Mexico: Inflation Report Shows Confidence in Cuts

Banxico's latest report reveals a weaker growth outlook, with a 2024 forecast cut to 1.4% and further weakening expected in 2025. Despite rising non-core CPI, inflation remains controlled. Banxico is likely to continue rate cuts, aiming for a year-end policy rate of 10.25%, amid moderate inflation concerns.

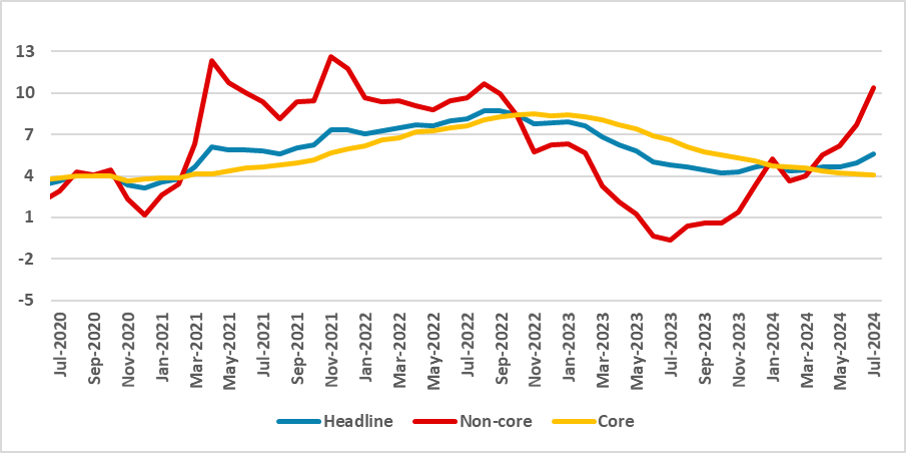

Figure 1: Mexico’s CPI (%, Y/Y)

Source: INEGI

Mexico's Central Bank (Banxico) has released its quarterly inflation report, providing important insights into Banxico's thinking. First of all, Banxico has lowered its growth forecast from 2.4% to 1.4%, highlighting the weakening of internal demand. Moreover, they believe the economy will weaken further in 2025, growing by only 1.2%. Additionally, their estimation of the output gap is becoming less negative.

Regarding inflation, they point out that the recent rise in the headline index was entirely related to the increase in the non-core component of the CPI, as the Core CPI continued to decline. According to their extreme-shock index, the shocks to the non-core CPI were not generalized. Therefore, their view on the recent inflationary episode is somewhat benign.

In terms of monetary policy, Banxico emphasized that inflation expectations are anchored slightly above the 3.0% target, at 3.5%. Furthermore, the recent volatility in international markets has contributed to the depreciation of the Mexican peso.

Interestingly, the report includes two sections related to the pass-through of exchange rates to the CPI and the pass-through from the non-core CPI to the core CPI. In both cases, the sections highlighted that the pass-through is not significant and has overall decreased in recent times.

In conclusion, the inflation report indicates that Banxico is comfortable with continuing rate cuts, the economy is weakening, and the recent surges in non-core CPI and the depreciation of the exchange rate will not pose significant problems. We continue to expect two additional 25bps cuts before the end of the year, meaning the policy rate will finish the year at 10.25%.