Mexico GDP Review: 0.6% Contraction in Q4 and Recession Risks

Mexico’s GDP shrank by 0.6% in Q4 2024, bringing annual growth to 1.5%, well below previous years. The industrial sector led the decline, driven by uncertainty over Trump’s election and weaker investment, while agriculture also contracted sharply. Monetary tightening, lower U.S. demand, and political uncertainty have slowed the economy, raising concerns of a 2025 recession. In response, Banxico is expected to accelerate rate cuts to support growth, with board member Victoria Rodríguez hinting at larger reductions ahead.

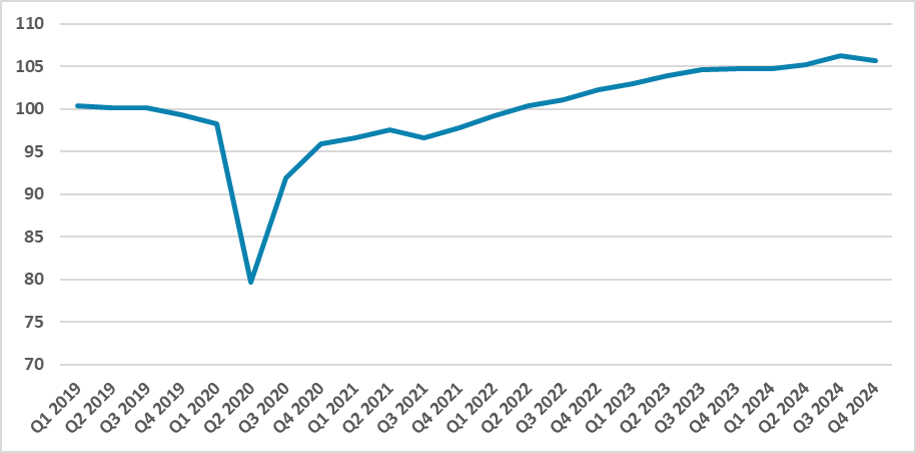

Figure 1: Mexico’s GDP (Seasonally Adjusted, 2019 = 100)

Source: INEGI

Mexico’s National Statistics Institute (INEGI) has released the preliminary estimate of GDP for the last quarter of 2024. The estimate shows a 0.6% contraction in Mexico’s GDP. The figures were below market consensus, which had predicted a 0.3% contraction, according to a Bloomberg survey. As a result, Mexico’s economy grew by 1.5% in 2024, well below the 3.0% growth recorded in 2022 and 2023.

The primary driver of the decline was the industrial sector, which contracted by 1.2% during the quarter. We believe this contraction was mainly driven by uncertainties surrounding Donald Trump’s election and future U.S.-Mexico relations. Investments likely declined in construction and mining activity, while manufacturing reduced its production capacity. Agriculture also experienced a significant drop, contracting by 8.9%, largely due to adverse climate conditions. Meanwhile, the services sector grew marginally by 0.2% but was not sufficient to offset the declines in other sectors.

At this level of growth, the Mexican economy has likely fallen below its potential growth rate. The recent economic slowdown is likely a response to monetary tightening, weaker demand from the U.S., and the uncertainty caused by Trump’s election and the institutional reforms being promoted by the ruling party, Morena. These factors have made investment decisions more challenging.

Another interpretation of this economic performance could be the early signs of a recession in 2025. With the investment seen in 2023 tapering off and employment generation slowing, both investment and consumption could point toward an economic contraction. This could impact government revenues, making it more difficult to reduce the fiscal deficit. Further uncertainty remains regarding whether the Trump administration will impose tariffs on Mexico instead of deepening U.S.-Mexico value chains. Given this high level of uncertainty, we believe Mexico’s economy is likely to stagnate at the beginning of the year.

On another front, this weak economic performance will likely prompt Banxico to implement additional policy rate cuts, reaching neutral levels sooner than previously expected. This expectation was corroborated in an interview with Banxico board member Victoria Rodríguez, stating that Banxico could increase the magnitude of the next cuts.