Mexico CPI Review: Food Prices Lead the 1% Rise

Mexico's CPI rose by 1.0% in July, pushing the year-over-year rate to 5.6%, the highest since November 2021. The increase was driven by a 1.9% rise in food and beverages due to drought and exchange rate impacts. Non-core inflation surged by 3.3%, widening the gap with core inflation. Given these risks and recent Peso devaluation, Banxico is expected to hold rates and delay further cuts, with CPI forecasted to end 2024 at 5.2%.

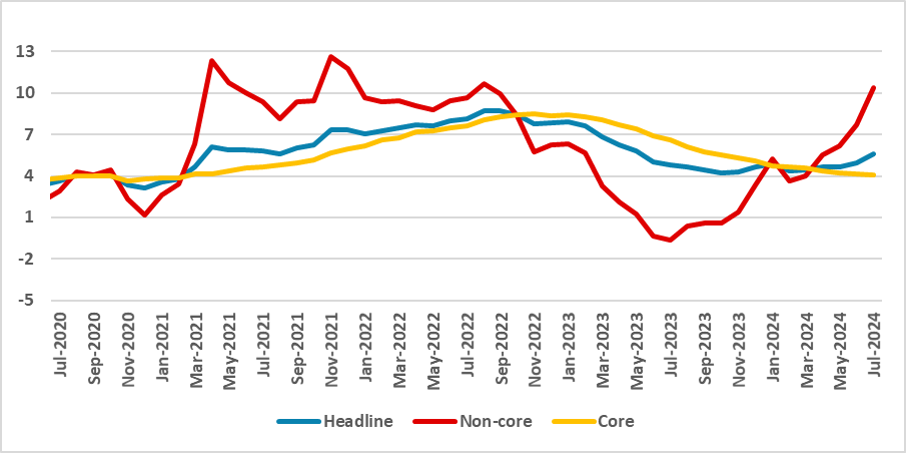

Figure 1: Mexico’s CPI (%, Y/Y)

Source: INEGI

The Mexico National Statistics Institute has released the CPI data for July. The data shows that Mexico's CPI rose by 1.0% in July, aligned with market expectations according to the Bloomberg Survey. This was the biggest rise since November 2021. Consequently, the year-over-year CPI rose to 5.6% from 5.0% in June, marking six consecutive months of increase.

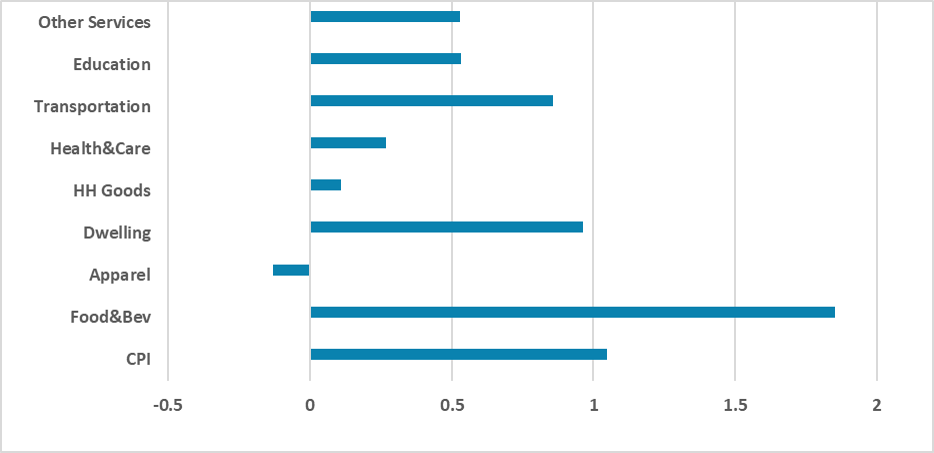

Figure 2: Mexico’s July CPI (%, m/m)

Source: INEGI

The primary driver of this rise is the increase in the food and beverage group, which rose by 1.9% during the month, placing a burden on Mexican households. Agricultural output is suffering from adverse climate conditions, with a strong drought affecting the production of fruits and vegetables. Moreover, some Mexican foods, such as poultry, apples, and grapes, are imported from the U.S., and their prices are impacted by the devaluation of the exchange rate. Transportation also saw a significant increase, with a 0.9% rise in the month, driven especially by higher fuel prices.

Examining the core and non-core groups, the gap between the two continues to widen. While core CPI grew by only about 0.3% in the month, which is roughly aligned with inflation convergence, the non-core group rose by 3.3%, with agricultural goods rising by 5.0% and energy rising by 3.8%. In light of these new numbers and the shock in the food and beverages CPI, we expect the CPI to remain elevated. The rise in food and beverage prices is likely to reverse only in the final months of the year when the water situation is expected to normalize. We now forecast Mexico's CPI to end 2024 at 5.2% year-over-year.

Given these CPI risks, we believe Banxico will need to exercise more caution. The shock in the food group was clearly not anticipated 45 days ago, and although this information emerged on the same day as the meeting, it will definitely be taken into account by the board. Banxico will need to assess the effects of the food shock. Additionally, the recent devaluation of the Mexican Peso and market volatility present challenges for cutting rates at this time. We believe Banxico will now hold rates and delay the resumption of rate cuts.