Banxico Review: 50 bps Cut as Expected

Banxico cut the policy rate by 50bps to 10.5%, with a cautious stance and a split vote. Inflation has fallen but remains above target, expected to converge to 3.0% by Q3 2026. Global risks, including Trump’s tariff threats, add uncertainty. Despite economic weakness, some monetary tightening may still be needed. Banxico plans further 50bps cuts, likely pausing at 8.0%, depending on economic conditions.

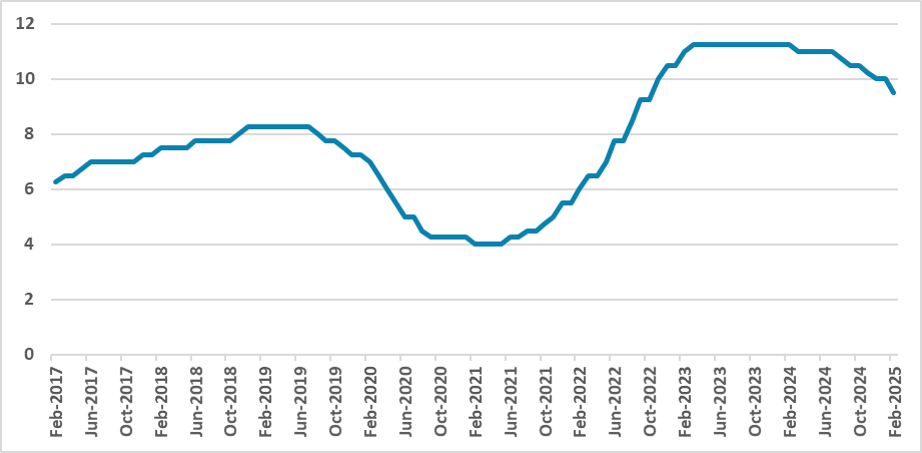

Figure 1: Mexico’s Policy Rate (%)

Source: Banxico

Mexico’s Central Bank (Banxico) has convened to decide on the policy rate. As widely expected by the markets, Banxico has opted for a 50bps cut, lowering the policy rate to 10.5% from 11%. The communiqué adopted a generally cautious tone. The votes were not unanimous, with one member favoring a more conservative approach, advocating for a 25bps cut.

Regarding foreign markets, Banxico stated that global risks have increased, particularly due to the possibility of reversals in global integration, driven by threats from Trump’s administration to impose tariffs. The exchange rate was volatile during this period, rising following the announcement of tariffs and reversing once their suspension for one month was announced. The majority believes that, ultimately, Mexico will concede to Trump's demands and that tariffs will not be imposed, although Trump’s policies are sometimes unpredictable.

On the domestic front, the board emphasized that inflation has fallen to levels not seen since February 2021. There were some dovish signals on the inflationary front, with Banxico stating that current inflation levels are comparable to those observed in the past. Although inflation expectations remain above the 3.0% target, Banxico still expects inflation to converge to 3.0% by the third quarter of 2026.

Banxico’s balance of risks remains skewed to the upside, prompting some caution. Upside risks include the persistence of core inflation, exchange rate depreciation, disruptions in trade policies, cost pressures, and climate change. Downside risks include weaker economic activity, lower pass-through of cost pressures, and a reduced impact from exchange rate depreciation.

Banxico’s wording in the communiqué suggests that they are now in the final phase of disinflation, meaning they will actively pursue the 3.0% target. With the economy weakening, it is feasible for them to continue cutting rates, but at a more measured pace. However, we continue to expect that some degree of monetary tightening will still be necessary. Banxico indicated that they will evaluate a similar cut (50bps) in their March meeting. We now believe Banxico will continue with 50bps cuts until the policy rate reaches 8.0%, at which point they will pause. However, we will continue to assess the conditions for this strategy based on incoming data.