Banxico Preview: Continuing to Cut at 25bps Pace

Mexico's Central Bank (Banxico) is expected to proceed with a 25 basis-point rate cut on Oct. 10, bringing the policy rate to 10.0%. Banxico remains focused on core CPI, which is gradually decreasing toward its 3.0% target. While some previously anticipated a 50 basis-point cut, consensus now favors a slower pace due to peso depreciation and economic growth. Banxico is likely to maintain 25 basis-point cuts, projecting a rate of 10.0% by year-end 2024 and 8.5% in 2025.

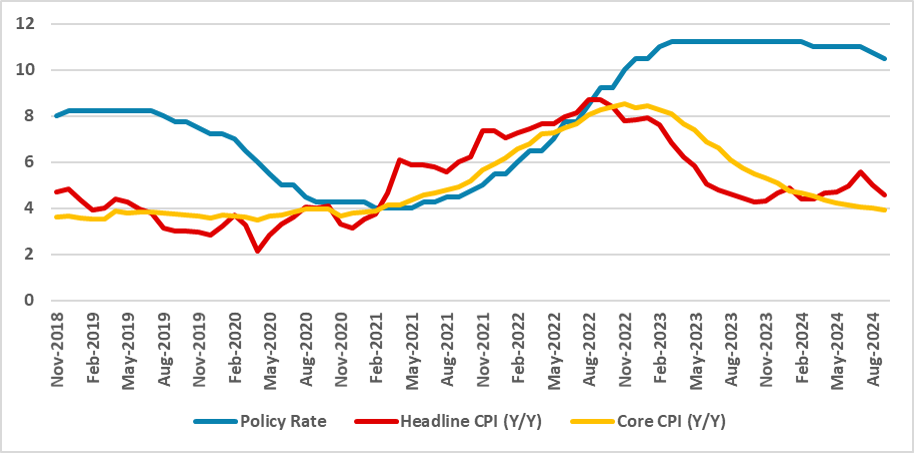

Figure 1: Mexico’s Policy Rate and CPI (%)

Source: INEGI and Banxico

Mexico's Central Bank (Banxico) will convene on Oct. 10 to decide the policy rate. We forecast that the board will continue the rate-cutting cycle with a 25 basis-point cut, lowering the policy rate to 10.0%. Despite a recent uptick in the inflation rate, Banxico is focused less on the general index and more on core CPI, which continues to decrease gradually, indicating some consolidation toward the 3.0% target.

A few weeks ago, some market participants anticipated an acceleration in the pace of cuts to 50 basis points. However, recent weeks have brought consensus that the prudent course is to continue with a 25 basis-point pace. First, the Mexican Pesos has depreciated due to recent volatility in foreign markets related to the U.S. election, raising concerns about possible inflationary pressure from this depreciation. Additionally, the preliminary GDP estimate shows a 1% growth, indicating a slight acceleration in economic activity. Although this is expected to moderate, it further supports maintaining the 25 basis-point cut.

We expect Banxico to continue with 25 basis-point cuts in upcoming meetings, as core CPI inflation is projected to fall slowly and the economy shows signs of slowing due to the lagged effects of tight monetary policy. Most estimates place the neutral rate in Mexico around 7.0%, meaning that continuing with 25 basis-point cuts will keep the policy rate in contractionary territory, supporting inflation's convergence toward the 3.0% target. As a result, we maintain our forecast for the policy rate to end 2024 at 10.0% and 2025 at 8.5%.