Mexico: Labour Market Decelerating as Expected

Mexico's labor market remains strong with an unemployment rate of 2.7%, but signs of deceleration are emerging. Worker affiliation to the pension system and wage growth are slowing, and some job creation stagnation is expected, potentially pushing the unemployment rate above 3%. A technical recession in Q1 is a possibility, though exports to the U.S. could offer some support. Banxico is likely to continue cutting interest rates to neutral levels in 2025, though risks from the U.S. remain.

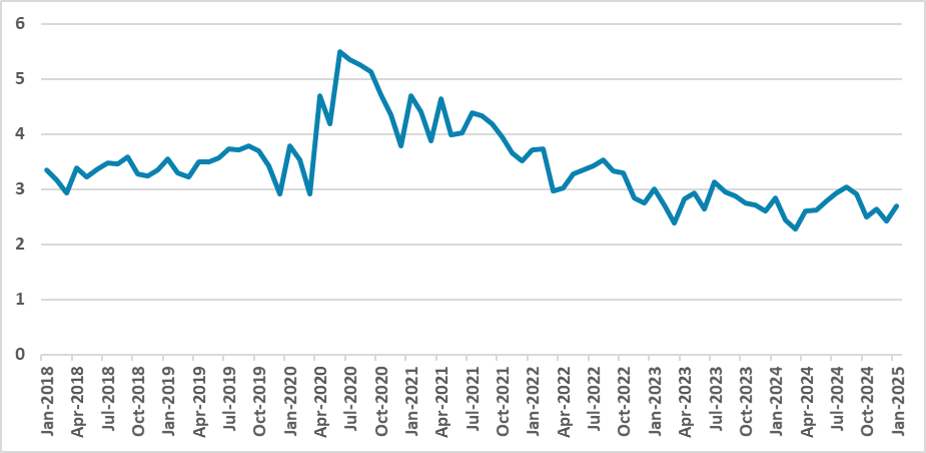

Figure 1: Mexico’s Unemployment Rate

Source: INEGI

Data shows that Mexico’s labor market remains strong, with the unemployment rate registering only 2.7%. However, we also see signs that the labor market is finally decelerating. Although employment is high, the number of workers affiliated with the pension system, which is more closely related to formal jobs, is clearly decelerating, significantly reducing from the early months. Wage growth is also showing signs of cooling a bit and is currently below double digits. We continue to see Mexico’s labor market experiencing some degree of tightening, but the lagged effects of a very tight monetary policy are likely feeding through, and we expect this deceleration scenario to continue through 2025.

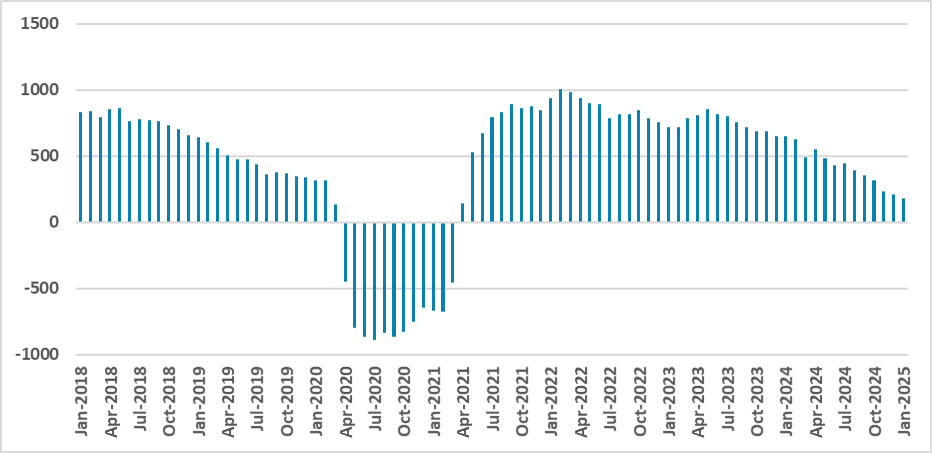

Figure 2: Formal Jobs Creation (12-months sum, Thousands)

Source: IMSS

With labor markets corroborating the deceleration scenario, questions start to arise about whether we will see a technical recession in Q1, as the economy contracted 0.6% (q/q) in Q4. Early data suggests that companies in Mexico are advancing exports to the U.S. to avoid the promised tariffs from Donald Trump. This could inject some demand into the Mexican economy during the first quarter, although we believe the growth scenario will generally remain weak.

We still need to see how the deceleration will affect the labor market moving forward. We believe we will likely see some stagnation in job creation, which will likely push the unemployment rate up a bit, probably above the 3% mark. Some slack could also be observed if immigrants return to Mexico or if people seeking to reach the U.S. stay in Mexico. However, it seems that for Mexico to absorb additional labor, relations with the U.S. need to remain close, and U.S. demand must continue to drive Mexico’s production through the value chains.

Looking at Banxico, we believe the data coming out will give Banxico confidence to continue cutting the policy rate at a 50 bps pace and bring it to neutral levels in 2025. It seems to be the consensus that the trend for inflation is converging, although a depreciation of the exchange rate and shaky relations with the U.S. under the Trump administration pose a non-negligible risk.