View:

March 06, 2026

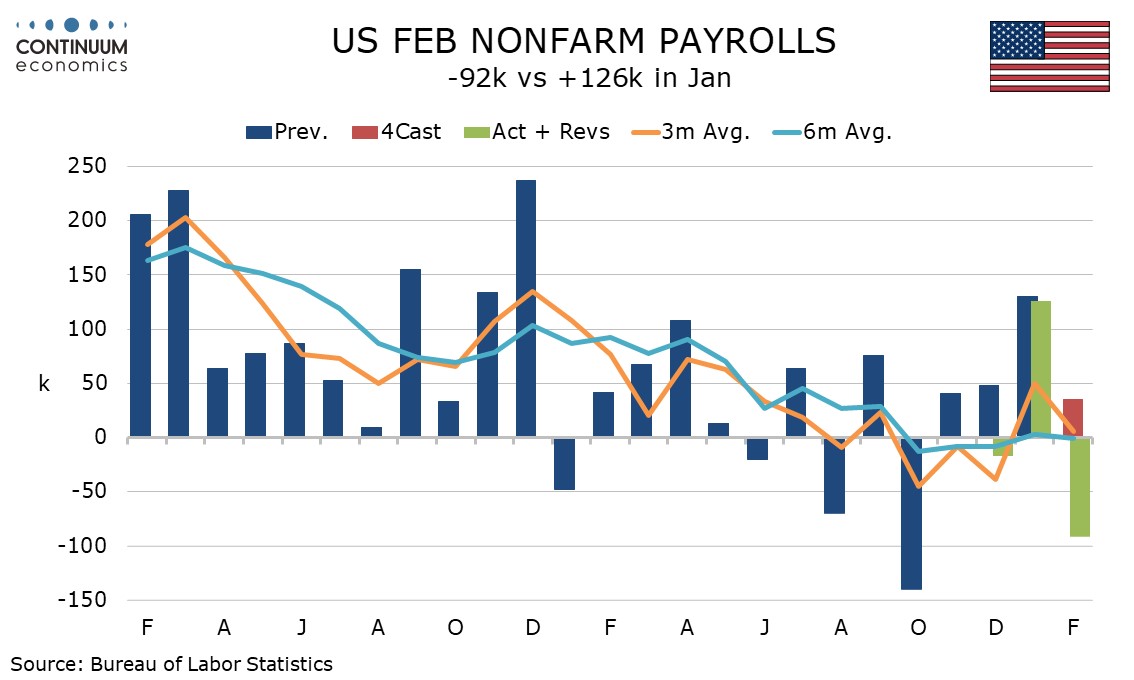

U.S. February Employment - Decline follows an above trend January, trend near flat

March 6, 2026 2:24 PM UTC

February’s non-non-farm payroll with a 92k decline is well below expectations but needs to be seen alongside a 126k increase in January, and in the context of bad weather between the two surveys. Unemployment edged up to 4.4% from 4.3% though more positive are a 0.4% rise in average hourly earning

March 05, 2026

U.S. Initial Claims remain low, Some inflationary risk visible in Q4 Productivity and Costs report

March 5, 2026 1:54 PM UTC

Initial claims are unchanged at 213k, a recent bout of bad weather having no significant impact, contrasting late January when a spell of bad weather did coincide with a rise in initial claims. Q4 productivity data is solid but this is not eliminating inflationary pressures.

March 04, 2026

U.S. February ISM Services strength contrasts slower S&P Services PMI

March 4, 2026 3:15 PM UTC

February’s ISM services index of 56.1 from 53.8 is the strongest since July 2022 and in a stark contrast to a weaker S and P services PMI of 51.7, revised down from 52.3 to its weakest level since April 2025. The true picture probably lies somewhere between the two surveys, but averaging the two a

U.S. February ADP Employment - A stronger month after sharply underperforming payrolls in January

March 4, 2026 1:37 PM UTC

February’s ADP’s estimate of private sector employment of 63k is stronger than the market expected though in part offset to a downward revision to January to 11k from 22k. The bounce in ADP data looks like a correction from a weak January which sharply underperformed the non-farm payroll.

March 03, 2026

Inflation Edged Up to 31.5% y/y in February as Monthly Pressures Persist

March 3, 2026 11:56 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced February inflation figures on March 3. After hitting 30.7% annually in January, Turkiye’s inflation surged to 31.5% in February due to rising food, transportation and housing prices. Our average inflation forecast for 2026 stands at 2

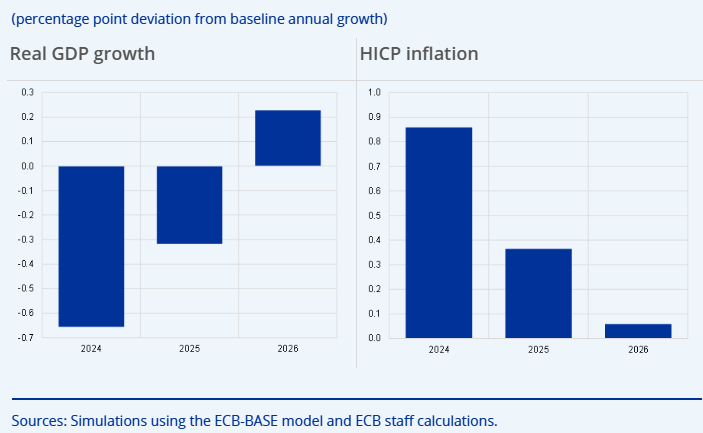

EZ HICP Review: Core Rate Spikes as Upside Inflation Risks Return

March 3, 2026 10:35 AM UTC

Having dropped to 1.7% in the January data, thereby matching expectations and the short-lived Sep 24 outcome, it is likely especially in view of the Middle East conflict that the headline HICP rate may not be any lower through this year and into next. Indeed, we headline rate rose 0.2 ppt to 1.9%

March 02, 2026

Turkish Economy Grew by 3.6% y/y in 2025

March 2, 2026 9:16 PM UTC

Bottom Line: The Turkish Statistical Institute (TUIK) announced Q4 2025 and full-year GDP growth for 2025 on March 2. Turkish economy expanded by 3.6% y/y in 2025 (3.4% y/y in Q4), underpinned by domestic demand while the main drag came from net trade as annual exports of goods and services declined

U.S. February ISM Manufacturing - January surge largely sustained, prices bounce

March 2, 2026 3:25 PM UTC

February’s ISM manufacturing index at 52.4 is only marginally down from January’s 54.6 which was the highest August 2022. We now have two straight clearly positive numbers to follow two straight negatives, a sign that manufacturing activity is picking up in early 2026.

February 27, 2026

Canada Q4 GDP slips despite strong support from government, but some positive signals

February 27, 2026 2:32 PM UTC

Canada’s 0.6% annualized Q4 GDP decline was slightly weaker than expected and further below a flat BoC projection, and came despite quite strong support from government. Q3 was revised down to 2.4% from 2.6% but this was more than outweighed by an upward revision to Q2 to -0.9% from -1.8%.

February 26, 2026

U.S. Initial Claims at a low level between two bouts of bad weather

February 26, 2026 1:45 PM UTC

Initial claims at 212k are up from 208k in the preceding week (the latter revised up from 206k) but remain low and below the preceding two weeks that were probably lifted by bad weather. Bad weather may lift next week’s data, but the underlying picture looks quite healthy.

February 20, 2026

Q4 U.S. GDP: Lower Than Expected

February 20, 2026 2:13 PM UTC

Lower than expected Q4 GDP was mainly caused by the temporary government shutdown (-5.1% annualised), while consumer spending remained reasonable at 2.4% and AI related spending helping parts of fixed investment. However, income growth remains lower than consumption and we see this slowing the U.S.

February 18, 2026

South Africa Inflation Moderately Eased to 3.5% y/y in January

February 18, 2026 1:41 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on February 18 that annual inflation slightly edged down moderately to 3.5% y/y in January, driven by higher housing and utilities, food and non-alcoholic beverages, and insurance and financial services. Annual core inflation came in at 3.4%

UK CPI Review: Fresh and Marked Fall Resumes as Core Slips to Cycle-Low?

February 18, 2026 10:03 AM UTC

Although most aspects of the January CPI came in a notch above BoE thinking, the clear fall in the headline rate and further looser labor market messages still point to a BoE rate cut next month, not least given the likely return to the 2% target by April. These projected falls started with these Ja

February 17, 2026

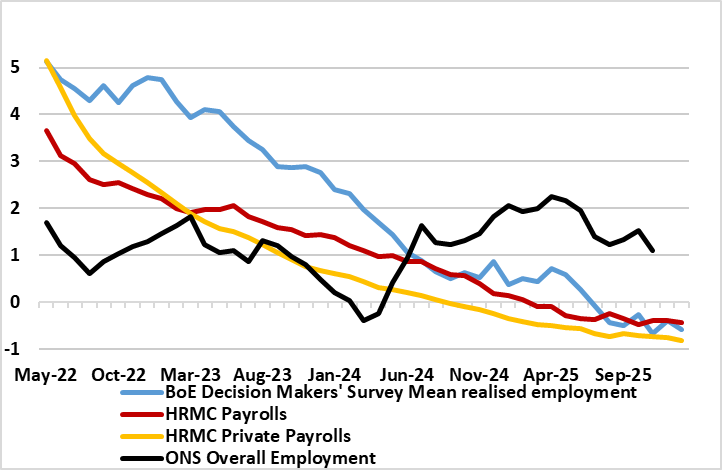

UK Labor Market: Job Losses Weighing on Wages

February 17, 2026 7:52 AM UTC

There are further signs that the labor market is haemorrhaging jobs both clearly and broadly with fresh and deep falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down almost a full ppt in y/y terms and more steeply so (Figure 1).

February 16, 2026

India’s CPI Overhaul: Smoother Prints, Deeper Scrutiny

February 16, 2026 6:37 AM UTC

India’s January 2026 CPI rose to 2.75% yr/yr, marking the launch of a rebased 2024=100 index that better reflects modern consumption patterns. Food’s reduced weight is likely to dampen headline volatility, while services, housing and discretionary spending will exert greater influence going forw

February 13, 2026

VAT Hike, Stubborn Food and Services Prices Pushed Russia’s Inflation to 6.0% y/y in January

February 13, 2026 5:08 PM UTC

Bottom Line: After easing to 5.6% y/y in December, Russia’s inflation edged up to 6.0% y/y in January due to VAT hike and stubborn food and services prices, the State Statistics Service (Rosstat) said. Despite Central Bank of Russia (CBR) announced that the inflation forecast for 2026 has been

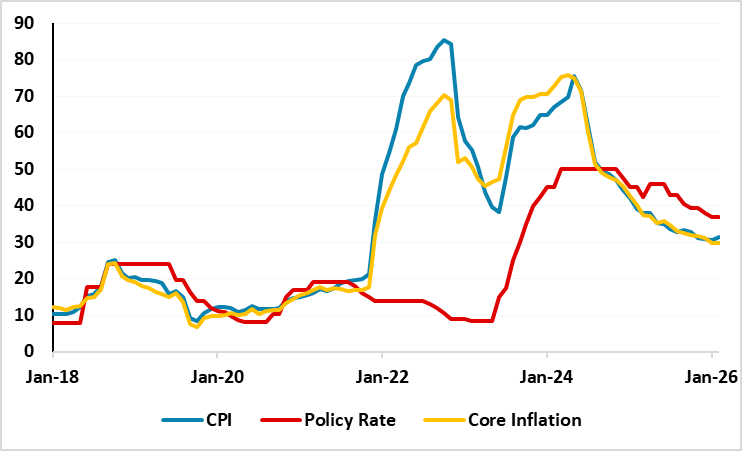

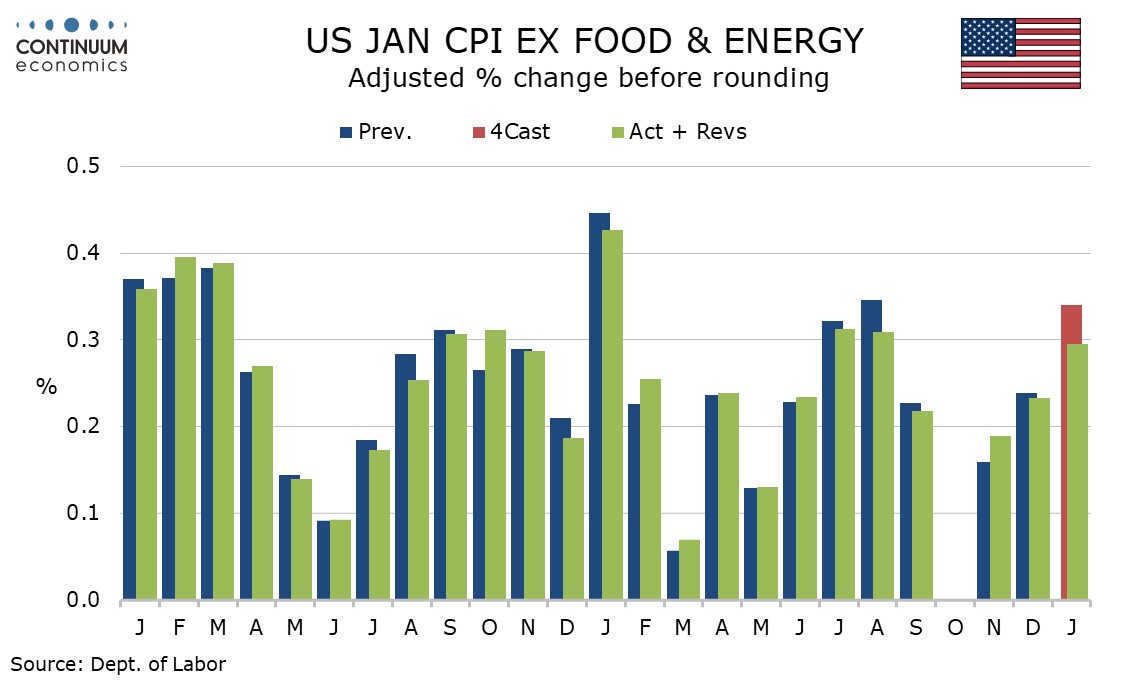

U.S. January CPI - Yr/yr ex food and energy pace slowest since March 2021

February 13, 2026 2:18 PM UTC

January CPI is slightly lower than expected at 0.2% overall though the ex food and energy rate at 0.3% is on consensus, with the core rate almost spot on 0.3% even before rounding. Given a strong year ago rise, yr/yr growth slowed, overall to 2.4% from 2.7% and the core to 2.5% from 2.6%, the latter

February 12, 2026

U.S. January Existing Home Sales - Sharp fall was signaled by pending home sales

February 12, 2026 3:17 PM UTC

January existing home sales are well below expectations with a fall of 8.4% to 3.91m, the lowest level since September 2024. Bad weather may have played a part but given that pending home sales fell by 9.3% in December, weather is unlikely to be the whole story.

U.S. Initial Claims remain inflated by weather, but February payroll likely to be weaker than January's

February 12, 2026 1:48 PM UTC

Initial claims at 227k are down from 232k but still higher than expected and higher than the seven preceding weeks. We suspect weather is playing a part in the recent upturn in initial claims, though the data suggests that February’s payroll will not be as strong as January’s.

UK GDP Review: Underlying Economy Fragility Does Continue

February 12, 2026 7:52 AM UTC

First the good news; the UK economy grew for a second successive month in December, something not seen for almost a year. But as is familiar with recent UK real economy data, there is a negative flip side with the 0.1 m/m December advance negated by downward revisions to previous figures (November

February 11, 2026

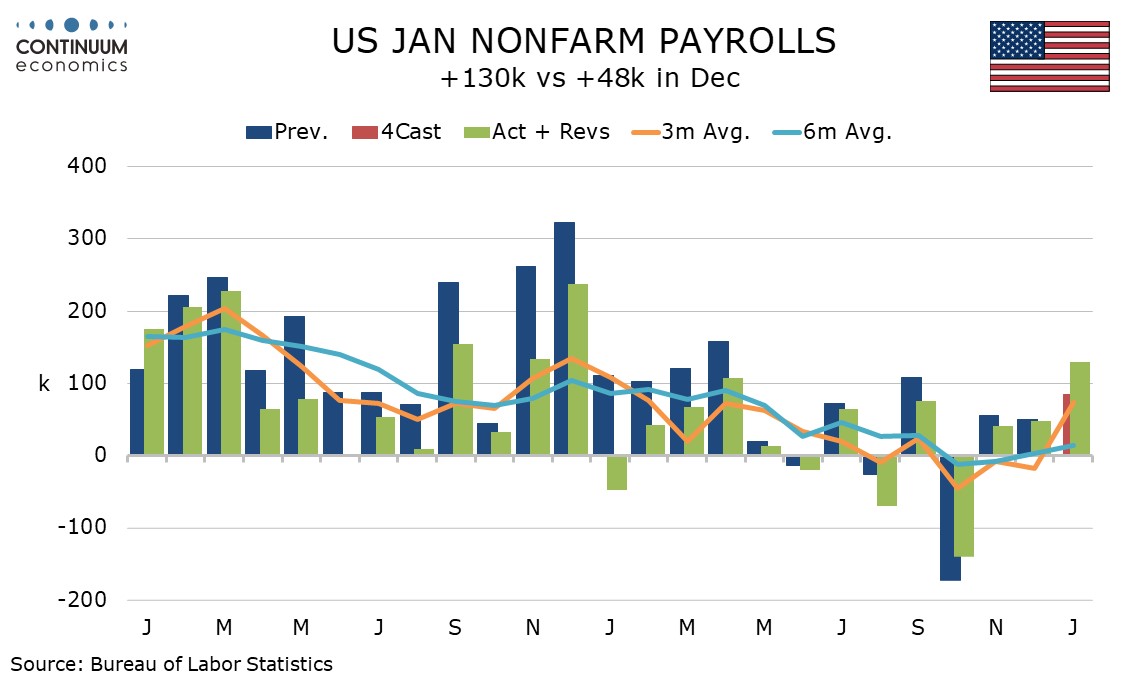

U.S. January Employment - Stronger across the board, will keep Fed in no hurry to ease

February 11, 2026 2:21 PM UTC

January’s non-non-farm payroll at 130k is significantly stronger than expected and even more so in the private sector at 172k. An above trend 0.4% rise in average hourly earnings, a rise in the workweek to 34.3 from 34.2 hours and a fall in unemployment to 4.3% from 4.4% leave the data as stronger

February 10, 2026

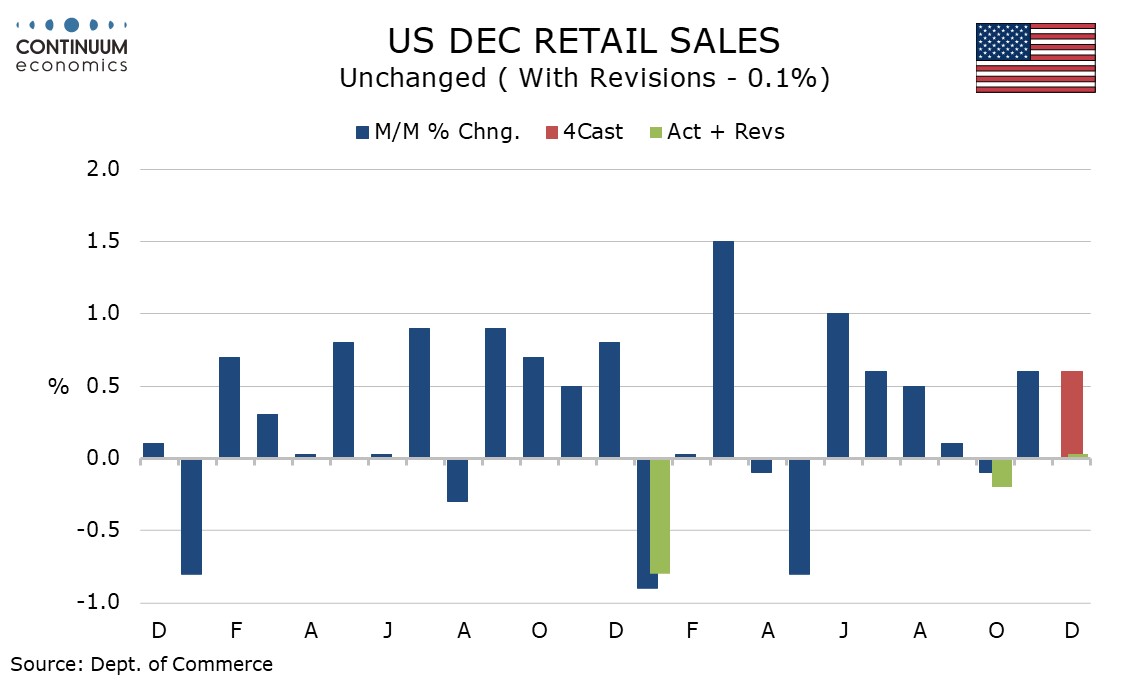

U.S. December Retail Sales and Q4 Employment Cost Index show fading momentum

February 10, 2026 2:03 PM UTC

December retail sales are weaker than expected, unchanged overall, ex autos and ex autos and gasoline. This could be a sign of consumer spending losing momentum in response to real disposable income coming in near flat in both Q3 and probably Q4, given limited employment growth and resilient inflati