LatAm Outlook: Navigating the Uncertainty

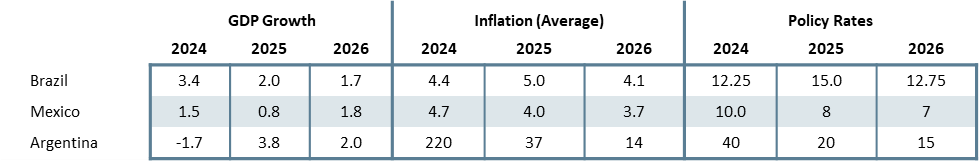

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tariffs in Mexico. Full tariff implementation would occur in our alternative scenario and mean a recession. Brazil’s growth will be affected by contractionary monetary policy and a slightly lower fiscal push which will be clearer in the second half of 2025. In 2026, we see some rebound for both countries. In Argentina, the economy will see some recovery from the contraction seen in 2024.

· Inflation is showing some stickiness in Brazil, and expectations are unanchored. We see some stickiness of inflation in the beginning of the year which in the second half will decrease as tight monetary policy feedthrough and the economy weakens. Mexico’s CPI is showing sign it will converge to the inflation target in 2025, especially in the core group. Headline CPI will likely continue to be affected by supply shocks, while weakened demand will compress it, but risks of exchange rate depreciation and from retaliatory tariffs exists. Argentina CPI will likely continue to slowdown and we forecast it to reach 1% monthly inflation in the second half of 2025, although falling below this barrier will be difficult.

· In terms of interest rates, we see Brazil sustaining very restrictive policy due to a positive output gap, de-anchoring of inflation expectations and credibility issues with a 15% peak in the second quarter of 2025. We see cuts only in 2026 now. In Mexico, we forecast Banxico to increase the pace of cuts reaching 8.0% in 2025 but it risks to be lower if the economy weakens further,

· Forecast changes: From our December outlook, we decreased our forecast for Brazil growth for 2025 to 2.0%, due to the lower growth in last quarter of 2024 that impacts the base, while we reduce Mexico’s growth forecast to 0.8% due to a weaker internal demand and uncertainty from Trump’s tariffs. We also increased our CPI and interest rates for Brazil while we made only marginal changes in our Mexico’s forecasts. We increase GDP growth forecast for Argentina.

Source: Continuum Economics

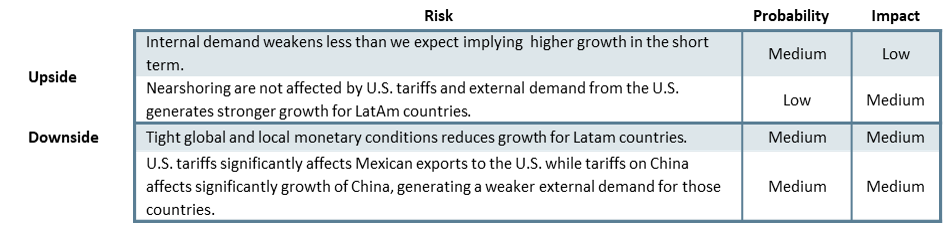

Risks to Our Views

Source: Continuum Economic

Risks to Our Views

Source: Continuum Economics

Brazil: Inflation Crossroads

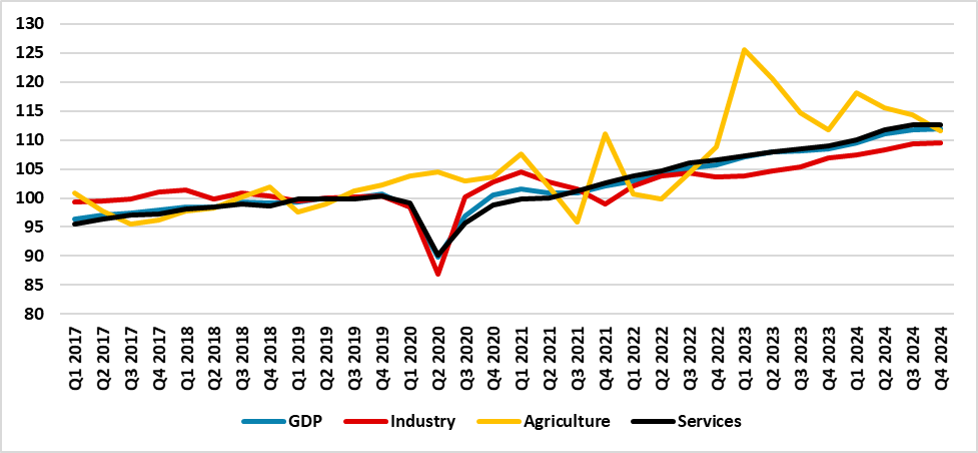

After registering strong growth for two consecutive years, surpassing the 3.0% threshold, discussions in Brazil have now turned to whether the output gap has closed and whether the economy is overheating. Despite a high interest rate, now at 14.25%, inflation is showing signs of acceleration, reaching 5.1% at the moment, with inflation expectations unanchored from the 3.0% BCB target. We have argued (here) that in the last quarter of 2024, the Brazilian economy finally showed signs of deceleration at the margin, which could provide some breathing room for the BCB, which is trying to calibrate the terminal rate.

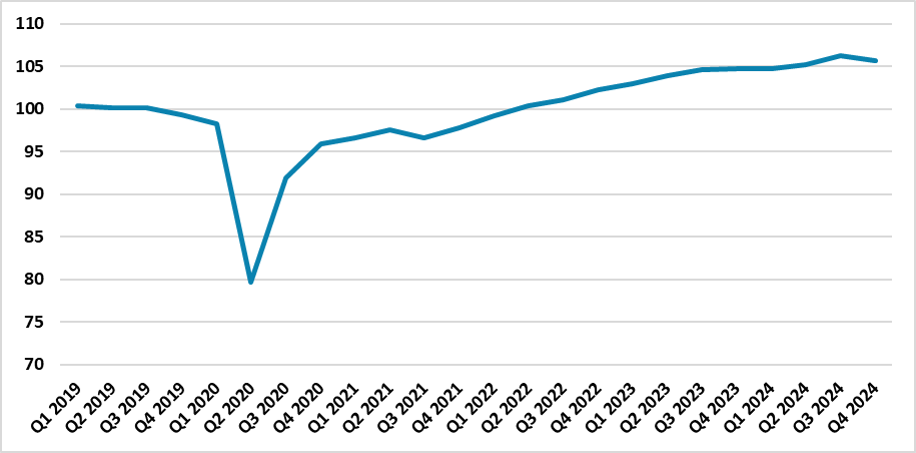

Figure 1: Brazil GDP by Sectors (2019=100, Seasonally Adjusted)

Source: IBGE

We believe the high growth pace seen last year was a mix of idle capacity left over from the 2015-16 crisis and the pandemic, combined with a strong fiscal push seen in the last elections and at the end of 2023, including rising social transfers and the resumption of judicial decision payments (Precatórios). We believe this fiscal push will fade, and growth will be more modest this year, especially in the second half of the year. However, growth in the agricultural sector in the first half of the year and a significant statistical carry-over from 2024 will likely push growth to 2.0% in 2025. In 2026, there will likely be an additional fiscal push, which will likely come from both the federal government and states as Brazil holds general elections, with Presidents and Governors likely increasing investments to try to win elections. However, the poor growth we estimate for the second half of 2025 will leave some statistical effects, resulting in our estimate of 1.7 growth for Brazil in 2026.

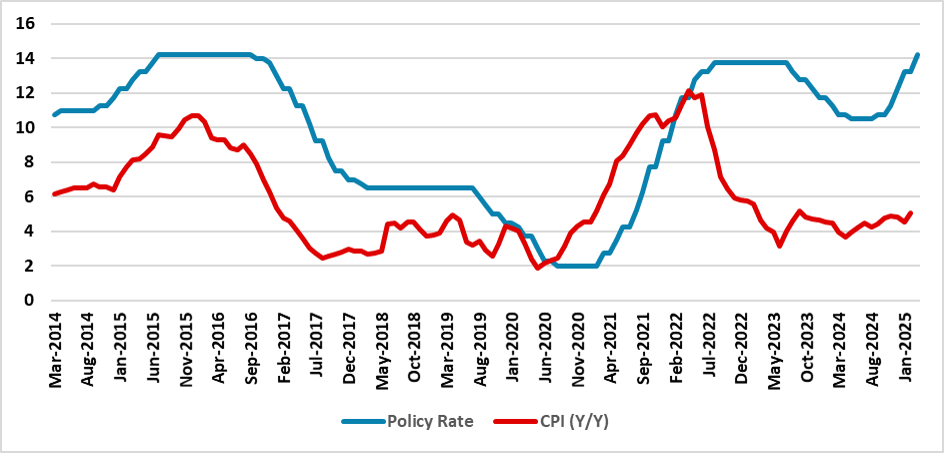

On the inflationary front, food and beverage inflation, which now registers 7.0% annual inflation, has been a concern for government popularity, which has decreased in recent months. However, what worried markets was the overheating of the economy and fiscal risks, which translate into a weak exchange rate, with possible impacts on short-term inflation. Recent movements show a corrective bounce in the exchange rate, which has now moved closer to 5.6 versus the USD. While fiscal risks exist, we believe there has been some overreaction from market participants. We believe the exchange rate is likely to fluctuate around the 5.6 value in the second half of the year, meaning some reversion from the 6.2 maximum it reached in recent months and, therefore, having a limited impact on inflation. Still, some persistence in the labor market in terms of wage increases will likely put some pressure on inflation in the first half of the year. In the second half, we see inflation cooling and finally responding to a very tight monetary policy. We expect inflation to end 2025 at 5.0%, above the BCB's target band and likely implying that the BCB will see inflation above its upper band of 4.5% for six consecutive months, meaning they will miss their continuous target. However, our forecast is quite below market expectations of 5.6%.

Figure 2: Brazil Policy Rate and Inflation (%)

Source: IBGE and BCB

In 2025, we see inflation slowing to 4.1%. The fiscal push will likely put some pressure on inflation, as we believe the economy will not see any idle capacity at that time, but this will be partially offset by a still contractionary monetary policy.

The BCB is now at a crossroads. While the economy gives early signs of deceleration, inflation is moving up and expectations are unanchored. Additionally, the current level of monetary tightening at 14.25% is clearly contractionary. We are of the view that the BCB will likely hike to 15.0% if the economy cools down in the next few months and the exchange rate stabilizes. However, this is our central scenario. If the economy does not cool and inflation continues to rise in the next few months, the BCB will likely end the policy rate at 15.5%, with an additional hike of 50 bps. If the exchange rate depreciates back to levels above 6 USD/BRL, the BCB could extend its hiking cycle to 15.75%. In 2026, we see limited room for the BCB to quickly return to a neutral rate. Unanchored inflation expectations and the projected fiscal push will limit the BCB's capacity to cut, and we believe they will cut by 225 bps, meaning our central scenario for the policy rate now stands at 12.75% for 2026. Only in the scenario of a more significant economic slowdown could the BCB cut more.

Mexico: Between Tariffs and Slow Growth

Claudia Sheinbaum has started her presidency marked by uncertainty shocks. First, the election results were surprising, as her coalition was able to gather a qualified majority (over two-thirds) in both Houses of Congress, meaning they can change the Constitution without negotiating with the opposition. The first amendment approval was regarding judicial reform. Now, all federal judges will be elected by popular vote, including Supreme Court justices, indicating that Claudia Sheinbaum's party, MORENA, will increase its influence on the judiciary system. Another shock was Donald Trump’s election and the constant threats of aggressive 25% tariffs, which had been announced multiple times and then postponed. These two shocks have increased uncertainty in Mexico, translating into less business investment in the short to medium term.

Figure 3: Mexico’s GDP (Seasonally Adjusted, 2019 = 100)

Source: INEGI

Apart from these uncertainty shocks, Mexico has been experiencing slow growth in recent months, with job creation dropping and the economy contracting in the last quarter of the 2024 (here). Mexico’s growth in 2024 decreased to 1.5% as a result of this deceleration, which we believe was due to tight monetary policy and slower growth in demand from the U.S. In the next quarters, we foresee Mexico’s economy continuing to be slow, affected by the uncertainty surrounding the imposition of tariffs and, especially, the relationship with the U.S. We are still skeptical about whether Trump will apply the 25% tariffs on Mexican imports, especially under the USMCA, and it could just be a tactic to renegotiate the deal under better terms for the U.S. However, the prospects of nearshoring and Mexico’s strategy to substitute China in North American value chains, as stated in Plan Mexico (here), are at risk, and this will likely prevent new business investments in Mexico.

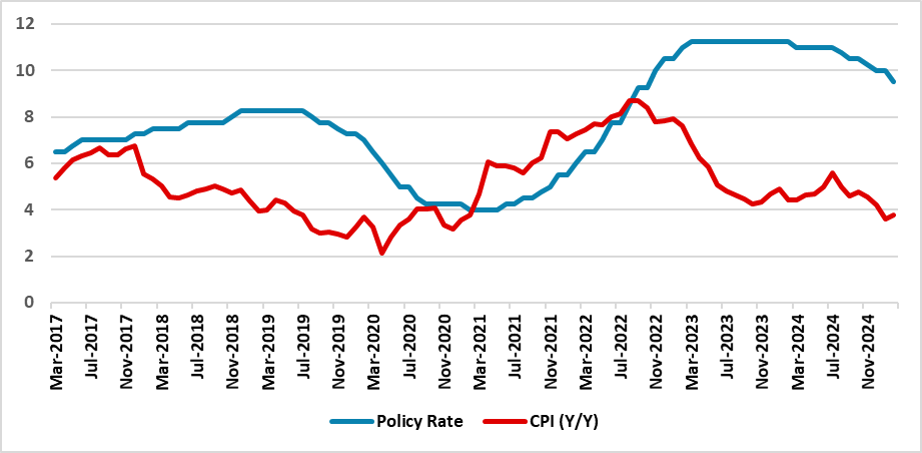

Figure 4: Mexico’s CPI and Policy Rate (%)

Source: INEGI and Banxico

As a consequence, we expect Mexico’s growth to slow to 0.8% in 2025, but we see the risks being downsized. The imposition of the 25% tariffs would likely cause Mexico’s economy to contract by 0.2% in 2025, driven by lower demand. In 2026, we believe Mexico will experience some recovery from the poor growth in 2025, growing 1.8%, led by a less tight monetary policy. Some lagged effects from monetary policy will still constrain growth during this year.

In terms of inflation, Mexico is clearly moving inflation rates back towards the target. Mexico’s Central Bank (Banxico) has been able to cool down the Mexican economy, which is causing both core CPI and the overall CPI to slow. As the economy weakens this year, we expect inflation to slow further in 2025, closing the year at 4.0% (Yr/Yr average). Two potential risks come from this scenario: one is that climate change risks damaging agricultural production, leading to higher food CPI, which could be exacerbated by retaliatory tariffs from Mexico on U.S. agricultural goods exported to Mexico. Another risk comes from the possibility that the exchange rate depreciates quickly in the short term as a flight-to-quality movement occurs after tariffs are firmly imposed on Mexican products. We see the latter as a low-probability risk.

In terms of monetary policy, with inflation more controlled and the economy cooled, Banxico is now focusing on returning the policy rate to neutral levels in a cautious way. We believe they will continue with 50bps cuts until they reach neutral levels. This would mean the policy rate finishing 2025 at 8.0% and 2026 at 7.0%. However, if the economy continues to weaken and inflation falls back more quickly than predicted, Banxico could move toward stimulative levels, lower than the 7.0% neutral level. In this scenario, Banxico would accelerate the pace of cuts to 100bps at some point during the year, meaning the policy rate would finish 2025 at 7.0% and 2026 at 6.0%.

Regarding tariff talks, the Claudia Sheinbaum administration will try to negotiate with the Trump administration to avoid the imposition of tariffs, meaning they would be willing to make concessions. It is still unclear whether the discussions on immigration and drug control are the real demands from Trump and whether any kind of deal can be made, as Trump can behave in an irrational way and he wants to shift production back to the U.S. and raise tax revenues.

Argentina: Moving to Phase Two

After facing a strong recession in the first half of 2024, the Argentine economy has seen some rebound in the second half. We now see Argentine GDP dropping by 1.7% in 2024, a significant reduction from our previous forecast of -4.0%. As inflation slows to around 2.0% and prices seem realigned after the devaluation shock in December 2023, Argentina will likely try to enter phase two of its plan, which involves lifting capital controls, especially access to U.S. dollars by its residents. However, FX reserves are still depleted at USD 29 billion. The level required to lift the controls will likely be around USD 45-50 billion. The government has recently passed an emergency decree allowing the country to approve a new IMF deal. The expectation is that, in the next few months, a new deal will be approved, but lifting capital controls will have to wait until next year, when reserves are stronger.

We are expecting Argentina to maintain the zero fiscal deficit policy, allowing the central bank not to finance the deficit through monetary emissions. Most of the 3.7% growth for 2025 we are now predicting comes from the poor base of comparison in 2024 and the recovery of Mille’s shock plan. Into late 2025, things are more uncertain. So far, the peso is appreciating in real terms, and some sort of controlled devaluation will likely be needed to lift capital controls, but we don’t know its magnitude yet. For the moment, we are forecasting 2.0% growth in 2026, with the baseline being that Argentina is successful in lifting capital controls, which will lead to some optimism and a boost in consumption. There is also a scenario in which, when capital controls are lifted, inflation spikes, and all this optimism fades. We see this scenario with a 30% chance of materializing.

In terms of inflation, the government has been able to reduce inflation to a growth rate of 2.4% monthly. With inertia still high, we believe inflation will converge to 1.0% monthly rate in the second half of the year. With the central bank not fuelling monetary emissions, this will lead to inflation ending 2026 at around 0.8% monthly. Therefore, our forecast for inflation is 37% in 2025 and 14% in 2026. On interest rates, the central bank is more focused on cleaning its balance sheet and stopping printing of pesos, keeping a negative real rate. We forecast the policy rate to end 2025 at 20% and 15% in 2026. We still see no room for dollarization in Argentina.

Midterm elections set to be held in October will be a good thermometer of how the Argentine population evaluates Milei’s shock plan. So far, he has been able to maintain a 50% approval rate, and despite some violent protests seen recently, early polls suggest that his party, La Libertad Avanza, will be able to reach 30% of the seats, a big leap from the current 7%.