EM FX Outlook: Fed Easing Helps but Divergent Trends

USD strength is ebbing across the board, which provides a positive force for most EM currencies on a spot basis. However, where inflation differentials are large, the downward pressure will remain in 2025 e.g. Turkish Lira (TRY). Where inflation differentials are modest against the U.S., but interest rate differentials are wider then this can mean modest appreciation v USD – especially if the starting point is an undervalued currency (e.g. Brazilian real BRL). Small spot gains can be made by the S African Rand (ZAR) and Indonesian Rupiah (IDR) by end 2025.

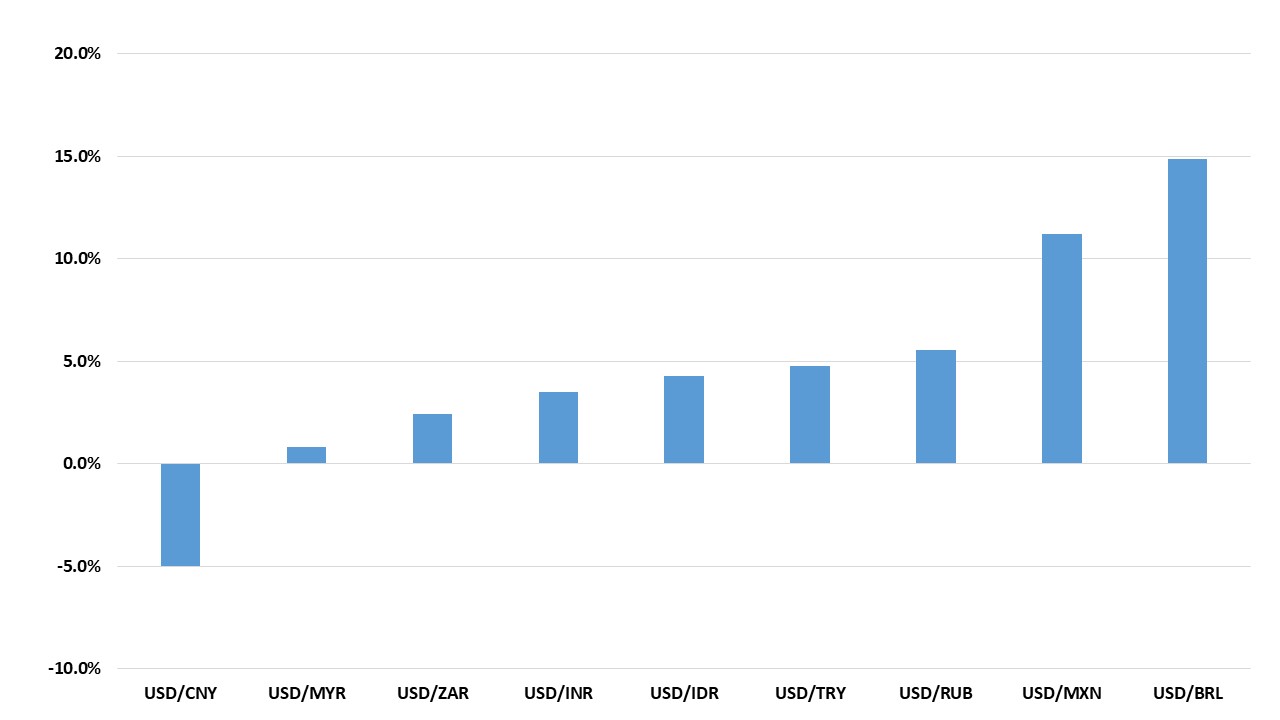

· On a total returns basis, yield spreads favor the BRL, while we also see spot appreciation (Figure 1). Negative total returns should be seen for Chinese Yuan (CNY), as we see the policy rate remaining below the U.S. and as China authorities favor supporting exports to help GDP growth by weakening the Yuan. If Donald Trump is elected president and introduces new tariffs, then China would react by allowing more CNY declines. The MXN faces a volatile U.S. presidential election, but a Kamala Harris victory would produce a rebound and more stability for the carry trade.

· Elsewhere, South Africa, India and Indonesia will not ease as much as the Fed, which helps total return prospects. Turkey will allow further exchange rate decline to avoid real exchange rate appreciation, but also reduce policy rates and this will make a less attractive total returns play in 2025.

Risks to our views: A serious economic slowdown in the U.S. would likely mean a larger decline of the USD versus DM currencies on more proactive Fed cuts and spill over to benefit EM currencies.

Figure 1: 15mth Total Returns Versus the USD (%) (+ve = USD losses)

Source: Continuum Economics

Asia

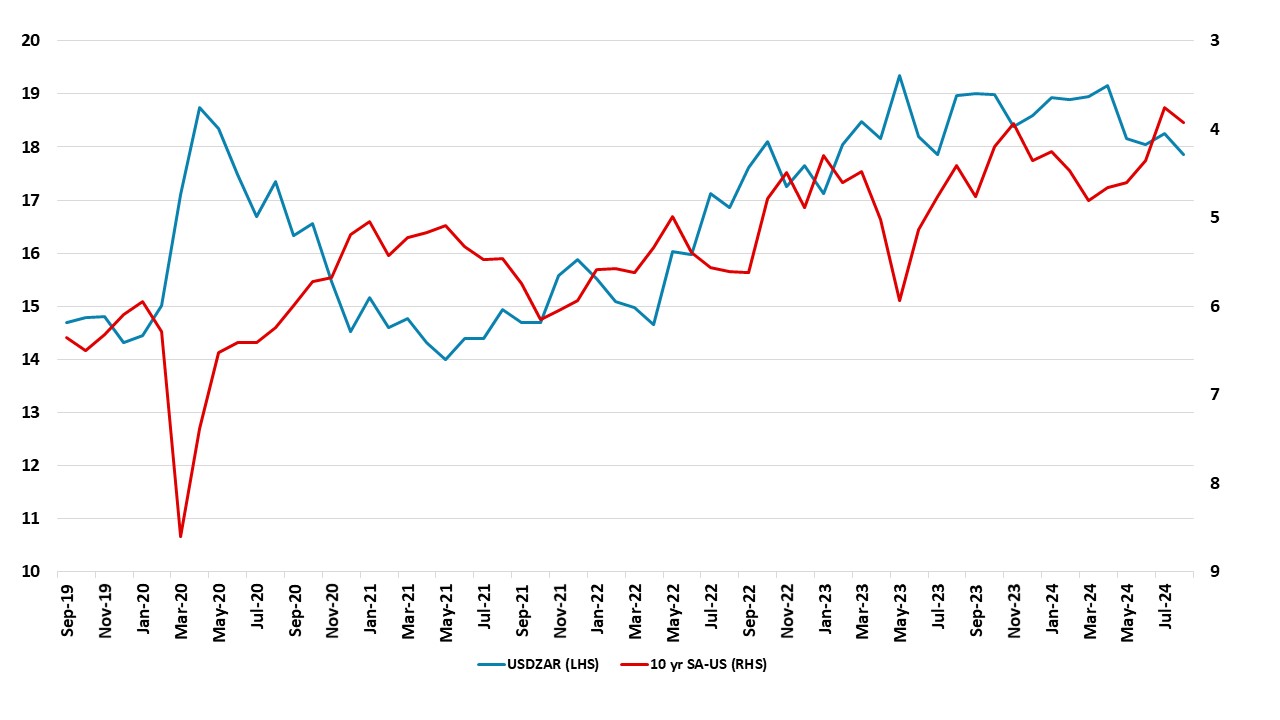

CNY has bounced with more Fed cuts being discounted and the USD softening. We now see 7.10 on USDCNY by end 2024. While this sentiment shift can still have a near-term influence, interest rate differentials remain adverse for the CNY. Figure 2 shows that 2yr yield spreads are consistent with a weak Yuan. Additionally, China will likely be biased towards maintaining a competitive CNY, which means intervening to cap CNY gains around 7.00 and encouraging CNY gradual decline in 2025 to help exports.

Figure 2: USDCNY and US/China 2yr Government Bond Yield (%)

Source: Continuum Economics

If Kamala Harris wins the U.S. presidential election then this means strategic pressure remaining on China, but no across the board trade war. USDCNY would then likely end 2025 at 7.30. Alternatively, if Donald Trump wins then China would fear new tariffs and a trade war, which would likely be countered by offsetting CNY weakness like 2018. The problem under the Trump win scenario is whether he would launch extra tariffs against China in 2025 or 2026. We feel that immigration and getting 2017 tax cuts renewed is his prime policy focus in 2025. Even so, the threat against China could mean that USDCNY is 7.45-50 by end 2025 in this scenario.

Meanwhile the Reserve Bank of India will attempt to keep the INR range bound (USDINR 83-83.7) over 2024. With foreign exchange reserves high, the RBI will continue to intervene in the market. This coupled with slower rate cuts will see USDINR at 83.4 by end 2024 and 83.1 by end 2025. Elsewhere in Asia, the IDR has gained significant ground in recent weeks. Given these dynamics and the expectation of successive and larger rate cuts by the Fed, IDR will likely strengthen further. We see, USDIDR at 15100 by end-2024 and 15000 by end-2025. Given MYR’s recent performance and a weak USD, the currency will trend to USDMYR 4.2 by end-2024 and 4.15 by end-2025.

LatAm: Possible Gains in the Coming Quarters

Mexico and Brazil's currencies have generally remained weak during the past quarter. Although there are concerns related to Mexico’s judicial reform and the sustainability of Brazil's fiscal policy, we believe most of this weakness was driven by external noise. With Japan raising rates, some investors have moved out of Mexico and Brazil and lifted short Japanese Yen funding, contributing to the weakness of the Brazilian Real (BRL) and the Mexican Peso (MXN).

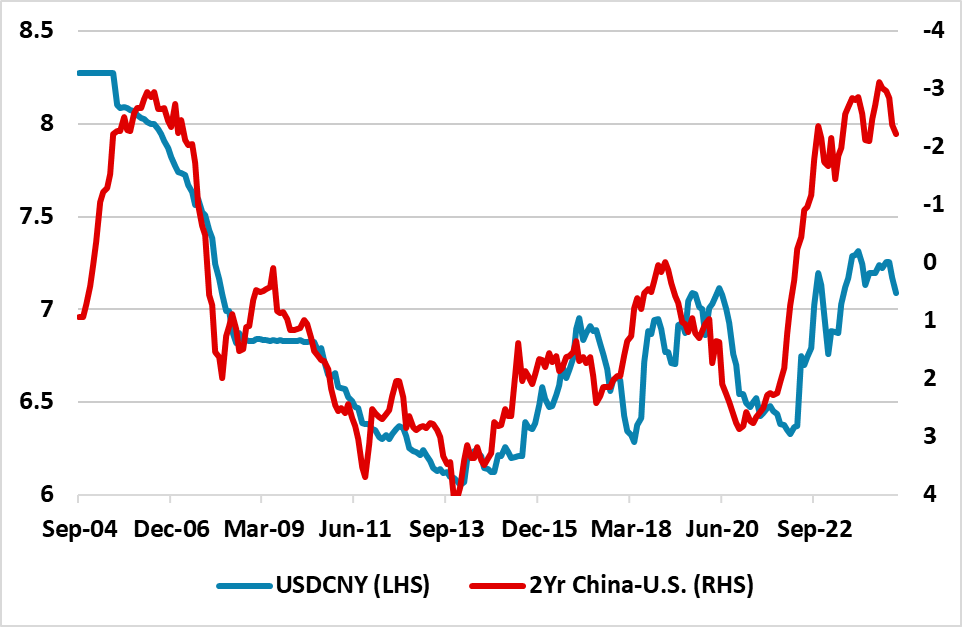

Figure 3: Brazil Exchange Rate, 10-year Yield Spread, and Policy Rate Spread with U.S

Source: Datastream and Continuum Economics

In Mexico, we still expect the effects of the judicial reform on the MXN to be mild. Although uncertainty has increased due to the reform, investors are more concerned with the safety of their assets. We continue to view Claudia Sheinbaum's government as friendly toward foreign investors. More important to Mexico is its relationship with the U.S. We believe that, in the event of a Donald Trump victory, this relationship could deteriorate. However, we expect the MXN to gain some ground in the coming 15 months as the dollar weakens further with the Fed’s cuts. As Banxico will likely cut rates more slowly than the Fed, a favorable interest rate spread will be maintained. We project the MXN to end the year around 19, with further gains potentially bringing it to 18.5 in 2025. We believe the MXN could appreciate further if Kamala Harris wins the U.S. election, as her administration would likely maintain a strong relationship with Mexico.

In the case of Brazil, the BCB has resumed its hikes, which will widen the spread between the SELIC and the Fed Funds rate. This will likely lead to a slight appreciation of the BRL by the end of the year. We expect the BRL to appreciate and end 2024 at 5.3. Strong economic growth will likely boost confidence in the BRL, and although there are concerns regarding fiscal policy, we still believe that in the long term, the debt-to-GDP ratio will stabilize. As the USD weakens in 2025, we see the BRL finishing this year at 5.2.

Turning to Argentina, there is some positive news as the gap between the official and free (blue) exchange rate has narrowed to 23%. Currently, we expect the government to maintain its 2% crawling peg until 2025, meaning the ARS will end 2024 at 1,024 and 2025 at 1,230. We believe that at some point in 2025, the Argentine government will be able to lift the multiple exchange rate regime, unifying the exchange rate. This move will be timed to avoid the need for a significant devaluation.

EMEA

EMEA currencies will continue to be divergent depending on inflation and interest rate differentials. DM countries have started easing cycles and EMEA central banks will have opportunities to cut as Fed easing softens USD strength, but the timing and scale of easing will likely be influenced by domestic growth and inflation conditions.

Firstly, we expect the downward pressure will remain for TRY and RUB as inflation differentials are still large. We don’t foresee CBRT and CBR will start cutting rates until 2025 as the central banks will likely ease in late Q1 if inflation is partly under control.

Despite the TRY decline slowing in Q2 and Q3 2024, we continue to see losses for TRY as foreign capital inflow remains weaker-than-expected and domestic vulnerabilities dominate. TRY losses are set to accumulate on still wide inflation differentials, which will likely remain in 2025 and 2026. We see the USD/TRY rate at 34.6 by the end of 2024 and 44 for end 2025. The pressure has been growing on CBRT from exporters and industrialists to start lowering its rates to reverse a marked slowdown in the economy while exporters complain that TRY is overvalued and has to depreciate.

The RUB remains vulnerable and it lost 7% of its value against USD just in August. We expect RUB will remain weak and volatile in 2025 since the sanctions hurt and high inflationary expectations and pressures continue to erode the currency. Our end year USD/RUB rate prediction is 93.7 for 2024, and 101.5 for 2025.

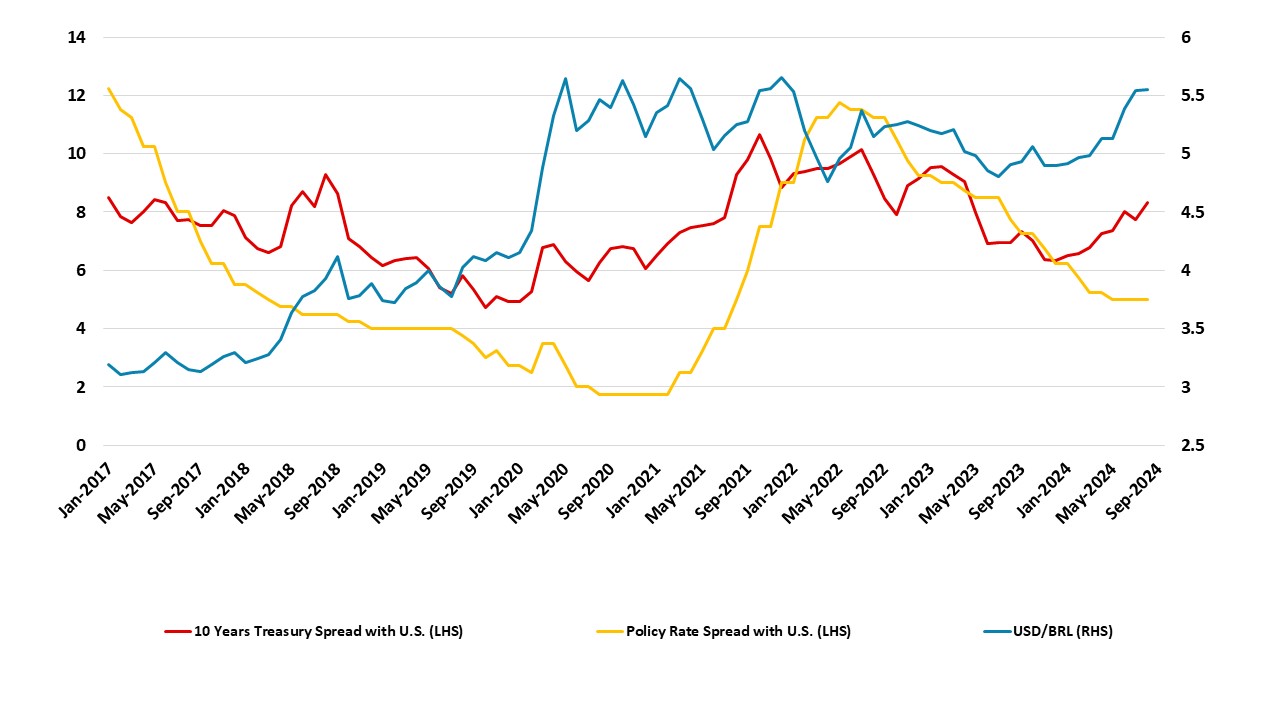

We expect the South African economy will be supported by a trade surplus in 2024 and 2025 coupled with increasing investor appetite for South Africa. The trade surplus could fall moderately due to global slowdown, particularly in China. We think cumulative Fed easing should soften the pressure on the ZAR and South Africa can use it as an opportunity build FX reserves and further cut rates in 2025 if domestic inflation continues heading towards target. Taking into account the improved investor sentiment, inflation differentials remaining modest against the U.S. and wider interest rate differentials, we envisage a modestly appreciation of the ZAR in 2024 and relatively stable ZAR against the USD in 2025. Our end year USD/ZAR rate prediction is 17.5 for 2024, and 17.8 for 2025.

Figure 4: USD/ZAR Rate and 10yr South Africa-U.S. Government Bond Yield (%)

Source: DataStream/Continuum Economics