EM Currencies with a USD Downtrend

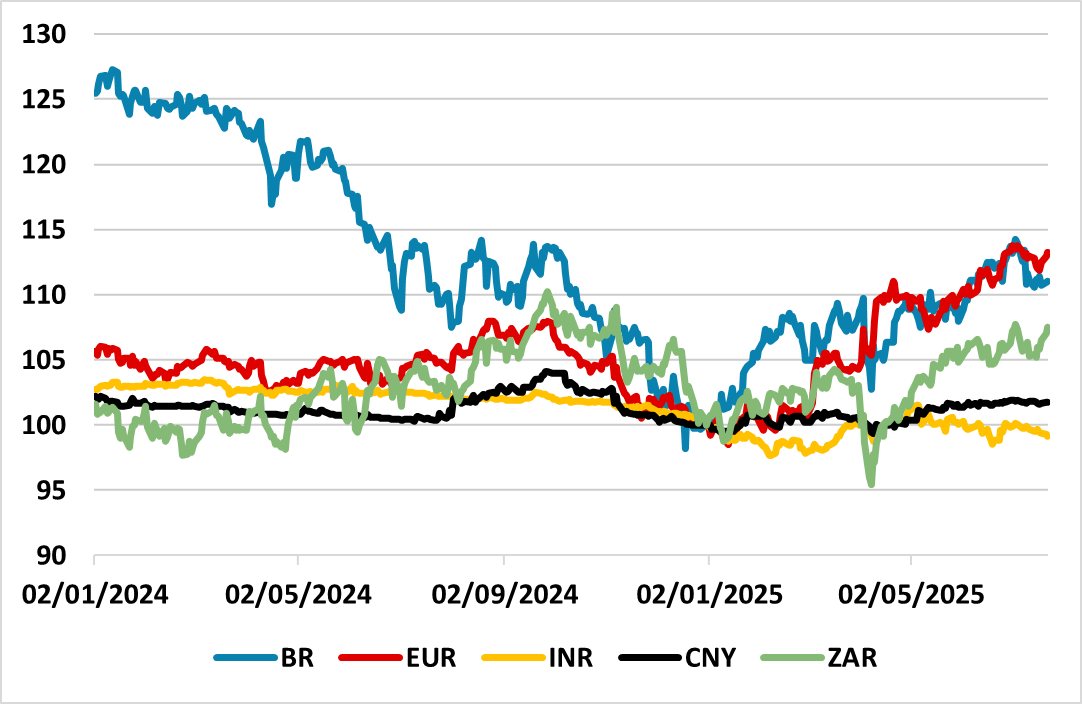

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by Q4, CNY will not likely benefit much due to long-term net outflows. Finally, we think INR will remain choppy versus the USD with mixed forces on the INR.

Figure 1: Selected Currency Performances Versus USD (31/12/24 = 100)

Source: Datastream/Continuum Economics.

The USD decline against DM currencies 2025 has selectively spread into EM currencies, but divergence exists. We would make a number of points for major EM currencies.

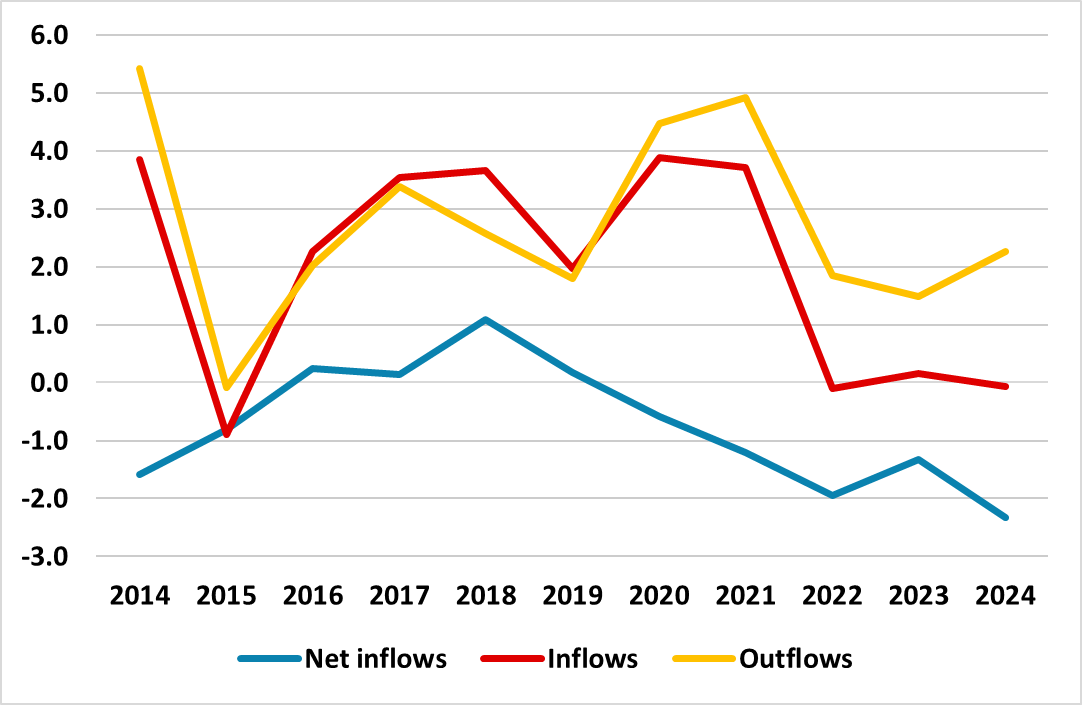

· Chinese Yuan (CNY) and net outflows. Though the CNY is up marginally against the USD YTD, net outflows are strategically against the CNY. The latest IMF External Sector Report (ESR) which is just out (here) shows that net outflows were -2.3% of GDP in 2024, as both new inflows grinding to a halt and outflows accelerating. Global equity investors are wary about prospective returns, due to low nominal GDP/slowing earnings growth; a less business friendly outlook than 1990-2019 and Chinese companies issuing too many new shares that dilutes earnings per share. Global fixed income investors are put off by low nominal yields across the curve, especially where JGB yields are now higher from the 20yr maturity. Global FDI flows are being restrained by concerns over a U.S./China trade war, abrupt shifts in long-standing geopolitical relationships and concerns over the ability to extract profits from China in good and bad times – however we attach only a 5% probability to a full scale China invasion of Taiwan in the next 18 months (here). We eventually see the U.S./China agreeing a trade deal (most likely in Q4) (here), which should help sentiment but we suspect that will not produce a lasting bounce due to the structural net outflows above, and we see 7.25 on USD/CNY by end 2025.

Figure 2: Net Inflows Into China (% of GDP)

Source: IMF ESR 2025/Continuum Economics.

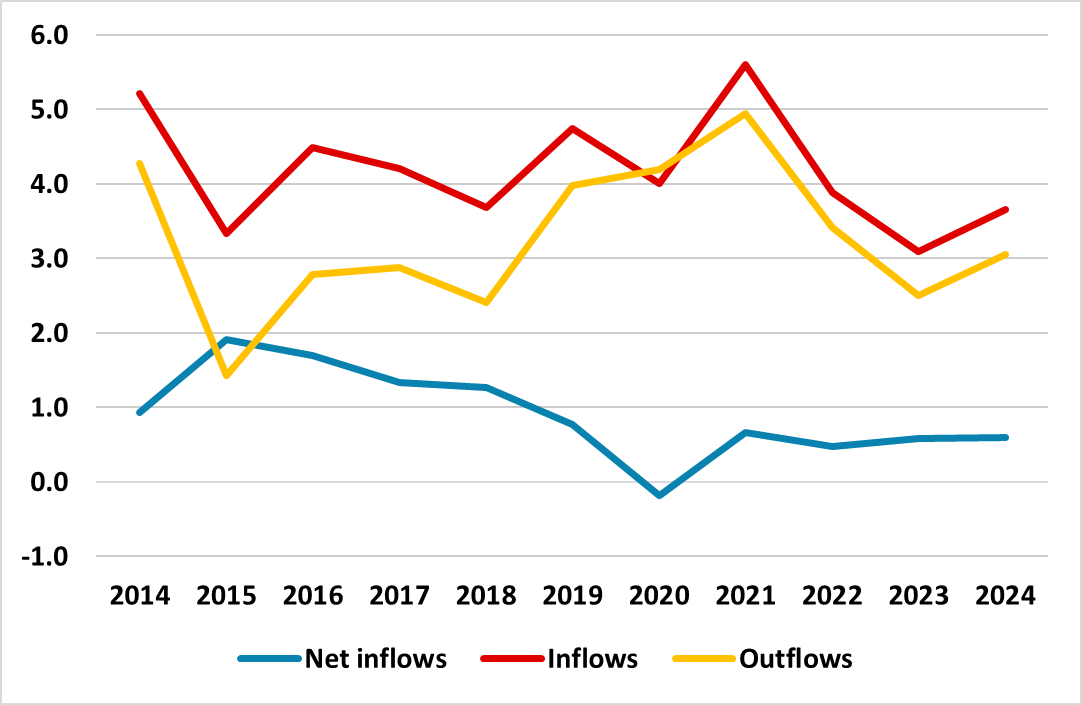

Figure 3: Net Inflows into EM ex China (% of GDP)

Source: IMF ESR 2025/Continuum Economics

· Mexico/Brazil/South Africa benefit from carry and bond yield pick-up. The best performing major EM currencies have been the Mexican Peso (MXN); Brazilian Real (BRL) and South African Rand (ZAR). At the short-end money market spreads are wide enough to encourage FX carry trades. Bond yields are also falling to produce capital gains, but spread remain wide enough against the U.S. The 2025 IMF ESR report (Figure 3) highlights that the net inflows into EM ex China in 2025 have largely been money and fixed income. Though Banxico is moving quicker than the Fed, we do not see the policy rate differential falling significantly below 4% that has prompted MXN weakness in the past (here). Elsewhere, South African Reserve Bank (SARB) is cautious (here) and BRB is signalling a prolonged pause at ultra-high interest rates (here), while we look for the Fed to start a 100bps cutting cycle from Q4 2025. The problem is that President Donald Trump feels that Brazil and South Africa are too left wing and they are at high risk from some of the threatened 50% and 30% reciprocal tariffs actually being introduced. Though Trump has a good relationship with Mexico’s President Sheinbaum, Trump wants a better USMCA deal and he will likely disrupt U.S./Mexico trade further. BRL and ZAR and to a degree MXN are at risk of a corrective pullback on actual tariff news, before some carry/bond trades return in Q4. Our end 2025 USD/BRL and USD/ZAR forecasts are 5.40 and 18.10, while we have revised our USD/MXN forecast to 18.90 instead of 19.10, as the fiscal fundamentals are better than Brazil or South Africa.

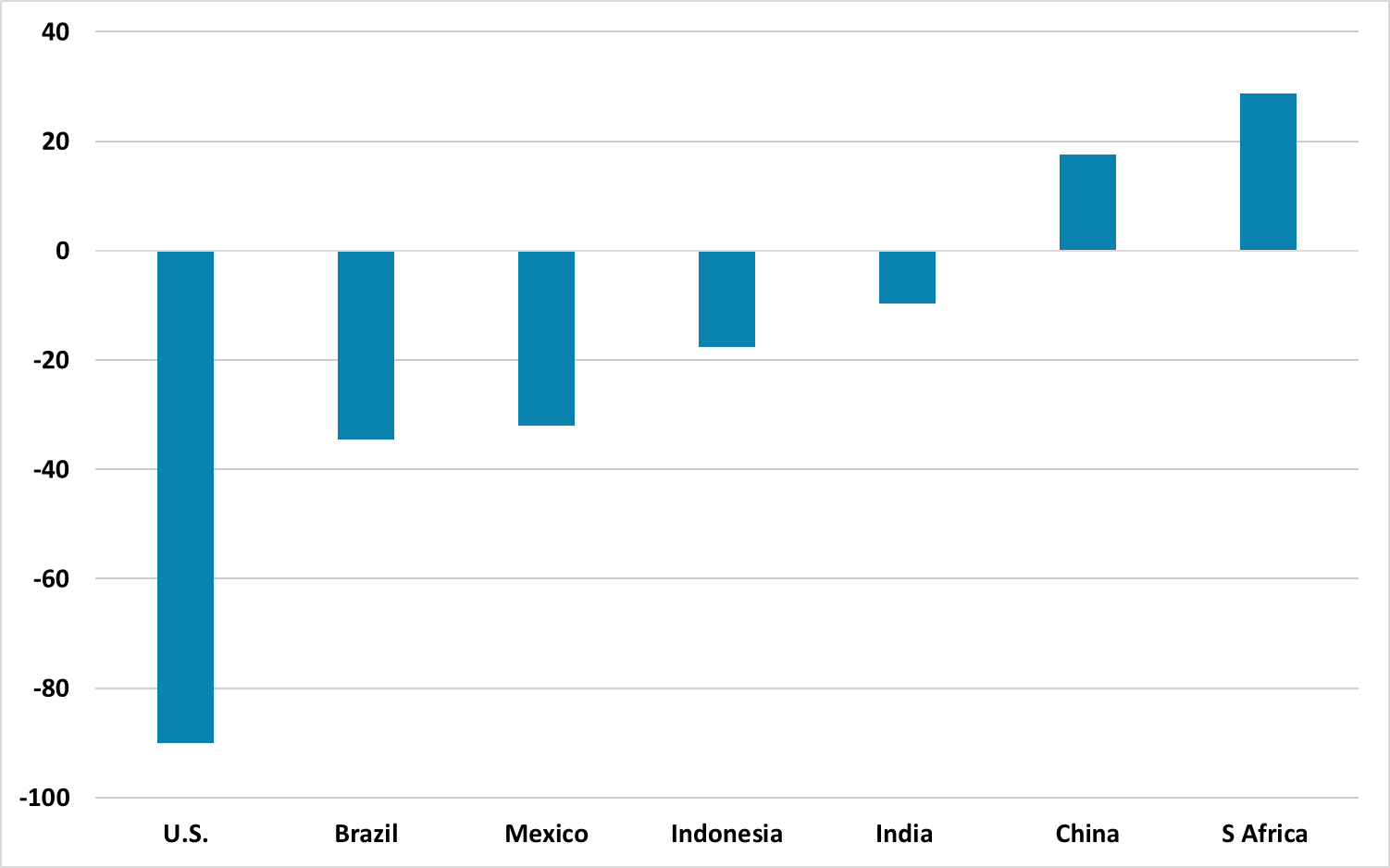

Figure 4: Net International Investment Position/GDP (%)

Source: IMF ESR 2025/Continuum Economics

· India and Indonesia. India is trying to navigate Trump trade demand to get a reasonable trade deal, and avoid being drawn into U.S. desires for India to play a greater defense role in Asia. A deal will eventually get done, but is unlikely to significantly move the Indian Rupee (INR). Though inflation is currently U.S. like, this is temporary and medium-term inflation will likely remain about 2% above the U.S. and this is important for the RBI/market and currency determination. India would also prefer to use the negative view on the USD and FDI inflows to cut interest rates to help the economy (here). The RBI has signaled an additional rate cut of 25bps in 2025. This all produce mixed currents and we still forecast 86.70 on USD/INR by end 2025 (here). It is worth mentioning that India net international investment position (NIIP) is a small deficit (Figure 4), where India growth phase could normally argue for a higher C/A deficit and NIIP deficit – note the U.S. is now at 90%! Finally, though Indonesia Rupiah (IDR) swings with risk and USD sentiment, we do feel that the USD downtrend has not helped enough yet. With reasonable GDP/inflation/rates and NIIP, plus an ok trade deal at 19% with the U.S. (here), we still see scope for the Indonesian Rupiah (IDR) to appreciate to 16,275 by end 2025.