View:

February 18, 2026

Turkish Economy Will Likely Grow by Around 3.8% in 2025

February 18, 2026 3:13 PM UTC

Bottom Line: The Turkish Statistical Institute (TUIK) is scheduled to announce Q4 2024 and full-year GDP growth on March 2. We expect the Turkish economy expanded by approximately 3.8% y/y in 2025, underpinned by resilient household consumption, investment, and ongoing construction projects. Domesti

South Africa Inflation Moderately Eased to 3.5% y/y in January

February 18, 2026 1:41 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on February 18 that annual inflation slightly edged down moderately to 3.5% y/y in January, driven by higher housing and utilities, food and non-alcoholic beverages, and insurance and financial services. Annual core inflation came in at 3.4%

Taiwan: Trade Deal with U.S. and China Grey Warfare

February 18, 2026 11:55 AM UTC

· The most likely option for China is to continue the air and naval grey zone warfare around Taiwan, combined with support for pro-China factions in Taiwan’s parliament to build pressure for reunification at some stage before 2049 (the 100th anniversary of the communist party). Wi

UK CPI Review: Fresh and Marked Fall Resumes as Core Slips to Cycle-Low?

February 18, 2026 10:03 AM UTC

Although most aspects of the January CPI came in a notch above BoE thinking, the clear fall in the headline rate and further looser labor market messages still point to a BoE rate cut next month, not least given the likely return to the 2% target by April. These projected falls started with these Ja

February 17, 2026

China: Boosting Consumption In March?

February 17, 2026 2:05 PM UTC

· China’s consumption medium term could be boosted by higher structural safety nets (social spending/health/pensions) and revisions to the Hukou system (shifting 200mln urban workers from lower rural to higher urban benefits). However, March NPC will likely see only further small to m

UK Labor Market: Job Losses Weighing on Wages

February 17, 2026 7:52 AM UTC

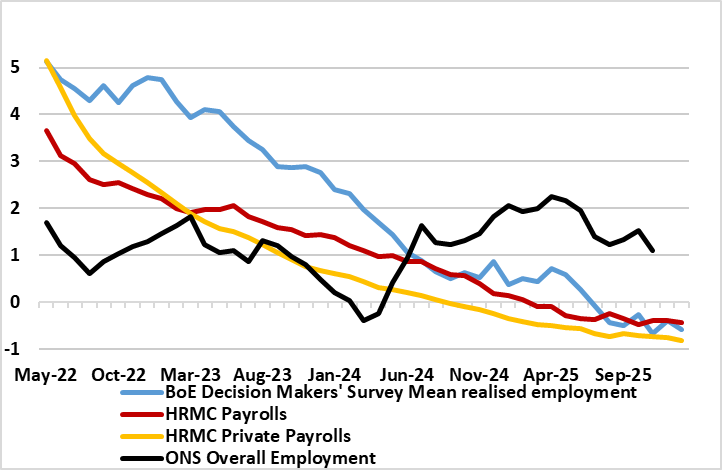

There are further signs that the labor market is haemorrhaging jobs both clearly and broadly with fresh and deep falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down almost a full ppt in y/y terms and more steeply so (Figure 1).

February 16, 2026

Warsh, AI and Lower Policy Rate?

February 16, 2026 10:55 AM UTC

· Warsh will find it tricky to convince FOMC members that AI is currently boosting productivity and acting as a disinflationary force. However, Warsh could also try to get the Fed to be more forward looking and less data dependent, which could add some proactivity into Fed debates. Fo

From Trade War to Trade Truce: Washington and Delhi Recalibrate

February 16, 2026 7:50 AM UTC

The US–India interim trade pact lowers tariffs after a bruising 2025 dispute, offering relief to Indian exporters while committing New Delhi to expanded market access for American goods. Washington is presenting the deal, including India’s stated intent to import up to USD 500bn in US energy and

India’s CPI Overhaul: Smoother Prints, Deeper Scrutiny

February 16, 2026 6:37 AM UTC

India’s January 2026 CPI rose to 2.75% yr/yr, marking the launch of a rebased 2024=100 index that better reflects modern consumption patterns. Food’s reduced weight is likely to dampen headline volatility, while services, housing and discretionary spending will exert greater influence going forw

February 13, 2026

VAT Hike, Stubborn Food and Services Prices Pushed Russia’s Inflation to 6.0% y/y in January

February 13, 2026 5:08 PM UTC

Bottom Line: After easing to 5.6% y/y in December, Russia’s inflation edged up to 6.0% y/y in January due to VAT hike and stubborn food and services prices, the State Statistics Service (Rosstat) said. Despite Central Bank of Russia (CBR) announced that the inflation forecast for 2026 has been

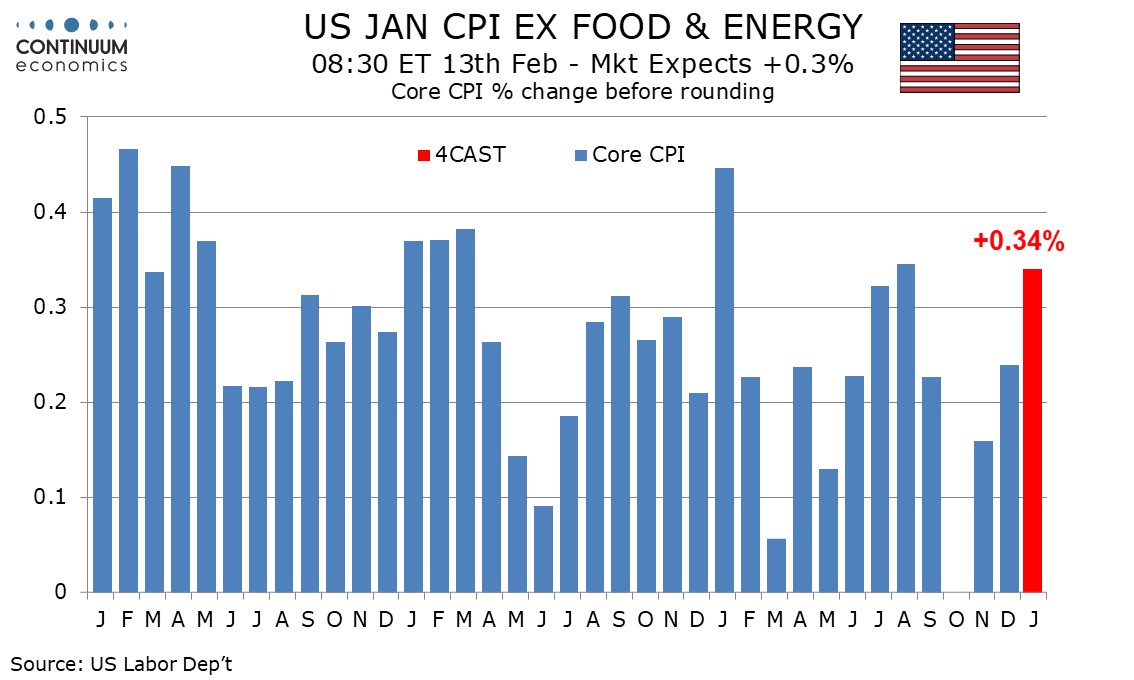

U.S. January CPI - Yr/yr ex food and energy pace slowest since March 2021

February 13, 2026 2:18 PM UTC

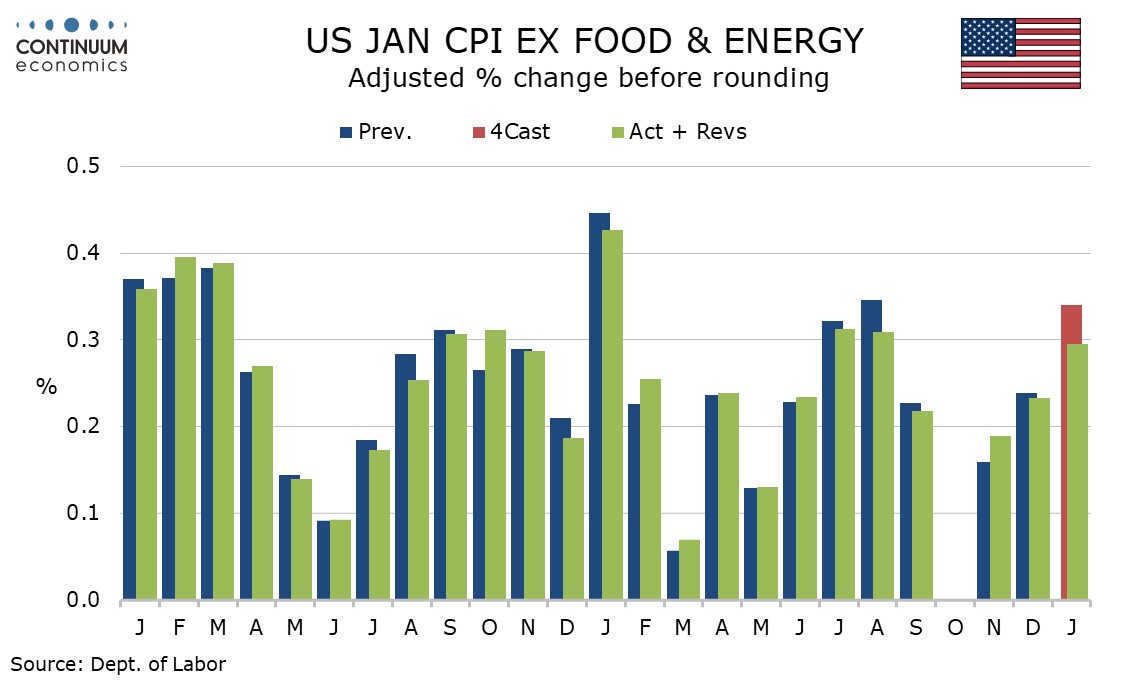

January CPI is slightly lower than expected at 0.2% overall though the ex food and energy rate at 0.3% is on consensus, with the core rate almost spot on 0.3% even before rounding. Given a strong year ago rise, yr/yr growth slowed, overall to 2.4% from 2.7% and the core to 2.5% from 2.6%, the latter

Surprising Move by the CBR: 50 Bps Interest Rate Cut Despite Inflationary Risks

February 13, 2026 12:48 PM UTC

Bottom Line: Despite we expected the Central Bank of Russia (CBR) to hold the policy rate at 16% during the MPC on February 13 and anticipated a cautious stance as the Bank monitors inflationary risks, including the VAT hike in 2026, utility tariff increases, and elevated inflation expectations; the

February 12, 2026

Preview: Due February 20 - U.S. Q4 GDP - GDP and Core PCE Prices both seen at 2.6%

February 12, 2026 4:48 PM UTC

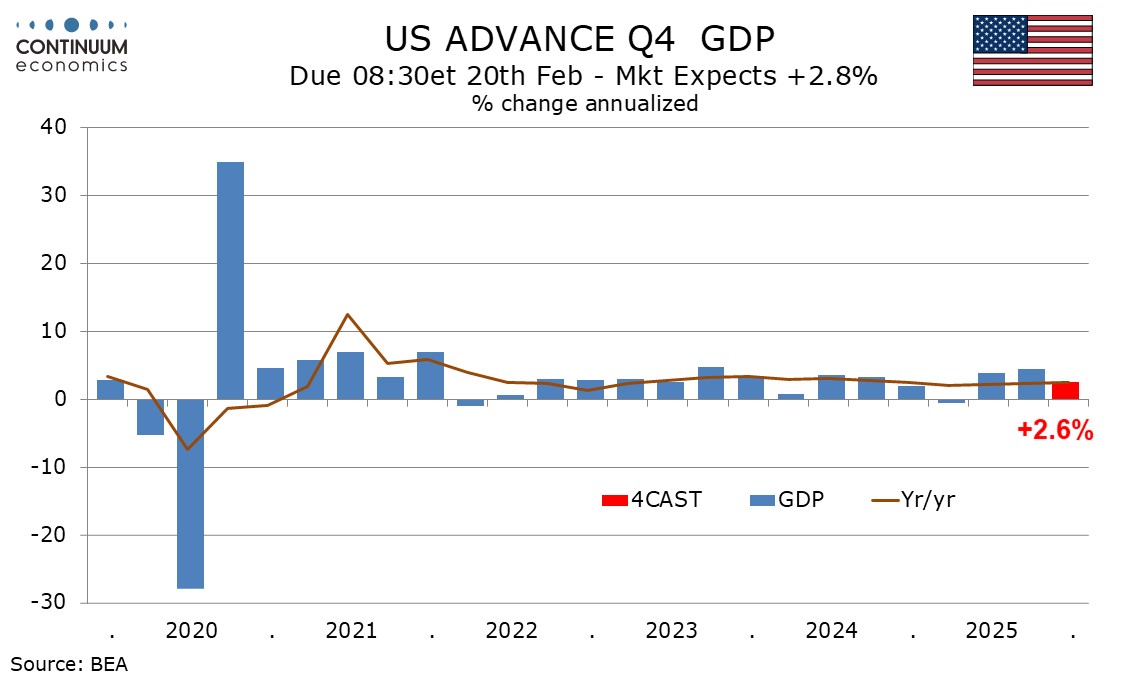

We expect a 2.6% annualized increase in Q4 GDP, well above a flat forecast we had entering the quarter, but off a peak estimate of 3.6%, with weaker November trade and December retail sales data having trimmed the forecast. December trade data, due on February 19, remains a significant source of unc

Preview: Due February 13 - U.S. January CPI - A stronger month but slower yr/yr

February 12, 2026 1:13 PM UTC

We expect a 0.2% increase in January’s CPI, with a 0.3% rise ex food and energy, though risks are to the upside with our forecasts before rounding being for gains of 0.24% overall and 0.34% ex food and energy. The latter would be the strongest since August.

Cuba: Pressure Grows

February 12, 2026 8:05 AM UTC

· The Donroe doctrine has pressured Mexico into halting oil exports to Cuba, which is intensifying pressure on Cuba’s regime. While chaos and attempted mass immigration is a risk, the baseline is for a negotiated deal as U.S./Cuba discussions deepen – though with the added complex

UK GDP Review: Underlying Economy Fragility Does Continue

February 12, 2026 7:52 AM UTC

First the good news; the UK economy grew for a second successive month in December, something not seen for almost a year. But as is familiar with recent UK real economy data, there is a negative flip side with the 0.1 m/m December advance negated by downward revisions to previous figures (November

February 11, 2026

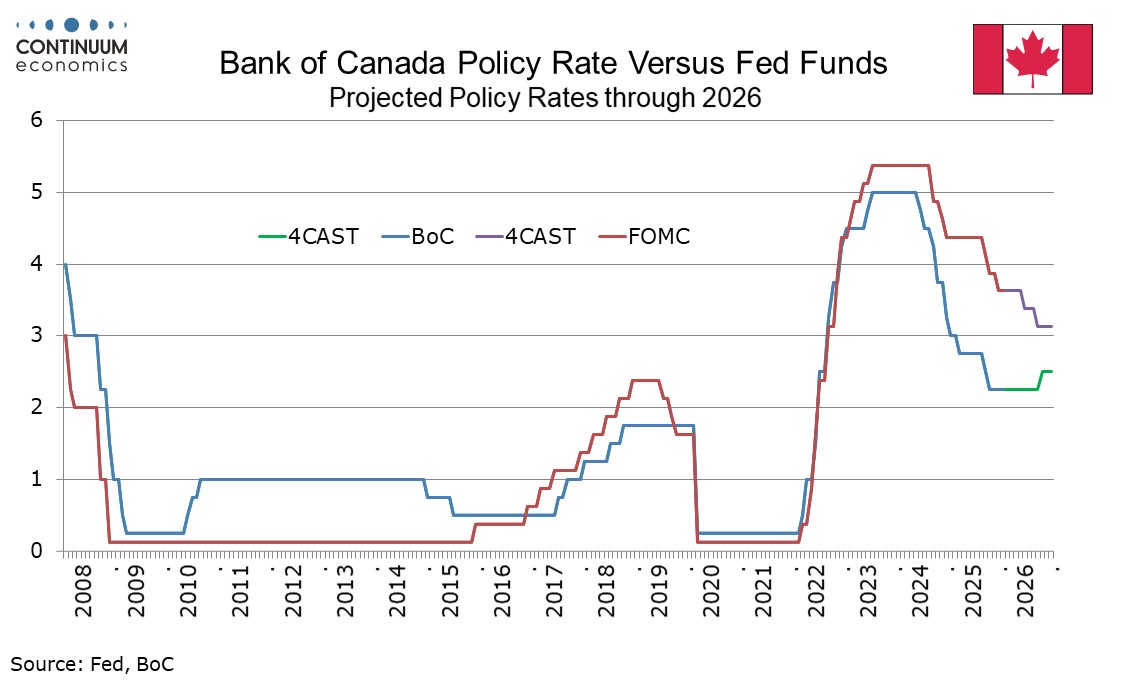

Bank of Canada Minutes from January 28 - Steady policy dependent on economy evolving as expected

February 11, 2026 7:06 PM UTC

The Bank of Canada has released minutes from its January 28 meeting which provide no major surprises. The meeting saw rates left unchanged at 2.25% but noted heightened uncertainty, which the minutes also emphasize, with steady policy conditional on the economy evolving as expected.

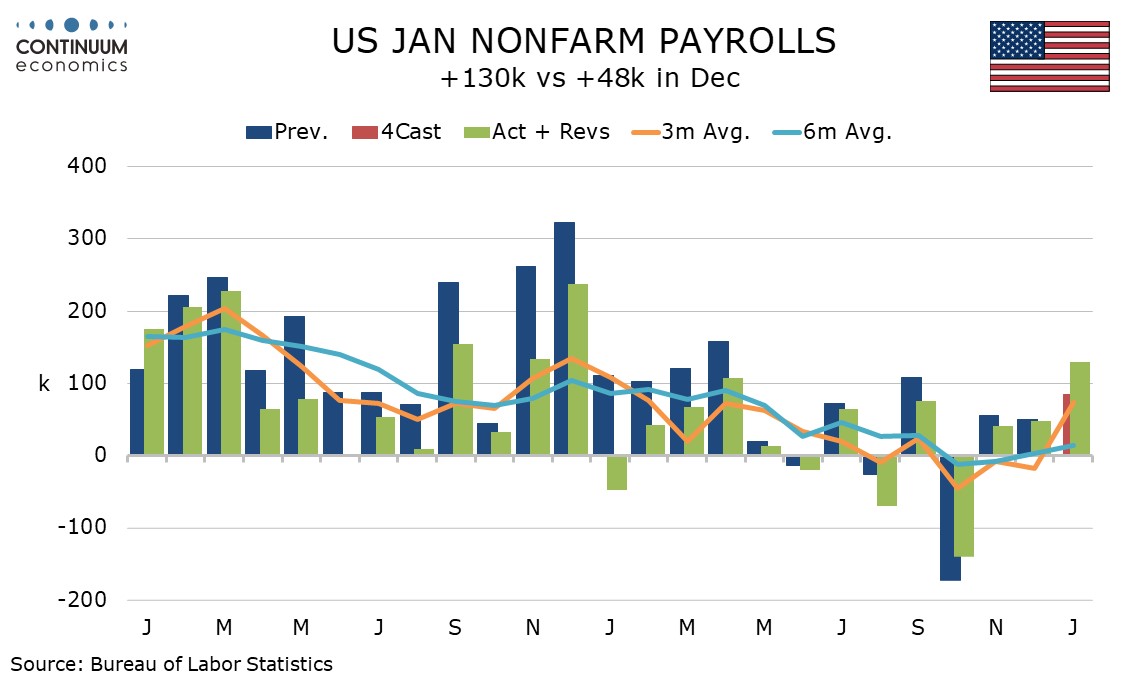

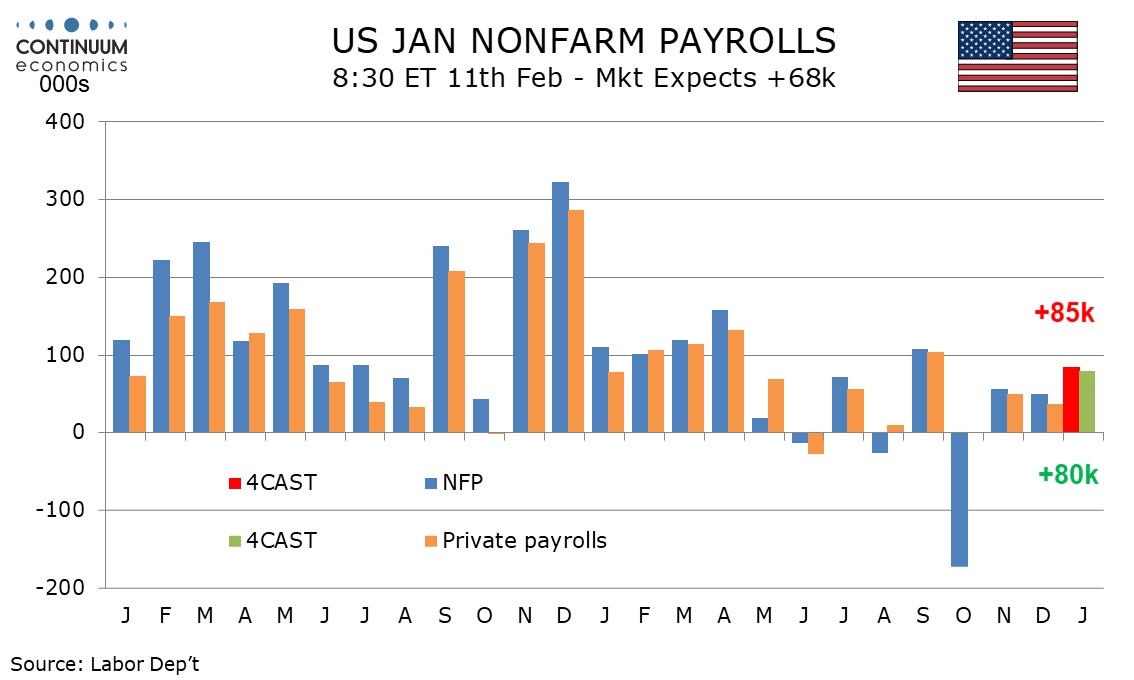

U.S. January Employment - Stronger across the board, will keep Fed in no hurry to ease

February 11, 2026 2:21 PM UTC

January’s non-non-farm payroll at 130k is significantly stronger than expected and even more so in the private sector at 172k. An above trend 0.4% rise in average hourly earnings, a rise in the workweek to 34.3 from 34.2 hours and a fall in unemployment to 4.3% from 4.4% leave the data as stronger

UK Gilt Vigilantes and Politics

February 11, 2026 9:05 AM UTC

• The Gilt market is sensitive to the prospect that Starmer/Reeves could be replaced, resulting in some changes to the fiscal rules in the scanario of a new PM/Chancellor. Further fiscal rule refinement could be possible, but a new PM would want a political reset and this would likely pre

February 10, 2026

Preview: Due February 11 - U.S. January Employment (Non-Farm Payrolls) - Above trend but with higher unemployment

February 10, 2026 2:30 PM UTC

We expect January’s non-farm payroll to rise by 85k overall and by 80k in the private sector, which would be on the firm side of trend and could be even more so after what could be substantial negative historical revisions. However, we expect unemployment to rise to 4.5% from 4.4%. We expect avera