Mexico CPI Review: Signs of Disinflation

Mexico’s November CPI rose 0.4%, lowering the Y/Y rate to 4.6% from 4.8% in October. Non-core inflation increased 1.7%, driven by energy costs and seasonal electricity tariff adjustments, while core inflation remained flat, with core goods contracting 0.3%. Key declines occurred in Domestic Goods and Clothing, while Housing rose 1.7%. Banxico may consider accelerating rate cuts if inflation continues its downward trend, though fiscal risks and weak domestic demand could shape 2025 policy. Y/Y CPI is projected to end 2024 at 4.4%.

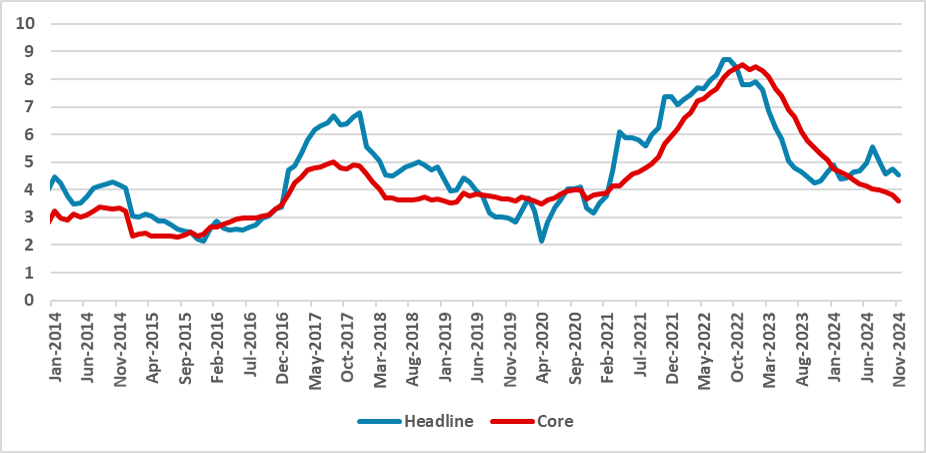

Figure 1: Mexico CPI (%, Y/Y)

Source: INEGI

Mexico’s Statistics Institute has released the CPI data for November. The data indicates that the CPI grew by 0.4% in November, causing the year-over-year (Y/Y) index to decline to 4.6% from 4.8% in October. Most of the increase was concentrated in the non-core group, which grew by 1.7% in November, driven by higher energy costs. This trend is common in November due to adjustments in electricity tariffs during winter, linked to higher thermoelectric costs. Agricultural goods grew by 0.7%, likely due to adverse climatic conditions.

The good news came from the core group, where the index remained flat (0%) in November. The Y/Y core CPI dropped to 3.5% from 3.8% in October, driven primarily by a contraction in core goods, which fell by 0.3% during the month, resulting in an annual variation of 2.8%. Services grew by 0.3%, a figure compatible with the 3% annual target, but still accumulated a 4.9% Y/Y growth.

Looking at specific groups, the largest declines occurred in Domestic Goods (-1.0%) and Clothing (-0.9%), while the most significant increase was in the Housing group (+1.7%), influenced by the rise in electricity costs. The Food and Beverages group grew by 0.4% during the month, and Other Services increased by 0.7%. The highest annual inflation (+6.3%) was observed in Other Services, which appears to still be catching up with higher prices. Once this adjustment finishes, we expect this group to align with others, registering lower inflation levels.

November's CPI numbers clearly show that lower demand is finally translating into a downward trend in the CPI, particularly in the core group, which is closely monitored by Mexico’s Central Bank (Banxico). With a projected 0.5% CPI growth in December, the Y/Y CPI is expected to end the year at 4.4%. Although this is far from the 3.0% target but it does indicate signs of convergence.

The lower inflation could give Banxico the confidence to increase the pace of rate cuts from the current 25 basis points (bps) to 50 bps, though it could be a narrow decision. If inflation continues its downward trend and the Mexican economy weakens further, especially domestically, Banxico could move towards a neutral stance even in 2025, although this is not yet our central scenario. We continue to expect Banxico to maintain a 25 bps pace of rate cuts into 2025, as it is likely to start focusing on fiscal risks and the impact of the fiscal adjustment announced for this year.