About Us

Continuum Economics provides independent macroeconomic, policy & financial markets research. Our worldwide client base consists of over 600 banks, asset managers, corporations, central banks and government organisations. Research is produced from our London, New York and Singapore research centres for a global audience.

Best FX, EM and Technical Analyst Team of the Year

Best EM Research

Best FX, FI, EQ and Multi-Asset Research

Our Clients

Our Content Modules

Macro Newsletters

Macro Strategy

Outlook Center

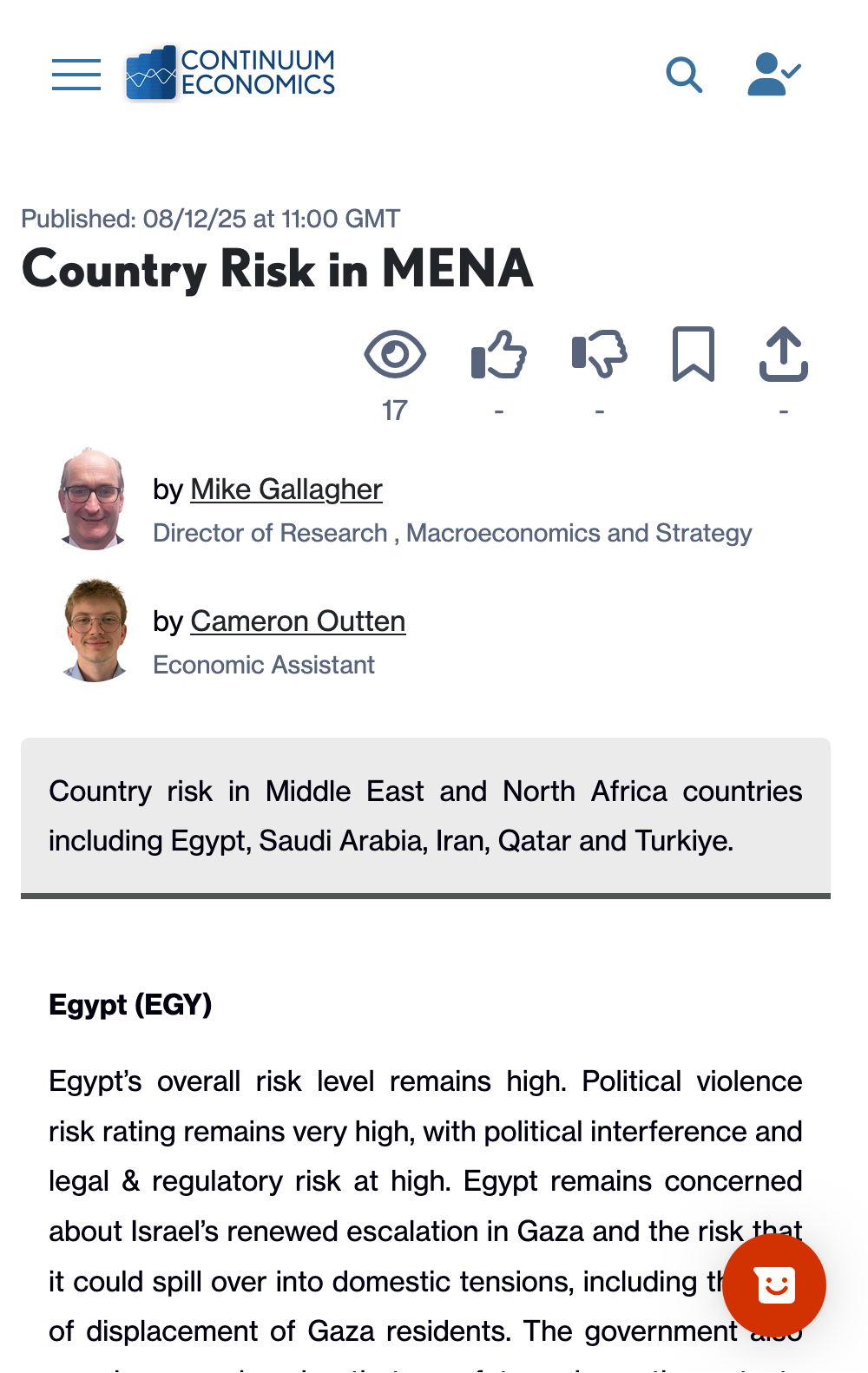

DM Country Research

EM Country Research

DM Central Bank Policy

EM Central Bank Policy

FX Module

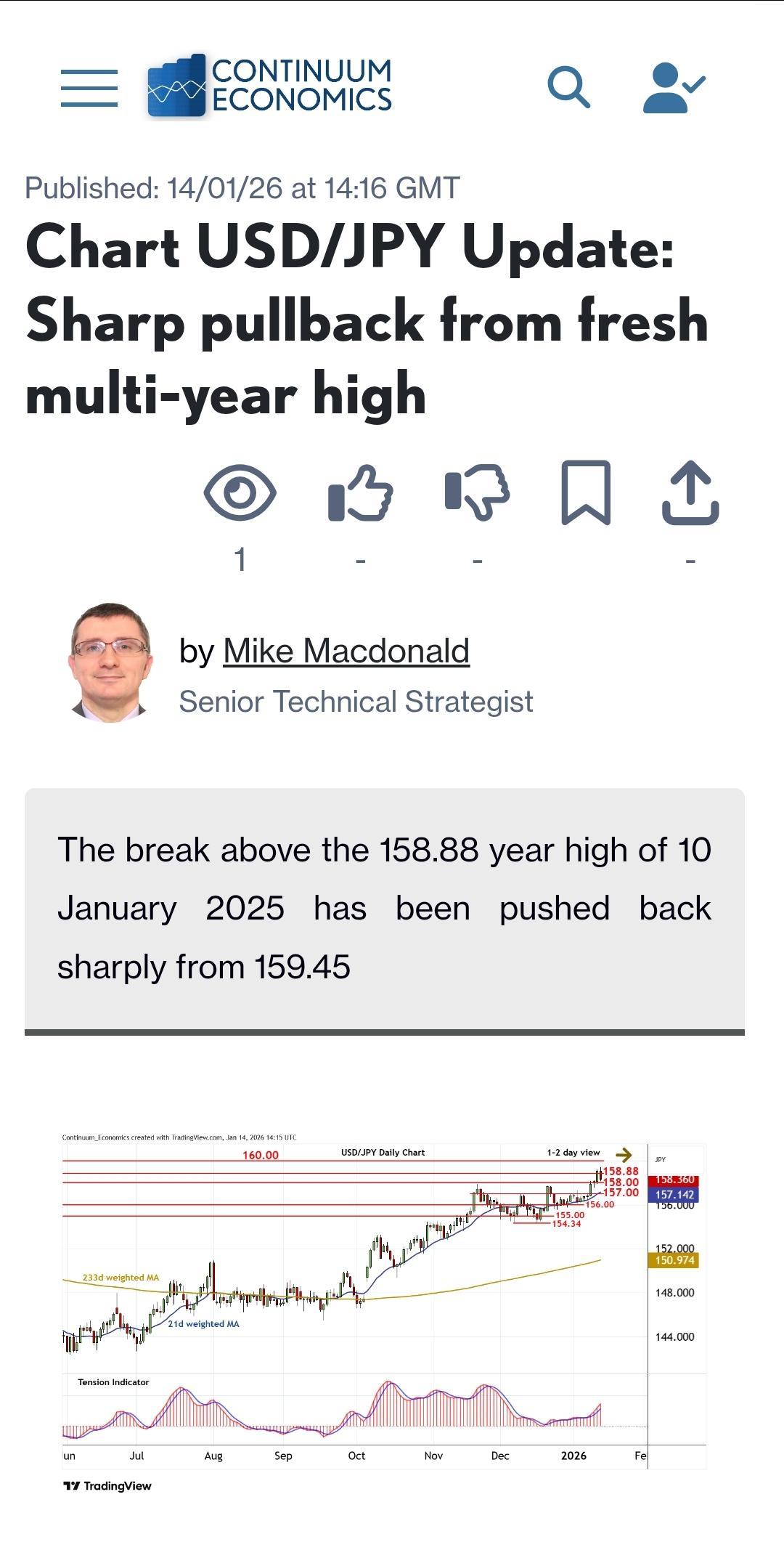

Technical Analysis

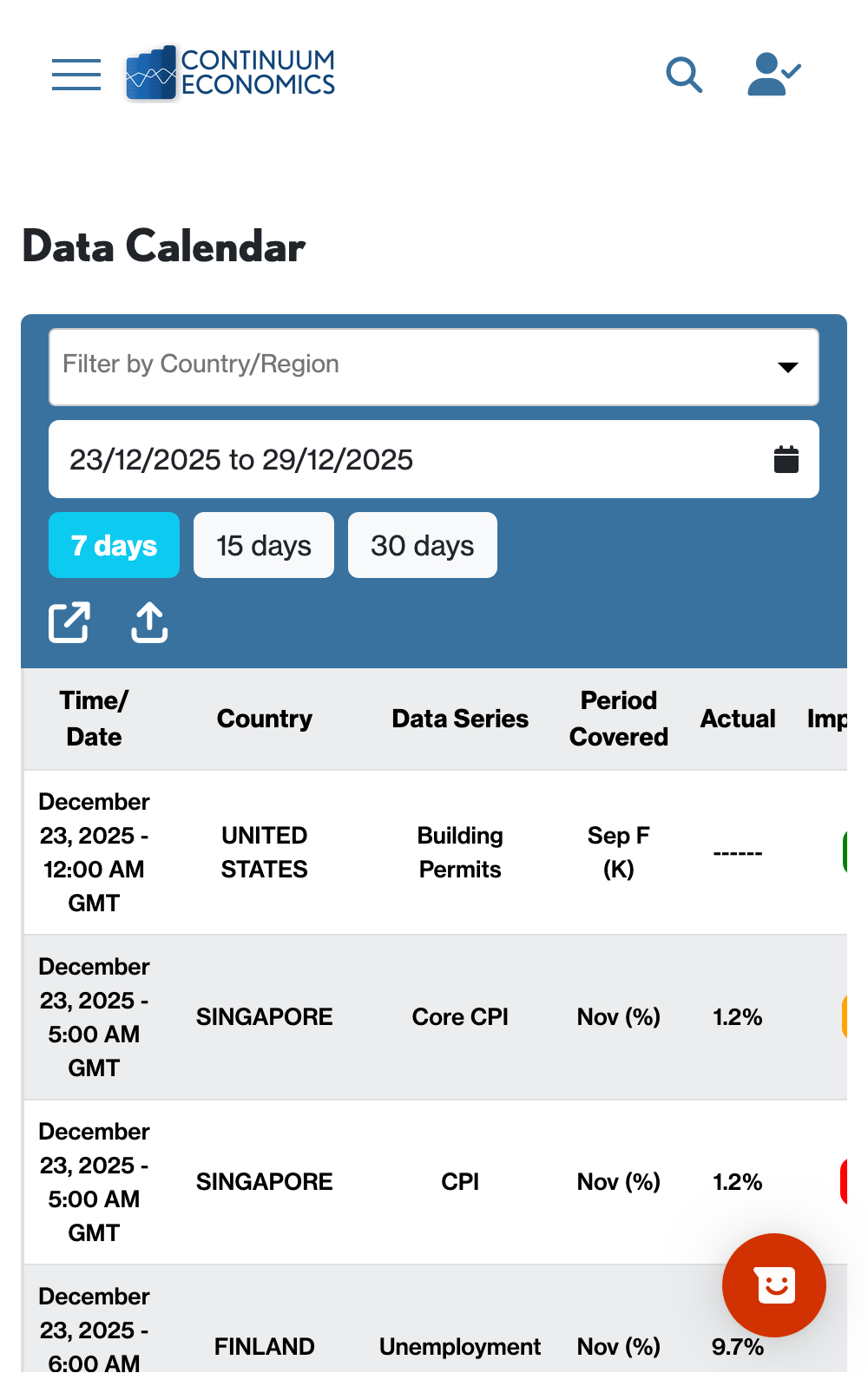

Economic Data Calendar

Tactical Newsletters

Country Insights

How we deliver our data

Desktop / Tablet / Mobile

You can download our raw data in Excel format or read articles where our analysts provide insights and commentary on emerging trends across the global economy – our content is optimised for all devices.

Newsletters

We offer a module that sends you a daily (or weekly) newsletter comprised of articles configured to your interests. This saves you time searching for what you want to know about so you can focus on reading what truly matters to you.

Email Alerts

We offer a service that allows articles related to any module you are subscribed to be sent to your email address. Alerts can be configured so they are emailed as soon as an article is published. That can be overwhelming to some users, who instead prefer to opt for a grouped (sent three times a day) or a daily alert.

Desktop Notifications

We also allow users to receive instant desktop alerts whenever an article that is related to a module they have subscribed to is published.

Bloomberg

We provide our subscribers with a newsfeed on Bloomberg so they can access our analysis directly via their terminals.

Refinitiv

We provide our subscribers with a newsfeed on Refinitiv so they can access our analysis directly via their terminals.

White Labelling

Technical Analysis

We offer real-time, 24-hour technical analysis of financial markets covering around 80 instruments across FX (both developed and emerging markets), Fixed Income Rates, Equities and commodities.

Economic Data & Events Calendar

We provide an economic data calendar that allows customers to track upcoming data releases, key market events, market holidays, and bond auctions. These are coupled with our market impact assessment, enabling you to focus on what data is truly moving the market.

E-Commerce Integrations

Custom Solutions: Many of our clients use our APIs and RSS feeds to integrate subsets of our research directly into their own trading platforms, websites, and intranets. We work with our customers to develop customised solutions that suit their needs.

Our E-Commerce solutions are typically used by:

Trading Platforms

Customers have differentiated their online trading solutions by integrating our research, technical analysis, and economic data calendars into their services. This provides their customers with pre-trade decision support, and market intelligence to support their decision-making and manage their risk.

Media and Market Intelligence

Newspapers and financial market intelligence vendors have integrated our economic data calendars to provide their customers with greater awareness of upcoming economic data releases and market events.

E-Commerce Clients

Integration of Continuum Economics Technical Analysis charts into bank's own charting application

Customer Segments

Sales & Trading

Sales and traders use our short-term views of financial markets, psychology, and reaction to events in real-time to make their decisions. Often, these are combined with our intraday Technical Analysis to enable them to be better informed about the market.

Asset Management

Asset Managers value our research to make more informed investment decisions by looking at our Global Outlook. Combining the Outlook with our research on country policies helps them identify opportunities and risks across Developing and Emerging Markets.

Central Banks

CBs value our independent view on how markets interpret their policies. Our Global Outlook, Country Insight risk scoring, and scenarios analysis help identify risks across Developing and Emerging Markets.

Corporate

Corporations value our macro research, country risk tools, and our global market coverage to improve risk management when navigating the hazards of operating in a globalized world.

Public Sector

Public Sector organisations use our research to understand global economic conditions and relative risks across the world. This enables them to make more informed long-term policy and sovereign lending decisions.

Private Equity/Hedge Funds

PE and Hedge funds value the quality and breadth of our macro policy and global markets coverage, when evaluating investment project risks and trading strategies.

Risk Management

Risk departments at banks, insurers, and MNCs value our Country Insights risk tools, macro and policy research to monitor global risks impacting their organizations.

eCommerce

Firms integrate our data calendars, technical analysis reports, and newsletters into their trading platforms, websites, and intranets to deliver actionable research to staff and clients.

Brokerages

Online brokerages integrate our research into their platform, giving clients more insight into the state of the market to make better trading and investment decisions.

Our Offices

Headquarters/Europe, Middle East, and Africa

(t/a Continuum Economics),

1 Harrington Gardens,

SW7 4JJ, London, United Kingdom

Sales & Support: +44 (0) 207 881 8802

Email: support@continuumeconomics.comThe Americas

Sales & Support: +1 212 897 6777

Email: support@continuumeconomics.comAsia

Sales & Support: +65 6979 5998

Email: support@continuumeconomics.com