View:

March 05, 2026

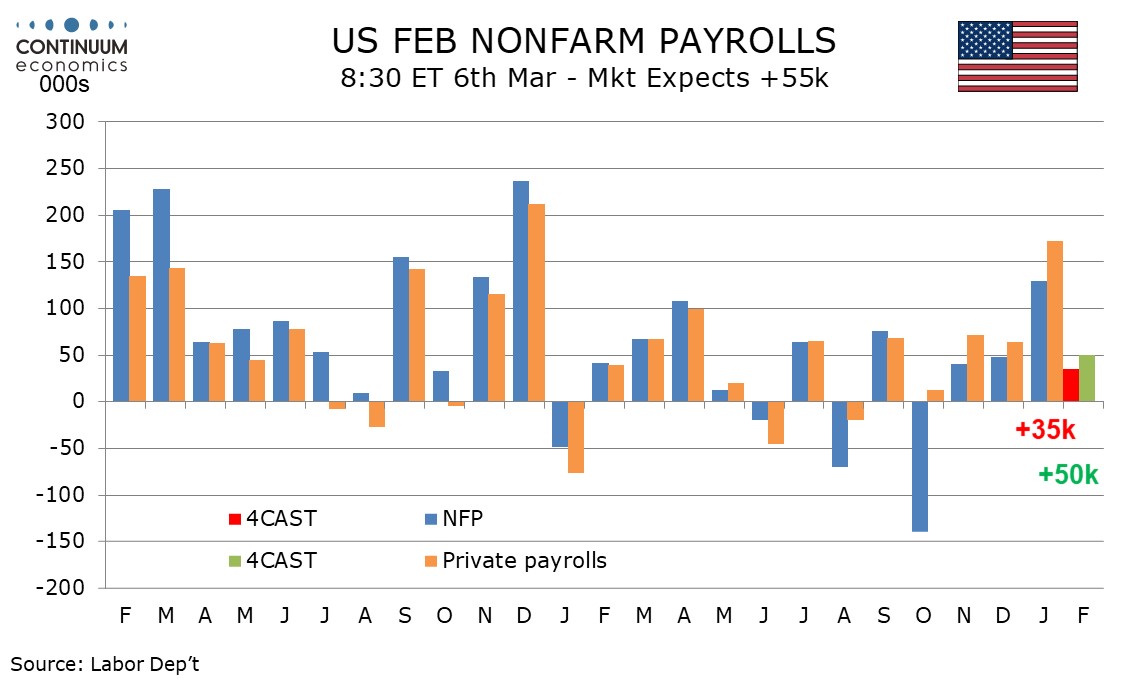

Preview: Due March 6 - U.S. February Employment (Non-Farm Payrolls) - Not as strong as January, but still marginally positive

March 5, 2026 2:26 PM UTC

We expect February’s non-farm payroll to rise by 35k overall and by 50k in the private sector, both four month lows and significantly slower than January’s above trend respective gains of 130k and 172k. We expect unemployment to edge up to 4.4% from 4.3%, reversing a January dip, and average hou

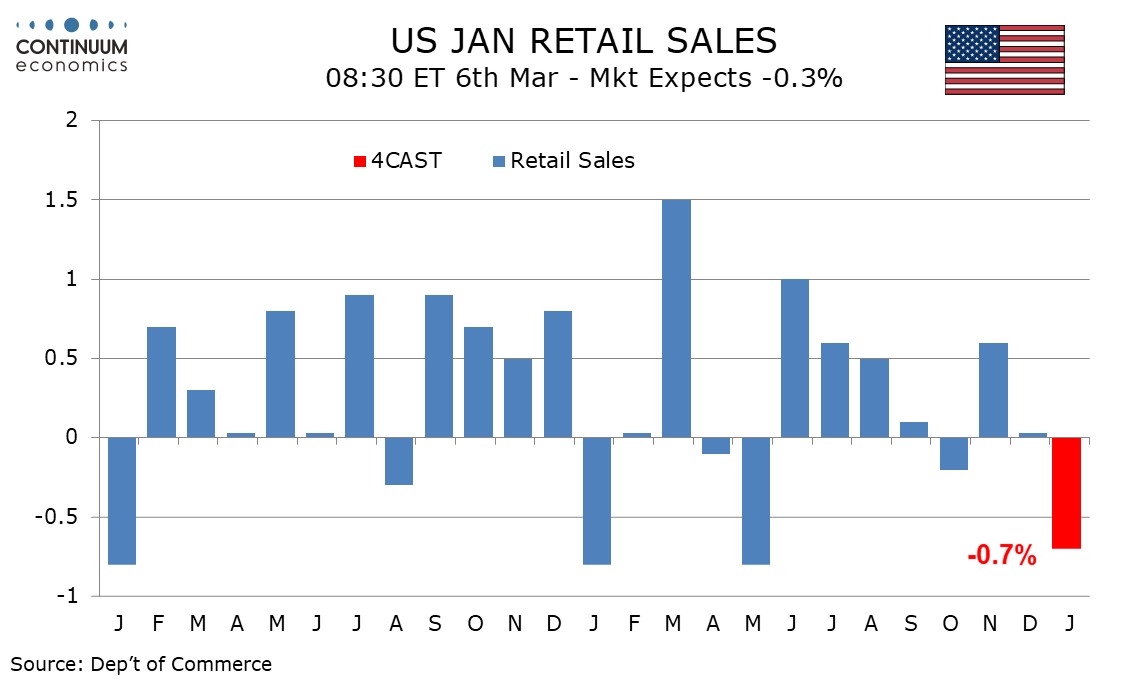

Preview: Due March 6 - U.S. January Retail Sales - Weather adding to downside risk

March 5, 2026 2:17 PM UTC

We expect retail sales to see a weak month in January, falling by 0.7% overall, with declines of 0.4% ex auto and 0.2% ex auto and gasoline. Bad weather late in the month will contribute to the decline.

China: 4.5-5.0% GDP Growth for 2026

March 5, 2026 9:16 AM UTC

• China announced a central government budget deficit at 4% of GDP, which is the same as last year and points to only modest fiscal stimulus. Though investment was supported, consumption trade in programs were cut from Y300bln to Yuan250 and no new structural safety net for households hav

March 04, 2026

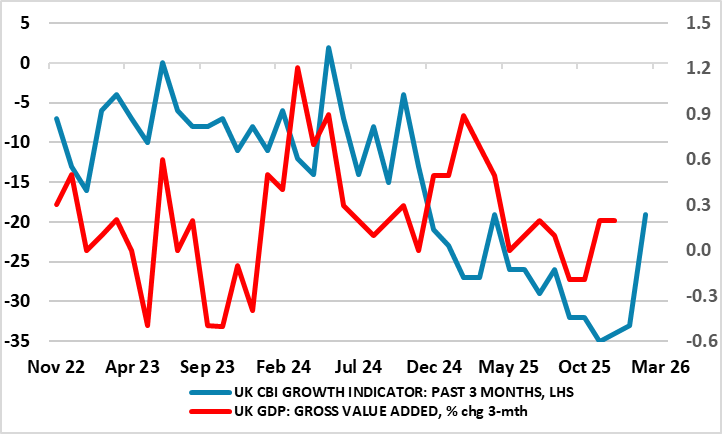

UK GDP Preview (Mar 13): Were Things Getting Better?

March 4, 2026 11:11 AM UTC

Belatedly, some good news; the UK economy grew for a second successive month in December, something not seen for almost a year. Even more encouragingly, it may very well enjoy a further rise in the looming January data, thereby providing the best three-month showing in two years. But as is famil

Markets and the Iran War

March 4, 2026 9:50 AM UTC

• The Trump administration’s objective appears to be pivoting from regime change to hurting Iran ballistic missile capabilities, which argues for a 2-4 week war rather than a prolonged war. However, the most intense missile battles will likely occur in the next one week and markets are

March 03, 2026

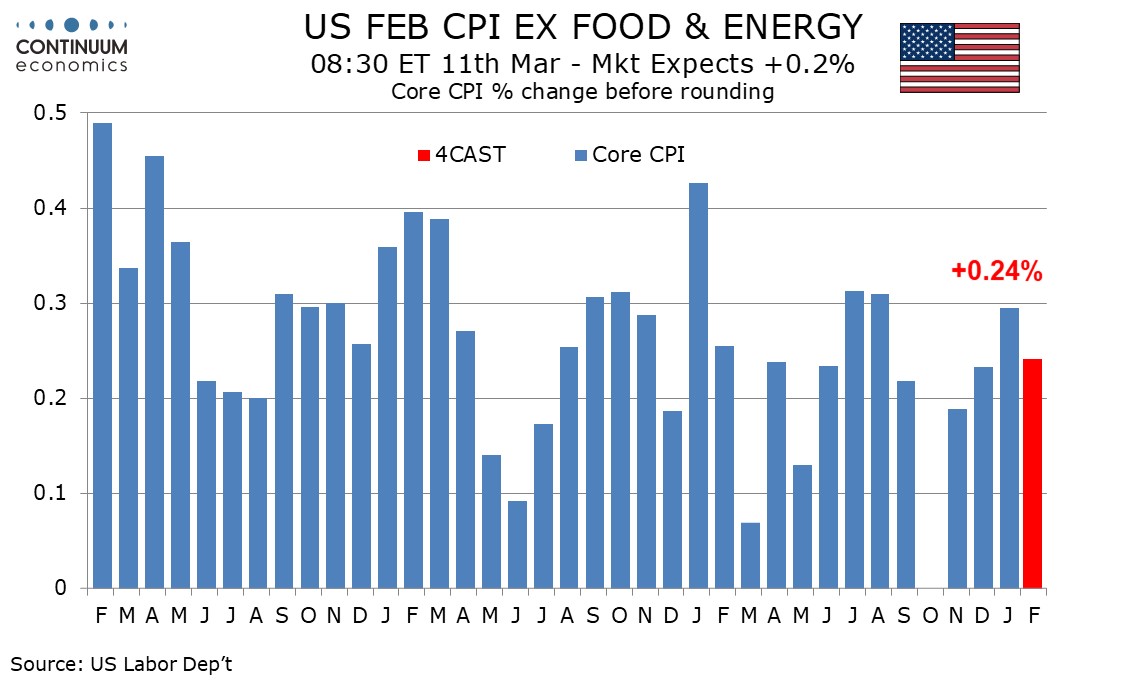

Preview: Due March 11 - U.S. February CPI - A moderate gain, but inflation not yet defeated

March 3, 2026 7:30 PM UTC

We expect February’s CPI to increase by 0.3%, with a 0.2% increase ex food and energy. Before rounding we expect the gains will be similar, with the overall CPI rounded up from 0.26% and the core rounded down from 0.24%. CPI has slowed, but it is too soon for the Fed to declare victory.

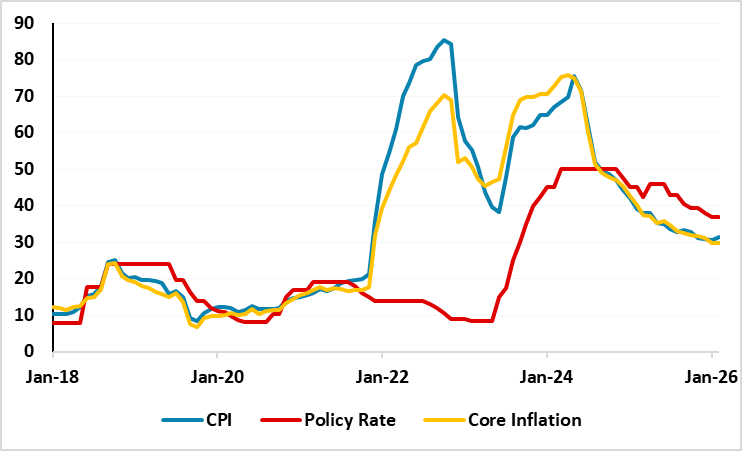

Inflation Edged Up to 31.5% y/y in February as Monthly Pressures Persist

March 3, 2026 11:56 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced February inflation figures on March 3. After hitting 30.7% annually in January, Turkiye’s inflation surged to 31.5% in February due to rising food, transportation and housing prices. Our average inflation forecast for 2026 stands at 2

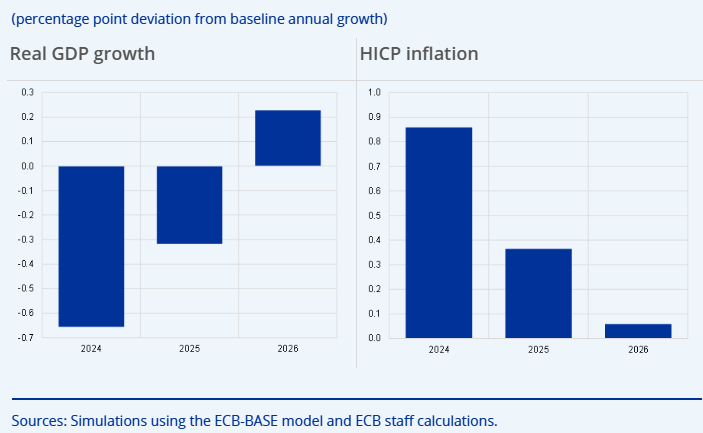

EZ HICP Review: Core Rate Spikes as Upside Inflation Risks Return

March 3, 2026 10:35 AM UTC

Having dropped to 1.7% in the January data, thereby matching expectations and the short-lived Sep 24 outcome, it is likely especially in view of the Middle East conflict that the headline HICP rate may not be any lower through this year and into next. Indeed, we headline rate rose 0.2 ppt to 1.9%