Mexico CPI Review: Moving as Expected

Mexico’s March CPI rose 0.31%, matching expectations but below the historical average. Annual inflation edged up to 3.80%, driven by core components like food and services. Non-core inflation fell due to lower energy prices. Food saw strong gains, while transport costs declined. The narrowing gap between services and goods inflation supports a favorable inflation outlook. With CPI aligning with Banxico’s forecast, a 50 bps rate cut is likely. Disinflationary pressures may persist, reinforcing the case for moving rates to neutral in 2025.

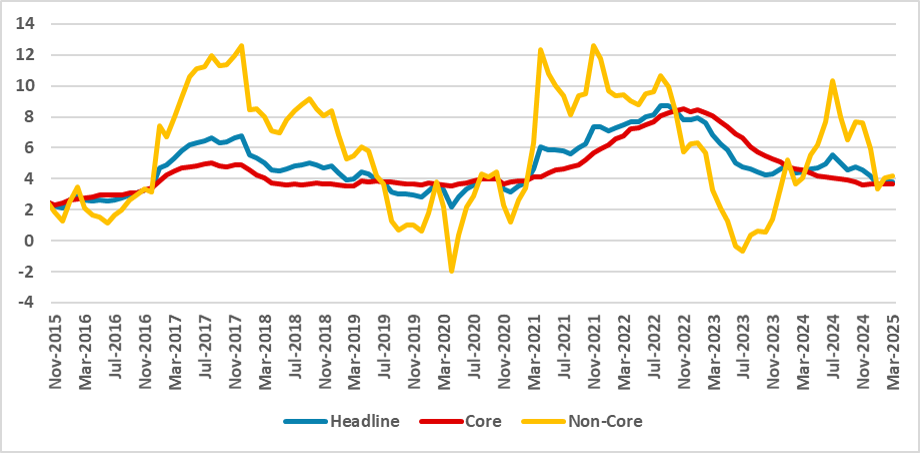

Figure 1: Mexico’s CPI (%, Y/Y)

Source: INEGI

Mexico’s National Statistics Institute (INEGI) has released the CPI data for March. The figures show that Mexico’s CPI grew by 0.31%, in line with market expectations, according to the Bloomberg Survey. The number came in below the historical average for March (0.41%). Year-over-year (Y/Y) CPI increased slightly to 3.80% from 3.77% in February. The increase was concentrated in the core group, which grew 0.44% in the month, while the non-core group contracted by 0.1%.

Looking at specific groups, the biggest rise occurred in the food and beverages category, which grew 0.6% month-over-month (m/m) after two months of contraction. The rise in food was driven by increases in lemons (+20.7%), tomatoes (+17.7%), and avocados (+7.2%). Y/Y Food CPI stands at 4.2%, above the general CPI. Other services grew 0.5% and represent the highest Y/Y growth, reaching 7.4%, showing some persistence in not trending downward in recent months. On the downside, Transportation CPI dropped 0.3% in the month as a result of lower oil prices in the domestic market. This group registered only 2.3% annual growth.

The gap between Services and Goods CPI continued to narrow. Services posted a 4.3% annual growth in March, down from 4.6% in February. Goods CPI rose slightly to 3.0% Y/Y, up from 2.7% in February. The biggest drop in the non-core category was due to lower energy prices, stemming from both electricity tariffs and fuel. Energy CPI dropped 0.5%, while agricultural goods rose 0.4%.

The outlook for inflation in Mexico remains favorable. March CPI was in line with Banxico's scenario and will likely support another 50 bps cut at the next Banxico meeting. So far, the weakening of economic activity and tighter monetary conditions—stemming from the still-contractionary monetary policy—have persisted. The effect of possible tariffs and the uncertainty they are generating is still unclear; they could be inflationary due to a more depreciated exchange rate, or disinflationary due to reduced economic activity. For now, we tend to believe that if the impact is not neutral, it is likely to be disinflationary in the short term, which supports our view of Banxico moving rates toward neutral in 2025.