EM FX Outlook: USD Less in Favor, but EM Mixed

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasional scares on U.S. tariffs. Insufficient slowdown in Turkish inflation will mean that the Turkish Lira will remain under downward pressure. 2026 should see a broadening of USD losses, except against BRL where the Oct presidential election will create uncertainty, and high inflation countries (Russia/Turkey/Argentina).

· The Chinese Yuan (CNY) will likely remain stable while trade negotiations with the U.S. continue. We see a trade deal in our baseline (probably Q4) and then a small rise in CNY v USD due to general USD weakness.

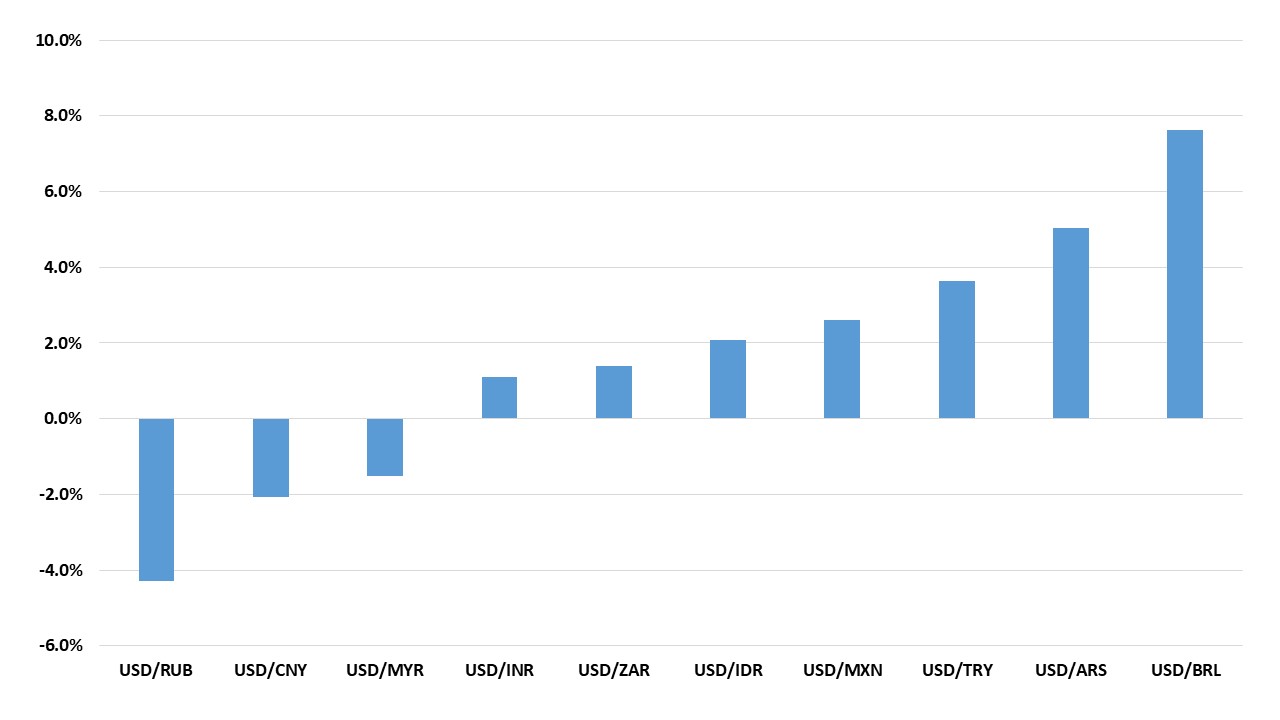

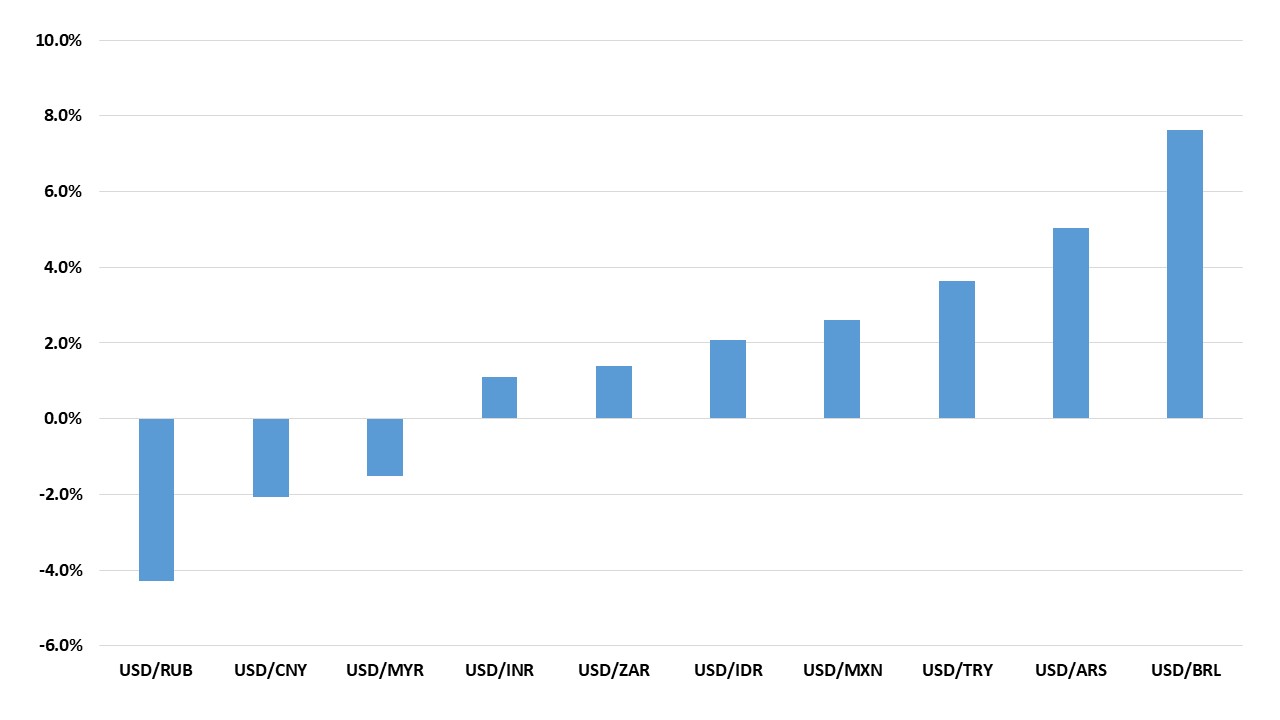

· In terms of total returns for the remainder of 2025, the large yield pick-up for Brazil should see the BRL and MXN making solid total returns (Figure 1), with more volatile positive returns for TRY. Adverse rate differentials mean negative CNY returns. Risks to our views: Negotiations over a trade deal fail and U.S. impose higher sanctions and China allows a controlled depreciation to the 7.50-7.60 area on USD/CNY.

Figure 1: 6mth Total Returns Versus the USD (%)

Source: Continuum Economics

Asia

The Geneva/London trade truce has allowed a shift from penal to 30% tariffs on China’s exports to the U.S. The hard part is reaching a new phase 2 trade deal. Differences of opinion on the size of bilateral trade surplus reduction and whether penalties should be imposed for failure, likely mean a deal will only be achieved eventually around Q4 2025. We attach a 65% probability to such a scenario (here), which could bring the effective tariff rate on China goods for the U.S. to 15-20%. China authorities will want to avoid upsetting the negotiations by undertaking a depreciation against the USD, while tactically the reluctance to use this option in April/May shows that China’s authorities are very wary about depreciation. Nevertheless, interest rate spreads remain large and adverse against the USD (Figure 2), which could mean intermittent softness and we see 7.25 on USD/CNY by end 2025.

Figure 2: USDCNY and 2yr China-U.S. Government Bond Spread (%)

Source: Datastream/Continuum Economics

By 2026 the force starts to change, as we see more Fed easing producing a narrowing of short-end differentials between the U.S. and China. Secondly, we expect USD weakness to broaden across EM, as the era of U.S. exceptionalism is seen to have peaked and the current account deficit requires a lower USD. Thirdly, China inflation is below the U.S. by 2-3% per annum, which means that the Yuan should appreciate against the USD to keep the real exchange rate constant. However, the overall Yuan real exchange rate is still 20% higher than Dec 2007 and so China will be reluctant to accept too much of a Yuan bounce. We see 7.15 on USD/CNY by end 2026.

The INR regained some ground against the USD in April 2025, reversing earlier losses triggered by tariff-related uncertainty. However, continued volatility in US markets is likely to create spillover risks, complicating the Reserve Bank of India’s efforts to manage currency stability. The RBI though retains ample firepower in its foreign-exchange reserves to intervene when needed and temper excess volatility. Yet these buffers are being tested. India’s domestic interest rates are now on a downward trajectory, narrowing the yield differential. At the same time, foreign direct investment momentum has slowed, and institutional flows remain sensitive to global sentiment swings. We expect a managed but steady rupee, reaching USD/INR 86.7 by end-2025. Given expectations of USD weakness in 2026, USD/INR will likely strengthen to 86 by end-2026. Meanwhile, the Indonesian rupiah is expected to remain choppy through H2 2025, with the currency forecast to end-2025 at 16250 USD/IDR helped by a softer USD v EM. While recent appreciation in late May and early June provided a temporary reprieve, the broader outlook remains volatile. Political and policy uncertainty in the US—amplified by Donald Trump’s presidency, unpredictable trade and escalating geopolitical tensions—has heightened volatility across emerging-market currencies. A modest trend recovery in the currency is likely from mid-2026 onward, reflecting a weaker USD. However, domestic headwinds will temper the pace of that rebound. Risk of fiscal slippage will weigh on investor sentiment. Finally, the Malaysian ringgit is likely to preserve its gains in recent months against the USD. Following similar dynamic to the INR, USD/MYR is expected to close 2025 at 4.34, and thereafter strengthen marginally to 4.3 by end-2026.

LatAm: Depreciated Too Far?

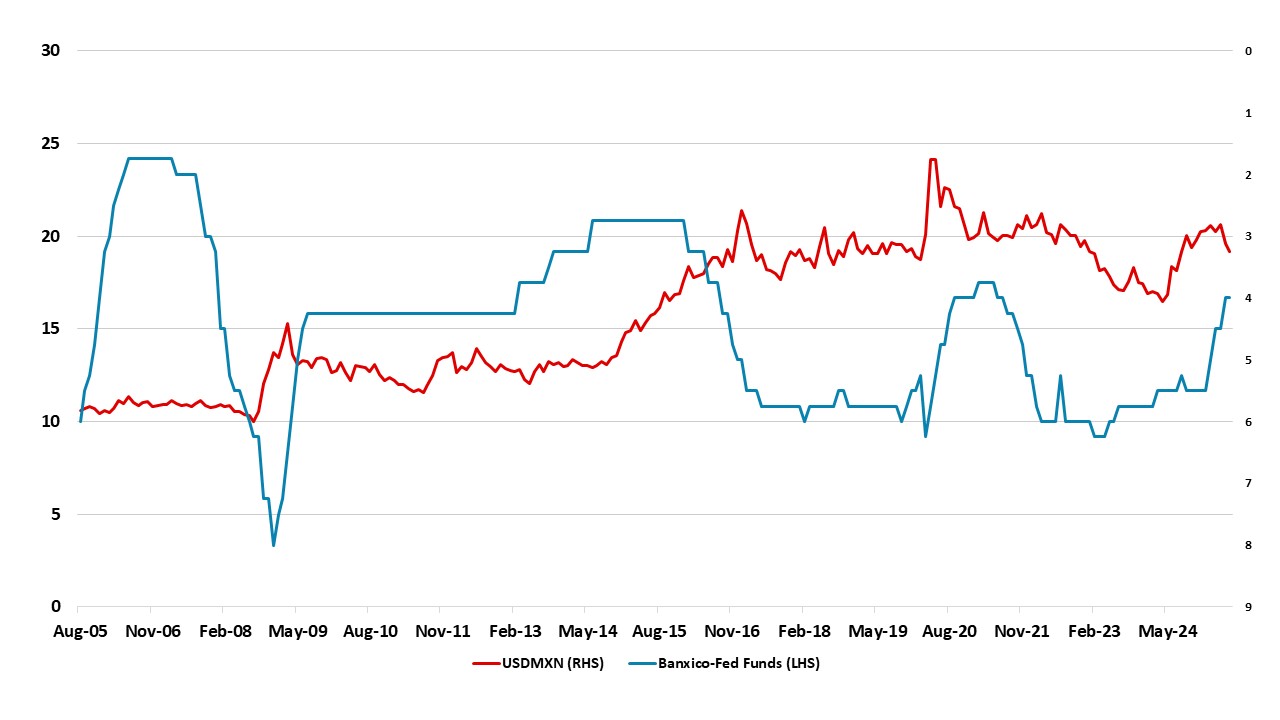

The level of USDMXN now reflects some scope for two way movement, with the real exchange rate now less overvalued than 2023/24. The USD downtrend against DM currencies can spill over to produce some carry trades for the MXN provided that the U.S./Mexico trade tensions do not reignite. We feel that the Trump administration focus is on other countries in the next 3-6 months. Additionally, though the policy rate differentials will continue to narrow with H2 Banxico easing, we see this dipping just below 4% before the Fed starts easing in December and in 2026 Banxico easing will only be marginally faster than the Fed. This is not the policy rate narrowing that occurred 2014-15 that caused MXN trend weakness (Figure 3). We see modest MXN appreciation in H2 to 19.15.

2026 is not straightforward, as Trump will want to revise the USMCA deal and this could involve extra tariff threats and action. This can produce volatility for the MXN and intermittent weakness. However, Mexico’s administration will try its best to avoid a trade war and will be flexible on USMCA and try to avoid any lasting damage. USMCA drama should turn into a new deal and MXN can see some recovery from any intra year weakness to 18.80 by end 2026.

Figure 3: Mexico Exchange Rate, 10-year Yield Spread, and Policy Rate Spread with U.S

Source: Datastream and Continuum Economics

The BRL has scope to appreciate modestly against the USD in H2 2025, as BCB stick with ultra-high interest rates and a wide interest rate differential that can encourage carry trades. Although, 50% tariffs on steel and aluminium could harm some parts of Brazilian economy, those exports represent a small portion of Brazil’s overall exports. Economic slowdown could also build the narrative that inflation pressures should ease into 2026 and reduce pressure on Brazil. We can see 5.40 by end 2025 on USDBRL.

However, further BRL gains will be restrained by the approach of the Oct 2026 presidential election. Lula’s bias is fiscal slippage in 2026 to help boost his flagging poll rating. This will leave the BCB cautious in its easing, but also this can strain Brazil’s fiscal consolidation. The outcome could be a choppy performance, though Q1 should see carry trade dominating for further small/modest appreciation. End 2026 USD/BRL is dependent on the 2 round outcome with early polls suggest a Lula/Freitas run off in a close race. USD/BRL is forecast at 5.60 end 2026.

EMEA

EMEA currencies will continue to be divergent depending on inflation and interest rate differentials, and H2 2025 will likely see more divergence across EMEA given global uncertainties facing the world economy in terms of both the impact of tariffs and geopolitics.

We expect the downward pressure will remain for TRY and RUB as inflation differentials remain large. We envisage RUB would remain volatile in H2 since inflationary pressures won’t likely soften significantly and macroeconomic instability will remain substantial. We foresee a ceasefire in Ukraine as unlikely in 2025; and we expect a continued RUB recovery requires a full-scale peace deal together with the decision to lift sanctions against the Russian economy, which will likely take years. RUB will still be falling on a spot basis in H2 2025 and 2026 due to inflation differentials coupled with foreign capital inflows likely remaining weak until the Ukraine war is totally over and sanctions are lifted. We have hiked our end year USD/RUB rate prediction to 86 and 93 for 2025 and 2026, respectively.

When it comes to TRY, we continue to see losses for TRY in 2025 and 2026 as inflation remains much higher than Turkiye’s main trading partners, the current account deficit (CAD) is widening, foreign capital inflow remains weaker-than-expected and domestic uncertainties dominate. Ekrem Imamoglu’s arrest risked the disinflationary process, caused TRY to plunge in Q2, and triggered market losses coupled with loss in investor confidence. In H2, TRY will still be falling on a spot basis but at a slower pace than the interest rate differentials against the USD, since we expect CBRT will recommence its cutting cycle in H2, but at a cautious pace due to stickiness in inflation and domestic and geopolitical risks. Our end year key rate prediction for 2025 and 2026 remain at 34% and 21%, respectively. We increased our predictions for the USD/TRY rate at 43.5 by the end of 2025, and 49 for end 2026. (Note: Inflation could stay above expectations due to sticky food and services prices and adverse geopolitical developments, which would mean more TRY depreciation than our central scenario).

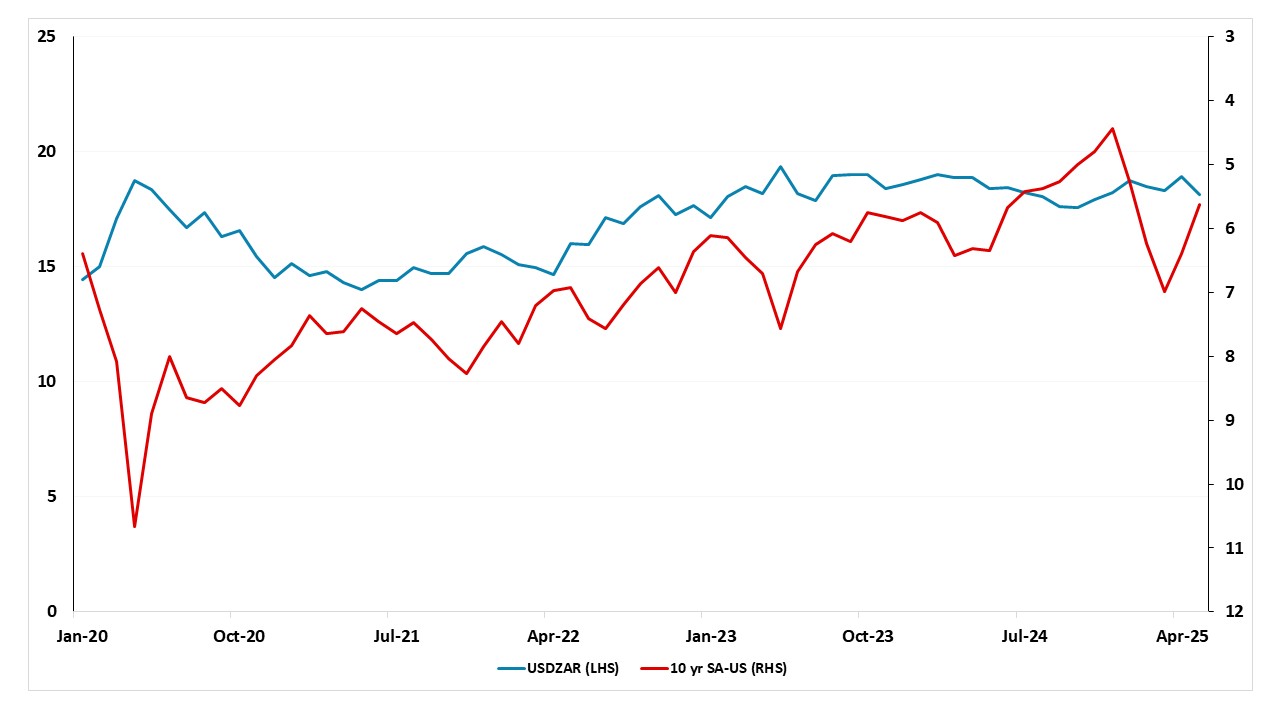

Turning to South Africa, we think the South African Reserve Bank (SARB) will continue its cutting cycle in H2 if domestic inflation continues hovering around the SARB target as inflation differentials remain modest against the U.S. despite the return of power cuts (loadshedding). Despite DM easing cycles continuing, we think SARB will have to be cautious due to global uncertainties like geopolitical risks and tariff wars, which could slow SARB policy easing. 30% additional tariffs by the U.S. over South Africa-origin products after the 90 days-pause could also hit South Africa’s exports causing ZAR to lose value. On the upside, if Trump relents on tariffs, inflation is contained and there is a big improvement in the geopolitical situation, we are likely to see a more risk positive picture emerging with ZAR in H2. This might require an improvement in the Iran crisis. We expect the South African economy will continue to be supported by a trade surplus coupled with a higher FDI and equity flows thanks to increasing investor appetite. Taking into account that we foresee a Dollar downtrend and three rate cuts by the Fed in 2026, our end year USD/ZAR rate prediction stands at 18.10 for 2025, and 18.05 for 2026. The key for ZAR in H2 will be U.S. tariffs, global uncertainty, and inflation.

Figure 4: USD/ZAR Rate and 10yr South Africa-U.S. Government Bond Yield (%)

Source: DataStream/Continuum Economics