 172k. We expect unemployment to edge up to 4.4% from 4.3%, reversing a January dip, and average hou

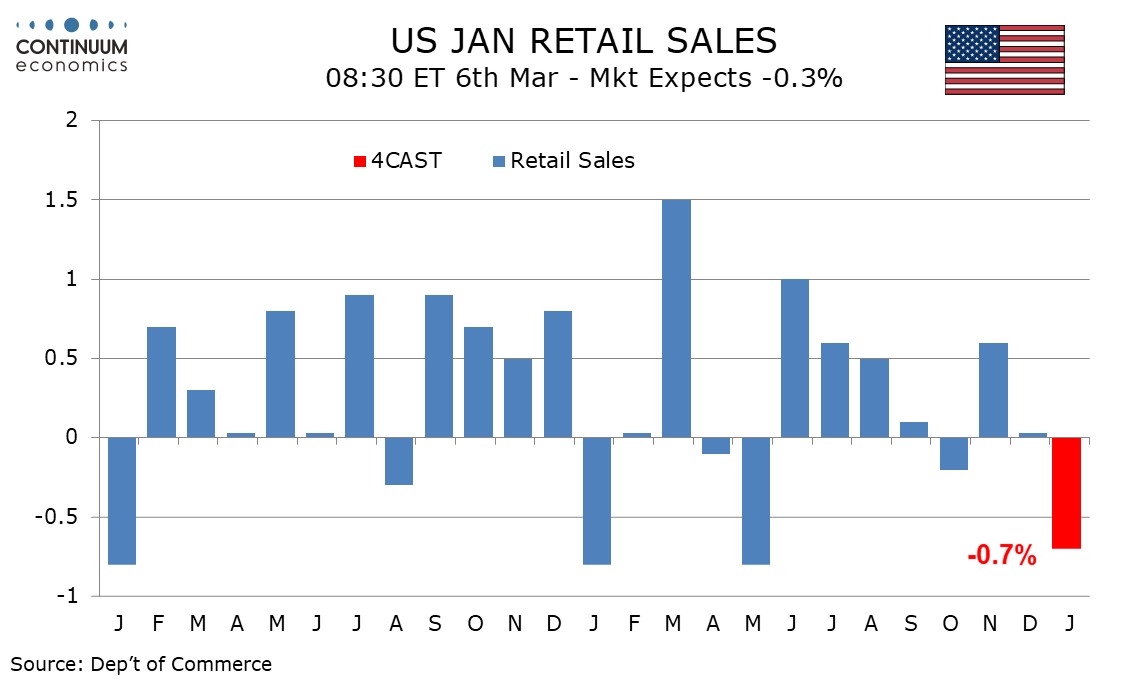

Preview: Due March 6 - U.S. January Retail Sales - Weather adding to downside risk

March 5, 2026 2:17 PM UTC

We expect retail sales to see a weak month in January, falling by 0.7% overall, with declines of 0.4% ex auto and 0.2% ex auto and gasoline. Bad weather late in the month will contribute to the decline.

U.S. Initial Claims remain low, Some inflationary risk visible in Q4 Productivity and Costs report

March 5, 2026 1:54 PM UTC

Initial claims are unchanged at 213k, a recent bout of bad weather having no significant impact, contrasting late January when a spell of bad weather did coincide with a rise in initial claims. Q4 productivity data is solid but this is not eliminating inflationary pressures.

March 04, 2026

Preview: Due March 18 - U.S. February PPI - Ex food, energy and trade suggests trend at 0.3% per month

March 4, 2026 6:58 PM UTC

We expect PPI to rise by 0.3% in February, slower than January’s 0.5% and December’s 0.4%. Ex food and energy we expect a rise of 0.2% after a strong 0.8% January increase. Ex food, energy and trade however, we expect a fourth straight increase of 0.3%, which would signal where trend is.

Preview: Due March 16 - Canada February CPI - Softer in part due to year ago end of a sales tax holiday

March 4, 2026 6:09 PM UTC

We expect February Canadian CPI to slip to a 6-month and on-target low of 2.0% yr/yr (1.96% before rounding) from 2.3% (2.29% before rounding) in January, the slowing mainly due to the ending of a sales tax holiday a year ago, which lasted from mid-December of 2024 to mid-February of 2025). The Ba

U.S. February ISM Services strength contrasts slower S&P Services PMI

March 4, 2026 3:15 PM UTC

February’s ISM services index of 56.1 from 53.8 is the strongest since July 2022 and in a stark contrast to a weaker S and P services PMI of 51.7, revised down from 52.3 to its weakest level since April 2025. The true picture probably lies somewhere between the two surveys, but averaging the two a

U.S. February ADP Employment - A stronger month after sharply underperforming payrolls in January

March 4, 2026 1:37 PM UTC

February’s ADP’s estimate of private sector employment of 63k is stronger than the market expected though in part offset to a downward revision to January to 11k from 22k. The bounce in ADP data looks like a correction from a weak January which sharply underperformed the non-farm payroll.

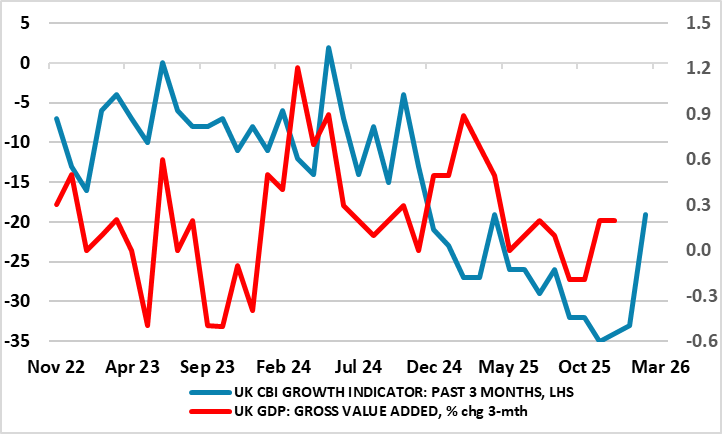

UK GDP Preview (Mar 13): Were Things Getting Better?

March 4, 2026 11:11 AM UTC

Belatedly, some good news; the UK economy grew for a second successive month in December, something not seen for almost a year. Even more encouragingly, it may very well enjoy a further rise in the looming January data, thereby providing the best three-month showing in two years. But as is famil

March 03, 2026

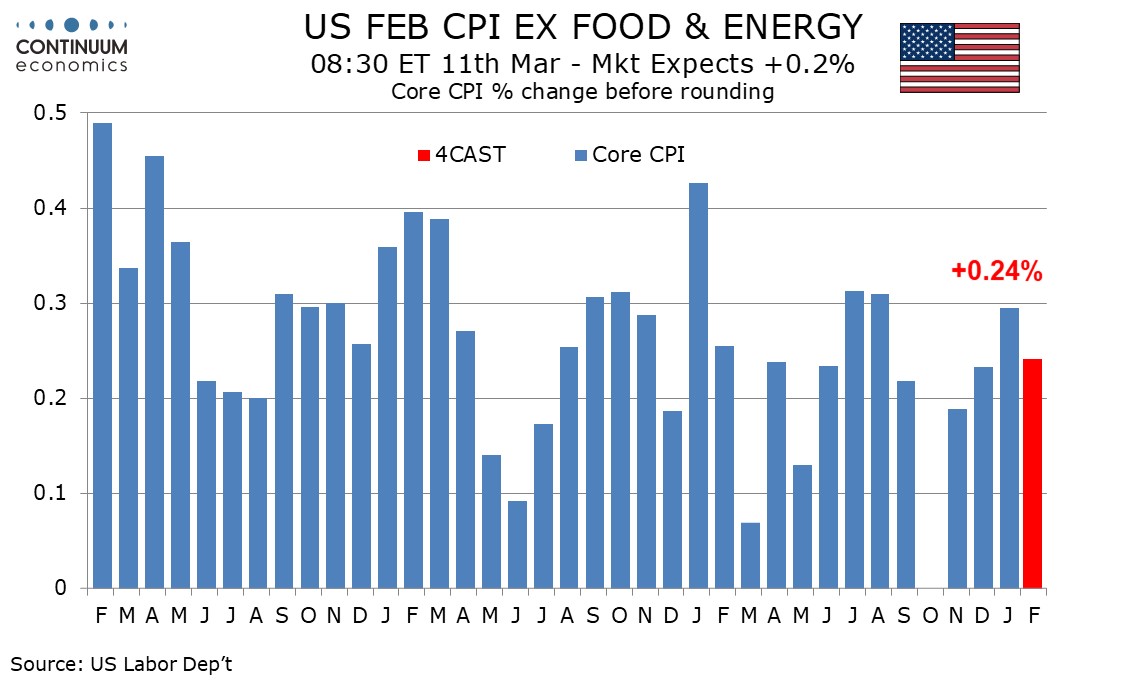

Preview: Due March 11 - U.S. February CPI - A moderate gain, but inflation not yet defeated

March 3, 2026 7:30 PM UTC

We expect February’s CPI to increase by 0.3%, with a 0.2% increase ex food and energy. Before rounding we expect the gains will be similar, with the overall CPI rounded up from 0.26% and the core rounded down from 0.24%. CPI has slowed, but it is too soon for the Fed to declare victory.

Preview: Due March 4 - U.S. February ADP Employment - To pick up after underperforming payrolls in January

March 3, 2026 1:29 PM UTC

We expect a 60k increase in February’s ADP estimate for private sector employment, which would be a significant pick up from January’s 22k, which dramatically underperformed a 172k increase in January’s private sector non-farm payroll.

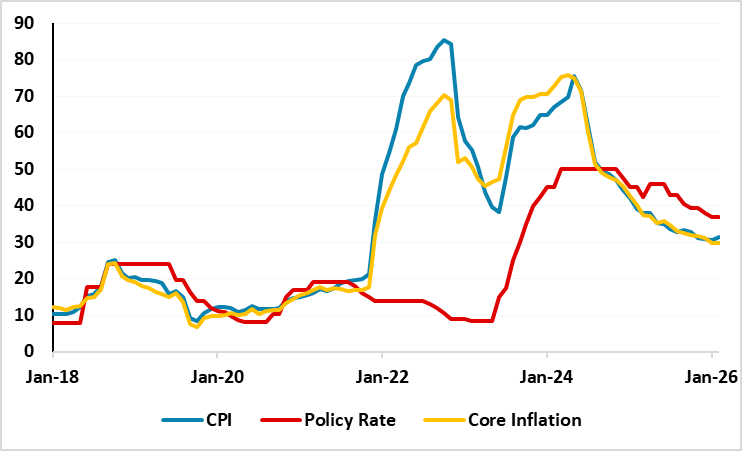

Inflation Edged Up to 31.5% y/y in February as Monthly Pressures Persist

March 3, 2026 11:56 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced February inflation figures on March 3. After hitting 30.7% annually in January, Turkiye’s inflation surged to 31.5% in February due to rising food, transportation and housing prices. Our average inflation forecast for 2026 stands at 2

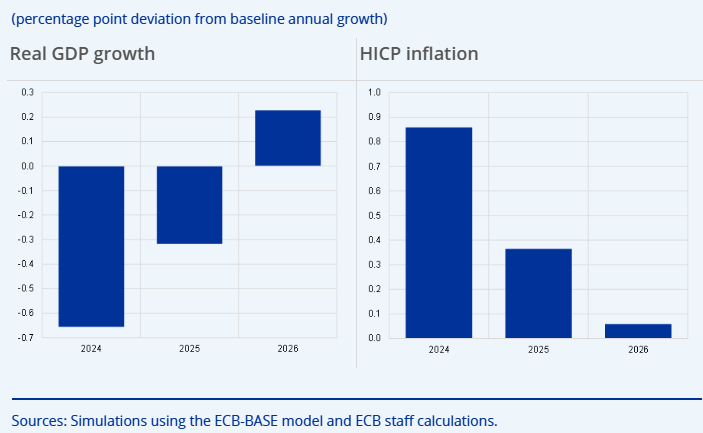

EZ HICP Review: Core Rate Spikes as Upside Inflation Risks Return

March 3, 2026 10:35 AM UTC

Having dropped to 1.7% in the January data, thereby matching expectations and the short-lived Sep 24 outcome, it is likely especially in view of the Middle East conflict that the headline HICP rate may not be any lower through this year and into next. Indeed, we headline rate rose 0.2 ppt to 1.9%

March 02, 2026

Turkish Economy Grew by 3.6% y/y in 2025

March 2, 2026 9:16 PM UTC

Bottom Line: The Turkish Statistical Institute (TUIK) announced Q4 2025 and full-year GDP growth for 2025 on March 2. Turkish economy expanded by 3.6% y/y in 2025 (3.4% y/y in Q4), underpinned by domestic demand while the main drag came from net trade as annual exports of goods and services declined

Preview: Due March 13 - U.S. January Durable Goods Orders - Aircraft to slip, but ex transport trend is positive

March 2, 2026 3:54 PM UTC

We expect January durable goods orders to see a second straight moderate decline, of 0.6%, as a November surge in aircraft orders continues to correct, but ex transport we expect continued underlying strength to be shown, with a rise of 0.7%.

U.S. February ISM Manufacturing - January surge largely sustained, prices bounce

March 2, 2026 3:25 PM UTC

February’s ISM manufacturing index at 52.4 is only marginally down from January’s 54.6 which was the highest August 2022. We now have two straight clearly positive numbers to follow two straight negatives, a sign that manufacturing activity is picking up in early 2026.

February 27, 2026

Preview: Due March 13 - Canada February Employment - Employment and Labor force due for a rebound in Ontario

February 27, 2026 8:20 PM UTC

We expect Canadian employment to increase by 50k in February, more than fully reversing a 24.8k decline in January to keep trend modestly positive. However we expect an even stronger rebound in the labor force from a decline in January to lift the unemployment rate to 6.6% from 6.5%, while remaining

Preview: Due March 12 - U.S. January Housing Starts and Permits - Weaker and not only on weather

February 27, 2026 6:02 PM UTC

We expect January housing starts to fall by 6.0% to 1.32m to follow a 6.0% December increase while permits fall by 5.2% to 1.38m to follow a 4.8% December increase. Underlying slowing in demand and bad weather are both likely to contribute to the decline, with the latter impacting starts more than p

Preview: Due March 10 - U.S. February Existing Home Sales - Extending a sharp January decline

February 27, 2026 5:16 PM UTC

We expect February existing home sales to fall by 0.8% to extend a sharp 8.4% January decline, to a level of 3.88m, which would be the lowest since October 2010. This would follow a 0.8% decline in January pending home sales, which extended a sharp 7.4% December decline.

Preview: Due March 2 - U.S. February ISM Manufacturing - Correcting lower but still positive

February 27, 2026 4:00 PM UTC

We expect February’s ISM manufacturing index to correct lower to 50.5 from January’s sharply improved 52.6, though this would still deliver a second straight positive reading to follow ten straight negatives.

Canada Q4 GDP slips despite strong support from government, but some positive signals

February 27, 2026 2:32 PM UTC

Canada’s 0.6% annualized Q4 GDP decline was slightly weaker than expected and further below a flat BoC projection, and came despite quite strong support from government. Q3 was revised down to 2.4% from 2.6% but this was more than outweighed by an upward revision to Q2 to -0.9% from -1.8%.

February 26, 2026

Preview: Due March 4 - U.S. February ADP Employment - To pick up after underperforming payrolls in January

February 26, 2026 4:32 PM UTC

We expect a 60k increase in February’s ADP estimate for private sector employment, which would be a significant pick up from January’s 22k, which dramatically underperformed a 172k increase in January’s private sector non-farm payroll.

Preview: Due March 6 - U.S. February Employment (Non-Farm Payrolls) - Not as strong as January, but still marginally positive

February 26, 2026 3:22 PM UTC

We expect February’s non-farm payroll to rise by 35k overall and by 50k in the private sector, both four month lows and significantly slower than January’s above trend respective gains of 130k and 172k. We expect unemployment to edge up to 4.4% from 4.3%, reversing a January dip, and average hou

Low Inflation and No Loadshedding Continue to Support South African GDP Growth

February 26, 2026 3:19 PM UTC

Bottom Line: Department of Statistics of South Africa (Stats SA) will announce Q4 2025 GDP growth figures on March 3. Following a 0.5% q/q expansion in Q3 2025, we expect growth momentum to be sustained in Q4. This trajectory is supported by low inflation, improved consumer sentiment, a power cuts (

Preview: Due February 27 - Canada Q4/December GDP - A modest correction from a surprisingly strong Q3

February 26, 2026 2:29 PM UTC

We expect Q4 Canadian GDP to decline by 0.3% annualized, marginally softer than an unchanged estimate made by the Bank of Canada with January’s Monetary Policy report. This would be consistent with December GDP rising by 0.1% as projected with November’s data.