Mexico: FDI Increases but No Sign of Nearshoring

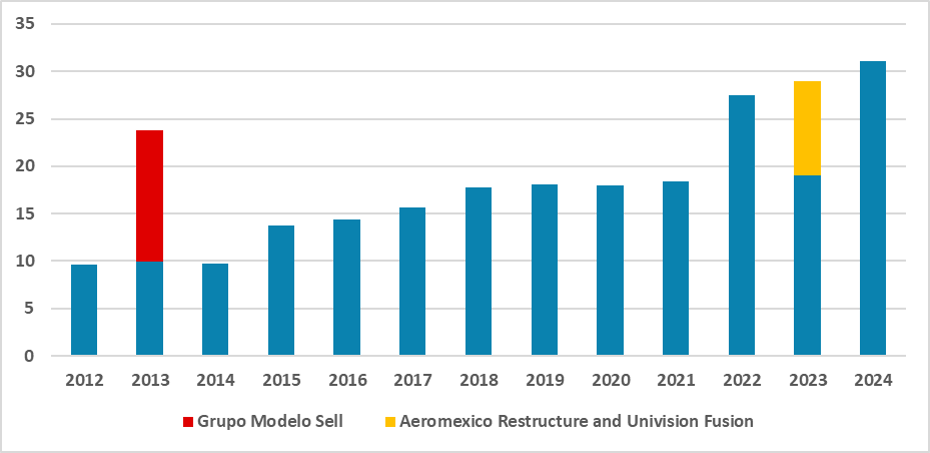

Mexico's FDI reached USD 31 billion in the first half of 2024, a 7% increase from 2023. However, this figure may be inflated by not accounting for USD inflation, potentially reducing real growth. While nearshoring discussions continue, current FDI largely reflects reinvestment by existing foreign firms rather than new investments. Effective nearshoring would require fresh investments and new industries, which are not yet evident. The U.S.-Mexico relationship remains crucial, with potential political shifts impacting future developments.

Figure 1: Q2 FDI (USD Bln)

Source: Economy Secretary

Mexico’s Economy Secretary has released information on Foreign Direct Investment (FDI) in Mexico. According to the data, Mexico has recorded the highest level of FDI flow in the first half of 2024. The total amount reached USD 31 billion in 2024, which is 7% higher than in the same period of 2023. However, it is important to note that this figure may include some distortions. First, this number does not account for USD inflation, meaning that this growth in real terms could be significantly lower.

Much has been said about nearshoring in Mexico. With U.S. companies wanting to nearshore their value-chain production, Mexico, which has close ties with the U.S. and a free-trade agreement with them (TMEC), is a clear candidate for U.S. enterprises to nearshore and move away from Asian value-chains. However, this would require the introduction of new high-tech industries in Mexico, meaning Mexico would need to develop new human capital skills and establish new plants from new industries. This process would not be instantaneous and would likely require several years of growth and investment.

We have been advocating that the nearshoring we are observing in Mexico is primarily an expansion of the industries already established in Mexico, with these industries increasing their production capacity for the U.S. The latest data supports this view. Approximately 95% of the FDI flows into Mexico came from the reinvestment of profits by foreign firms already established in Mexico. Additionally, these companies likely responded only to higher demand from the U.S. in 2023. While this reinvestment could enhance Mexico’s export capacity to the U.S., it is a clear sign that new value-chains are not being established in Mexico.

For nearshoring to occur effectively, we need to see new investment plans from industries outside Mexico. TESLA has announced the construction of a plant in Mexico but has yet to specify when construction will begin. Beyond some initial discussions about developing microchip facilities in Mexico, there has not been much progress in terms of fresh plants from foreign companies. We believe that the prospect of nearshoring will remain on the market’s radar in the coming years, but its realization has yet to become evident. It is worth noting that the relationship between Mexico and the U.S. is crucial for nearshoring, and a potential victory for Donald Trump in the U.S. could jeopardize this process.