Mexico GDP Review: Slow Growth in Continues

Mexico's GDP grew by just 0.2% in Q2 2024, with Industry and Services up 0.3% but Agriculture down 1.7%. The economy shows signs of deceleration, especially in agriculture due to extreme climate conditions, despite rising wages. The detailed data is pending, but a slowdown in investment and consumption is evident. Nearshoring prospects hinge on U.S. election outcomes and Mexican reforms, with potential risks if U.S.-Mexico relations worsen or investors remain wary of domestic changes.

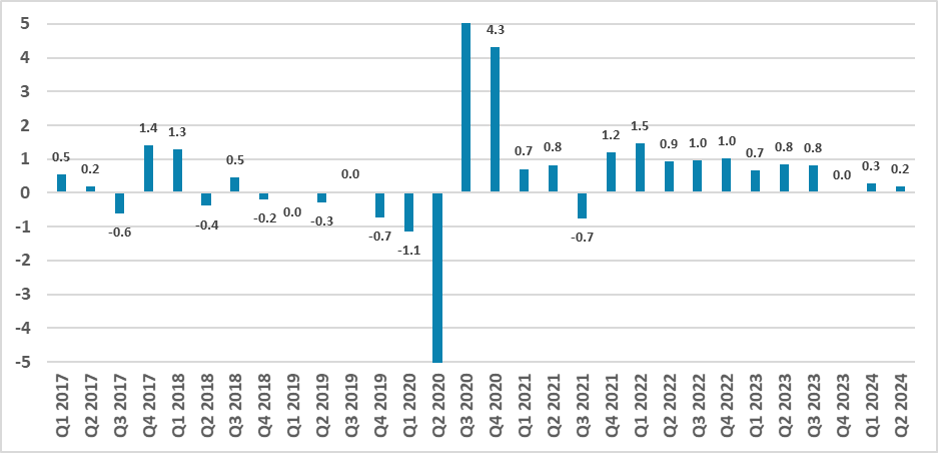

Figure 1: Mexico GDP Growth (q/q, %)

Source: INEGI

The Mexico National Institute of Statistics (INEGI) has released the preliminary GDP data for the second quarter of 2024. The data points out that the Mexican GDP grew by only 0.2% in the second quarter of the year, continuing a trajectory of slow growth seen in recent quarters. While Industry and Services both grew by 0.3%, the Agricultural sector contracted by 1.7% in the quarter. Lower agricultural production is pressing the prices of agricultural goods, which have accumulated around a 30% price increase in the fruits and vegetables group over the last 12 months.

The GDP data only confirms what we were seeing in the high-frequency data: Mexico's economy is decelerating compared to the previous year. The Industrial sector, which is well connected to the U.S., is also suffering from the deceleration in the U.S. Additionally, employment numbers are showing signs of deceleration, although wages are increasing. The contraction in the Agricultural sector could be explained by unfavorable conditions in Mexico’s rural areas, which are facing extreme climate conditions.

The detailed data by subsectors and from the demand side is yet to come out, but we believe the general picture shows slower demand as investments are falling while consumption tends to decelerate a bit. We are still expecting some construction sectors to prompt a bit of growth in the second quarter, and some recovery in the Agricultural sector is likely.

In the longer term, most of the discussion will be centered around the nearshoring prospects. It seems that the announced investments in the country are yet to kick in and await the results of the U.S. elections and the conclusion of some institutional reforms in Mexico. In the case of a Trump victory in the U.S. and a more hostile relationship with the U.S., the nearshoring prospects could be jeopardized. Additionally, investors are not well aligned with the reforms in the judicial system in Mexico, and some concerns about institutional reform in the electricity sector in Mexico are not well aligned with the T-MEC deal. There are still a lot of cards to be played when we look at nearshoring.