EMFX Outlook: Hit From Tariffs, Before Divergence

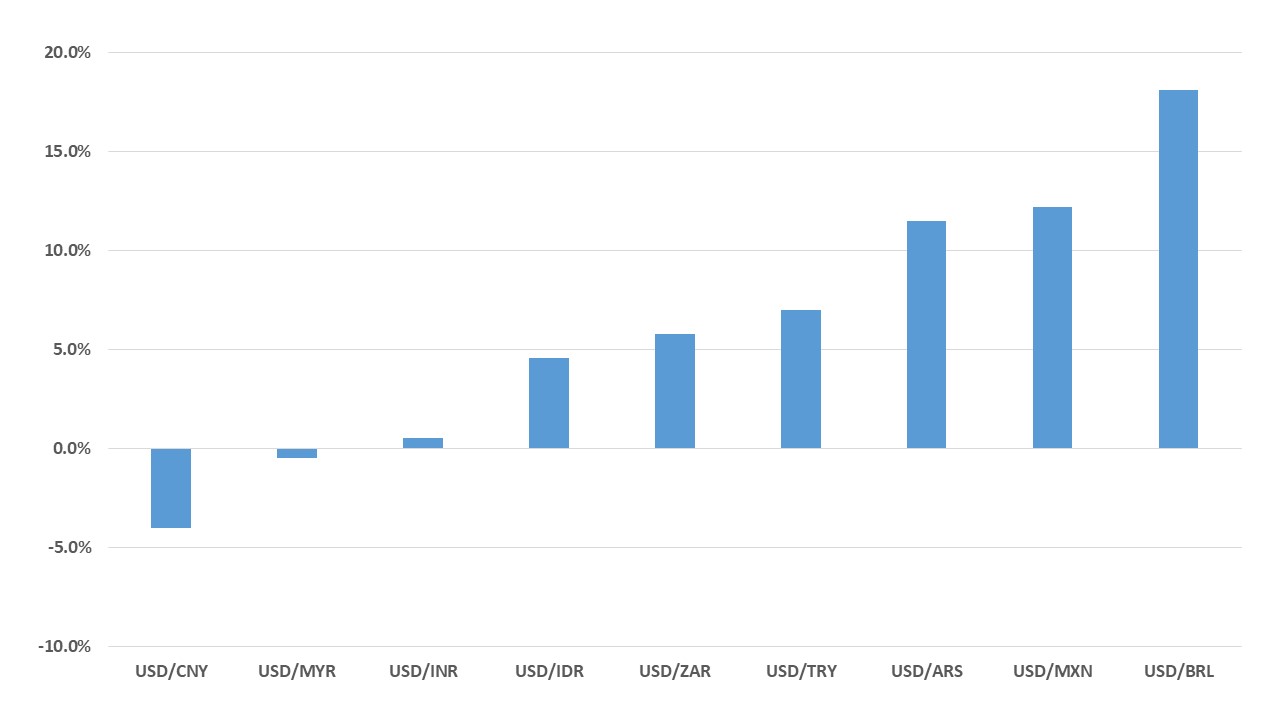

· EM currencies on a spot basis will remain on the defensive in H1 2025, as we see the U.S. threatening and then introducing tariffs on China imports – 30% against the current average of 20%. China’s response will likely include a Yuan (CNY) depreciation to the 7.65 area on USD/CNY (here), which will spillover to produce weakness for Asian currencies and across EM. However, H2 will see divergence across EM, as Latam currencies rebound from already low levels, with a U.S./China revised trade deal. Additionally, Brazil fiscal fears appear overblown and Mexico will likely work with President elect Trump on immigration and a revised USMCA trade deal.

· In terms of total returns for 2025, the Brazilian Real (BRL) and Mexican Peso (MXN) should be the standouts, given the wide interest rate differentials versus the U.S.. Asia total returns will be more difficult given interest rate spreads versus the U.S. and we see only a partial EM Asia currency rebound in H2 2025. EM Europe is divergent, as the TRY will still be falling on a spot basis but at a slower pace than the interest rate differentials against the USD. India, Indonesia and to a degree S Africa will likely attract FDI and equity flows.

Risks to our views: More aggressive tariffs by the U.S. on China than our 30% baseline would produce more Yuan depreciation towards 8.00 on USD/CNY and spill over to more losses for EM currencies in H1 2025.

Figure 1: 12mth Total Returns Versus the USD (%) (+ve = USD decline)

Source: Continuum Economics

Asia

CNY has moved lower after Donald Trump victory, but will likely depreciate further once a trade war starts between the U.S. and China. Trump could go for a H1 2025 trade war, with 30-40% overall tariffs on China versus the current 20% average. China does not have the same scale of imports from the U.S. and would like counter with a three-part response: some targeted tariffs; Yuan 3-5trn of fiscal stimulus and Yuan depreciation. 30% across the board on China exports would like see the authorities managing a gradual depreciation to the 7.60 area on USDCNY and 40% tariffs to 7.70-7.90 area. However, China does not want to trigger capital flight, which could be intensified by too quick or large a depreciation of the Yuan. Large scale capital flight causes concerns about domestic protest against the CCP. High uncertainty exists over the trajectory however, given that tactics could vary from the 2018-19 playbook that saw moderate tariff escalation and threats that were not carried out. This CNY volatility can spillover to other EM currencies from a sentiment standpoint and as other countries look to sustain competitiveness versus China.

However, China knows that it will likely have to agree a renewed trade deal with the U.S. and we see this occurring by late 2025, which should help to produce relief in EM currencies and this a late bounce for CNY versus the USD. We see USDCNY to 7.45 by end 2025. For 2026, relief over a trade deal will likely be more than counterbalanced by a further widening of interest rate differentials, as 10yr U.S. yields rise with huge supply but 10yr China yields remain subdued with aggressive disinflation and weak domestic demand. We see 7.50 on USDCNY by end 2026.

Elsewhere in Asia, the Indonesian Rupiah (IDR) is expected to weaken in the first half of 2025 due to global uncertainty, particularly surrounding the imposition of tariffs on China and other countries. However, we see a U.S./China trade deal producing a softer USD in H2 and we forecast the USDIDR to be at 15850 by end-2025. Only gradual strengthening is expected, as the current account deficit is expected to widen in 2025. USDIDR is forecast at 15700 by end 2026. Meanwhile, USDINR is expected to weaken over H1 2025. The Indian rupee (INR) is expected to remain under pressure in the near term due to global factors such as the Federal Reserve’s slower pace of easing and CNY weakness. A spike as far as 87 could be seen before RBI intervention restrains the move. However, the gradual moderation of Indian inflation, along with stronger exports and foreign investment inflows, should provide some support to the currency in H2. USDINR is projected at 86.3 in end 2025 and a slight decline to 86.1 for end 2026. The Reserve Bank of India will continue to intervene heavily in the forex market to avoid rapid moves. Finally, investor concerns about potential protectionist policies under Mr. Trump are expected to exert downward pressure on the Malaysian Ringgit (MYR). This will see USDMYR decline H1 before a recovery to 4.50 by end 2025. A current account surplus, strong macroeconomic fundamentals and narrowing interest rate differential with the U.S. Federal Reserve will support the currency. USDMYR is forecast at 4.4 in end 2026.

Figure 2: Share of 2023 China Exports by Country (%)

| Pct of Exports | |

| EU | 14.8 |

| US | 14.8 |

| Japan | 4.7 |

| UK/AUS/NZ/Canada | 6.1 |

| HK | 8.1 |

| Asean | 15.5 |

| India | 3.5 |

| Latam | 7.3 |

| Africa | 5.1 |

| Russia | 3.3 |

Source: Customs PRC/Continuum Economics

LatAm: Depreciated Too Far?

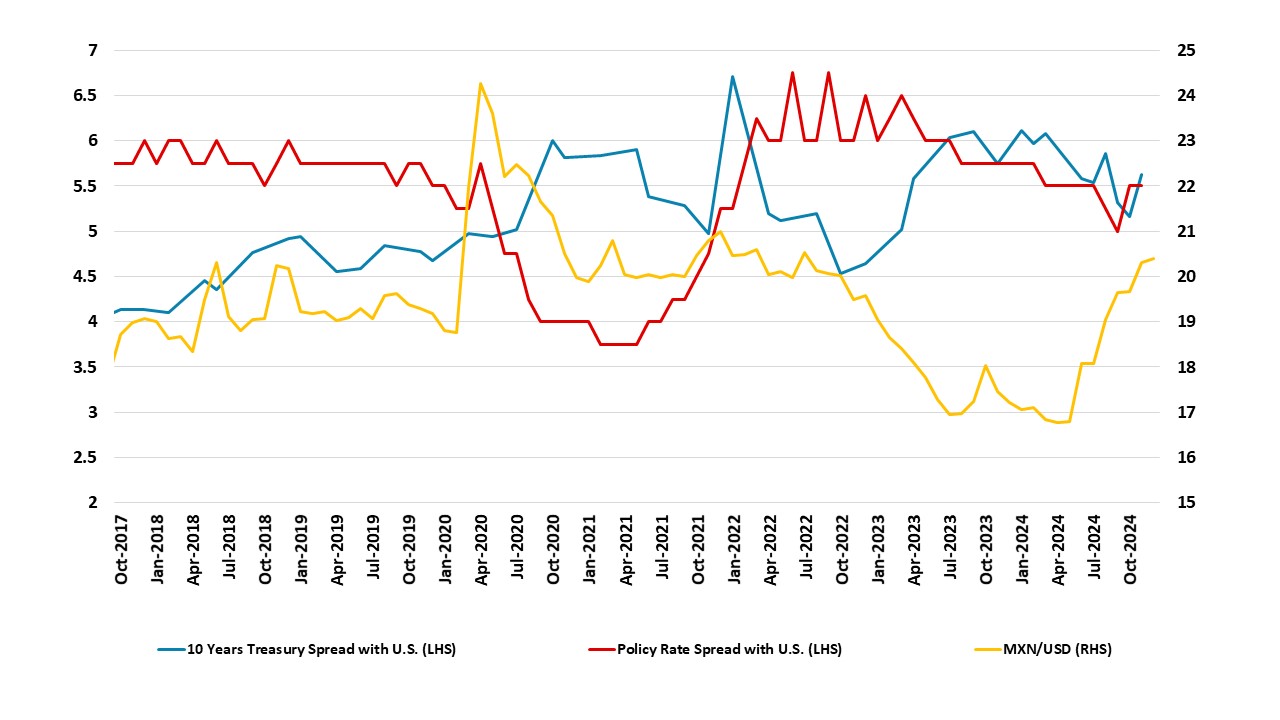

The Mexican currency has remained weak in the last quarter, averaging around 20.5 USD/MXN. We believe a mix of internal and external policies has driven this weakness. First, the prospect of less Fed easing under Trump, moving investors into the U.S. Second, the institutional reforms promoted by Claudia Sheinbaum and her party, Morena, such as the judicial reform and the strengthening of state companies in the electricity system. We expect the MXN to remain volatile in 2025, especially as Trump's threat to impose tariffs lingers. However, we anticipate the MXN to appreciate slightly, moving closer to 19.0, once tensions around the judicial reforms subside and it becomes clearer that tariffs will not be imposed on Mexico – Mexico is likely to compromise with the U.S. as in Trump’s first term. Although, Banxico is expected to continue cutting rates, the gap with the Fed funds rate will remain significant, favouring the MXN. We forecast the MXN to finish 2025 at 19.0.

Figure 3: Mexico Exchange Rate, 10-year Yield Spread, and Policy Rate Spread with U.S

Source: Datastream and Continuum Economics

In the case of Brazil, we believe there is a negative sentiment, especially among internal investors, regarding fiscal policy. With the economy approaching its full capacity, there is a view that the government needs to resolve fiscal policy issues quickly; otherwise, its debt will become unsustainable and inflation will accelerate. The BRL has reached its weakest level at 6.0 USD following the presentation of a timid fiscal package, which was deemed insufficient to put debt/GDP/BRL on a sustainable path. In response, the BCB has announced a shock interest rate hike of 100bps and will likely set the policy rate at 14.25% in Q1-2025. This will likely make Brazil attractive, and we believe that once tax revenues rise and it becomes clearer that it is possible to put fiscal policy on a sustainable path, the BRL will appreciate and finish 2025 at 5.60 versus the USD.

Turning to Argentina, there is some positive news as the gap between the official and free (blue) exchange rates has narrowed to 5%. Inflation is clearly on a downward trend, and we expect it to narrow to 1% in the second half of 2025. The government will likely reduce the crawling peg to 1% per month from 2% previously, and a major devaluation will likely not be needed. We forecast the Argentina Peso (ARS) to finish 2025 at 1,178. An upside risk emerges from the unification of the multiple exchange rates, as the government wants to lift capital controls. This could cause some volatility and even depreciation at the end of 2025.

EMEA

EMEA currencies will continue to be divergent depending on inflation and interest rate differentials in 2025, and H2 2025 will likely see more divergence across EMEA due to global uncertainties.

We expect the downward pressure will remain for Turkish Lira (TRY) and Russian Ruble (RUB) as inflation differentials are still large. Despite the TRY decline slowing in H2 2024, -which was important in cooling down inflation given FX pass-through from a weak TRY-, we continue to see losses for TRY as inflation remains much higher than Turkiye main trading partners; foreign capital inflow remains weaker-than-expected and domestic vulnerabilities dominate. TRY will still be falling on a spot basis but at a slower pace than the interest rate differentials against the USD. We see the USD/TRY rate at 42 by the end of 2025, and 48 for end 2026.

In Russia, the RUB remains vulnerable and it lost 10% of its value against USD just in November partly due to due to panic buying of foreign currency in the wake of new U.S. sanctions on Russian banks including Gazprombank in November. Despite Central Bank of Russia (CBR) halting foreign currency purchases in response to the RUB fall, the RUB remains above the 100 threshold. We expect RUB will remain volatile in 2025, inflationary pressures won’t likely start to soften and macroeconomic instability will remain substantial, though a ceasefire in Ukraine is likely and this could underpin the RUB – a RUB recovery requires a peace deal to lift sanctions, which could take years. Our end year USD/RUB rate prediction is 100 for 2025, and 95 for 2026.

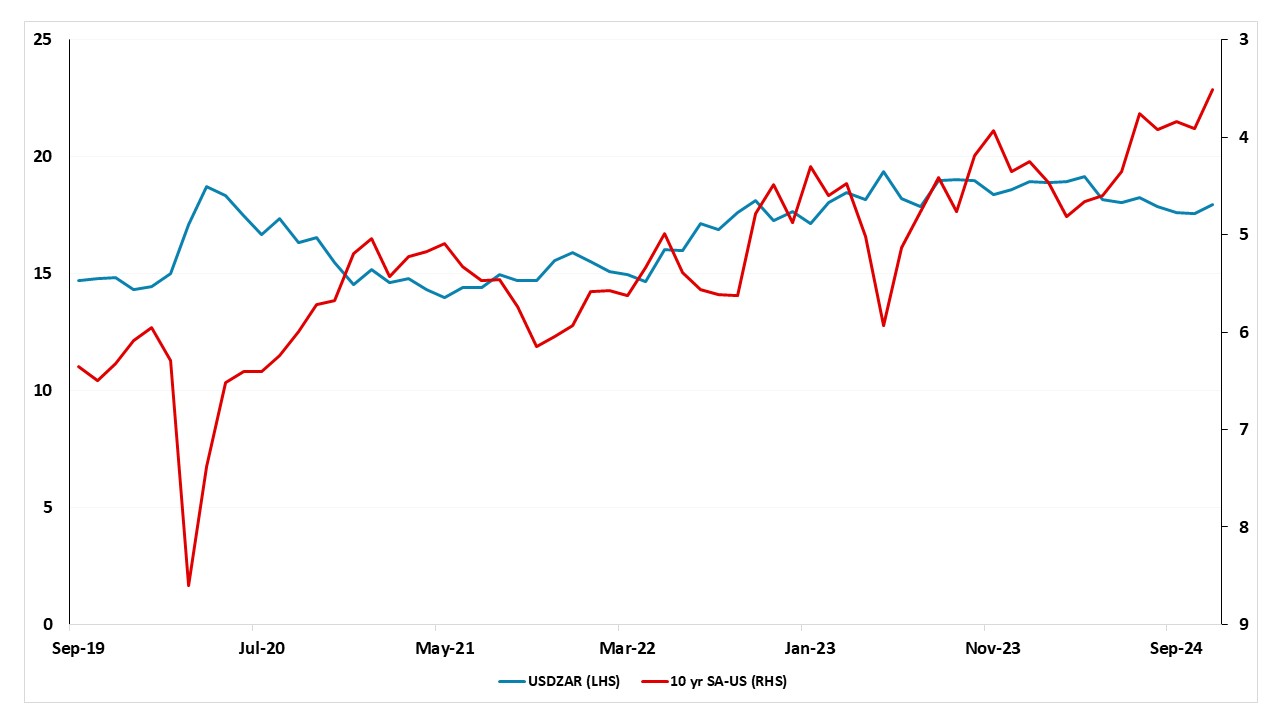

Turning to South Africa, South African Rand (ZAR) appreciated to its strongest level against the USD in almost two years in October although it lost some of these gains on account of the USD strengthening post U.S. elections. We expect the South African economy will be supported by a trade surplus in 2025 and 2026 coupled with a higher FDI and equity flows thanks to increasing investor appetite. (Note: The current account deficit is expected to remain modest at around 2% of GDP).

We think SARB will continue to cut rates in 2025 if domestic inflation continues hovering around the SARB target as inflation differentials remain modest against the U.S. Despite the Fed and ECB easing cycles continuing, we think SARB will have to be cautious due to global uncertainties including Yuan weakness, plus an initially generally strong USD in H1 2025, which could slow SARB policy easing. Our end year USD/ZAR rate prediction is 17.9 for 2025, and 18.1 for 2026.

Figure 4: USD/ZAR Rate and 10yr South Africa-U.S. Government Bond Yield (%)

Source: DataStream/Continuum Economics