Food Glorious Food

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited room to grow domestic food production. While more U.S. food imports are tactically attractive as part of any U.S. trade deal, strategically China will want to secure Brazil and Russian imports.

Lower growth in food prices has helped CPI inflation trends in a number of countries. What is the outlook?

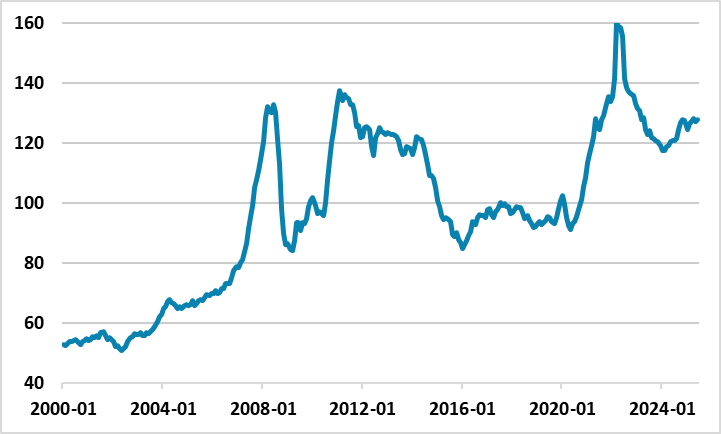

Figure 1: FAO World Food Price Index (USD Blns)

Source: FAO

Raw agriculture prices globally (Figure 1) have come down from the Ukraine war peaks and are now stable, as global food demand is being meet by production and inventories. In some countries this has feedthrough to reduce CPI inflation, though the situation varies due to country differences in food demand/supply/weather and also to other cost considerations further along the food production chain. What is the outlook for the future?

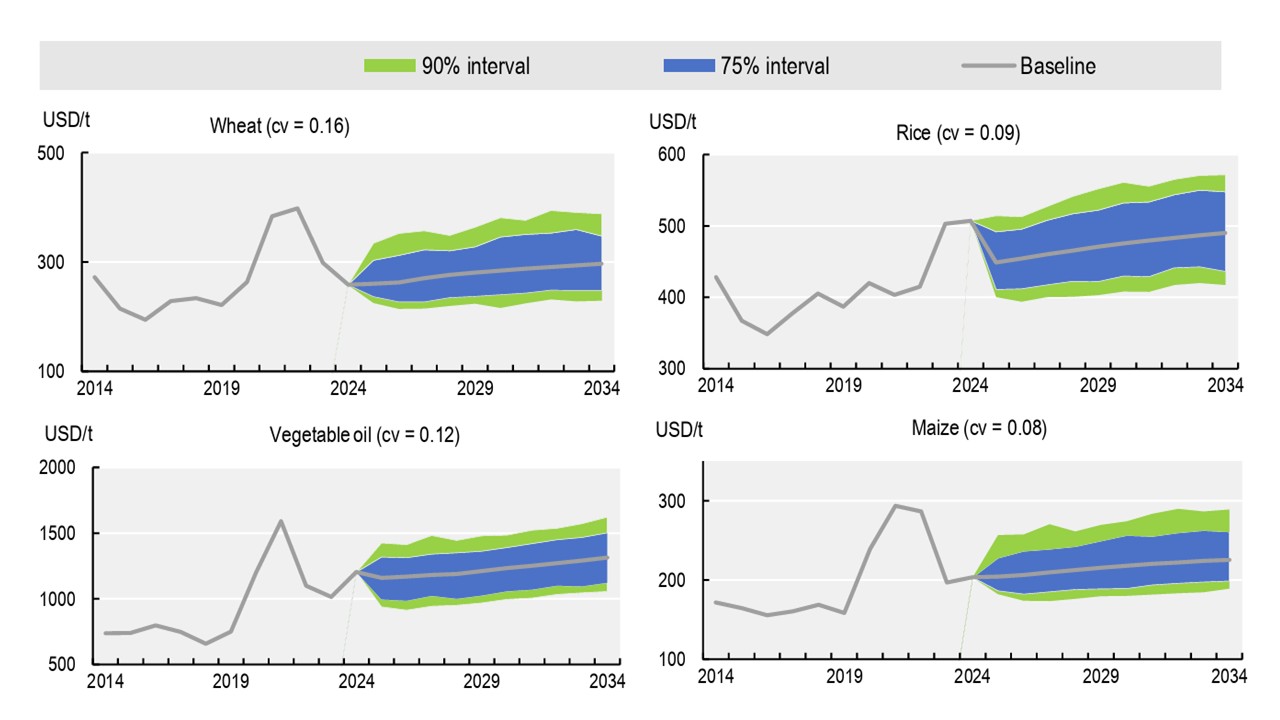

Food demand increases annual due to global population growth, but also as middle income EM countries consume more calories per person per day with rising income levels. The latest OECD/FAO 2025-34 agricultural report forecast a 13% rise in food demand by 2034. The good news is that a 14% rise is forecast in food production over the same period, if modern farming techniques become more widespread (e.g. technology, optimal water and fertilizers). This in turn produce a forecast of gentle price rise for raw agricultural commodities in nominal terms (Figure 2) and real price decline.

Figure 2: Baseline Price Forecasts and Distribution (USD/T)

Source: OCED/FAO Agriculture 2025-34 report (here)

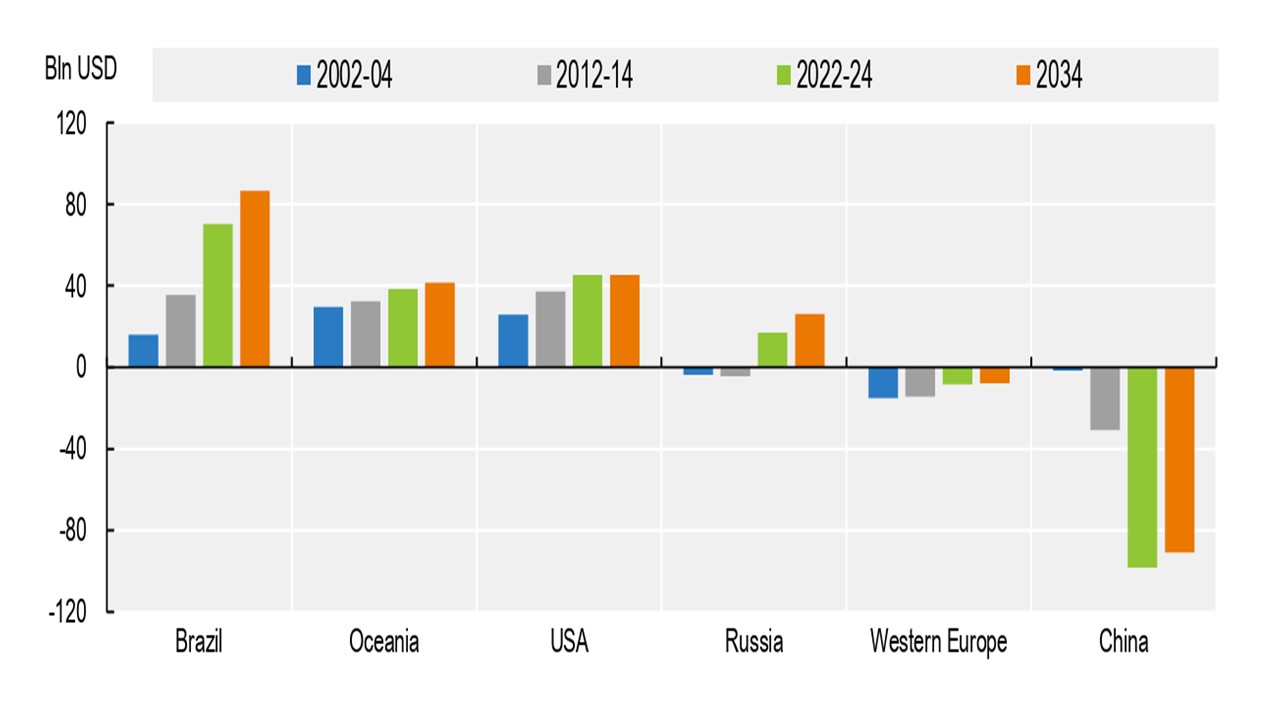

While this backdrop is comforting, some tensions still exist. China has largely maximized land usage and modern farming techniques, which means it is a persistent net importer of food (Figure 3). While this is not projected to worsen, it will still leave China working to import food securely. Food is an emotion and political issue for China’s authorities, given the 1959-61 famine caused by the great leap forward. Policies are designed to prioritize China’s food production. Though tactically China could buy more U.S. food as part of a trade deal (here), strategically it will want to avoid become too dependent on U.S. food imports and this suggest a major long-term role for Brazil and Russia.

Figure 3: Real Net Trade in Agricultural Commodities (USD Blns)

Source: OCED/FAO Agriculture 2025-34 report (here)