Mexico: Further 25bps Cuts Ahead

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rate cuts in Q1 and one in Q2.

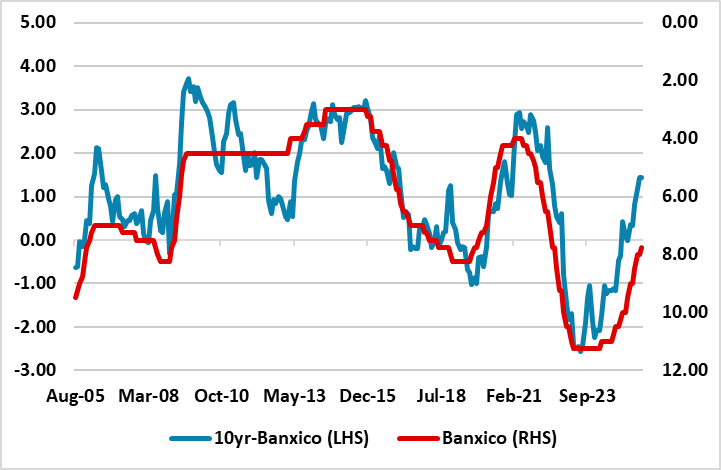

Figure 1: Mexico 10yr-Banaxico Rate and Inverted Banxico Rate (%)

Source: Datastream/Continuum Economics

Banxico cuts the policy rate by 25bps to 7.75%, with a 4-1 vote and Heath once again voting for no change. The Banxico statement is not materially changed, which leaves the impression that they expect weak growth to feed into lower inflation in 2026. Indeed, headline and core inflation are still projected to be 3.0% by Q3 2026, as these disinflationary forces kick in.

While Banxico remaining data dependent, the forward guidance remains towards further interest rate cuts. The Mexican peso is not suffering, while 10yr yields are higher than would normally be seen with current policy rates (Figure 1 shows they would normally be closer to 8.0-8.50% at this policy rate). Only upside data surprises could be enough to stop a September 25bps cut.

The trade negotiations with the U.S. are also important, as they could hurt the projected economic rebound into 2026. Trump has given a 90 day extension to Mexico until end October, but his intention is to renegotiate USMCA. Mexico will likely lose this battle to win the war and sustain the bulk of exports to the U.S. However, it remains uncertain where the landing zone is for a trade deal. For Banxico, trade policy uncertainty is high and this means downside risks for the baseline 2026 economic projections.

On balance, we feel that Banxico will now cut by 25bps in September and December to end 2025 at 7.25% -- an October pause to see what the trade deal will be. With increasing prospects that the Fed could cut in September, Banxico will also feel that financial markets provide a window of opportunity. With a 3% inflation target, Banxico estimates of real neutral policy rate implies a nominal neutral policy rate of 4.8-6.6%. While the policy rate is above this target, then policy is restrictive and we now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rate cuts in Q1 and one in Q2.