Banxico Preview: Inclined to Cut but There Are Risks

The Mexican Central Bank will meet on Aug. 8 to consider a 25 bps rate cut, though risks remain. At 11%, the rate is highly contractionary, impacting job creation and growth. The MXN’s volatility and 10% depreciation since June pose short-term inflation risks, complicating rate cuts. Adverse climate conditions are raising agricultural prices. Market expectations lean towards a cut, but a split decision is likely, with potential for intermittent cuts based on future inflation data.

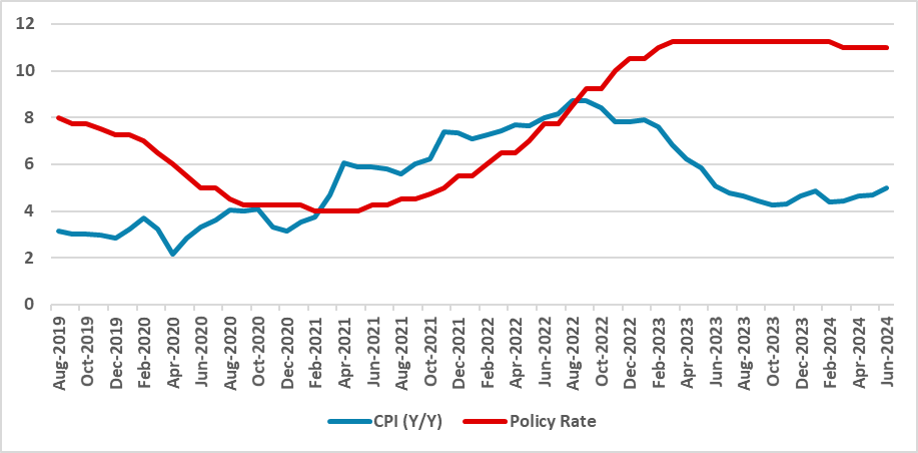

Figure 1: Mexico’s CPI and Policy Rate (%)

Source: BCB and IBGE

The Mexican Central Bank will convene on Aug. 8 to decide the policy rate. A 25 bps cut will be on the table for all members of the board, but some discussion related to the risks of the cut will take place. At 11%, the policy rate in Mexico is clearly contractionary, and we estimate it would take at least a 300 bps reduction to reach near-neutral levels. Indeed, the impact of the contractionary policy rate is starting to be felt in the economy: job creation is decelerating and growth has reduced substantially.

However, new risks have started to appear on the horizon, which could lead some members of Banxico to diverge from the idea of cutting rates. Since the results of the election in June, the MXN has shown strong volatility and is now around the 19 MXN/USD mark. Since June, the Mexican currency has depreciated by around 10%. This could have short-term inflationary effects, and cutting rates when inflation is rising is not the best course of action.

Additionally, adverse climate conditions are taking a toll on agricultural production, raising the prices of some agricultural goods. Although Banxico can do little about this, reducing the level of tightening could help this local inflationary shock in agricultural goods to spread to other sectors.

Banxico President Victoria Rodriguez has been giving interviews stating that Banxico will likely discuss further cuts in the August meeting, and it is clear from the money markets that most of the market expects a cut in August despite the risks. We foresee a split decision from Banxico, with some members voting to continue the pause and others voting to cut by 25 bps. It is important to remember that Banxico cut by 25 bps in May and then paused in June. This pattern of intermittent cuts rather than a continuous cutting movement could continue. If Banxico applies a 25 bps cut but inflation numbers continue to deteriorate in August and September, it is quite possible they will pause in September. That’s why we foresee Banxico applying only two 25 bps cuts in the second half of the year, with the specific dates of the cuts being uncertain.