Mexico’s Plan: An Eye on Nearshoring and Displacing China in U.S.

President Claudia Sheinbaum’s “Mexico Plan” targets USD 270 billion in investments, aiming to reduce poverty, boost sustainability, and expand Mexico’s economy. Key goals include nearshoring, increasing domestic production, and fostering U.S. trade relations. However, private investment stagnation, uncertainties about U.S.–Mexico ties, and reliance on foreign companies may delay immediate impact despite its long-term growth potential.

President Claudia Sheinbaum has presented the “Mexico Plan,” a plan developed around 13 goals that seeks to further develop Mexico through directed investments, which could amount to up to USD 270 billion. Most of these investments are related to companies aiming to produce in Mexico. Most of the Plan’s goals are generic, such as reducing poverty and increasing sustainability. However, others are more specific: Mexico wants to enter the top-10 largest economies in the world, produce internally around 60% of its domestic consumption, raise the investment/GDP ratio to 25%, and provide financing to around 30% of Mexican SMEs.

Although all the specific targets are yet to be presented, the Mexican government has committed to arranging a multigovernmental desk to oversee the projects, and new regulations will be presented to Congress in order to simplify the entry of foreign companies into Mexico. Moreover, a program called “Made in Mexico” is set to be launched in March.

In her speech, Finance Minister Rogelio de la O highlighted the increase in Chinese exports to North America, advocating that expanding Mexico’s participation in North American trade could add up to 1.2% to GDP growth.

Mexico’s Plan places the issue of nearshoring at center stage, but much of this program will depend on U.S. willingness to increase its imports from Mexico and Mexico’s capacity to replace Chinese and other Asian imports. This also shows that Claudia Sheinbaum’s government wishes to maintain a good relationship with Trump’s Administration. However, it seems much of this investment will rely on foreign companies coming to Mexico to produce and then export to the U.S. There are still many uncertainties surrounding the Trump Administration and the rule of law within Mexico. We believe much of this investment will be on hold in the coming months as investors seek to clarify how the Trump Administration’s relations will play out.

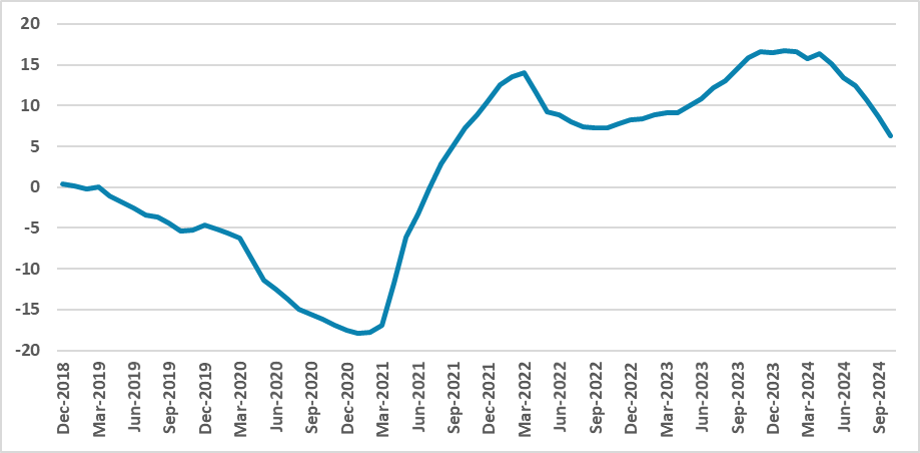

Figure 1: Mexico’s Investment Index (12-months sum annual variation, %)

Source: INEGI

Recently, investment in Mexico has been stagnating, especially private investments. The investment index has been decelerating, indicating that measures are needed to support investment growth. We continue to see that this Plan will have little impact, especially during this year. Investors are keen to understand how U.S.–Mexico relations will evolve, which will limit investment prospects this year. However, we see it as a positive indication that Mexico seeks good relations with the U.S., which will be key to Mexico’s growth in the coming years.