Mexico: Budget Aims at Resuming Fiscal Discipline

Claudia Sheinbaum’s administration has introduced the 2025 budget, reaffirming Mexico's commitment to fiscal discipline with a projected fiscal consolidation of 2.0% of GDP, reducing the fiscal deficit from 5.9% in 2024 to 3.9% in 2025. Although there is likely an overestimation on GDP growth we believe the fiscal consolidation will be partially successful, with some expenditures to aid PEMEX, and the Debt/GDP ratio stabilizing around 52%.

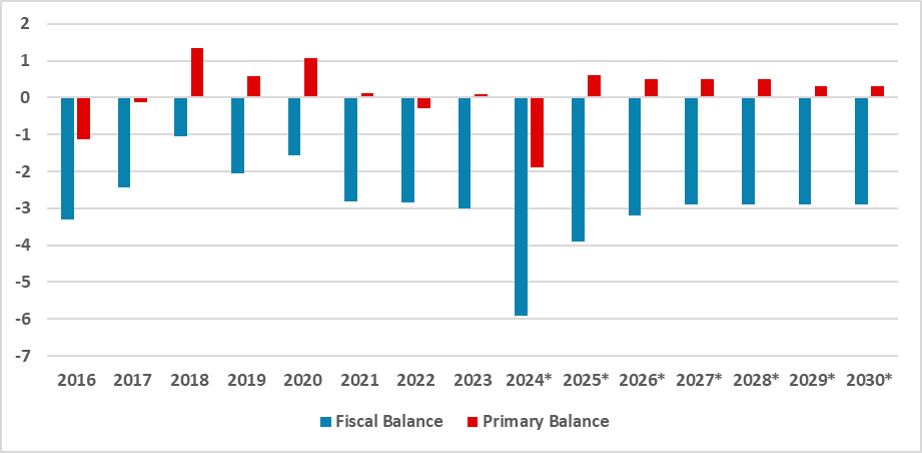

Figure 1: Fiscal and Primary Balance of the Public Sector (% of GDP)

Source: SHCP and Continuum Economics

Claudia Sheinbaum’s administration has presented the 2025 budget, which will then be discussed and likely approved by Mexico’s Congress. When the 2024 budget was presented (here), Mexico deviated from its usual fiscal discipline, increasing the deficit by around 1.9% of GDP, aiming to increase public investment and social expenditures. There were some doubts about whether this would indicate a new trend or just an isolated event. The 2025 budget reaffirms Mexico’s commitment to fiscal discipline, aiming to reduce the previous deficit by around 2.0% of GDP. The Mexican government bets on a small reduction in certain expenditures, with revenue growing above most of the increases in expenditures. Therefore, Mexico aims to achieve a primary surplus of 0.6% and a fiscal deficit of 3.9%, which, according to government estimates, would allow the debt-to-GDP ratio to stabilize around the current level of 51.6%.

Recently, Moody’s changed Mexico's outlook from stable to negative while maintaining the current rating of Baa2, two levels above investment grade. Regarding the reasons for changing the outlook from stable to negative, Moody’s cites the reduction in Mexico’s growth rate, the judicial reforms that could erode Mexican institutions, and doubts about whether Mexico's government would be able to reverse the current deficit. It is also important to note that if Mexico is able to revert the deficit, as it has intended in the 2025 budget, the outlook could be changed back to stable.

Some of the assumptions used in the budget could be unrealistic. Mexican officials estimate that Mexico’s GDP will grow between 2% and 3% in 2025, while most market estimates predict Mexico will grow below 2%. Our estimates point to a growth rate of 1.6% for Mexico in 2025, with Mexico’s potential growth being around 2%. This overestimation could result in revenues growing less than expected, thereby reducing the deficit. The government indicates that administrative measures will also be taken to avoid tax evasion without the need to increase taxes.

Another important point is Mexico’s possible aid to PEMEX. The state oil company is experiencing liquidity problems, and Mexico’s government will likely need to support the company to comply with its obligations. This aid could take the form of tax reductions and capital injections into the company. Overall, we see the costs to the Mexican government for aiding PEMEX being around 0.5% of GDP, which weighs on the budget but is far from catastrophic.

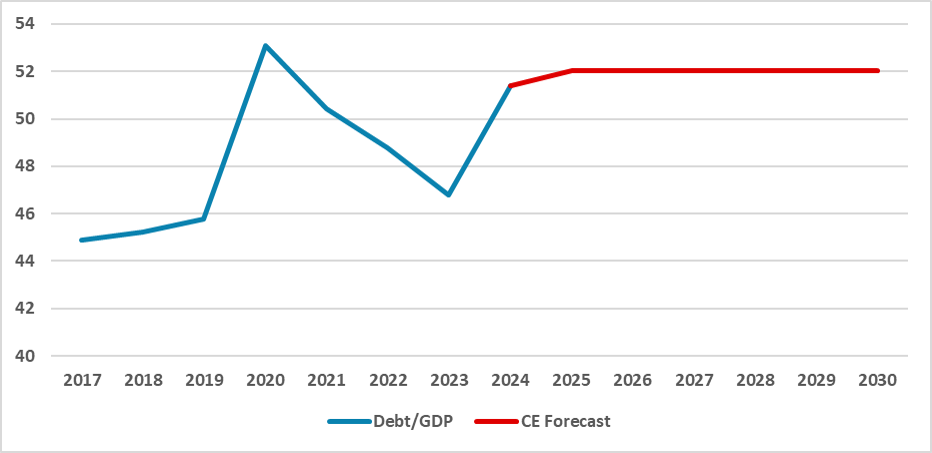

Figure 2: Debt/GDP Forecast

Source: Continuum Economics

We forecast that Mexico will continue with its consolidation plan, although we believe the consolidation will likely be smaller in 2025 due to lower revenue growth and PEMEX aid, with the primary surplus being around 0.1%. However, we forecast Mexico’s debt to be sustainable, stabilizing around 52% of GDP, with most rating agencies maintaining their current credit rating for Mexico.