View:

Iran: What Length For War?

March 2, 2026 7:44 AM UTC

· If the war is short (ie 1-2 weeks) and leads to a ceasefire then the global economic impact will be small, with the greatest impact in the middle east of oil/gas supplies on a temporary basis and tourism. If the war is more prolonged (ie months) then oil/gas supplies could be sque

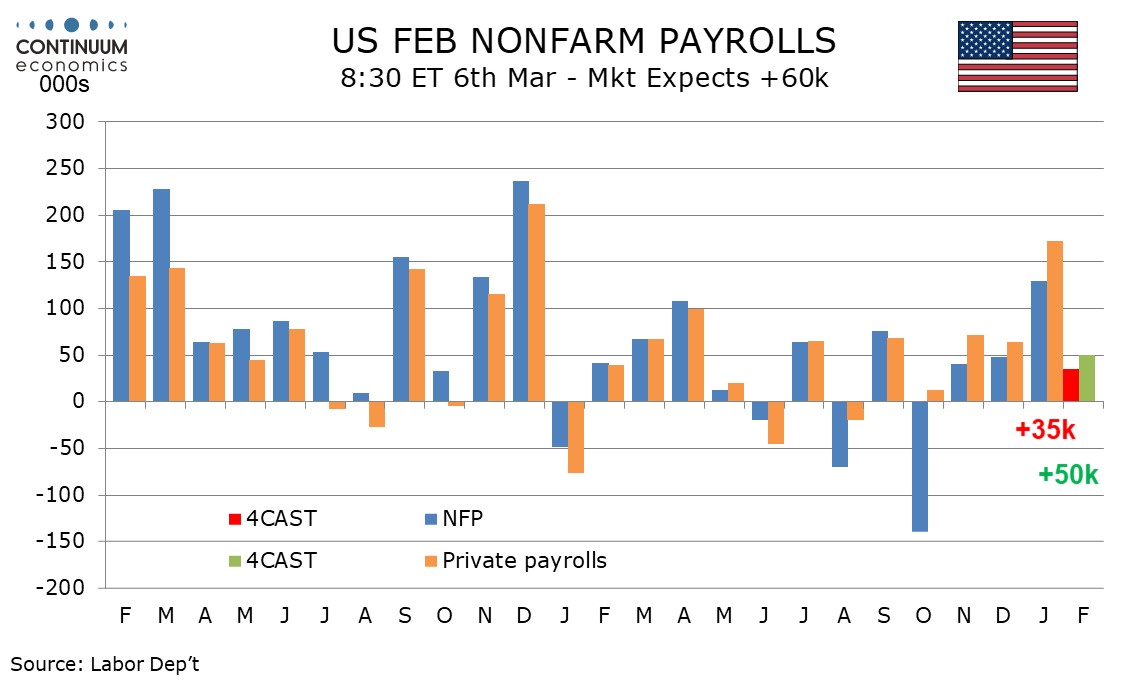

Preview: Due March 6 - U.S. February Employment (Non-Farm Payrolls) - Not as strong as January, but still marginally positive

February 26, 2026 3:22 PM UTC

We expect February’s non-farm payroll to rise by 35k overall and by 50k in the private sector, both four month lows and significantly slower than January’s above trend respective gains of 130k and 172k. We expect unemployment to edge up to 4.4% from 4.3%, reversing a January dip, and average hou

India’s CPI Overhaul: Smoother Prints, Deeper Scrutiny

February 16, 2026 6:37 AM UTC

India’s January 2026 CPI rose to 2.75% yr/yr, marking the launch of a rebased 2024=100 index that better reflects modern consumption patterns. Food’s reduced weight is likely to dampen headline volatility, while services, housing and discretionary spending will exert greater influence going forw

This week's five highlights

February 13, 2026 12:00 PM UTC

U.S. January Employment Stronger across the board, will keep Fed in no hurry to ease

This Week's Fed Speakers

BoC Minutes Show Steady policy dependent on economy evolving as expected

UK GDP Underlying Economy Fragility Does Continue

Landslide Victory for Japan LDP