Mexico CPI Review: Downtrend Continues

December’s CPI grew 0.4%, with Y/Y inflation dropping to 4.2%, above Banxico’s 2%-4% target. Core CPI rose 0.5%, driven by services, while non-core inflation was stable. MXN depreciation’s pass-through impact remains limited. Tight monetary policy supports convergence, but Banxico faces a decision: maintain 25bps cuts or accelerate to 50bps, with most of Banxico members leaning towards the latter.

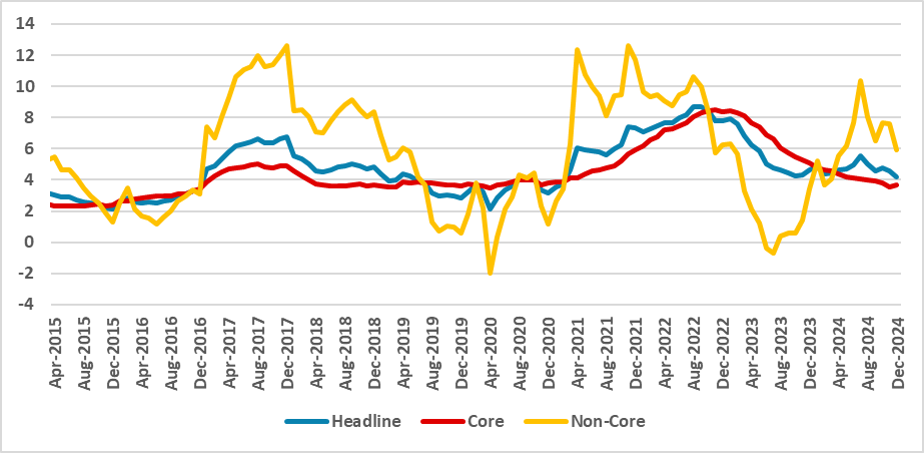

Figure 1: Mexico’s CPI (Y/Y, %)

Source: INEGI

Mexico’s National Statistics Institute has released the CPI figures for December. Data shows that the CPI grew by 0.4%, similar to our preview (here). Therefore, Y/Y CPI dropped to 4.2% from 4.5% in November. For the third consecutive year, annual inflation finished above Banxico's target bands (2%-4%), although the signs are that inflation is moving slowly towards convergence. December figures had mixed signs; Core CPI accelerated slightly, growing 0.5%, the highest variation in this group since March 2023. On annual terms, the index grew 3.6%, inside Banxico's target range. Most of the growth was concentrated in services (+0.6% m/m), while goods grew 0.4% in the month.

The non-core group was the biggest contributor to the moderate levels of inflation in December. This group remained stable in the month as the agricultural goods CPI dropped by 0.6%, while the energy group grew 0.4%. In general, December inflation showed mixed signs. Although there was a small spike in core CPI, we believe there isn’t much to worry about, as most signs point to the Mexican economy decelerating, affected by tight monetary policy, which will contribute to inflation convergence.

One point of concern is the current level of MXN depreciation. Although there are signs that its pass-through effect has been narrow, they are even weaker in the presence of weak demand. This all points to Banxico cutting the policy rate. The question now is whether they want to accelerate the pace of cuts to 50bps or keep it at 25bps. We believe the correct action would be for Banxico to continue with caution, indicating a continuation of the 25bps cuts. However, the majority of Banxico will likely lean towards increasing the cuts with the view that the policy rate will remain in contractionary terrain, but the level of tightening can be diminished.