Mexico CPI Review: 0.38% Inflation in June

INEGI reports Mexico's CPI rose 0.38% in June, above expectations. Year-over-year CPI increased to 5.0%, with core CPI at 4.1% and non-core CPI at 7.7%. Non-agricultural goods drove the rise, raising concerns about inflation due to climate-related agricultural shocks. Food and beverages saw the highest monthly increase. With economic deceleration and rising oil prices, Banxico faces challenges in deciding future rate cuts. Year-end CPI is forecasted at 4.4%.

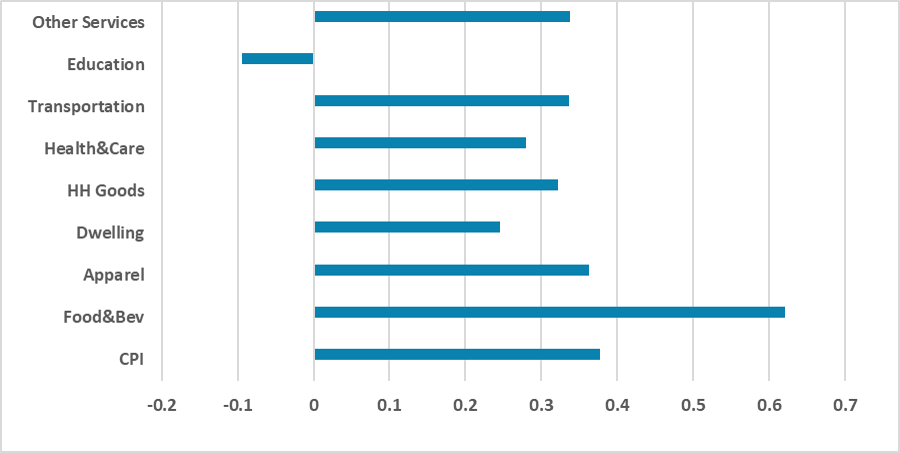

Figure 1: Mexico’s CPI (%, m/m)

Source: INEGI

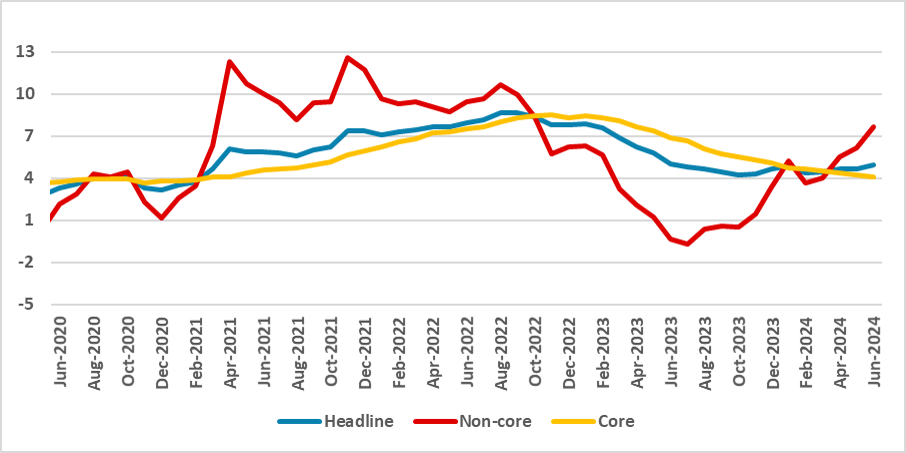

The Mexico National Statistics Institute (INEGI) has released the CPI figures for June. The data show that the CPI rose by 0.38% in June, slightly above market expectations of 0.29%, according to the Bloomberg Survey. Therefore, the year-over-year (Y/Y) index has risen to 5.0% from 4.7% in May, raising some concerns. Disaggregating into core and non-core components, the core CPI rose by 0.2%, and its Y/Y index dropped to 4.1%. Non-core CPI rose by 0.9%, and its Y/Y index rose to 7.7%.

Figure 2: Mexico’s CPI (%, Y/Y)

Source: INEGI

While the core CPI presented a stable behavior, the non-core CPI raised some concerns. Most of the rise came from non-agricultural goods, which rose by 1.5% and accumulated a 10% rise annually. This could indicate some shocks within agricultural goods, mostly related to climate change. Fruits and vegetables already accumulated a 20% rise annually. The central bank can do little about the shock on agricultural prices, but it raises concern whether those shocks will be passed towards core CPI, making inflation stickier.

Looking at the CPI groups, food and beverages presented the highest rise, growing by 0.7% in the month. Apparel rose by 0.4% month-over-month (m/m), while transport rose by 0.3%. The only group to present a negative variation was education, which decreased by 0.1%.

The gap between core CPI and non-core CPI, which now reaches over 3 percentage points, is a concern. Currently, Mexico's economy seems to be decelerating, but this deceleration, aligned with an agricultural shock, could raise doubts about whether to resume the cutting cycle. The recent rise in oil prices could also increase transport prices, adding another layer of problems for Banxico. Still, in real terms, the policy rate seems to be excessively high at 6%.

We expect the CPI to continue to be sticky in the following months, with the difference between core and non-core CPI widening. Our year-end CPI forecast for Mexico stands at 4.4%. The Banxico board is currently divided over the cuts, with some members in favor and others not. The discussion for cuts will be on the table in August and could be decided by a single vote. We still see the policy rate ending at 10.5%, meaning two 25 basis point cuts this year.