View:

February 19, 2026

Preview: Due February 20 - U.S. November and December New Home Sales - Improvement in trend to continue

February 19, 2026 3:02 PM UTC

November and December new home sales data will be released on February 20. We expect moderate continuations of a recent improvement in trend, with November rising by 1.1% to 745k and December rising by 1.3% to 755k. This would be the highest level since February 2022.

Preview: Due February 20 - U.S. December Personal Income and Spending - Firmer prices matching income and spending

February 19, 2026 2:49 PM UTC

December’s personal income and spending report may be overshadowed by Q4 GDP data released at the same time, but is likely to see a strong core PCE price index increase of 0.4%, the highest since February. We expect personal income to rise by 0.3%, underperforming a 0.4% rise in spending, with bot

Preview: Due February 20 - U.S. February S and P PMIs - Manufacturing significantly stronger, Services marginally so

February 19, 2026 2:47 PM UTC

We expect improvement in February’s S and P PMIs, more significantly in manufacturing, to 53.5 from 52.4, with services seeing only a modest increase to 53.0 from 52.7.

February 18, 2026

Turkish Economy Will Likely Grow by Around 3.8% in 2025

February 18, 2026 3:13 PM UTC

Bottom Line: The Turkish Statistical Institute (TUIK) is scheduled to announce Q4 2024 and full-year GDP growth on March 2. We expect the Turkish economy expanded by approximately 3.8% y/y in 2025, underpinned by resilient household consumption, investment, and ongoing construction projects. Domesti

Preview: Due February 19 - U.S. December Trade Balance - Despite volatility, 2025 will average similar to 2024

February 18, 2026 2:46 PM UTC

We expect a December trade deficit of $59.5bn, which would be the widest since August and up moderately from November’s $56.8bn. It would be up sharply from October’s $29.2bn which was the lowest since June 2009 but heavily influenced by temporary factors. The data may bring some fine tuning to

February 17, 2026

Preview: Due February 18 - U.S. November and December Housing Starts and Permits - Moderately positive picture

February 17, 2026 3:10 PM UTC

Housing starts and permits data for both November and December are due on February 18. For starts we expect a rise of 8.3% in November to 1350k to follow a decline of 4.6% in October, with a more moderate 1.5% increase to 1370k in December. For permits we expect moderate gains of 0.6% in November, t

Preview: Due February 18 - U.S. December Durable Goods Orders - Aircraft to slip, but ex transport trend is positive

February 17, 2026 2:45 PM UTC

We expect December durable goods orders to fall by 5.0% after a 5.3% increase in November, the reversal led by aircraft after a strong November increase. Ex transport we expect a 0.4% increase, matching the gain in November.

February 16, 2026

Preview: Due February 17 - Canada January CPI - Little change from December but some underlying slowing

February 16, 2026 2:38 PM UTC

We expect January Canadian CPI to be unchanged at 2.4% yr/yr, with both December and January at 2.36% before rounding). We expect the Bank of Canada’s core rates to be on balance softer, with CPI-Trim and CPI-Common both slowing, but CPI-Median stabilizing after a sharper fall in December.

February 12, 2026

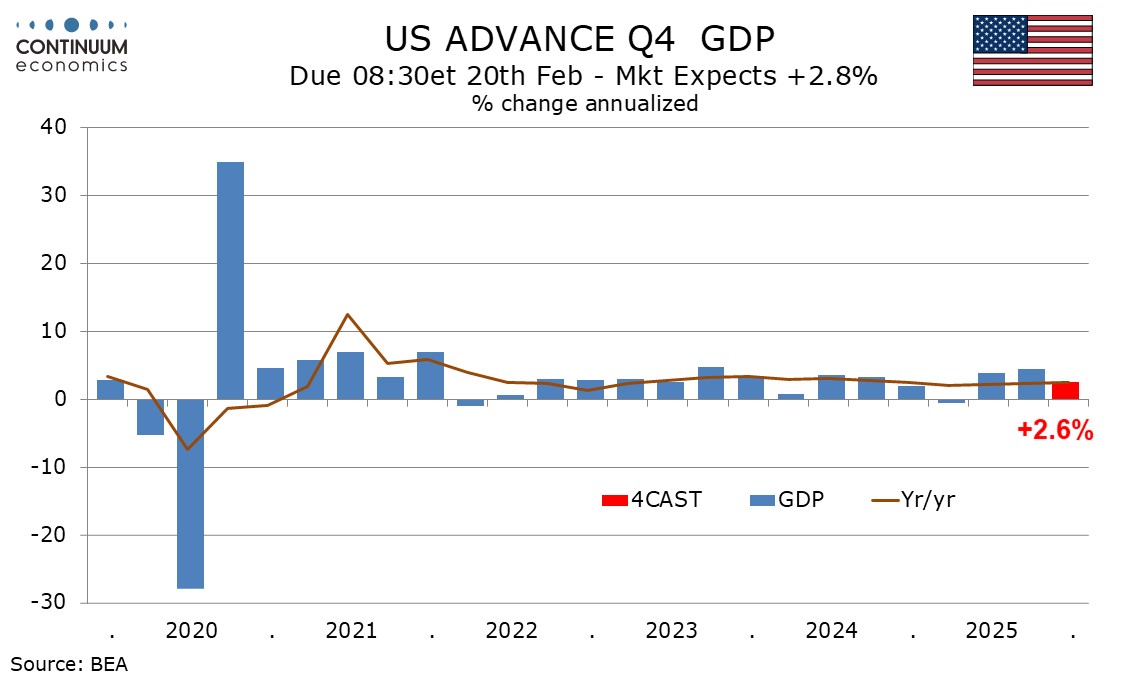

Preview: Due February 20 - U.S. Q4 GDP - GDP and Core PCE Prices both seen at 2.6%

February 12, 2026 4:48 PM UTC

We expect a 2.6% annualized increase in Q4 GDP, well above a flat forecast we had entering the quarter, but off a peak estimate of 3.6%, with weaker November trade and December retail sales data having trimmed the forecast. December trade data, due on February 19, remains a significant source of unc

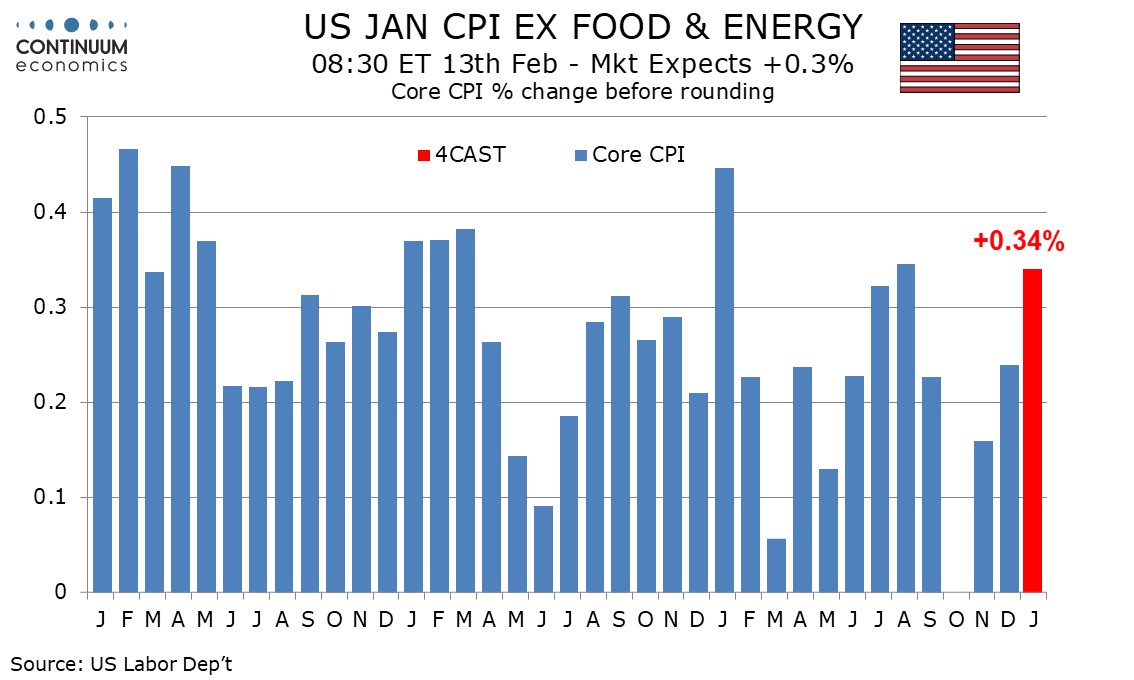

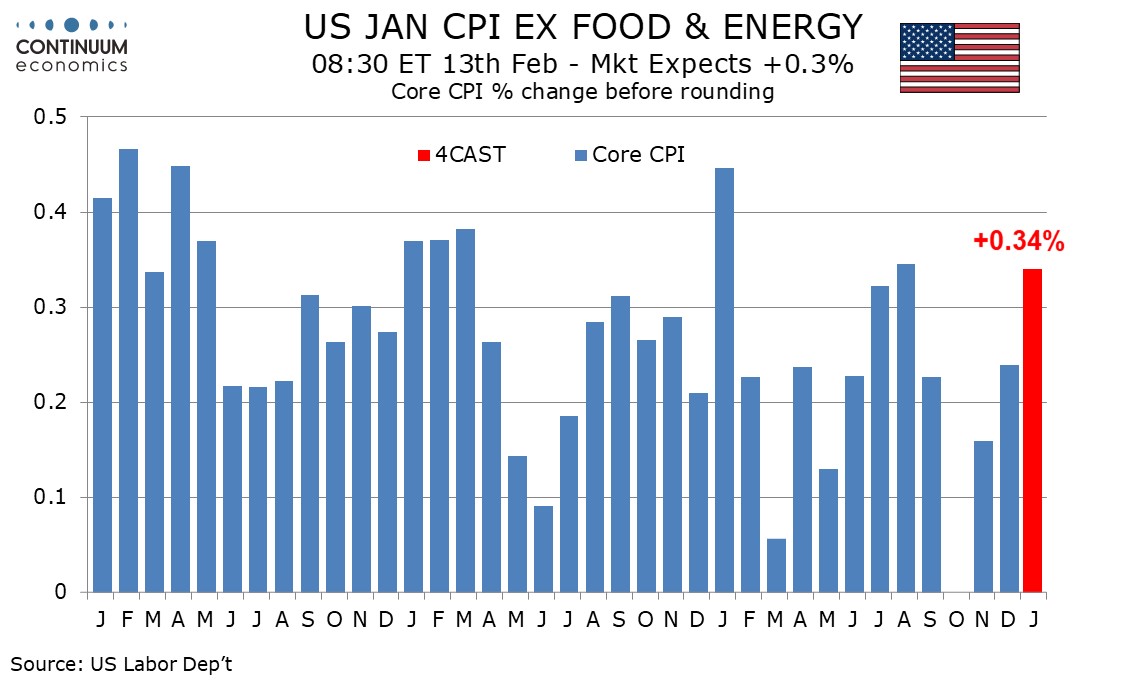

Preview: Due February 13 - U.S. January CPI - A stronger month but slower yr/yr

February 12, 2026 1:13 PM UTC

We expect a 0.2% increase in January’s CPI, with a 0.3% rise ex food and energy, though risks are to the upside with our forecasts before rounding being for gains of 0.24% overall and 0.34% ex food and energy. The latter would be the strongest since August.

February 11, 2026

Preview: Due February 12 - U.S. January Existing Home Sales - Reversing a strong December gain

February 11, 2026 3:35 PM UTC

We expect January existing home sales to fall by 5.3% to 4.12m, more than fully erasing a 5.1% December increase. Pending home sales are signaling a sharp decline and bad weather late in the month is a further downside risk.

February 10, 2026

Preview: Due February 19 - U.S. December Trade Balance - Despite volatility, 2025 will average similar to 2024

February 10, 2026 7:16 PM UTC

We expect a December trade deficit of $59.5bn, which would be the widest since August and up moderately from November’s $56.8bn. It would be up sharply from October’s $29.2bn which was the lowest since June 2009 but heavily influenced by temporary factors. The data may bring some fine tuning to

Preview: Due February 20 - U.S. December Personal Income and Spending - Firmer prices matching income and spending

February 10, 2026 4:02 PM UTC

December’s personal income and spending report may be overshadowed by Q4 GDP data released at the same time, but is likely to see a strong core PCE price index increase of 0.4%, the highest since February. We expect personal income to rise by 0.3%, underperforming a 0.4% rise in spending, with bot

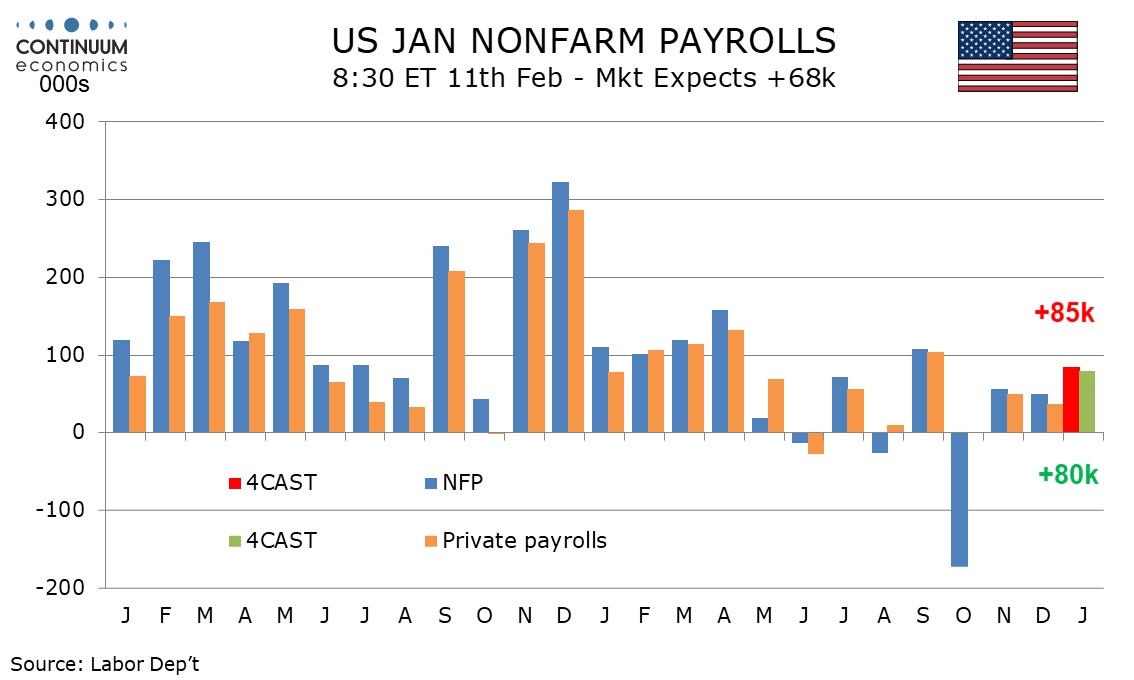

Preview: Due February 11 - U.S. January Employment (Non-Farm Payrolls) - Above trend but with higher unemployment

February 10, 2026 2:30 PM UTC

We expect January’s non-farm payroll to rise by 85k overall and by 80k in the private sector, which would be on the firm side of trend and could be even more so after what could be substantial negative historical revisions. However, we expect unemployment to rise to 4.5% from 4.4%. We expect avera

UK CPI Preview (Feb18): Fresh and Marked Fall to Resume as Core to Hit New Cycle-Low?

February 10, 2026 11:35 AM UTC

UK policy makers may not be able to say they have won the war against inflation, but a clear victory may be seen in the batter likely in the next few months with a likely return to the 2% target by April These projected falls are likely to commence with the looming January numbers (Figure 1) where a

February 09, 2026

Preview: Due February 20 - U.S. February S and P PMIs - Manufacturing significantly stronger, Services marginally so

February 9, 2026 6:32 PM UTC

We expect improvement in February’s S and P PMIs, more significantly in manufacturing, to 53.5 from 52.4, with services seeing only a modest increase to 53.0 from 52.7.

Preview: Due February 18 - U.S. December Durable Goods Orders - Aircraft to slip, but ex transport trend is positive

February 9, 2026 4:26 PM UTC

We expect December durable goods orders to fall by 5.0% after a 5.3% increase in November, the reversal led by aircraft after a strong November increase. Ex transport we expect a 0.4% increase, matching the gain in November.

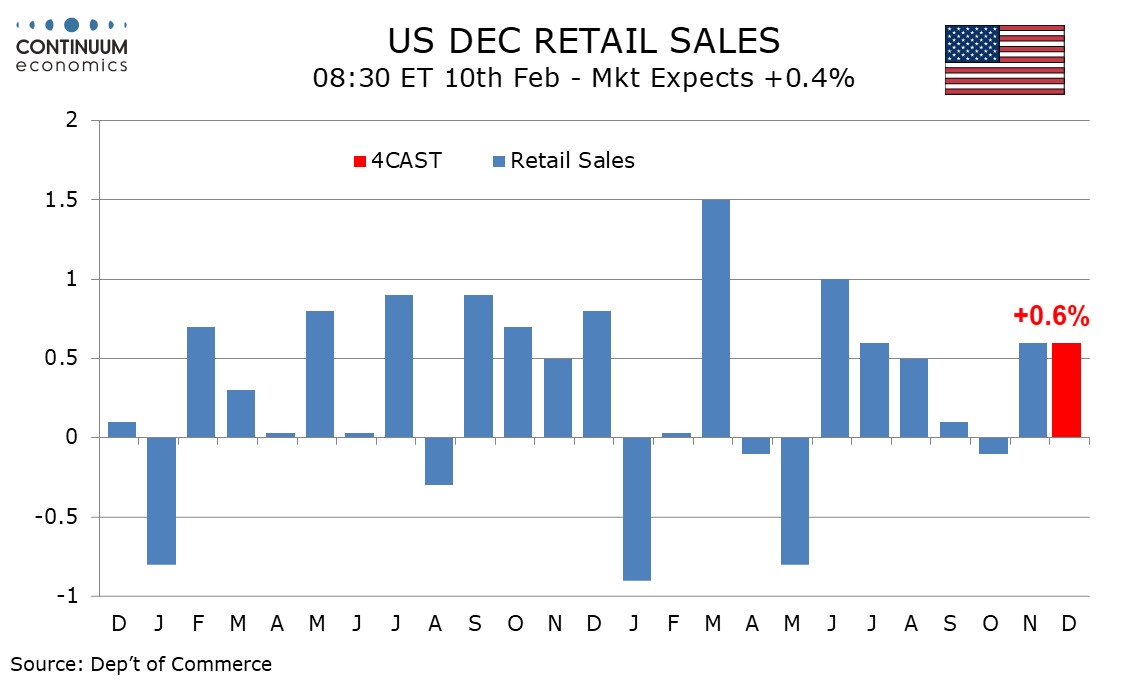

Preview: Due February 10 - U.S. December Retail Sales - Maintaining momentum

February 9, 2026 2:18 PM UTC

We expect retail sales to maintain momentum in December, rising by 0.6% overall and by 0.5% ex auto, both matching their November increases. Ex autos and gasoline we expect a 0.5% increase, a modest pick-up from two straight gains of 0.4%.

February 05, 2026

Preview: Due February 27 - Canada Q4/December GDP - A modest correction from a surprisingly strong Q3

February 5, 2026 5:22 PM UTC

We expect Q4 Canadian GDP to decline by 0.3% annualized, marginally softer than an unchanged estimate made by the Bank of Canada with January’s Monetary Policy report. This would be consistent with December GDP rising by 0.1% as projected with November’s data.

Preview: Due February 6 - Canada January Employment - A second straight subdued month after three strong ones

February 5, 2026 2:05 PM UTC

We expect Canadian employment to increase by 15k in January, a second straight moderate increase following December’s 8.2k that followed three straight strong gains averaging close to 60k. We expect unemployment to remain at December’s rate of 6.8%, but to fall before rounding.

UK GDP Preview (Feb 12): Underlying Economy Fragility Continues?

February 5, 2026 11:21 AM UTC

Even given the surprisingly solid November GDP release, this merely returns the level of GDP to where it was in June, albeit briefly as for the latter. Partly undermined by wet and warm weather through the month, we see no change on the December figure, in m/m terms (Figure 1), thus no reversal of

CBR will Likely Keep the Key Rate Stable on February 13

February 5, 2026 9:07 AM UTC

Bottom Line: Following the Central Bank of Russia’s (CBR) 50 bps cut to 16% on December 19—driven by an accelerated disinflationary trend in Q4—we expect the CBR to hold the policy rate at 16% on February 13. This cautious stance is anticipated as the Bank monitors inflationary risks, includin

February 04, 2026

Preview: Due February 27 - U.S. January PPI - Slower than a strong December, but trend still quite firm

February 4, 2026 7:03 PM UTC

We expect PPI to rise by a slower 0.2% in January both overall and ex food and energy, after strong respective gains of 0.5% and 0.7% in December. The slowing will be largely in trade, though ex food, energy and trade we expect a rise of 0.3%, slightly slower than December’s 0.4%.

Preview: Due February 13 (revised date) - U.S. January CPI - A stronger month but slower yr/yr

February 4, 2026 6:31 PM UTC

We expect a 0.2% increase in January’s CPI, with a 0.3% rise ex food and energy, though risks are to the upside with our forecasts before rounding being for gains of 0.24% overall and 0.34% ex food and energy. The latter would be the strongest since August.