Mexico: Tariffs and Growth Issues Could Impose Fiscal Difficulties

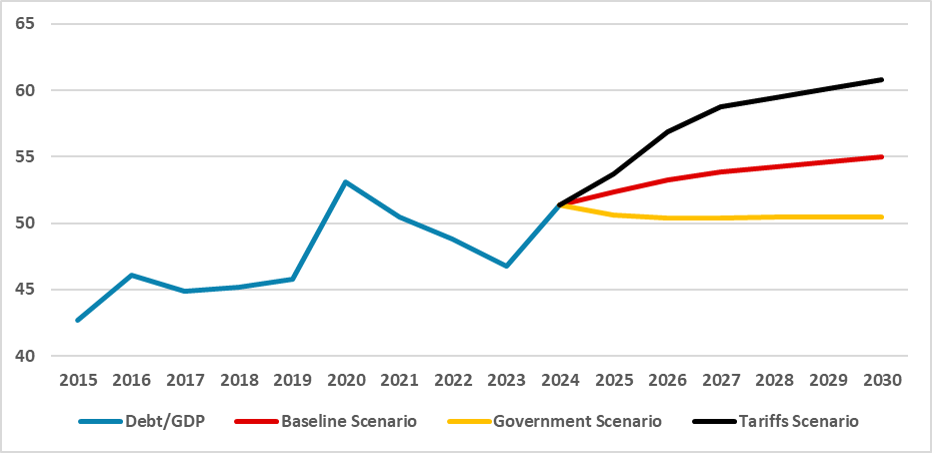

Mexico aims for fiscal consolidation in 2025, relying on revenue growth while freezing most expenditures. However, weak growth could undermine this strategy. Authorities expect 2–3% GDP growth, but our forecast is 1.6%, with a recession risk. A less integrated U.S.-Mexico trade relationship, particularly under a potential Trump presidency, poses additional threats. In a protectionist scenario, GDP could contract, delaying fiscal improvements and pushing debt-to-GDP to 60% by 2030. Our baseline scenario projects stabilization at 54%, above government estimates.

Mexico’s budget aims for a big consolidation this year after registering a 1.9% of GDP primary deficit and a fiscal deficit of 5.9% of GDP. The main source of the adjustment is revenue growth, fostered mainly by economic growth while maintaining most expenditures frozen, with some marginal cuts in certain areas. However, key to Mexico’s fiscal sustainability are the growth prospects. Mexican authorities believe Mexico will grow between 2% and 3%. Our forecast at the moment stands at 1.6%, but we cannot rule out any sort of recession this year, which, of course, would weigh on the main source of their fiscal consolidation—revenue growth. This could jeopardize the 0.6% primary surplus target.

Mexico’s plan (here) has as one of its primary sources of growth new investment aimed at increasing integration with the U.S. The thing is that Donald Trump’s administration is unpredictable, and there is a non-negligible probability that Trump will seek more protectionism rather than more integration within the scope of the USMCA. Around 40% of Mexico’s GDP depends on trade with the U.S. More than just tariffs, reshoring back to the U.S. rather than integrating in Mexico could severely damage Mexico’s value chains and, subsequently, growth. Moreover, we could see some structural factors affecting Mexico.

With less growth, the main source of Mexico’s fiscal adjustment will be jeopardized. This would cause the primary result to continue in negative territory, affecting the debt-to-GDP ratio from two sides: increasing debt to finance the higher deficit and diminishing the denominator.

We have run additional scenarios to incorporate a situation with less U.S. integration, stemming from protectionism and possible tariffs. In this scenario, we see Mexico growing only 0.5% in 2025, contracting by 0.5% in 2026, and then converging to a 1.5% growth rate. This means that primary result consolidation would be slower, with primary surpluses occurring only in 2028. In this scenario, debt-to-GDP would reach 60% by 2030, and some downgrades would likely be seen from rating agencies. Still, we see this scenario as unlikely. Our baseline scenario is for debt-to-GDP to stabilize around 54%, above the 50% projected by government officials.

Figure 1: Debt/GDP (%)

Source: Continuum Economics