Banxico Minutes: Cuts on the Table, Divided Board

Banxico has resumed its rate-cutting cycle, reducing the policy rate from 11% to 10.75%, with a split board decision. Most members noted weakening domestic activity and external volatility impacting the exchange rate. While some view the rise in non-core inflation as transitory, others see it, along with currency devaluation, as a risk, suggesting caution. The board remains divided, with expectations of further cuts but potential pauses, likely ending 2024 with a policy rate of 10.25%.

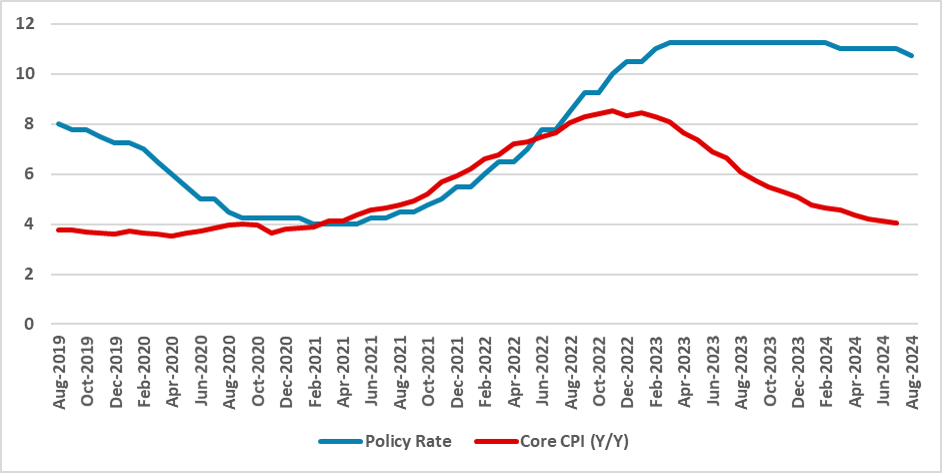

Figure 1: Mexico’s Policy Rate and Core CPI (%)

Source: Banxico and INEGI

The Mexico Central Bank (Banxico) has released the minutes from its latest meeting, in which it opted to resume the cutting cycle by lowering the policy rate from 11% to 10.75%. The minutes reveal a divided board, reflecting the split decision for the 25bps cut (3-2). Regarding foreign markets, Banxico highlighted the volatility seen in June, due to the elections, and in August, reflecting employment data in the U.S. and monetary policy in Japan. All members stated that as Mexico is an open economy, it is not immune to external shocks, which especially reflect in the exchange rate.

Most of the members highlighted the weakening of domestic activity. Manufacturing has reduced its economic activity, while the expansion in Services was not capable of compensating for it. Additionally, there has been some deceleration there. On the inflationary outlook, there was some dissension. The rise in the non-core group was seen by some members as transitory, with no real impact on the core CPI, which continued to drop and is expected to keep declining. Other members viewed the rise in the non-core group, coupled with the devaluation of the exchange rate, as a deterioration of the scenario compared to two months ago. Therefore, they believed that continuing the pause would be more prudent—a view we agree with.

Additionally, one member anticipates that we could still see some volatility in the market until the end of the year, especially concerning the U.S., on which Mexico is highly dependent. Surprisingly, no mention was made of the judicial reform currently under discussion in Congress, which could also increase volatility.

Within the three-member group supporting the cut, there is some heterogeneity. Two members clearly have a more dovish view on inflation, seeing a drop in core CPI that would allow for further cuts in the next meeting. Another member, however, suggested that although there is some improvement and monetary policy is very contractionary, the cuts should not necessarily be continuous, indicating that a pause could be seen. The other two members with more hawkish views pointed out that higher non-core inflation and the devaluation of the exchange rate are factors to be observed, and it would be more prudent to wait before resuming cuts.

All in all, we anticipate that unless core CPI resumes growth, the views of the five members will not change much, indicating a continuous split decision between a 25bps cut or a pause during the next meetings. This view aligns with our forecast of an additional two cuts until the end of the year, meaning one meeting will likely see a pause. Therefore, the policy rate will likely finish 2024 at 10.25%.