Banxico Minutes: More Slack Could Give Room for Rate Cuts

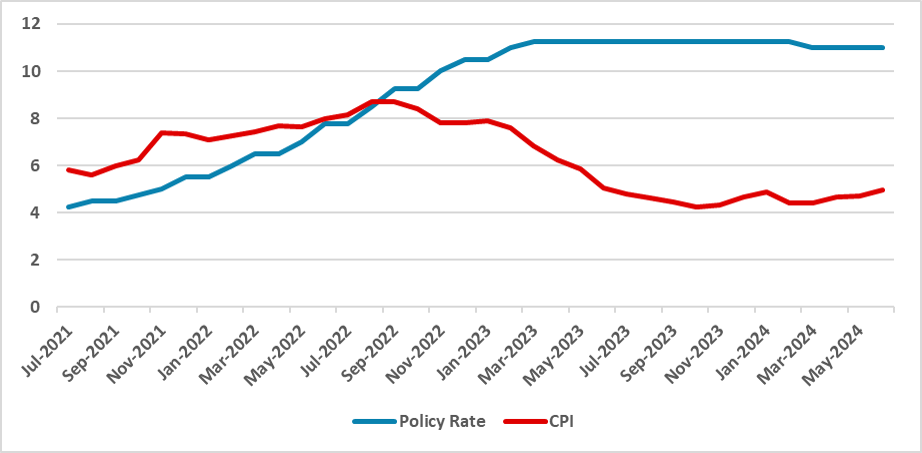

Banxico kept the policy rate unchanged at 11.0% but showed a slightly dovish tone, hinting at possible cuts in August. June's CPI figures revealed a widening gap between core and non-core inflation. Despite recent economic slowdowns and the MXN Peso's depreciation, Banxico expects economic slack to increase, providing room for rate cuts. Most board members are cautious about non-core inflation, but if July’s CPI stabilizes, a 25bps cut could occur although this is not our baseline.

Figure 1: Mexico’s CPI and Policy Rate (%)

Source: INEGI and Banxico

The Mexico Central Bank (Banxico) has released the minutes of their last meeting, in which they kept the policy rate unchanged at 11.0%. Overall, the minutes had a slightly more dovish tone than the communique, with several members discussing the possibility of cuts in their next meeting in August. Given the 14-day span between the communique and the meeting, new events occurred, such as the CPI figures for June, in which the dichotomy between core and non-core CPI widened. Additionally, several members of the Banxico board gave interviews indicating that the discussion for lowering the rate will be on the table in August. The money market curve still shows expectations of only two 25bps cuts for this year, indicating that most do not believe in an early cut in August.

Two weeks ago, markets were still dealing with expectations of fewer cuts from the Fed, which increased the volatility in external markets. This effect was compounded by the idiosyncratic shock of the election result, causing the MXN Peso to lose significant ground. Some members highlighted that the effect of this depreciation might not be strong for inflation in Mexico and that this effect was partially reversed. Now that the U.S. CPI has been released, markets will review their expectations and likely start to forecast three cuts from the Fed. This will probably provide some relief for the MXN and diminish possible inflationary shocks.

All the board members highlighted the decrease in Mexican economic dynamism. There have been three consecutive quarters of the Mexican economy showing a slowdown. The board admitted that growth risks are now biased towards the downside, which will diminish the tightness of the economy. Banxico now expects the gap to slacken in the second half of the year, providing additional room for cuts.

On the inflationary front, most members highlighted that the recent increase in inflation was due to the non-core group, while the core CPI continued to decrease. This trend intensified in the June inflation, especially in the agricultural group. While the board acknowledges that they have little control over such shocks, we believe that if the July CPI repeats the increase in agricultural goods, the board could extend the pause in August and justify it by stating they need additional data to assess whether these shocks are spreading to other groups.

The only governor to vote against the pause was Oscar Mejia, who voted for a 25bps cut. His statements in the minutes indicated that since the Mexican economy is expected to see more slack moving forward and core CPI continues to slow down, the board shouldn’t prioritize the movement in non-core CPI regarding their monetary policy stance. Additionally, he suggested that specific volatility in the exchange rate should be dealt with using instruments other than the policy rate.

We maintain our view that there will be two additional cuts by the end of the year, and the Mexico policy rate will likely finish the year at 10.5%. We believe the board will wait until September to implement the first cut. However, if the rise in inflation reverses in July, we can see a clear case for a 25bps cut with a 3 to 2 vote in that regard.