Mexico CPI Review: Inflation Falls as Demand Eases

Mexico’s CPI rose 0.3% in January, below its 0.6% historical average but in line with expectations. Y/Y inflation fell to 3.6%, the lowest since Jan/2021. Core CPI rose 0.4%, with core goods up 0.7% and services up 0.2%. Non-core CPI fell 0.13%, led by a 1.5% drop in agricultural goods. The economy is slowing, aiding disinflation, but Banxico remains cautious. Rate cuts to 8.0% are expected as recession risks rise, while trade tensions could pressure inflation.

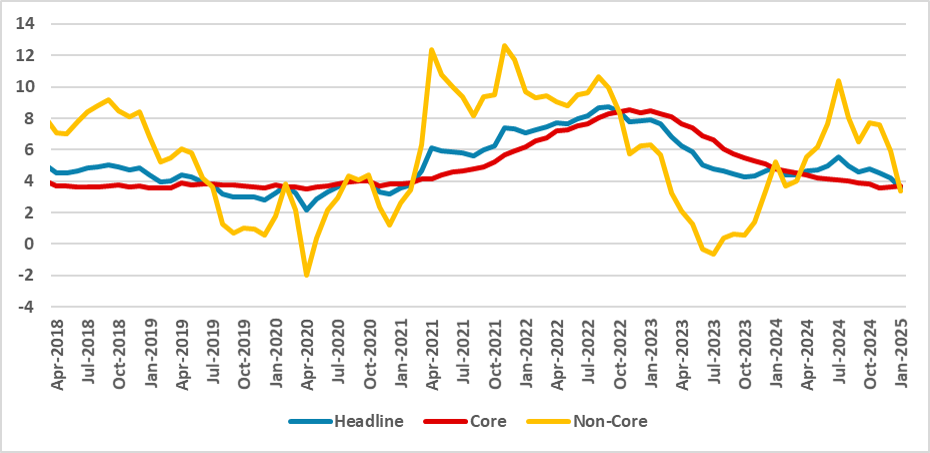

Figure 1: Mexico’s CPI (%, Y/Y)

Source: INEGI

Mexico’s National Statistics Institute (INEGI) has released the CPI figure for January. The data show that the CPI has increased by 0.3% in January, well below its historical average for the month (0.6%) but in line with market expectations, according to the Bloomberg survey. Therefore, the Y/Y index dropped to 3.6%, the lowest since Jan/2021.

Core CPI has grown 0.4% in the month, led by some rebound in core goods, which grew 0.7%, contrasting with core services, which grew 0.2%. In annual terms, Core CPI converged to levels similar to the headline one, reaching 3.5%. The weakness in Services CPI is a good indication of weakening demand in Mexico, likely meaning less inflationary pressure and indicating the output gap is positive now.

In the non-core group, the CPI contracted by 0.13% in the month, influenced mainly by agricultural goods, which contracted 1.5%, driven by better climate conditions and weaker demand. Annual agricultural goods inflation stands at 0.5%. The non-core energy group grew 0.9% in the month and accumulated 5.4% inflation in the last month.

January CPI figures, although influenced by the non-core CPI group, show some improvements in terms of disinflation progress. What makes the picture clear is that the Mexican economy is decelerating, which will help inflation converge toward the target. So far, expectations are not yet aligned with the target for the next two years, but we believe that once the CPI moves closer to the 3.0% target, it is very likely that inflation expectations will start to converge to figures closer to the target.

Banxico still sees inflationary risks biased to the upside, but once the February figures come out and if they are positive, there is a possibility they change communication toward a more balanced stance between upside and downside risks. However, caution will still be needed. Trump’s threats on tariffs and potential retaliation from Mexican authorities could impact inflation, especially through the exchange rate channel. We believe Banxico will apply 50bps cuts until they reach 8.0%, a level closer to neutral, as recession risks increase for 2025.