Banxico Review: 25bps Cut as Expected, But Not Unanimous

Banxico cut the policy rate by 25 bps to 10.5%, but the decision was not unanimous, with one dissenter favoring a higher rate. Weak domestic growth and softening core CPI suggest further cuts are likely, though caution is needed due to market volatility. Banxico’s minutes will provide more clarity on future policy direction.

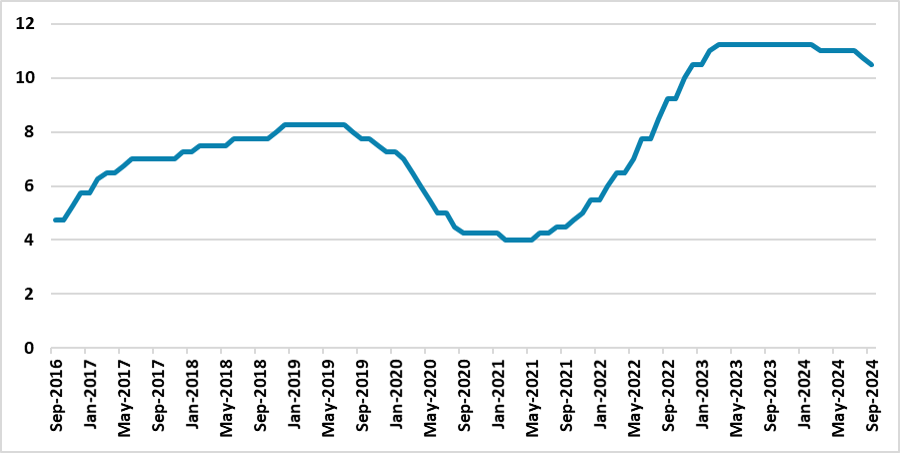

Figure 1: Mexico’s Policy Rate

Source: Banxico

Mexico’s Central Bank (Banxico) convened to decide on the policy rate (Overnight). In line with market expectations, Banxico opted to cut the policy rate by 25 basis points (bps), lowering it to 10.5%. However, the decision was not unanimous, with one dissident voting to maintain the policy rate at 10.75%.

Regarding foreign markets, the communiqué stated that growth in the third quarter is expected to be similar to that of the second, and that most central banks have opted to cut interest rates. Additionally, inflation in advanced economies is approaching target levels, while volatility has decreased. However, the Mexican peso (MXN) has exhibited marked volatility since the last Banxico meeting, and no mention was made of the potential impacts of the judicial reform (here).

On the domestic front, the communiqué emphasized the weakness of the Mexican economy, with employment numbers decelerating and uncertainty persisting in both external and domestic markets. Risks to growth are tilted to the downside. Interestingly, in Banxico’s balance of risks, inflationary risks remain biased to the upside, although board members acknowledged that these risks have diminished significantly. Their outlook suggests that core CPI will continue to decline in the coming months, which somewhat contradicts their upward-biased risk assessment.

The combination of a weakening economy and softening core CPI will likely allow Banxico to continue cutting rates, although caution will be needed, as U.S. elections could introduce some volatility toward the end of the year. The dissident vote also suggests that while the cutting cycle is expected to continue at the upcoming meeting, any discussion of accelerating the pace of cuts may be postponed until next year.

We are looking forward to the minutes, as they will provide more clarity on Banxico’s thinking. In particular, it will be important to understand the reasoning behind the dissident vote: whether it was precautionary—meaning that while the dissident shares similar views with his colleagues, he preferred to wait longer before resuming cuts—or whether he sees risks that could lead him to vote against further cuts at the next meeting. Overall, we continue to expect rate cuts of 25 bps, with the policy rate ending 2024 at 10.0%.