Mexico CPI Preview: Christmas Acceleration

Mexico's December CPI is forecasted to grow by 0.5% in December, bringing 2024 inflation to 4.3%, above Banxico's target. Core CPI aligns better at 3.5%. Weak demand aids inflation convergence, expected by Q3 2026. Risks include a 22% MXN depreciation and U.S. tariffs. Banxico is likely to continue rate cuts cautiously, targeting 8.0% in 2025 amid downside risks.

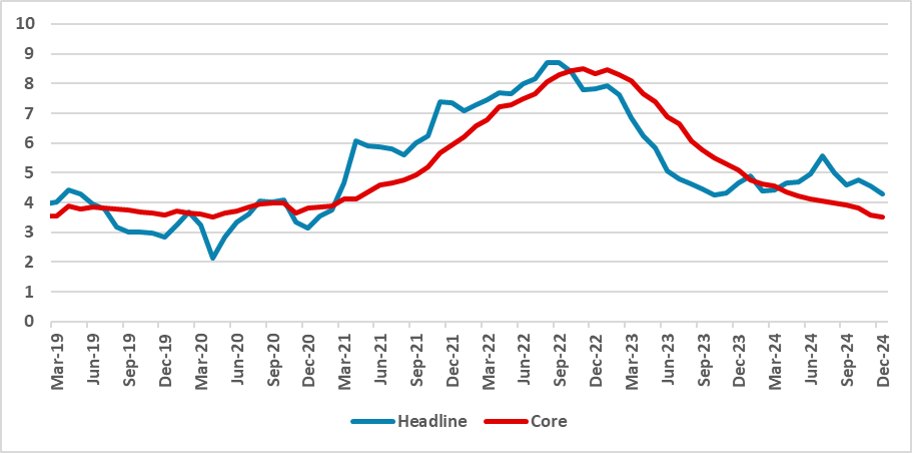

Figure 1: Mexico’s CPI (Y/Y)

Source: INEGI and Continuum Economics

Mexico’s National Statistics Institute will release the CPI data for December on Jan. 9. We are forecasting the CPI to have grown by 0.5% in December, meaning the CPI will have grown 4.3% in 2024, above Banxico's target (3.0%) and Banxico's target band (2.0%-4.0%), but with a clear downward trend observed in recent months. Core CPI will likely finish 2024 at 3.5%, which is more aligned with Banxico's target and consistent with inflation convergence.

One important feature for December is that the non-core item will likely show stable behavior, with both the energy and food items growing below 0.4%. The primary contributors to December CPI’s growth will likely be core goods and core services, both affected by the stronger seasonal demand typically seen in December.

Overall, we see inflation numbers as consistent with the deceleration of the Mexican economy. With the economy finally cooling, demand pressures are easing, meaning supply factors are likely to dominate in this final phase of inflation convergence. According to the latest inflation report, Banxico is expecting inflation to converge in the third quarter of 2026, finally reaching 3.0%. With demand continuing to weaken in 2025, it is possible that convergence may occur earlier. Until then, monetary policy will need to remain in restrictive territory.

One point of concern is the current level of the MXN in relation to the U.S. dollar. The Mexican currency ended 2024 at 20.4, marking a 22% depreciation during the year. Mexican authorities are confident that the pass-through to inflation will remain limited, especially now that demand is weak. However, this is a point to monitor in the coming months as Trump begins imposing his first measures, particularly in terms of tariffs.

From now on, we continue to see Banxico cutting the policy rate. We advocate for some caution, but it is clear that some members wish to increase the pace of cuts from the current 25bps. We continue to foresee the policy rate finishing 2025 at 8.0%, though the risks are now more clearly tilted to the downside.