Mexico CPI Review: Agricultural Goods Drive Inflation Up

Mexico's CPI rose 0.54% month-over-month in October, with a year-over-year increase to 4.8%, slightly above expectations. Agricultural goods and energy prices were key contributors. Core CPI, showing positive recent trends, rose 0.3% month-over-month and dropped to 3.8% year-over-year. Banxico is expected to continue gradual rate cuts, monitoring Core CPI closely, while the October increase is seen as temporary. The 2025 budget, anticipated to support fiscal consolidation, should aid inflation’s gradual convergence to the 3% target.

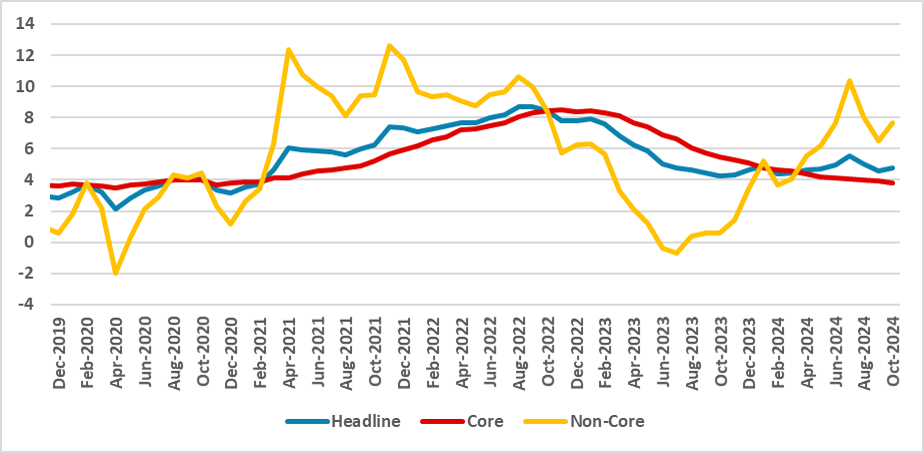

Figure 1: Mexico’s CPI (Y/Y, %)

Source: INEGI

Mexico’s National Statistics Institute (INEGI) has released the CPI figures for October. The data shows that the CPI rose by 0.54% month-over-month (m/m) during the month. Consequently, the year-over-year (y/y) CPI increased to 4.8%, up from 4.6%. The figure was slightly above market expectations, according to a Bloomberg survey. The biggest contributor to this rise was agricultural goods, which grew by 1.7% during the month and have accumulated a 10.9% increase on an annual basis. Energy prices rose by 1.3% in the month due to seasonal adjustments in electricity tariffs. Overall, the Non-Core CPI grew by 1.5% (m/m) in October.

The good news comes from Core CPI, which rose by around 0.3% (m/m) and has shown positive behavior in recent months. The y/y Core CPI continued to fall, reaching 3.8%, down from 3.9% in September.

All in all, October’s CPI aligns with market expectations. As the Mexican economy is finally showing signs of cooling, and the pass-through from a depreciated Mexican peso has been limited so far, it is very likely that Mexico’s CPI will continue its downward trend in the coming months, although the pace of decline is expected to be slow. The rise in October appears to be transitory, mainly due to adverse climate conditions and seasonal tariff adjustments, with a limited overall impact.

In terms of monetary policy, it is clear that Banxico is closely monitoring Core CPI, while Non-Core CPI takes a secondary position. We do not anticipate significant changes in Banxico’s strategy, which is expected to continue with policy rate cuts of 25 basis points (bps), although increasing the pace to 50 bps may occur at certain times if demand continues to weaken. We are also awaiting the 2025 budget, which will likely indicate some fiscal consolidation, further supporting the convergence of inflation toward the 3.0% target.