Banxico Minutes: Evaluating Further Cuts

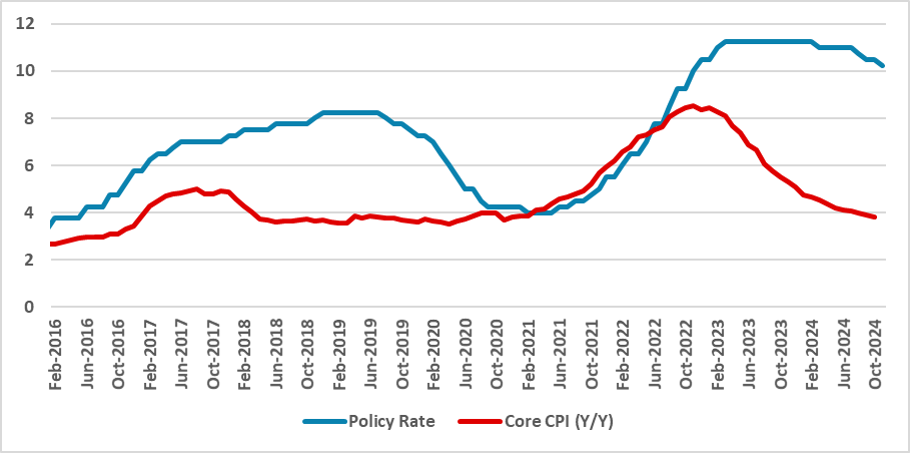

Banxico’s latest minutes reveal a 25 bps rate cut to 10.25%, with most board members supporting continued easing. They view recent non-core inflation spikes as transitory, expecting headline CPI to decline as shocks dissipate. Core CPI has dropped to 3.8%, reinforcing the case for further cuts, while inflation expectations and services inflation remain concerns. Banxico aims to maintain a contractionary stance, citing fiscal policy’s role in inflation control. Cautious cuts are expected, ending 2024 at 10.0% and 2025 at 8.5%.

Figure 1: Mexico’s Policy Rate and Core CPI (Y/Y, %)

Source: Continuum Economics

The Central Bank of Mexico (Banxico) has released the minutes of its last meeting (here), during which it opted to cut the policy rate by 25 basis points (bps), from 10.5% to 10.25%. Overall, the minutes indicate that most board members are aligned on continuing the rate cuts. They view the recent spike in non-core inflation as transitory, with limited effects on core inflation. Additionally, they expect the impacts of the recent shock on non-core inflation to be temporary, indicating a downward trend for overall inflation.

Regarding foreign markets, Banxico highlighted the election of Trump and the associated volatility. They also discussed the possible effects of a higher Federal Funds rate. However, these factors are not expected to significantly alter Banxico's overall strategy, which remains data-dependent and short-term focused. Banxico noted that most countries have continued easing monetary policy. With a 10.25% policy rate, the gap between this rate and the Federal Funds and other developed market rates suggests there is still some room for further cuts without generating volatility.

The minutes also emphasize the drop in core CPI to 3.8%, despite an increase in the headline index. According to Banxico, core CPI is likely to continue slowing, which would support further rate cuts. They also believe that as the shocks dissipate, headline CPI will decline, allowing inflation to converge toward the target. Banxico agrees that disinflation is ongoing but notes that Mexico still requires a contractionary policy rate to ensure inflation convergence.

Some discussion focused on the labor market and services inflation, which remain elevated. Banxico appears to believe that the labor market and the broader economy are cooling, which will ease wage pressures and eventually reduce services inflation. Inflation expectations, which have not yet converged to the 3.0% target, are seen as another justification for maintaining a contractionary monetary stance.

Interestingly, one board member emphasized the importance of adhering to the government’s recently presented fiscal plan, underscoring the role of fiscal policy in ensuring inflation convergence. We believe that even if the Mexican government deviates slightly from the current fiscal plan, government expenditures will remain largely contractionary, avoiding additional inflationary pressures.

One member advocated for increasing the pace of rate cuts, but we believe this is a minority view within Banxico. We anticipate that Banxico will proceed cautiously and avoid moving quickly toward a neutral stance. We continue to expect 25 bps cuts, with the policy rate ending 2024 at 10.0% and 2025 at 8.5%.