Banxico Minutes: Comfortable about the Cuts Amid the Volatility

Banxico’s latest minutes confirm a cautious but steady path toward policy normalization, with the policy rate expected to reach neutral levels (7.00–8.00%) in 2025. While the economy shows signs of deceleration and a negative output gap, inflation continues to ease, nearing historical averages. Attractive rate differentials may limit peso depreciation, despite external volatility. The board sees inflation converging to target by mid-2026, supporting further rate cuts while maintaining a short-term contractionary stance and transitioning toward neutrality by year-end.

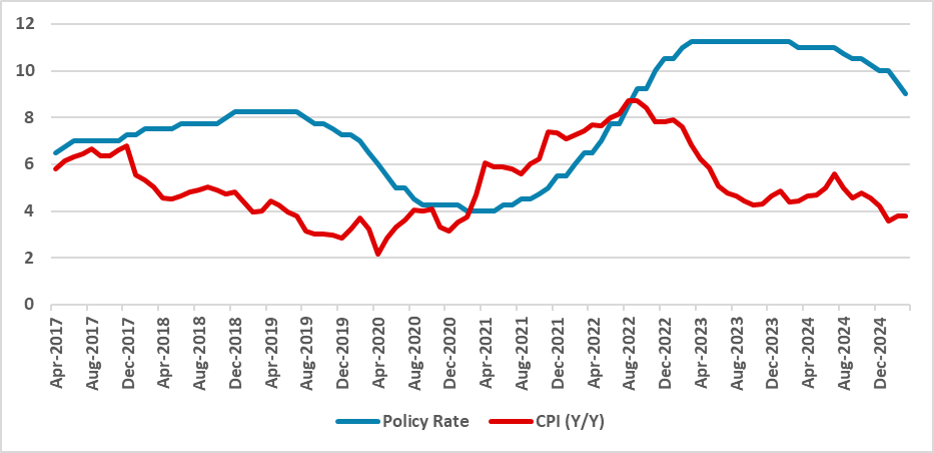

Figure 1: Mexico’s Policy Rate and CPI (%)

Source: Banxico and INEGI

Mexico’s Central Bank (Banxico) has released the minutes of its last meeting, in which it cut the policy rate by 50 bps to 9.00%. Overall, the minutes corroborated the tone of the communiqué, supporting our view that the board will remain cautious, while confirming their expectation that the policy rate will likely return to neutral levels in 2025, with the range estimated around 7.00–8.00%.

Regarding domestic matters, the board analyzed the latest trends in tariffs and volatility. According to them, the current situation increases uncertainty, affecting decision-making by economic agents, which could potentially impact emerging economies. What favors Mexico, according to the minutes, is that rate differentials remain attractive, which supports a scenario of only moderate depreciation, if any occurs. In recent days, the Mexican peso has shown some volatility due to external factors, although it recently touched the 19 USD/MXN mark for the first time in three years.

On domestic activity, there is some consensus that the Mexican economy is decelerating and that the risk of a contraction exists. Additionally, there is overwhelming evidence that the output gap is now negative, meaning the economy is operating below its potential, which suggests inflationary pressures are limited. The labor market is also showing signs of deceleration, with both job creation and wage growth slowing. Moreover, even if tariffs are applied on Mexican goods, a depreciation of the exchange rate could offset this impact, although this remains uncertain.

On the inflation front, the board again emphasized the progress made, noting that both headline and core CPI are approaching their historical averages. The board believes inflation will converge toward the target in the second quarter of 2026, which contrasts with market expectations. The weakness in economic activity and increased slack in the economy are expected to help slow inflation. They believe that any rise in goods prices will likely be offset by a decline in services inflation.

Overall, we believe the minutes support a positive view of the inflation outlook, which favors continued rate cuts, while still maintaining a contractionary stance in the short term. However, in the medium term, a move toward a neutral stance now seems likely. We believe Banxico will continue cutting the policy rate by 50 bps until it reaches 8.0%, after which it will slow to 25 bps cuts, bringing the policy rate to 7.5% by the end of 2025.