View:

March 04, 2026

Preview: Due March 18 - U.S. February PPI - Ex food, energy and trade suggests trend at 0.3% per month

March 4, 2026 6:58 PM UTC

We expect PPI to rise by 0.3% in February, slower than January’s 0.5% and December’s 0.4%. Ex food and energy we expect a rise of 0.2% after a strong 0.8% January increase. Ex food, energy and trade however, we expect a fourth straight increase of 0.3%, which would signal where trend is.

Preview: Due March 16 - Canada February CPI - Softer in part due to year ago end of a sales tax holiday

March 4, 2026 6:09 PM UTC

We expect February Canadian CPI to slip to a 6-month and on-target low of 2.0% yr/yr (1.96% before rounding) from 2.3% (2.29% before rounding) in January, the slowing mainly due to the ending of a sales tax holiday a year ago, which lasted from mid-December of 2024 to mid-February of 2025). The Ba

U.S. February ISM Services strength contrasts slower S&P Services PMI

March 4, 2026 3:15 PM UTC

February’s ISM services index of 56.1 from 53.8 is the strongest since July 2022 and in a stark contrast to a weaker S and P services PMI of 51.7, revised down from 52.3 to its weakest level since April 2025. The true picture probably lies somewhere between the two surveys, but averaging the two a

U.S. February ADP Employment - A stronger month after sharply underperforming payrolls in January

March 4, 2026 1:37 PM UTC

February’s ADP’s estimate of private sector employment of 63k is stronger than the market expected though in part offset to a downward revision to January to 11k from 22k. The bounce in ADP data looks like a correction from a weak January which sharply underperformed the non-farm payroll.

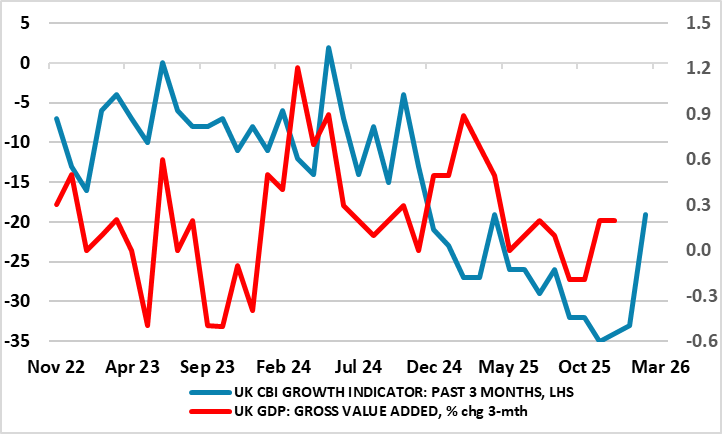

UK GDP Preview (Mar 13): Were Things Getting Better?

March 4, 2026 11:11 AM UTC

Belatedly, some good news; the UK economy grew for a second successive month in December, something not seen for almost a year. Even more encouragingly, it may very well enjoy a further rise in the looming January data, thereby providing the best three-month showing in two years. But as is famil

Markets and the Iran War

March 4, 2026 9:50 AM UTC

• The Trump administration’s objective appears to be pivoting from regime change to hurting Iran ballistic missile capabilities, which argues for a 2-4 week war rather than a prolonged war. However, the most intense missile battles will likely occur in the next one week and markets are