View:

EUR/USD: Europe’s Counter Threats to Trump

February 10, 2026 11:05 AM UTC

· Europe is highly unlikely to weaponize its existing portfolio holdings or new flows into the U.S., as Europe is dependent on the U.S. nuclear umbrella and as EZ/EU decision making is slow and modest in action. Such a move would be strongly opposed by EZ/European investors. Even so,

Iran: What Length For War?

March 2, 2026 7:44 AM UTC

· If the war is short (ie 1-2 weeks) and leads to a ceasefire then the global economic impact will be small, with the greatest impact in the middle east of oil/gas supplies on a temporary basis and tourism. If the war is more prolonged (ie months) then oil/gas supplies could be sque

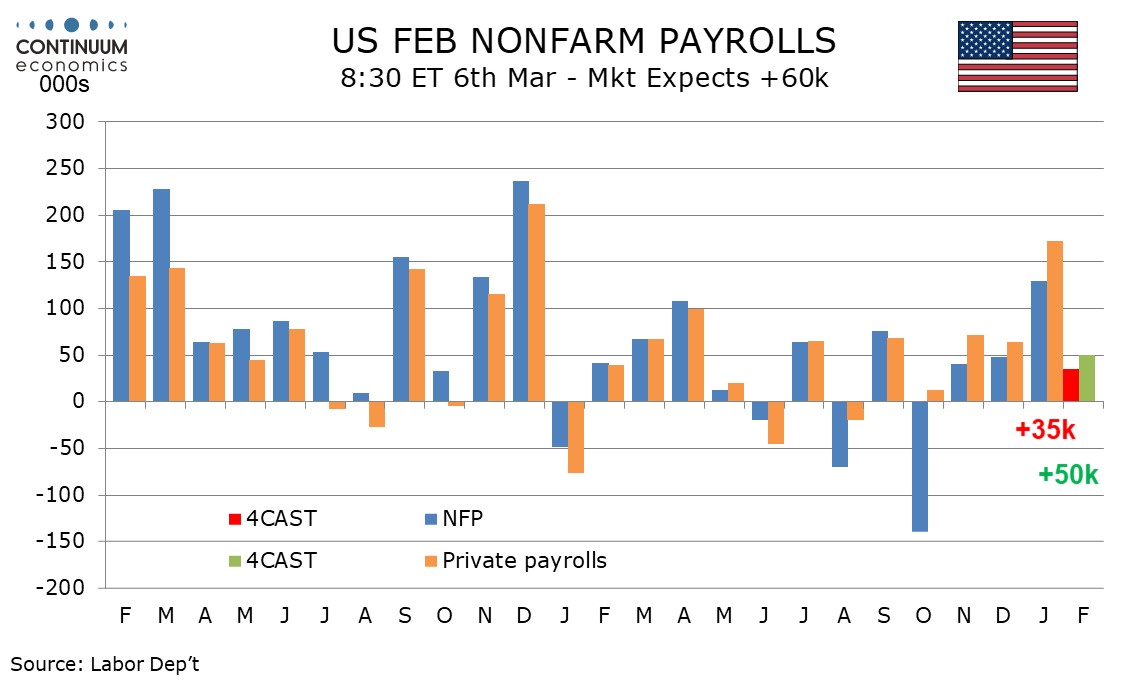

Preview: Due March 6 - U.S. February Employment (Non-Farm Payrolls) - Not as strong as January, but still marginally positive

February 26, 2026 3:22 PM UTC

We expect February’s non-farm payroll to rise by 35k overall and by 50k in the private sector, both four month lows and significantly slower than January’s above trend respective gains of 130k and 172k. We expect unemployment to edge up to 4.4% from 4.3%, reversing a January dip, and average hou

India’s CPI Overhaul: Smoother Prints, Deeper Scrutiny

February 16, 2026 6:37 AM UTC

India’s January 2026 CPI rose to 2.75% yr/yr, marking the launch of a rebased 2024=100 index that better reflects modern consumption patterns. Food’s reduced weight is likely to dampen headline volatility, while services, housing and discretionary spending will exert greater influence going forw

This week's five highlights

February 13, 2026 12:00 PM UTC

U.S. January Employment Stronger across the board, will keep Fed in no hurry to ease

This Week's Fed Speakers

BoC Minutes Show Steady policy dependent on economy evolving as expected

UK GDP Underlying Economy Fragility Does Continue

Landslide Victory for Japan LDP

Preview: Due March 16 - U.S. February Industrial Production - Pause after a stronger January

March 6, 2026 6:47 PM UTC

We expect an unchanged February industrial production total to follow a strong 0.7% increase in January. For manufacturing we expect a 0.1% increase to follow a 0.6% rise in January. Despite the subdued February forecast, trend appears to be picking up.

Preview: Due March 13 - U.S. Preliminary (Second) Estimate Q4 GDP - Marginally stronger on housing

March 6, 2026 4:45 PM UTC

We expect a marginal upward revision to Q4 GDP to 1.5% in the preliminary (second) estimate from 1.4% in the advance (first) release, led by an upward revision to housing investment to a 1.7% rise from a 1.5% decline.

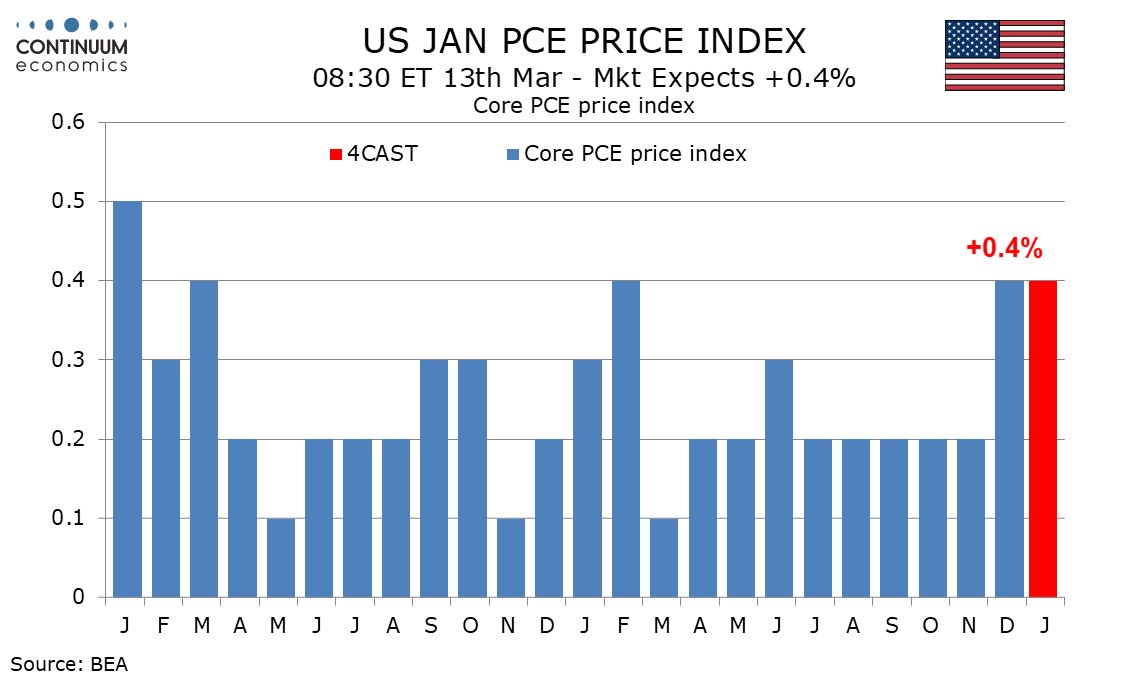

Preview: Due March 13 - U.S. January Personal Income and Spending - Core PCE Prices to outperform CPI

March 6, 2026 3:24 PM UTC

We expect January to see a strong core PCE price index increase of 0.4%, matching the rise seen in December. We expect personal income to increase by 0.6%, unusually outpacing personal spending, which we expect to rise by 0.4% for a third straight month.