View:

March 05, 2026

Preview: Due March 12 - U.S. January Trade Balance - May be stabilizing close to pre-tariff levels

March 5, 2026 3:25 PM UTC

We expect a January trade deficit of $69.0bn, which would be only a marginal correction from December’s $70.3bn which was the widest since July, though still well below the record $136.0bn deficit seen in March of 2025 shortly before the tariff announcement.

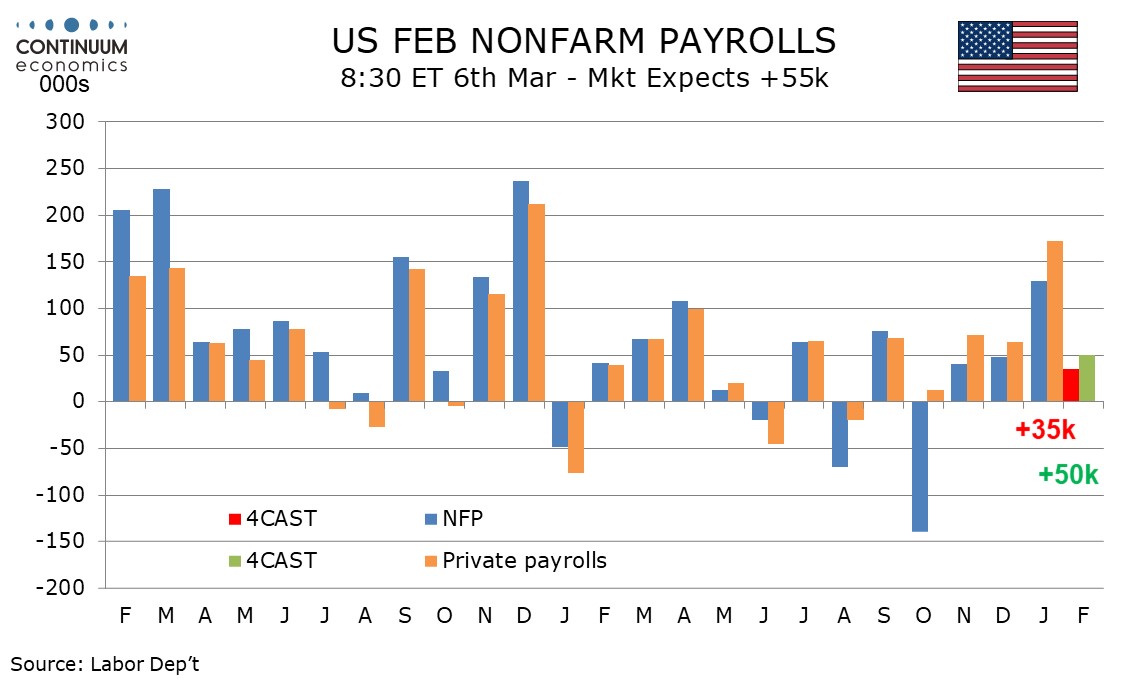

Preview: Due March 6 - U.S. February Employment (Non-Farm Payrolls) - Not as strong as January, but still marginally positive

March 5, 2026 2:26 PM UTC

We expect February’s non-farm payroll to rise by 35k overall and by 50k in the private sector, both four month lows and significantly slower than January’s above trend respective gains of 130k and 172k. We expect unemployment to edge up to 4.4% from 4.3%, reversing a January dip, and average hou

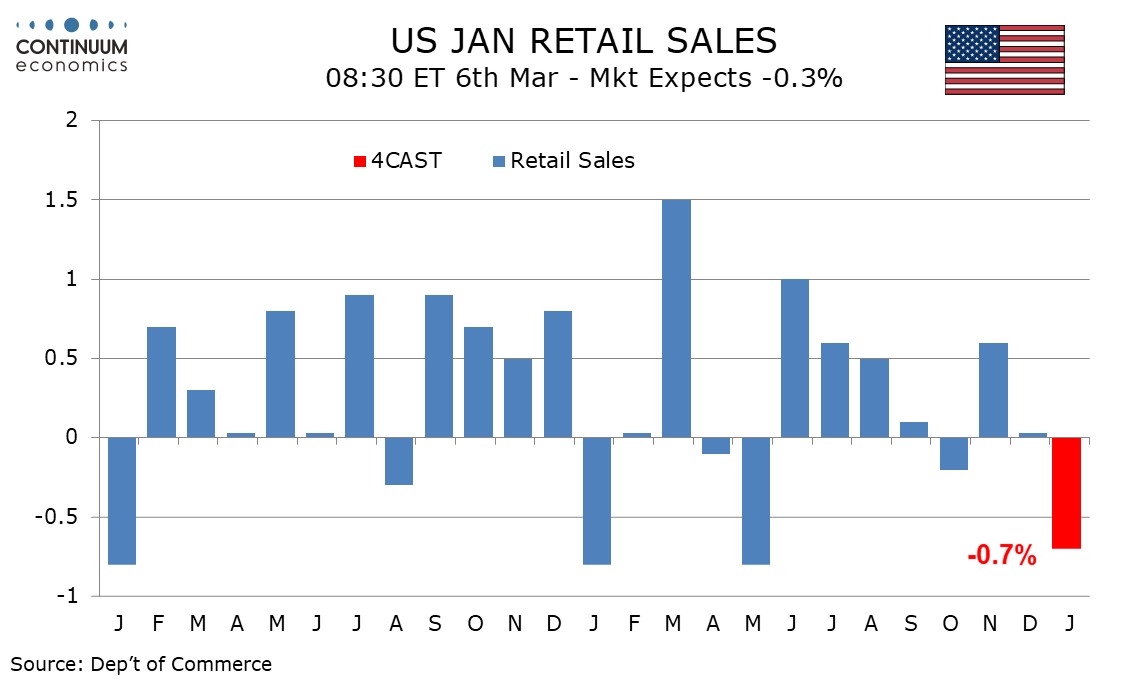

Preview: Due March 6 - U.S. January Retail Sales - Weather adding to downside risk

March 5, 2026 2:17 PM UTC

We expect retail sales to see a weak month in January, falling by 0.7% overall, with declines of 0.4% ex auto and 0.2% ex auto and gasoline. Bad weather late in the month will contribute to the decline.

U.S. Initial Claims remain low, Some inflationary risk visible in Q4 Productivity and Costs report

March 5, 2026 1:54 PM UTC

Initial claims are unchanged at 213k, a recent bout of bad weather having no significant impact, contrasting late January when a spell of bad weather did coincide with a rise in initial claims. Q4 productivity data is solid but this is not eliminating inflationary pressures.

China: 4.5-5.0% GDP Growth for 2026

March 5, 2026 9:16 AM UTC

• China announced a central government budget deficit at 4% of GDP, which is the same as last year and points to only modest fiscal stimulus. Though investment was supported, consumption trade in programs were cut from Y300bln to Yuan250 and no new structural safety net for households hav