Banxico Review: 25bps Cut Amid the Risk

Banxico narrowly voted (3-2) to cut the policy rate by 25bps, despite rising headline inflation and peso depreciation. Core inflation is declining, standing at 4% year-over-year, with expectations of further decreases. Inflation is projected to hit the 3% target by Q4 2025. Future rate decisions will be data-dependent, with another 25bps cut possible in September if economic slowing down continues and core inflation keeps falling.

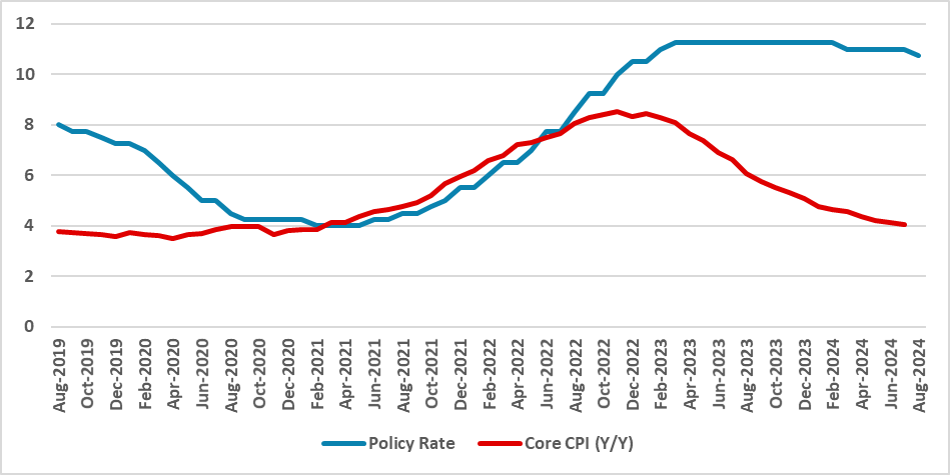

Figure 1: Mexico’s Policy Rate and Core CPI (%)

Source: Banxico and INEGI

The Central Bank of Mexico (Banxico) has convened to decide the policy rate. In a split decision, the option to cut the policy rate by 25 basis points (bps) emerged victorious, but with a narrow margin of 3 votes to 2. In our previous analysis (here), we stated that Banxico was inclined to cut rates based on their recent communications and interviews given by its members. However, the rise in headline inflation (here) and the depreciation of the Mexican peso in light of recent global market events could have led some members to reconsider and favor prolonging the pause. Nevertheless, this was not the case.

Banxico emphasized that despite the rise in headline inflation, core inflation has been exhibiting a favorable trend and continues to decline. Currently, it registers a 4.0% year-over-year increase, and according to Banxico's forecasts, it will continue to fall in the coming months. However, a similar argument could have been made to justify a rate cut in May and June. Another factor Banxico might have considered is the deceleration of the Mexican economy, both in terms of job creation and output. This scenario was not as evident now as it was two months ago.

According to Banxico, inflation will only converge to the 3.0% target in the fourth quarter of 2025. In their balance of risks, they cited upward risks such as the persistence of core inflation, exchange rate depreciation, cost pressures, climate tensions, and geopolitical risks. On the downside, they cited slower economic activity, lower cost pass-through, and reduced exchange rate pass-through to inflation. They admitted that their balance of risks is skewed to the upside, which somewhat contradicts their dovish decision to cut rates.

The communiqué concluded by stating that the discussion of continuing rate cuts will be on the table at their next meeting, suggesting that future decisions will be data-dependent. Although it is difficult to predict the intentions of a divided board, it seems likely that if economic activity continues to slow and core inflation continues to decline, they will likely repeat the 25bps cut in September. However, before updating our policy rate forecasts, we will wait for the minutes to be released to gather more information.