Mexico CPI Preview: Stabilization on August

Mexico’s August CPI is expected to remain flat at 0%, with year-on-year inflation dropping to 5.0% from 5.5% in July, driven by a contraction in non-core CPI. Core CPI is projected to rise by 0.2%, bringing its year-on-year figure to 3.9%. This trend may give Banxico more confidence to resume interest rate cuts. With the economy slowing, inflation is expected to decline further, particularly in core CPI, which could reach 3.7% by year-end.

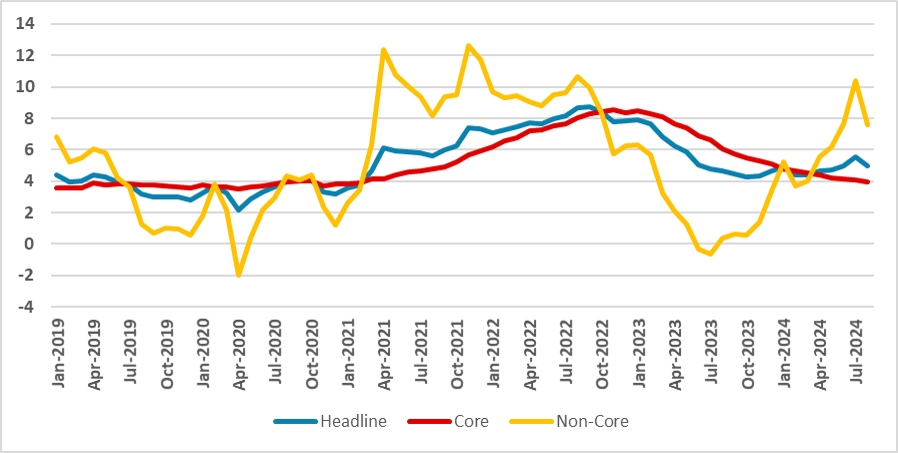

Figure 1: Mexico’s CPI (Y/Y, %)

Source: INEGI and Continuum Economcis

The Mexican National Statistics Institute will release the CPI data for August on Sep. 8. We are forecasting the CPI to have remained stable during August, growing 0%. Therefore, we expect the year-on-year CPI to fall to 5.0% in August from the 5.5% registered in July.

The biggest driver of the August CPI will be the contraction of the non-core CPI, which was mainly responsible for the recent surge. The bi-monthly index shows that the agricultural non-core CPI dropped by 1.5% during the first 15 days of August, indicating a reversal of the rise seen in July. Regarding the core CPI, we expect this index to continue to fall slowly toward the target. We believe core CPI grew by 0.2% in August, and its year-on-year index will likely fall to 3.9% from 4.0% in July.

In terms of monetary policy, this CPI trend will likely give Banxico members more confidence to fully support the resumption of the cutting cycle. In their last decision (here), there were still some dissenters who wanted to maintain the pause due to the risks from the recent surge in non-core CPI and the recent devaluation of the MXN. We argue that, according to Banxico's technical team, the impacts of the devaluation will be limited (here), and with the recent reversal of the non-core CPI surge, the argument for a pause will likely disappear.

The Mexican economy is clearly decelerating, with job creation slowing and investment and consumption figures weakening. This will likely contribute to lower inflation in the next quarter, especially in core CPI, which we believe will end 2024 at 3.7% year-on-year. While this is not fully aligned with the target, it shows a clear path toward convergence. It remains to be seen whether inflation expectations will move in the same direction.