Banxico Minutes: More Cuts on the Way

Banxico cut the policy rate by 50 bps to 9.5%, signaling a more dovish stance as inflation trends downward. The board cited weak domestic demand and improved inflation prospects but highlighted risks from U.S. policy uncertainty, tariffs, and immigration effects. While most members supported a 50 bps cut, one preferred a slower pace. Given the minutes' tone, further 50 bps cuts are expected until the rate reaches 8.0%, with a pause before resuming cuts in 2026.

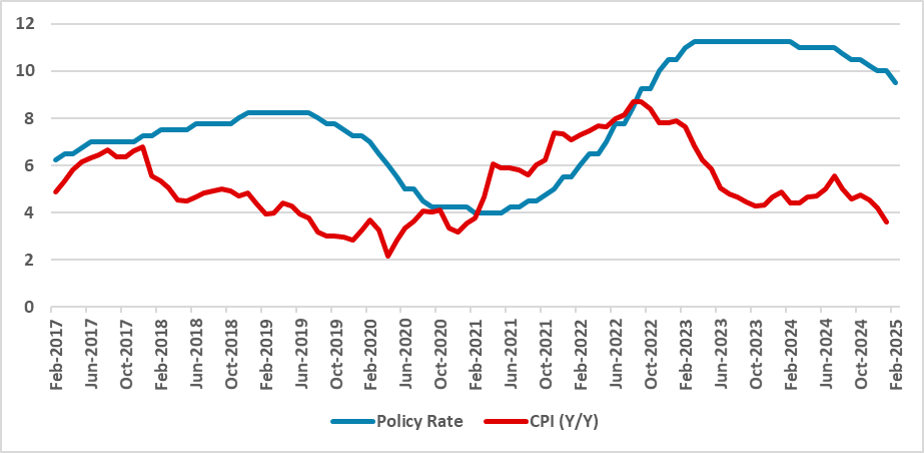

Figure 1: Mexico’s Policy Rate and CPI (%)

Source: Banxico and INEGI

Mexico’s Central Bank (Banxico) has released the minutes of its last meeting (here), in which it cut the policy rate by 50 bps to 9.5%. Analyzing the tone of the minutes, we can see that Banxico has been more dovish regarding the inflationary outlook. Recently, annual inflation dropped below 4% for both the core and non-core components, which, according to most members, has been in line with the historical trend since the 3% target was set in 2003.

Regarding foreign markets, the minutes highlighted the uncertainty caused by the new administration in the U.S. The volatility in the exchange rate was attributed to Trump’s threat of imposing a 25% tariff on Mexico. The board agreed that the materialization of these tariffs would have deleterious effects on both economies and could trigger some inflation, as costs along supply chains could increase. On immigration-related issues, the consequences could be twofold, potentially resulting in more slack in the Mexican labor market.

On the domestic front, the board reached a consensus that Mexico’s economy has been weaker, which could help inflation converge to 3.0%. More recently, Banxico’s inflation report lowered Mexico’s growth forecast to 0.6%, indicating a weakening of domestic demand. Consumption has stagnated, while labor markets are showing less dynamism. On the inflationary front, the board highlighted that the inflationary outlook has improved compared to the previous meeting and that they expect inflation to continue falling toward convergence with the 3.0% target. With economic activity weakening, we believe that, despite a strong exchange rate shock, the scenario outlined by Banxico is feasible.

It is important to note that the vote was not unanimous. One member (Jonathan Heath) preferred a more cautious cut of 25 bps, while the other four members opted for a 50 bps cut. The argument for most members was that inflation was converging and that reducing the degree of tightening was the right decision, with conditions justifying a 50 bps cut at this time. Heath wanted to be more conservative, stating that Banxico needs to focus on converging inflation to 3.0% rather than on weaker economic activity, justifying a slower cutting cycle. Given the tone of the minutes, we believe Banxico will continue cutting at a 50 bps pace in the next meeting, maintaining our previous view. Banxico will cut by 50 bps until the policy rate reaches 8.0%, then pause, resuming two 50 bps cuts in 2026.