View:

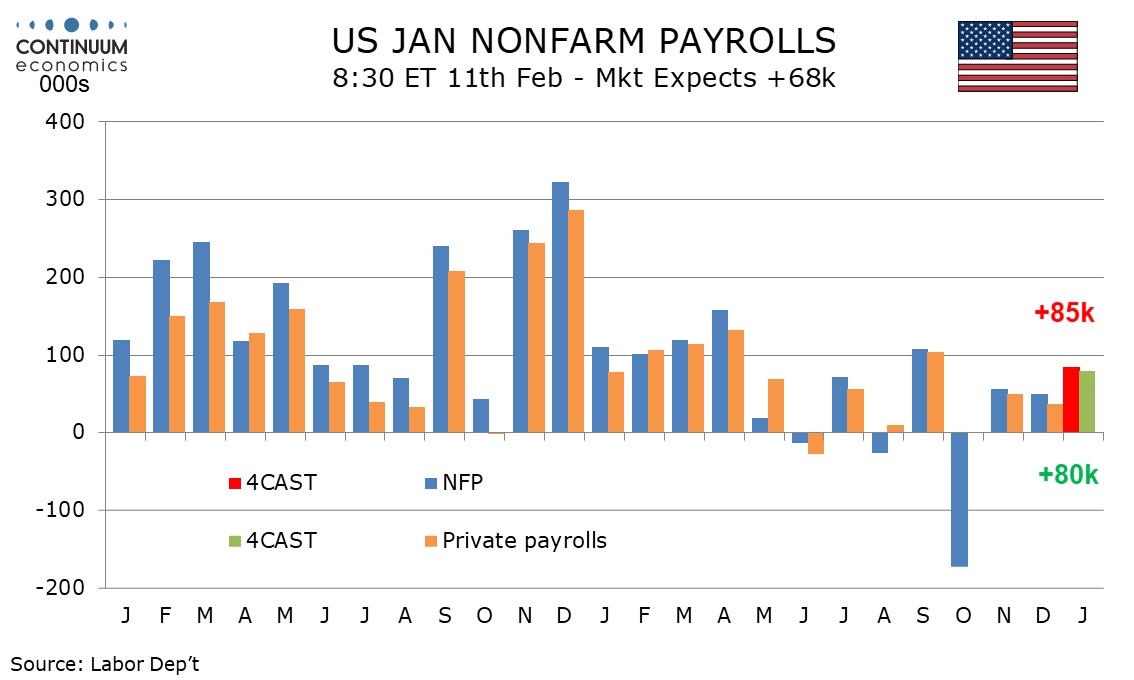

Preview: Due February 11 - U.S. January Employment (Non-Farm Payrolls) - Above trend but with higher unemployment

February 10, 2026 2:30 PM UTC

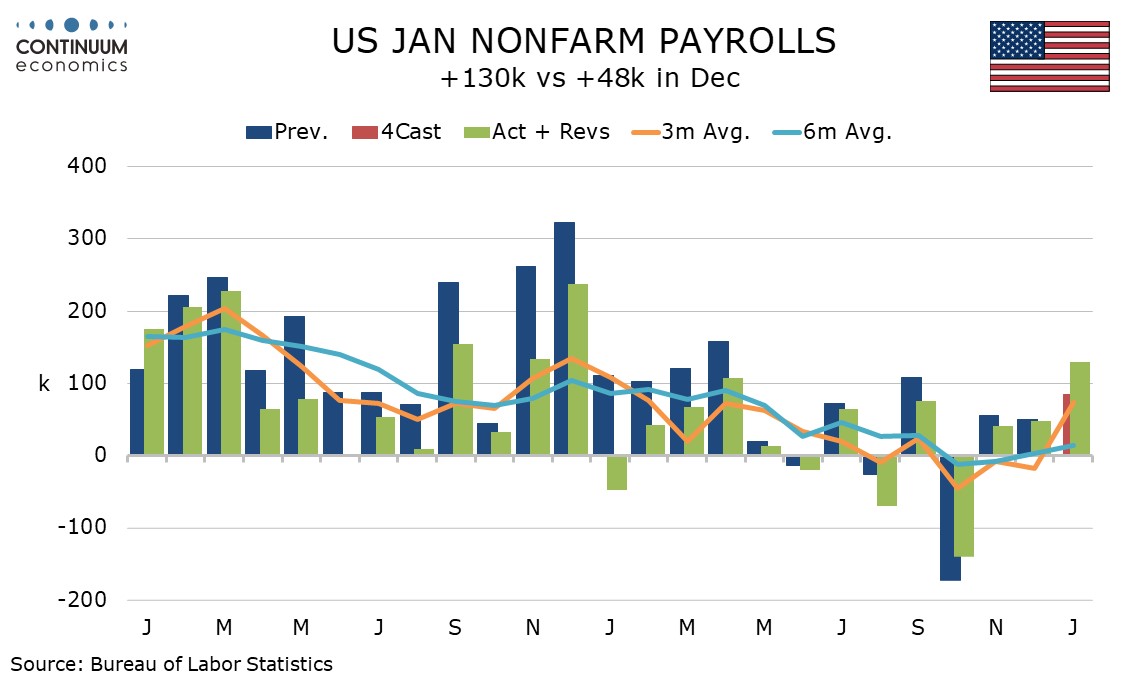

We expect January’s non-farm payroll to rise by 85k overall and by 80k in the private sector, which would be on the firm side of trend and could be even more so after what could be substantial negative historical revisions. However, we expect unemployment to rise to 4.5% from 4.4%. We expect avera

AI, Fed and Inflation and Disinflation Risks

February 26, 2026 8:24 AM UTC

• Existing Fed officials and Fed chair designate Warsh have divergent views on the impact of AI in boosting productivity and whether this means lower inflation/policy rates or high business investment/electricity prices argues against lower policy rates and potentially meaning a higher shor

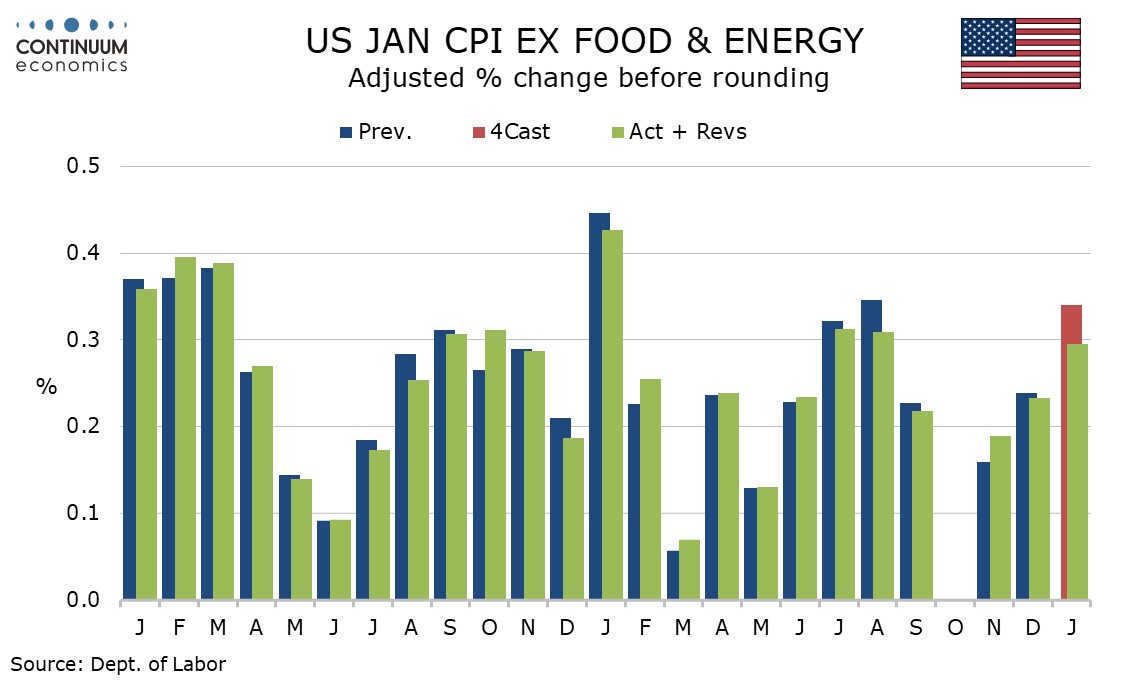

U.S. January CPI - Yr/yr ex food and energy pace slowest since March 2021

February 13, 2026 2:18 PM UTC

January CPI is slightly lower than expected at 0.2% overall though the ex food and energy rate at 0.3% is on consensus, with the core rate almost spot on 0.3% even before rounding. Given a strong year ago rise, yr/yr growth slowed, overall to 2.4% from 2.7% and the core to 2.5% from 2.6%, the latter

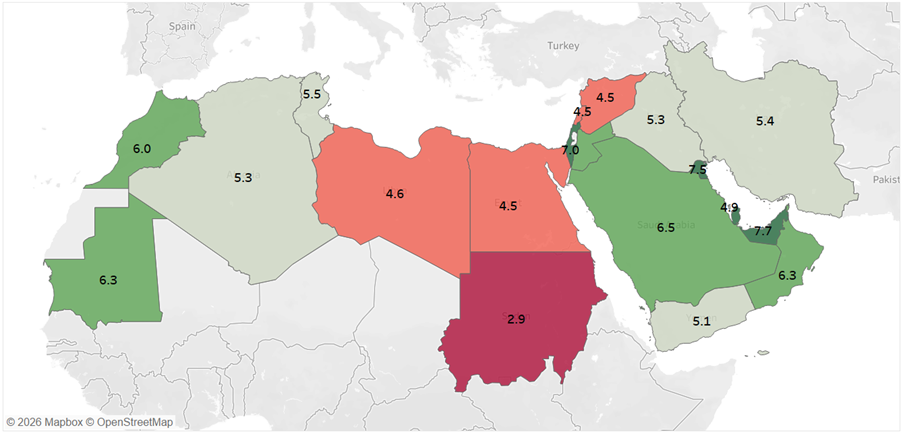

2025 Q4 Country Insights Scores to Download in Excel

March 3, 2026 10:00 AM UTC

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. The access to our full range of scores across 174 countries corresponding to the fourth quarter

Markets and the Iran War

March 4, 2026 9:50 AM UTC

• The Trump administration’s objective appears to be pivoting from regime change to hurting Iran ballistic missile capabilities, which argues for a 2-4 week war rather than a prolonged war. However, the most intense missile battles will likely occur in the next one week and markets are

Iran: What Length For War?

March 2, 2026 7:44 AM UTC

· If the war is short (ie 1-2 weeks) and leads to a ceasefire then the global economic impact will be small, with the greatest impact in the middle east of oil/gas supplies on a temporary basis and tourism. If the war is more prolonged (ie months) then oil/gas supplies could be sque

UK Gilt Vigilantes and Politics

February 11, 2026 9:05 AM UTC

• The Gilt market is sensitive to the prospect that Starmer/Reeves could be replaced, resulting in some changes to the fiscal rules in the scanario of a new PM/Chancellor. Further fiscal rule refinement could be possible, but a new PM would want a political reset and this would likely pre

Reciprocal Tariffs: Supreme Court Strike Down

February 20, 2026 4:31 PM UTC

· The 6-3 vote by the Supreme court and full ruling against reciprocal tariffs means that the Trump administration will likely resort to other tariffs for negotiating leverage. However, the Trump administration will also pressure to codify existing trade framework deals that have be

U.S. January Employment - Stronger across the board, will keep Fed in no hurry to ease

February 11, 2026 2:21 PM UTC

January’s non-non-farm payroll at 130k is significantly stronger than expected and even more so in the private sector at 172k. An above trend 0.4% rise in average hourly earnings, a rise in the workweek to 34.3 from 34.2 hours and a fall in unemployment to 4.3% from 4.4% leave the data as stronger

Iran: Limited U.S. Attack?

February 24, 2026 10:00 AM UTC

· Iran authorities appear reluctant to meet the Trump administration’s demand to stop nuclear fuel production for potential weapons. This increases the odds of a limited attack by the U.S. on Iran to 30-40% (Figure 1), which could occur as soon as this weekend. The most likely I

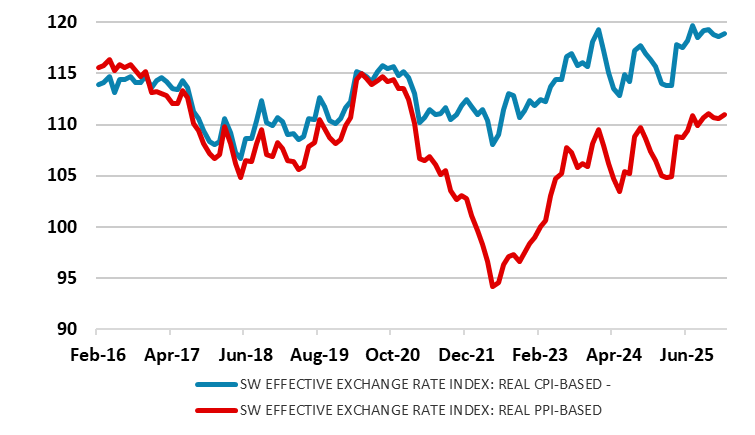

Swiss SNB Preview (Mar 19): Keeping a Low Profile

March 10, 2026 11:53 AM UTC

Once again and in line with consensus thinking we see SNB policy being unchanged when it gives its next quarterly assessment with little shift in the forecast for either growth or inflation. Admittedly, the tone of the economic outlook will be more guarded but where it will be underscored that it

EUR/USD: Europe’s Counter Threats to Trump

February 10, 2026 11:05 AM UTC

· Europe is highly unlikely to weaponize its existing portfolio holdings or new flows into the U.S., as Europe is dependent on the U.S. nuclear umbrella and as EZ/EU decision making is slow and modest in action. Such a move would be strongly opposed by EZ/European investors. Even so,

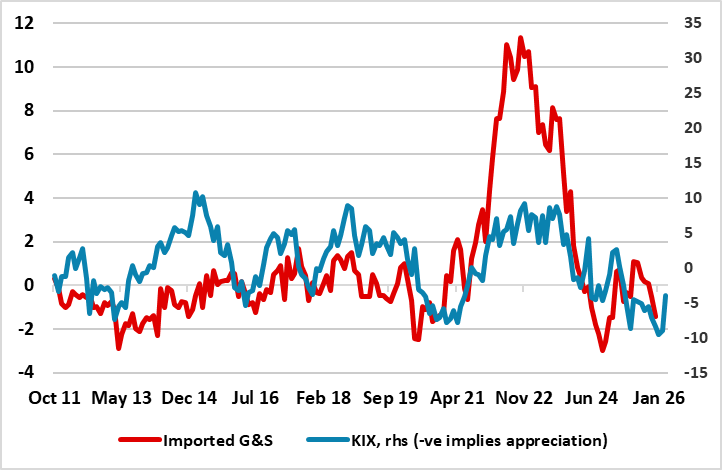

UK CPI Review: Fresh and Marked Fall Resumes as Core Slips to Cycle-Low?

February 18, 2026 10:03 AM UTC

Although most aspects of the January CPI came in a notch above BoE thinking, the clear fall in the headline rate and further looser labor market messages still point to a BoE rate cut next month, not least given the likely return to the 2% target by April. These projected falls started with these Ja

Warsh, AI and Lower Policy Rate?

February 16, 2026 10:55 AM UTC

· Warsh will find it tricky to convince FOMC members that AI is currently boosting productivity and acting as a disinflationary force. However, Warsh could also try to get the Fed to be more forward looking and less data dependent, which could add some proactivity into Fed debates. Fo

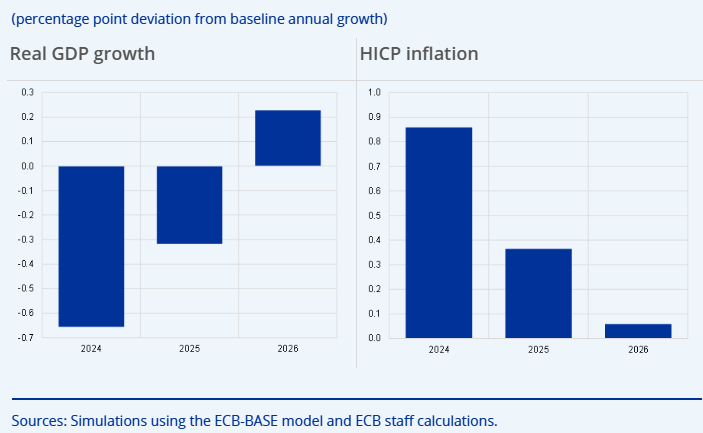

EZ HICP Review: Core Rate Spikes as Upside Inflation Risks Return

March 3, 2026 10:35 AM UTC

Having dropped to 1.7% in the January data, thereby matching expectations and the short-lived Sep 24 outcome, it is likely especially in view of the Middle East conflict that the headline HICP rate may not be any lower through this year and into next. Indeed, we headline rate rose 0.2 ppt to 1.9%

GBP: Foreign Investor Flows

February 23, 2026 11:05 AM UTC

· Inbound inflows into the UK have been solid in the last few years attracted by yield pick-up and fiscal consolidation for gilts and cheap comparable valuations in UK equities. UK BOP data suggests something would have to go really wrong to stop inbound portfolio flows e.g. UK recessio

Cuba: Pressure Grows

February 12, 2026 8:05 AM UTC

· The Donroe doctrine has pressured Mexico into halting oil exports to Cuba, which is intensifying pressure on Cuba’s regime. While chaos and attempted mass immigration is a risk, the baseline is for a negotiated deal as U.S./Cuba discussions deepen – though with the added complex

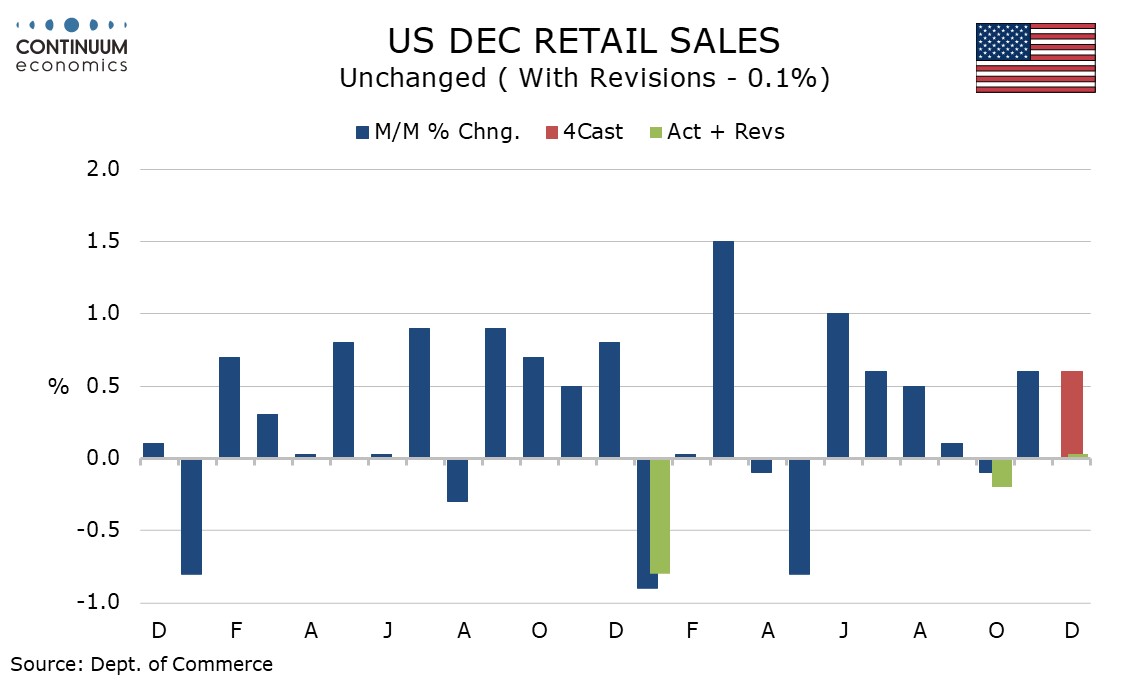

U.S. December Retail Sales and Q4 Employment Cost Index show fading momentum

February 10, 2026 2:03 PM UTC

December retail sales are weaker than expected, unchanged overall, ex autos and ex autos and gasoline. This could be a sign of consumer spending losing momentum in response to real disposable income coming in near flat in both Q3 and probably Q4, given limited employment growth and resilient inflati

Sweden Riksbank Preview (Mar 19): On Hold and Still For Some Time Ahead?

March 10, 2026 10:56 AM UTC

It is highly likely that the Riksbank will (again) keep policy on hold with the key rate left at 1.75% when it gives its next verdict. However, what will be more important is what the Board says; explicitly in terms of the recent (less pleasing to it) data flow and, implicitly in terms of updated

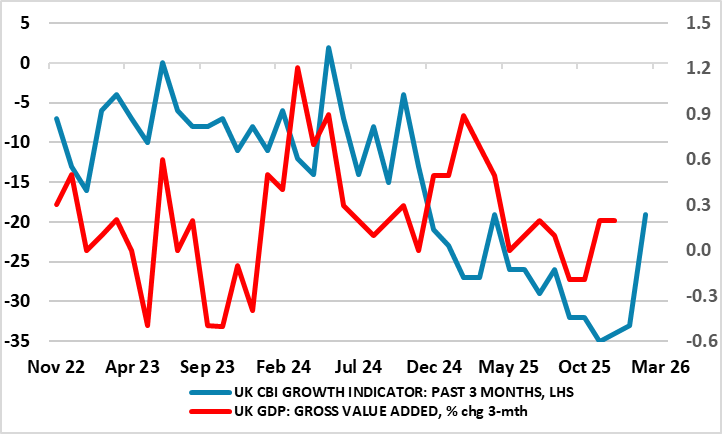

UK GDP Preview (Mar 13): Were Things Getting Better?

March 4, 2026 11:11 AM UTC

Belatedly, some good news; the UK economy grew for a second successive month in December, something not seen for almost a year. Even more encouragingly, it may very well enjoy a further rise in the looming January data, thereby providing the best three-month showing in two years. But as is famil

Canada Q4 GDP slips despite strong support from government, but some positive signals

February 27, 2026 2:32 PM UTC

Canada’s 0.6% annualized Q4 GDP decline was slightly weaker than expected and further below a flat BoC projection, and came despite quite strong support from government. Q3 was revised down to 2.4% from 2.6% but this was more than outweighed by an upward revision to Q2 to -0.9% from -1.8%.

China: Housing Not Bottomed Yet

February 25, 2026 10:55 AM UTC

• We do not feel that China residential property market has bottomed, as it faces two cyclical and two structural headwinds. Cyclically outstanding inventory of complete houses remains high, while households are also suffering from low income and employment growth. Structurally populati