Banxico Review: Lowering Rates Amid Tariffs

Mexico’s Central Bank (Banxico) has cut the policy rate by 50 bps to 9%, in line with market expectations. The tone of the communiqué suggests a more dovish stance, with the board moving towards a neutral rate. Inflation has reached its lowest level since 2021, while economic growth has slowed. Banxico plans another 50 bps cut in May, with two cuts expected in the next six months, ultimately moving the rate towards 8.0%. They remain cautious due to tariff-related inflation risks.

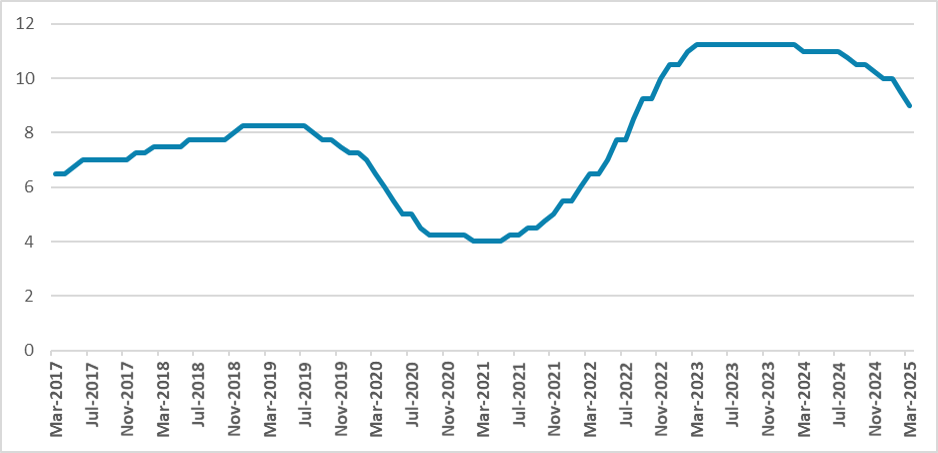

Figure 1: Mexico’s Policy Rate

Source: Banxico

Mexico’s Central Bank (Banxico) has convened to decide the policy rate. Acting according to market expectations, Banxico has opted to cut the policy rate by 50 bps to 9% unanimously. We will get more information on the decision when the minutes come out, but we see the general tone of the communiqué as more dovish, with a board more inclined to move towards a neutral rate, although some caution still remains.

The board highlighted that since their last decision, the interest rates of Mexican government bonds have decreased, while the exchange rate has shown some appreciation, although it has varied around a wide range recently. Much of this has been caused by the increasing uncertainty regarding the impact of tariffs. Regarding inflation, the board highlighted that it has reached the lowest level since 2021. Regarding the Core CPI, the board has consistently stated that it has reached a level similar to the year before the 3.0% target was adopted, which for us indicates a more benevolent view of inflation. Banxico also highlighted that the Mexican economy has slowed in the last quarter of 2024 and that they expect it to remain weak in the first quarter of 2025.

Interestingly, Banxico keeps stating that their balance of risk is skewed to the upside, but it has improved. To the upside: exchange rate depreciation, disruptions due to geopolitical conflicts and commercial tensions, persistence of core inflation, cost pressures, and climate change. To the downside: slower than anticipated economic activity, less pass-through from cost pressures, and the exchange rate. We believe Banxico is being cautious with their outlook, and the statement of their balance of risk being skewed to the upside will soon disappear.

Regarding their guidance, Banxico has indicated they will pursue another 50 bps cut in their next meeting in May. With the economy slowing and inflation also indicating it will converge, Banxico will continue cutting at least towards neutral levels. However, they also need to be careful with the possible impact of tariffs, which could generate inflationary pressures, although it is yet unclear. In the next six months, Banxico will move the policy rate towards 8.0%, with two 50 bps cuts. Then, they will evaluate whether tariffs will impact inflation and economic activity and decide their next moves, which will either be a pause or continued cuts. For the moment, we believe they will pause for a couple of meetings and resume cutting afterward.