EMFX Outlook: Divergence versus the USD

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest spot gains in the remainder of 2025.

· The Chinese Yuan (CNY) can lose some ground against the USD however, as the U.S. continues to aggressively pursue a better trade deal with China and interest rate differentials remain adverse for CNY.

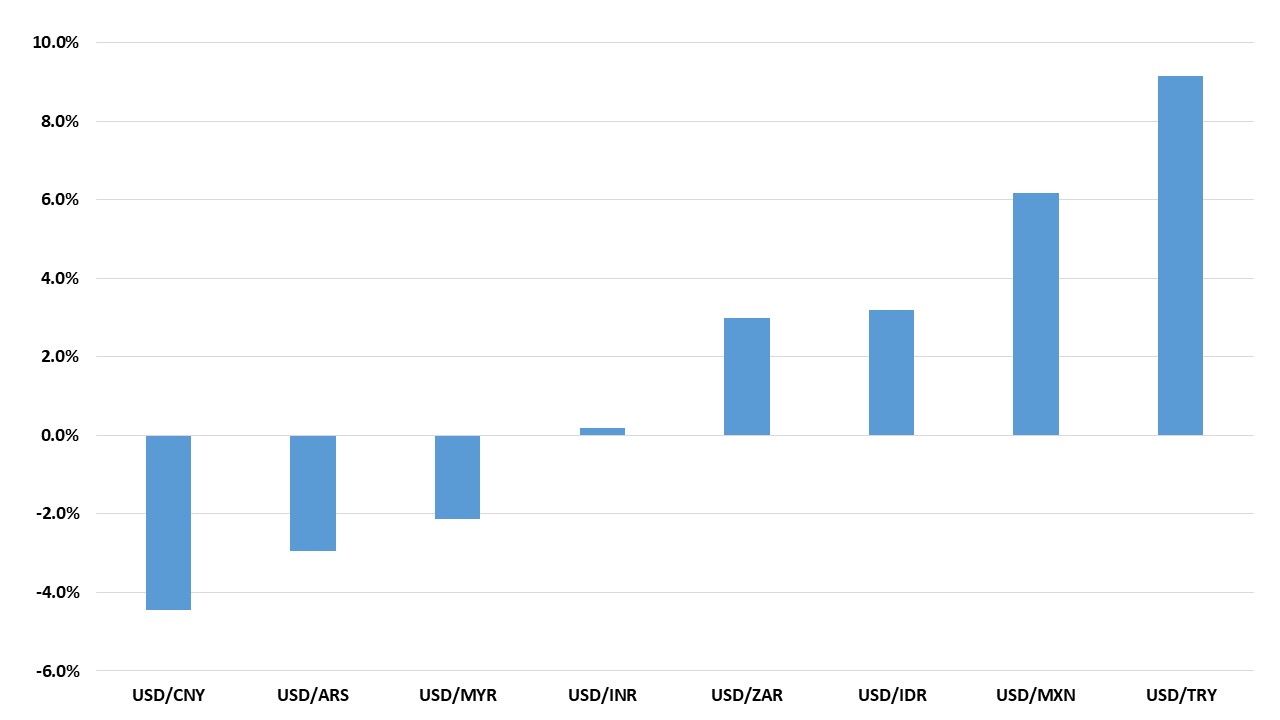

· In terms of total returns for 2025, the large interest rate differential for BRL really helps and Mexican interest rate differentials will also remain sufficiently high. Though the Turkish Lira (TRY) will likely see positive total returns (Figure 1), it will be a volatile ride. The South Africa Rand (ZAR) can also see positive total returns, but this is mainly interest rate differentials.

Risks to our views: More aggressive tariffs by the U.S. on China than our baseline would produce more Yuan depreciation towards 7.65 on USD/CNY and spill over to more losses for some EM currencies in 2025.

Figure 1: 9mth Total Returns Versus the USD (%)

Source: Continuum Economics

Asia

China has not yet undertaken a depreciation of the CNY, despite the U.S. imposing two sets of across the board 10% tariffs. A noticeable CNY depreciation now would likely prompt the Trump administration to threaten yet more tariffs and trade war escalation. This is the opposite of Beijing’s desire to quickly get the U.S. to the negotiating table and revise the phase 1 agreement with the U.S. We feel that the U.S. will likely want to announce reciprocal and product tariffs in April before going to the negotiating table into the summer. China authorities are also sensitive to domestic capital outflows, as a sharp fall in the CNY could led to protests about the economy and against the CCP. Slow CNY depreciation at the appropriate time is still feasible, as the real concern is that a quick CNY decline triggers domestic capital outflows.

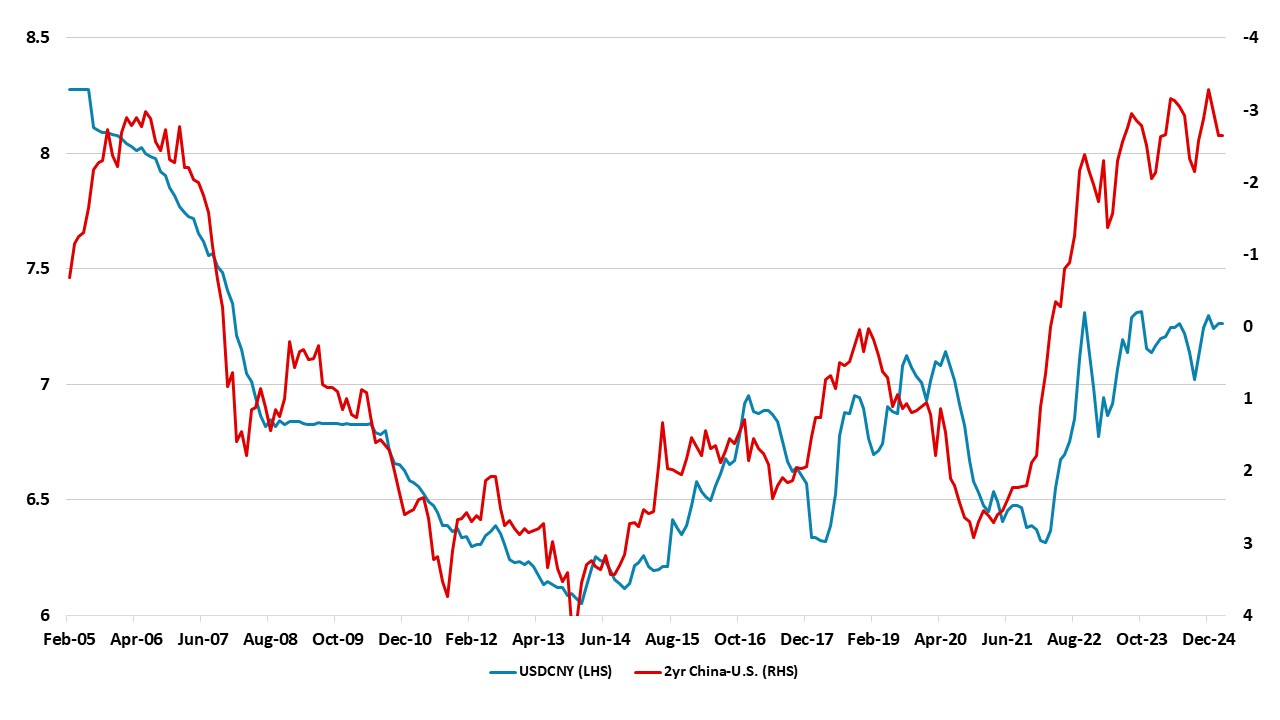

This could all mean that China’s authorities are reluctant to allow the CNY to depreciate too much in the next few months. Some depreciation of the Yuan into mid-year is still likely to around 7.40-45 on USDCNY, especially as a 10bps cut from the PBOC to the 7-day reverse repo rate is likely between March and May – Figure 2 shows that adverse interest rate differentials could argue for a weaker CNY. The risk of a move to 7.65-75 is now lower probability provided that China and the U.S. start negotiations.

Figure 2: USDCNY and 2yr China-U.S. Government Bond Spread (%)

Source: Datastream/Continuum Economics

Elsewhere in Asia, in 2025 and 2026, emerging Asian currencies have mixed forces with a weaker USD versus DM currencies, but interest rate differentials that are narrow versus the U.S. Although, central banks across the region are expected to defend against excessive volatility, inflation differentials and the recalibration of U.S. trade by the Trump administration will be negative factors. The Indian rupee is forecast to decline to USD/INR 86.9 by end-2025, before drifting in 2026 to 87.5. The Reserve Bank of India will continue to actively intervene to stabilize the INR, leveraging India’s deep FX reserves. However, the RBI is no longer keen on maintaining the tight range as it did in previous years.

The Indonesian Rupiah (INR) is expected to strengthen to USD/IDR 16,275 in 2025, with appreciation helped by the oversold nature of the IDR. As clarity returns to U.S. trade and rate outlooks by late 2025, the IDR may gently rise, supported by improving risk appetite and domestic macro fundamentals. However, current-account weakness will cap any meaningful appreciation in 2025. Thereafter the IDR is expected to strengthen to USD/IDR 15,880 in 2026. The Malaysian ringgit is projected to weaken marginally to USD/MYR 4.5 by end-2025. The currency will face downside pressure from Malaysia’s high trade exposure and renewed global protectionism, especially potential US tariffs targeting electronics and key export categories. In addition, a sustained US-Malaysia interest rate differential will attract capital away from the ringgit. Nevertheless, Malaysia’s persistent current-account surplus and Bank Negara’s active FX intervention strategy, backed by strong reserves, will act as buffers against sharp swings. Following these dynamics, USD/MYR will close at 4.4 in 2026.

LatAm: Depreciated Too Far?

LatAm currencies remained volatile during the first quarter of the year. In Mexico, the threat of U.S. tariffs against the Mexican economy and the strained relationship between the U.S. and Mexico caused the Mexican Peso to reach a maximum of 21 USD/MXN. However, it now seems to have stabilized at 20.3 USD/MXN. We still believe this value is somewhat low, and some further appreciation could be seen in the upcoming months of the year, as our forecast for USD/MXN is to end the year at 19.5 USD/MXN. However, this scenario assumes a resolution to Trump’s tariffs by a revision to the USMCA trade deal. In the event the 25% tariffs are fully implemented, Mexico could accept some depreciation of the MXN to make their exports more attractive to the U.S. In any case, the Mexico’s administration will try its best to avoid tariffs, which we believe could allow for this appreciation. Although Banxico will continue to cut rates, the rate differential remains attractive, and with fiscal discipline resuming in 2025, Mexico could still be an attractive investment.

In the case of Brazil, a mix of policy uncertainty regarding fiscal sustainability and the threat of tariffs affecting most LatAm currencies triggered a USD/BRL jump above 6.2. However, as the situation calms down and the government makes efforts to fulfil the 0% primary budget deficit target, most of these risks are likely to dissipate in the coming months. Although tariffs on steel and aluminium could harm the Brazilian economy, those exports represent a small portion of Brazil’s overall exports, which are more tied to China than to the U.S. With the BCB hiking the policy rate to control inflation, we believe the Brazilian Real will not return to the lows seen earlier this year but will rather stabilize around 5.6 USD/BRL. This level is likely to persist through 2026, as the interest rate differential will continue to be significant.

Regarding Argentina, Javier Milei’s administration has reduced the pace of devaluation of the Argentine Peso (ARS) to 1% per month, down from 2%. This strategy is likely to be maintained until the end of the year, meaning the Argentine Peso will continue to appreciate in real terms. This translates to the USD/ARS ending the year at 1232. In 2026, we believe Argentina will try to continue to maintain the Argentine Peso's appreciation to tackle inflation. However, there are still doubts about whether this will be possible as the current account begins to register a deficit. Some depreciation to realign the current account could occur, but this decision remains unclear at the moment. We forecast the USD/ARS to finish 2026 at 1420.

EMEA

EMEA currencies will continue to be divergent depending on inflation and interest rate differentials, and H2 2025 will likely see more divergence across EMEA due to increased global uncertainties.

We expect the downward pressure will remain for TRY and Russian Rouble (RUB) as inflation differentials remain large. In Russia, RUB gained about 28% of its value against the USD in Q1 on expectations of easing tensions between Russia and the U.S. and a peaceful settlement in Ukraine. Despite this, we envisage RUB will remain volatile in Q2 and Q3 since inflationary pressures likely won’t start to soften and macroeconomic instability will remain substantial. We foresee a ceasefire in Ukraine followed by a Russia-friendly peace deal in 2025 would underpin the RUB and help USD/RUB rate to stand at 83.5 by the end of 2025. We expect a continued RUB recovery requires a peace deal together with the decision to lift sanctions against Russian economy, which could take years. RUB will still be falling on a spot basis in 2026 due to inflation differentials coupled with foreign capital inflows likely remaining weak until Ukraine war is totally over and sanctions lifted. Our end year USD/RUB rate prediction is 90 for 2026.

On the TRY front, we continue to see losses for TRY in 2025 and 2026 as inflation remains much higher than Turkiye’s main trading partners; foreign capital inflow remains weaker-than-expected and domestic vulnerabilities dominate. (Note: The arrest of Istanbul mayor Imamoglu on March 23 could trigger market losses and TRY to lose value, particularly in Q2). TRY will still be falling on a spot basis but at a slower pace than the interest rate differentials against the USD suggest. We expect Central Bank of Turkiye (CBRT) will continue its cutting cycle unless a sustained surge in the underlying trend of monthly inflation is observed, and our end year key rate prediction for 2025 and 2026 remain at 30% and 19%, respectively. We see the USD/TRY rate at 42 by the end of 2025, and 48 for end 2026.

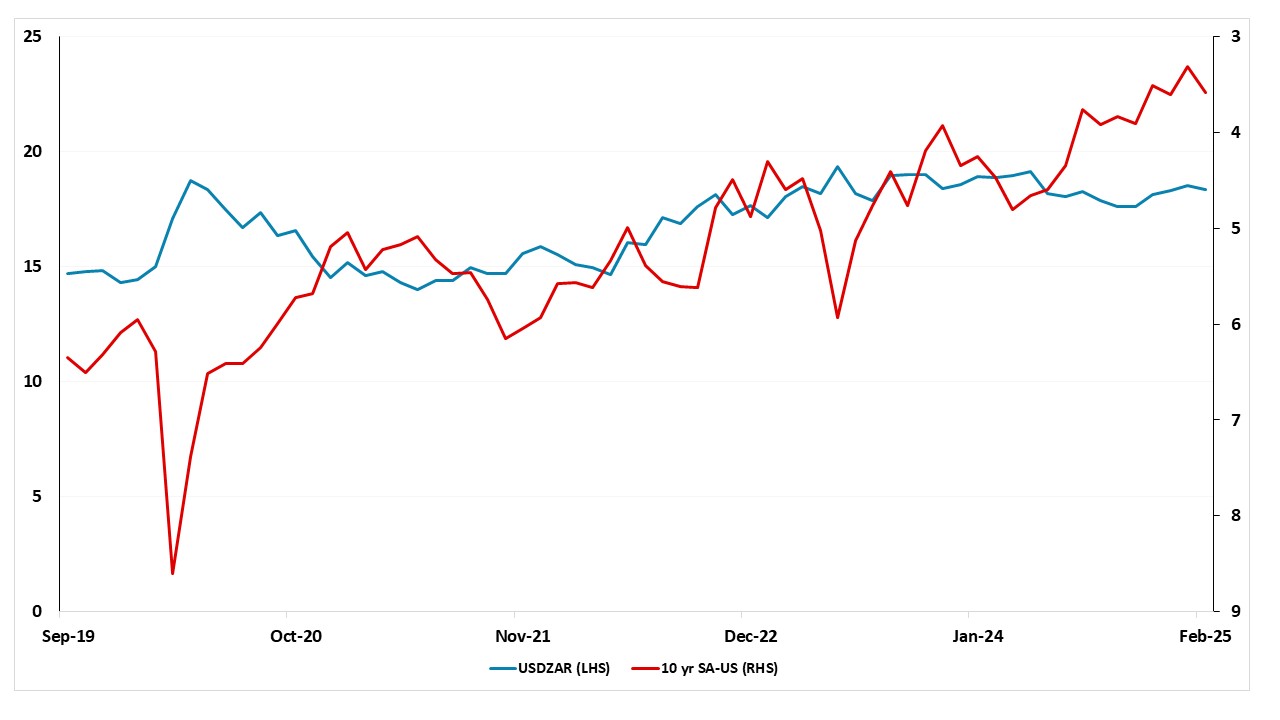

Turning to South Africa, we think SARB will continue its cutting cycle in Q2 and Q3 if domestic inflation continues hovering around SARB target as inflation differentials remain modest against the U.S. We expect the South African economy will continue to be supported by a trade surplus coupled with higher FDI and equity flows thanks to increasing investor appetite. Despite DM easing cycles continuing, we think SARB will have to be cautious due to global uncertainties like slowing China demand and tariff wars, which could slow SARB policy easing. Any tariff hikes by the U.S. over South Africa-origin products could hit South Africa’s exports, igniting ZAR to lose value. On the upside, if Trump relents on tariffs and a peace deal in Ukraine is reached more quickly, we are likely to see a more risk positive picture emerging for ZAR. Our end year USD/ZAR rate prediction is 18.15 for 2025, and 18.2 for 2026.

Figure 3: USD/ZAR Rate and 10yr South Africa-U.S. Government Bond Yield (%)

Source: DataStream/Continuum Economics